Technology Will Help to Smooth Auto Industry's Rough Road

Despite the fact that the auto industry has fallen on hard times, development of innovative technologies holds promise for renewed growth in this sector.

Feb/Mar 10

Suppliers Cautiously Optimistic

Delphi ended four years of bankruptcy in October of 2009, emerging as a private company. Along that arduous path, this major auto parts manufacturer (a former unit of General Motors) cut thousands of workers, divested several businesses, and agreed to sell its steering systems operations and four plants back to GM. Today, Delphi is a much leaner more focused company whose core business will be electronic and safety components; power train, thermal, electrical, and electronic systems; and replacement parts.

Smaller tier-two suppliers, unable to sustain their business as their tier-one customers fell onto hard times, also went out of business. This reduced supply chain has the OEMs worried as they struggle with how to prop up badly needed suppliers with a much reduced vehicle inventory. According to industry experts, the "suppliers that survive will be those with varied customers around the world, contracts to build parts on different types of vehicles, and the best technology."

Craig Fitzgerald, a partner with Plante & Moran LLC for the automotive industry segment, estimates that "in three to five years the average [automotive] supplier will see profits, before interest and taxes, climb to 7-9 percent of their sales. That compares with the 3-5 percent suppliers have averaged in the last five years. It will take until about the first quarter of 2012 to reach auto production in North America of 12.6 million vehicles."

In their November 2009 Automotive Suppliers Sentiment survey, the Original Equipment Suppliers Association (OESA) noted that this index had slipped to 68.5 from September's 70.8, as the number of respondents who are "significantly more optimistic" fell and the number of "unchanged" expectations increased. While Q1 2010 vehicle sales and production is uncertain, suppliers appear to be stabilizing and recovering. However, the majority of suppliers responding to the survey forecast their 12-month revenue and operating profits would decrease by more than 20 percent on a year-over-year basis. Going forward, noted the report, year-over-year and month-over-month comparables will begin to improve.

Maurice Sessel, vice president of product engineering for International Automotive Components (IAC), a global conglomerate of manufacturing companies that produce a range of components and assemblies for the automotive industry, gave the keynote address at the Society of Plastics Engineers Automotive TPO (thermoplastic olefins) Conference in Detroit in October. His presentation, "The Interior Challenge," was optimistic as he shared real-world examples of how IAC has turned many of the challenges of 2009 into business opportunities. "At IAC, we've used these variables [mounting industry, regulatory, and economic challenges] into outlets of opportunity, rather than recoiling from them," said Sessel.

Sessel addressed three key demands that will impact the future of the automotive industry: (1) the unprecedented economic and industry times that include the lowest production volume in decades, reduced cash flow, and increased prices; (2) demand in consumer trends for sustainable and natural materials and transition to smaller, more fuel-efficient vehicles; and (3) the tough government mandates for increased fuel efficiency and increased safety that continue to put automakers and their suppliers under tremendous pressure to find ways to reduce vehicle mass, while improving crash performance.

Future Looking Brighter for the OEMs

Yet, despite all the negative news of plant closures and unemployed auto workers, the automotive industry, including parts manufacturing, continues to be one of the largest employers in the United States. According to the Federal Reserve, over eight million motor vehicles were assembled in the United States in 2008. Building and assembling the thousands of components of these vehicles requires a huge supply chain and a complex design, manufacturing, and assembly process, said a report from the U.S. Bureau of Labor Statistics (BLS) for Motor Vehicle and Parts Manufacturing.

In 2008, the latest year for which full-year data are available, about 9,100 establishments manufactured motor vehicles and parts, said the U.S. BLS. These ranged from small parts plants with only a few workers to huge assembly plants that employ thousands. Approximately seven out of 10 establishments in the industry manufactured motor vehicle parts - including electrical and electronic equipment; engines and transmissions; brake systems; seating and interior trim; steering and suspension components; air-conditioners; and motor vehicle stampings, such as fenders, tops, body parts, trim, and molding.

In 2008, 22 percent of all workers in the overall vehicle manufacturing industry were engaged in vehicle assembly, with a large number of these assembly plants owned by foreign automakers known as the "foreign domestics." That same year - of the 877,000 jobs lost - 62 percent were in the firms that manufacture vehicle parts.

According to the latest report from PricewaterhouseCoopers (PwC), the game has changed for this industry. "The aftereffects of the worldwide economic and financial downturn have altered the business landscape and have challenged longstanding assumptions about successful operating structures," said a PwC press release. "During the last decade, the underlying competitive landscape has changed dramatically because of the emergence of new markets and new industry players, as well as fundamental changes in the economic environments of the mature markets," said Richard Hanna, global auto leader, PwC. "The global recession has challenged the core operating models responsible for delivering the business strategy of many companies."

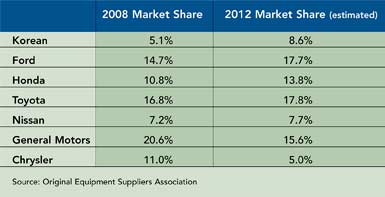

In a 2007 report, Honda projected that between 2008 and 2011, it would introduce 120 new or redesigned models. The new "foreign domestics" nearly doubled their market share from 1997 to 2007, going from 28.9 percent to 50.2 percent. Meanwhile, the Detroit Big 3 (General Motors, Ford, and Chrysler) lost market share during that same10-year period, decreasing from 71.1 percent to 48.8 percent.

Project Announcements

Japan-Based DENSO Expands Lebanon, Tennessee, Logistics Operations

01/20/2026

Canada-Based GreenPower Plans Santa Teresa, New Mexico, Headquarters Operations

01/14/2026

Lithium Battery Company Plans Tampa, Florida, Battery Pack Production Operations

01/10/2026

Volvo Group Plans Tacoma, Washington, Distribution Operations

12/29/2025

Japan-Based Imasen Bucyrus Technology Expands Bucyrus, Ohio, Operations

12/23/2025

T.RAD Plans Clarksville, Tennessee, Manufacturing Operations

12/19/2025

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026

-

The Skilled Trades Are Ready for a Digital Future

Q4 2025