It is common to hear references made to the business climate of “the Southeast,” “the Midwest”, “the Southwest,” “California” (always California on its own), “the Great Lakes States,” and so on. Yet, generalizations about regions mask a great deal of variation within those regions when one closely examines the things that matter most to business: the presence of workforce and talent; utility quality and cost; infrastructure capacities; availability of economic incentives; and other operating costs and conditions. These site selection factors (“location drivers”) are the details that differentiate locations that may be bad, good, or great for a new corporate investment, and there is often more variation at the local level than people commonly expect. Hence, when companies go global, their success often depends on place characteristics that are highly local and may only be discovered through a comprehensive site selection process.

Prioritizing Talent

Recent location consulting work illustrates this general point and is worth relating in detail. Newmark Knight Frank (“Newmark”) partnered in 2016 with a European manufacturer to support their global footprint expansion in the United States. Based on general supply chain and customer service requirements, we targeted six states in the Midwest, a region that our client expected was a relatively homogeneous business environment. Their first education in U.S. geography was to learn that this area spanning roughly Kansas City to Louisville included more than 200 counties; 20 potential metros, cities, or towns that met our preliminary screening criteria; and numerous utility service territories. It’s at this level that the site selectors’ work really begins.

As the global search for talent becomes more challenging, labor market due diligence becomes increasingly important. This requires extensive research to incorporate current state analysis, examination of historical trends, forecasting, and a scan for opportunities where talent can be developed and a workforce pipeline sustained. Businesses can no longer just build a facility and assume that the workforce will come or be readily available.

Factoring in Utility, Real Estate, Transportation Costs

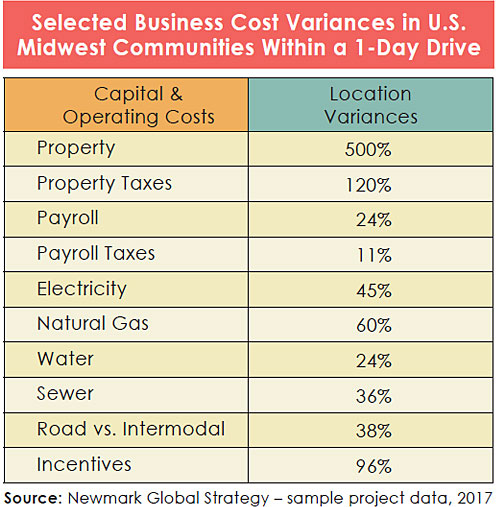

In tandem with the search for talent, our clients are prioritizing locations with cost-effective utility solutions that ensure both operational reliability and facilitate long-term business growth needs. This was true of our European client. As shown in the accompanying table, the cost of utilities varied between 24 percent and 60 percent within a one-day driving territory. Our client was again surprised at how many utilities were servicing the region; the diversity of service approaches; public, private, and co-op ownership structures; the various ages and conditions of local infrastructure; the regulatory differences from state to state; and, as a consequence of all of these factors, the costs of service delivery.

Equally compelling is the variance of real estate costs and availability, which serve as a fundamental determinant of a location decision for some projects. In this instance, we observed land prices for 25-acre development parcels range nearly 500 percent, and capital spending requirements vary more than 50 percent in cases where an existing building could be expanded or retrofitted for our client’s requirement. Real property tax rates also varied dramatically and were more than double in jurisdictions that were just a few hours’ drive from each other. This variation on an annually recurring cost was surprising to our foreign investment client.

Transportation costs were assumed by our client to be a relative well-known factor, costs per mile over the road by truck being the primary consideration. Even here, however, site selection and business acumen suggested that this client might benefit from intermodal transportation options available in the Midwest region. A truck-rail-truck transportation strategy held the opportunity of reducing freight costs by nearly 40 percent for a significant portion of its shipments.

After screening for all the aforementioned factors and costs, the final phase of strategic site selection (and perhaps the most sought-after) is the implications of incentives on the project proforma. Even within the United States, 50 different states mean there are 50 different approaches for how to support business investments and job creation. Governments at every level offer a great variety of tax and non- tax financial incentives to businesses in return for job, capital, and research and development investment. While incentives alone do not drive location decisions, the modern site selection perspective is that their overall impact must be considered in the context of their influence on investment and operating cost environments. Indeed, most company boards and executive leadership expect state and local officials to show support for any significant investment or job-creation activity.

In this European FDI example, among three competing finalist states and communities, the total value of the incentives packages varied nearly 100 percent, and their program structures were quite different. In the end, based on financial and other location quality and risk assessments, the community with the largest incentives package was declined in a favor of another location with a more optimal blend of workforce, real estate, and utility considerations. Understanding and reconciling these many and diverse location factors across a relatively small U.S. region was a fascinating process for the foreign inbound company management.

Successful businesses will continue to seek to identify strategic global locations for the growth and expansion of their corporate footprint. And as economic activity and competition continue to reach new heights, our clients are seeking locations that balance their needs for labor markets that meet niche and cross-sector talent requirements, competitive operating costs, high quality of place, and economic incentives that maximize value-return to their business. The companies that will experience the most success are those that leverage and capitalize on the great variations that exist regionally and locally within the primary cost and quality drivers for business location.