Food Processors’ Optimal Location Decision

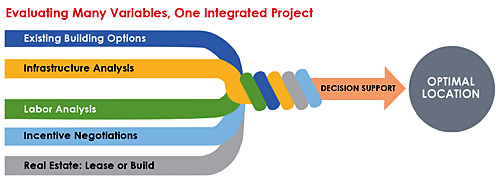

Whether evaluating existing buildings or finding a location for a new facility, food processors must make sure all the variables involved align to support the final decision.

Q4 2022

Each one of these reasons creates a different problem and requires a creative solution.

Updating Inefficient Operations, Existing Buildings

Companies tend to operate in buildings for many years, adding on and demising buildings to fit new operations and put off major expansion plans in light of the cost and the time take-away from their daily grind of keeping up with their business. The only way to update these operations is to start fresh and find a building or parcel of land that allows them to better fit their lines and flow.

Locating in the same area, if possible, provides the ability to keep existing labor and save on downtime and cost of retaining employees. The major question is, are available buildings located in the existing area that can deliver this opportunity? Locating in the same area, if possible, provides the ability to keep existing labor and save on downtime and cost of retaining employees. Although, there’s a national shortage of food processing and refrigerated distribution buildings.

Once a company determines it doesn’t have an existing building in its own market, it’s time to start looking regionally and or nationally. Now is an ideal time to look for additional savings, evaluating factors such as labor, incentives, and new construction. To investigate the prospects in full, a company should run a full site selection process.

The best way to start this process is by determining what are the optimal locations for the business. The first step is performing a supply chain transportation study. This study will identify where the best location is for a new facility based on costs savings in the supply chain. This study can also determine the location best for a company to gain market share, either through shifting capacity or moving closer to target suppliers or customers. This is a simplified description of a complex modeling and business strategy project.

Once a company determines it doesn’t have an existing building in its own market, it’s time to start looking regionally and or nationally. Addressing a Lack of Labor

Labor has become a key driver of site selection since the pandemic. Therefore, the next lane in the location process is performing a labor study, making sure there is an adequate supply of labor and that it matches the skill level of the jobs to be offered at the facility. Other questions include, is there a seasonal demand? How deep is the labor pool? And what is the drive-time for that labor pool? Also, are there state or local incentives and options to assist with recruiting and training? Will company executives be relocating? These are all factors that need to be accounted for. Labor can make or break an operation.

Satisfying Infrastructure Needs

The third lane to start running is infrastructure. Power and water are key, and both can be constrained so ensuring that there is adequate supply is essential. Does the local utility company have the capacity for the power requirement, and if additional power is required, what is the cost and, more importantly, when can it be delivered?

Water issues are twofold depending on the usage for the operation. Questions include, is the water supplied by a municipality or can it be supplied by wells? What is the quantity required and peak demand? Is the water good quality or will it require treatment and, if so, what is the cost?

The next lane in the location process is performing a labor study, making sure there is an adequate supply of labor and that it matches the skill level of the jobs to be offered at the facility. The second part to the water question is discharge. How much will the facility discharge and what are the discharge options? Can it be treated and sent to a municipal system or is setting up a private system an option and does that require more land on or off site? Does the target area offer incentives or financing options for infrastructure? This is one of the most limiting factors when looking to locate a new food processing facility.

Obtaining Incentives

The fourth lane is local and state business incentives. These can be in the form of everything from free land and delivering utilities, to worker training and expedited permitting. Incentives are different in every community and state. It’s best to engage a professional business incentive consultant with national experience to manage the C-suite’s expectations of what is possible in a community. Once again, like infrastructure studies and labor analysis, correctly evaluating and obtaining incentives requires a certain professional training and experience.

Power and water are key, and both can be constrained so ensuring that there is adequate supply is essential. Real Estate Search

The infrastructure study, labor analysis, and incentives will generate several locations, such as different municipalities in the same state or in several states. Real estate should be searched in each area as it is approved by the other project lanes.

Vetting real estate can hold up a project if not completed by a professional who understands what goes into a plant. Make sure all the other project lanes agree on the location when finding sites and/or existing buildings with a usable layout and space for expansion, as well as available utilities and proper zoning. This also includes satisfying company goals, i.e., own vs. lease, budgetary constraints, and ultimately the C-suite’s preferences.

Project Announcements

Poland-Based JGB Brothers Plans Bamberg County, South Carolina, Production Operations

01/23/2026

Lithium Battery Company Plans Tampa, Florida, Battery Pack Production Operations

01/10/2026

Germany-Based Silesia Flavors Establishes Huntley, Illinois, Production Operations

01/08/2026

Edelweiss Dairy Expands Freedom, New York, Operations

12/24/2025

Swire Coca-Cola, USA Plans Colorado Springs, Colorado, Production Operations

12/22/2025

Kroger Plans Simpson County, Kentucky, Distribution Operations

12/19/2025

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026