Six Factors to Consider When Selecting a Location for a Mission-Critical Data Center

When searching for a location for their next data center, companies need to take a holistic view of the process, prioritizing and balancing all the factors involved in site selection.

Data Centers 2017

In this high stakes situation, choosing where to store data is mission-critical. Data center providers must think strategically about where to invest in real estate, balancing factors such as energy and construction costs, tax incentives, proximity to customers, and demand. Following are six important tips for data center operators to consider when selecting a location for a mission-critical facility:

1. No data center is an island.

Before you think about the building, think about what’s underneath and around it. No matter how well a building is designed, without the right public infrastructure in place, a mission-critical facility will face a litany of challenges. A site’s security, geography, power capacity, and fiberoptic connectivity are all vital.

Data centers are power hogs. They require advanced energy infrastructure, so the reliability of the power grid is a critical site selection factor. The idea of data center microgrids is catching on as operators pursue reliable, high-quality power that endures when the central grid is unavailable or congested.

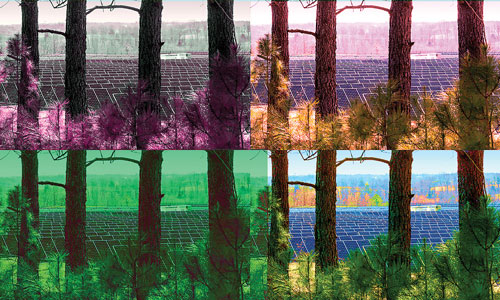

Data center owners and operators are also considering renewable energy options such as hydro, wind, and solar. In 2016, major data center operators, including Apple and Google, pledged to run their operations fully on renewable energy, demonstrating their commitment to reducing their carbon footprint. In realizing these pledges, some projects will call for sites offering nearby sources of renewable energy, while other requirements will be met by investing in renewable credits to offset their carbon footprint. The former will help more in case of an emergency, since nearby power reduces reliance on the wider power grid.

Geography is another important issue for mission-critical facilities. The environment must be assessed for risks such as exposure to extreme weather events, seismic activity, and flood plain threats. Manmade disasters must also be considered, which is why many companies examine a site’s closeness to chemical and nuclear plants and railroad lines that might carry hazardous materials.

Last, climate plays a role as air temperature and humidity levels impact energy costs significantly. Temperate climates offer natural cooling through systems that rely on outside air to offset the heat generated by equipment inside. The idea of data center microgrids is catching on as operators pursue reliable, high-quality power that endures when the central grid is unavailable or congested.

2. Speed matters.

Proximity weighs heavily in choosing where to open a data center. Consumers demand speed, whether to support binge-watching habits or to conduct business. Data centers that serve time-sensitive transactions, especially finance and banking, have locational restraints that influence real estate decisions.

As trading becomes more technologically dependent, the proximity of data servers gains importance. Financial firms depend on transactions that occur within nanoseconds. Latency of even a few milliseconds as data travels to a distant server can mean a major loss in revenue. Because of this, markets like northern New Jersey, northern Virginia, Toronto, and greater Chicago remain preferred data center locations.

Financial firms and other companies depending on accurate, quick data processing are willing to pay premium prices for data centers in primary markets if it means keeping data up-to-date and secure.

3. What is the cost of security?

For all businesses, an obvious goal when selecting a new site is to minimize taxes and developmental and operational costs. Skyrocketing construction costs are unavoidable in the United States. Labor costs are at all-time highs and the national average construction wage is expected to rise another 3 percent by March 2017, according to a recent JLL report. The most expensive markets to build in coincide with high-demand data center markets such as New York, northern California, and Chicago. Technology-rich data centers are especially susceptible to rising costs, as the IT infrastructure investment can be up to three times the amount to build. It’s important to make sure a disaster recovery facility is out of the same geographic path of natural disasters and has separate power supplies and redundant network paths.

While the cost of building a facility is important, electricity rates play an even bigger role in site selection. In a 20-megawatt data center, for example, a $.01 increase in the per-kilowatt-hour cost of power increases annual data center operating costs by an estimated $1 million. High electricity rates in the Northeast and California markets often spur companies to consider cities where energy is cheaper, but this is not an option for facilities that need to be close to consumers or business users.

Rural areas often appear attractive because of the lower cost and greater availability of land for sprawling complexes. But higher land costs in a metro area, relative to the cost of the data center itself, are negligible. Urban areas generally have better telecommunications and power infrastructure in place. One area where data center operators are finding success is at the “edge” of the network, in lower-tier yet highly populated markets. These cities provide access to key consumer bases outside traditional core markets.

4. Factor in tax incentives.

Data centers, which deliver high-paying and stable jobs, are especially promising candidates for economic development incentives. In fact, government officials extended nearly $1.5 billion in tax incentives to hundreds of data center projects nationwide during the past decade, according an Associated Press analysis of state revenue and economic development records in 2015. Arizona incentive legislation provides data center owners, operators, and qualified tenants full exemption from sales and use taxes for any equipment to outfit, operate, or benefit a data center. As states compete for data centers, we expect tax incentives to continue, easing the burden for these mission-critical facilities. Financial firms and other companies depending on accurate, quick data processing are willing to pay premium prices for data centers in primary markets if it means keeping data up-to-date and secure.

5. Consider the people behind the data.

Mission-critical facilities don’t run themselves; they rely on around-the-clock operational and security personnel. Facilities must be located in markets with access to skilled labor for many important functions, from security to technical IT and engineering jobs. An educated workforce is a basic requirement for any data center, while a high quality of life for employees is a consideration for companies prioritizing recruitment and retention.

6. What “always on” means in the real world.

The “always on” demands of consumers and businesses mean there must always be a second home for data when disaster strikes. This is particularly important for mission-critical industries such as healthcare. Hospitals and doctors are required by HIPAA regulation to have policies and procedures in place for safeguarding electronic health information in the event of fire, natural disaster, vandalism, or system failure.

Regulatory measures around disaster recovery require facilities to be located certain distances away from company headquarters. It’s important to make sure a disaster recovery facility is out of the same geographic path of natural disasters and has separate power supplies and redundant network paths. These requirements open up secondary and tertiary markets as options.

The Ideal Scenario

In an ideal scenario, when you set out to identify a new site for a mission-critical facility, you will find a location near your customers where real estate and energy costs are low, local universities supply abundant talent, natural disaster risks are limited, and the state offers tax incentives for new development. But in reality, the stars don’t always align and businesses must sacrifice one requirement for another. The key is to take a holistic view of the process, prioritizing and balancing all the factors involved in site selection.

Project Announcements

AVAIO Digital Partners Plans Pulaski County, Arkansas, Data Center Operations

01/14/2026

xAI Plans Southaven, Mississippi, Data Center Operations

01/14/2026

Hut 8 Plans West Feliciana, Louisiana, Data Center Operations

12/24/2025

Amazon Plans Warren County, Mississippi, Data Center Operations

11/24/2025

Meta Plans Beaver Dam, Wisconsin, Data Center Operations

11/15/2025

DartPoints Expands Greenville County, South Carolina, Data Center Operations

11/15/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025