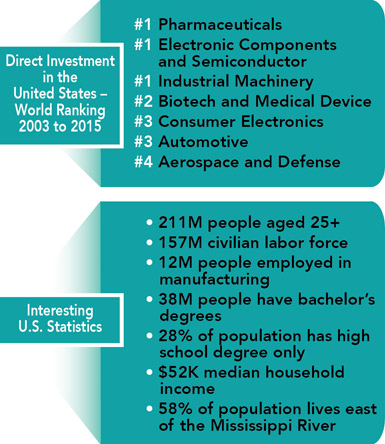

The United States is a top destination for foreign direct investment (FDI). For the period between 2003 and 2015, Financial Times data indicates that the United States received more investment in pharmaceuticals, electronic components, semiconductors, and industrial machinery than any country in the world.1 The United States is also among the top four countries for FDI in advanced manufacturing sectors like biotech and medical devices, consumer electronics, automotive, and aerospace and defense. Only China attracts as many large investments across a similar broad range of industry sectors.

With such a large volume of inbound direct investment, one might conclude the investment landscape is easy to navigate. In reality, the opposite is true. While the federal government binds the country together, each of the nation’s 50 states and 381 metropolitan areas has broad autonomy to set its own regulations concerning taxation, the environment, labor, and many other considerations. Couple this with significant geographic variability across the many factors important to location decisions, and the puzzle becomes quite complex, quite quickly.

State and local governments use a diverse set of tools to support economic development. Clusters of Activity

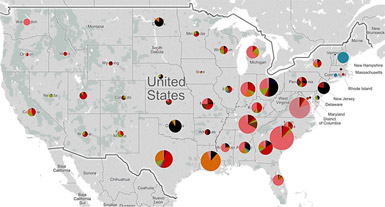

Over time, different U.S. regions and cities have developed unique competencies. For instance, the computer and electronic equipment industry is mostly found on the West Coast in California and Washington. From a contribution-to-GDP-by-metro-area perspective, the machinery equipment industry is mostly clustered in the center of the country, from Illinois, Wisconsin, and Minnesota in the North to Texas in the South. The aerospace industry has its own unique set of clusters, as does motor vehicle production. Production clusters like these are common to many industry verticals.

However, 2014 direct investment data suggests a shift taking place in the United States as a number of states challenge the legacy centers of production. Most foreign companies have been choosing to establish operations in alternative regions of the country. States in the South and Southeast have been increasingly successful in their efforts to attract foreign direct investment and diversify their economic bases.

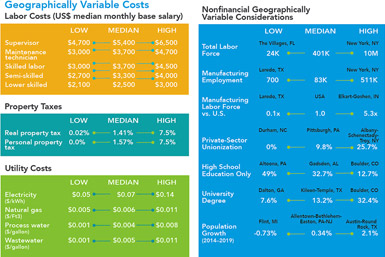

Understanding Geographically Variable Costs

When investing in the United States, companies should understand how financial, nonfinancial, and risk factors vary enormously from state to state and city to city across the spectrum of considerations that require analysis. Below are a few illustrations of how unit costs and key nonfinancial considerations can vary dramatically across U.S. regions:

Labor costs: Often the most significant geographically variable costs, compensation costs are an important cost to understand. Labor costs vary greatly and a company may find a 50 percent delta between lower-cost markets (usually smaller), such as McAllen, Texas, and higher-cost (larger and more urban) locations like San Francisco or New York City. For the investor seeking lower-cost locations, median compensation for a low-skilled worker would be approximately $2,100 per month, or $13 per hour. However, it is possible to pay below the median or even minimum wage, particularly in rural areas, to achieve much lower monthly labor costs. The accompanying chart illustrates approximate monthly wages in low-, median-, and high-cost locations.

- Los Angeles to Boston: $6,300

- New Orleans to Chicago: $1,200

- Saint Louis to Boston: $3,200

- Saint Louis to Los Angeles: $4,200

Utilities: Utility costs in the United States tend to compare favorably to those in other countries. Electricity costs tend to vary the most across the country — a result of a deregulated market that provides a wide range of service providers and diverse renewable and fossil fuel sources, along with passing taxes and other charges through to consumers.

Nonfinancial Geographically Variable Considerations

The accompanying table illustrates some common “nonfinancial” considerations that may be important in the overall investment decision.

Labor-management relations and union membership are of interest to many foreign investors. While union membership in the United States has been declining for decades, some communities still have double-digit rates of membership. In others, private-sector union participation may be zero.

The manufacturing labor force is another consideration of interest for most investors, and varies widely between locations. Some U.S. communities have almost exclusively nonmanufacturing employment, while others have had generations of workers employed in a particular manufacturing industry. A commonly used key measurement is the “industry occupation quotient,” which compares the percentage of local employment in a sector to the percentage of employment in the same sector nationwide. For example, locations like Laredo, Texas, have just 0.1 times the level of U.S. employment in manufacturing, while those like Elkhart-Goshen, Indiana, have more than five times the national percentage of employees employed in manufacturing.

The list of considerations that require review when selecting a location is long. The accompanying graphics highlight the many financial and nonfinancial factors that could, or in reality should, be reviewed when deciding where to locate.

Highlighted below are some of the distinctly U.S. investment considerations our team has identified:

Labor regulations: Labor regulations are highly flexible and favorable to the employer in terms of working hours, shift work, vacation expectations, and the ability to hire and fire.

Availability of large tracts of land: A legacy of private land ownership enables the assemblage of large tracts of land for industrial development, and site size is rarely a barrier to investment.

Industrial sites/building inventory: A large inventory of industrial land sites and/or industrial buildings is typically available to support direct investment.

Resource availability: Access to capital, a market-based system of land ownership, proactive economic development organizations, and coordinated efforts to solve site/infrastructure challenges by government and utilities officials typically result in unique capabilities to address site requirements.

Sophisticated economic development: The overall level of sophistication of economic development professionals at the state and local level of government is unprecedented.

Utility capacity: The United States’ gas and electric capacity and extension of the distribution network to communities across the country are unparalleled and typically not a deal-breaker except for some very large-scale investments.

Efficient, diversified supply chain and logistics transportation system: The United States’ port, rail, road, airport (cargo), and intermodal infrastructure is highly efficient.

Highly variable taxation: Each state has a distinct approach to the taxation of companies from an income, franchise, real and personal property, and sales and use tax perspective.

Diverse incentive programs: State and local governments use a diverse set of policies, tools, and approaches to support economic development.

The United States offers many opportunities for manufacturing operations. The following are five considerations to help ensure a successful investment.

1. Look for the labor. Although the manufacturing labor force has declined in some U.S. areas during recent decades, the contribution of manufacturing to U.S. GDP has been growing at an increasing rate and contributes more than $3 trillion annually to U.S. GDP. Manufacturing companies should focus on the cities or states that have invested in workforce development and have manufacturing clusters. Although the nation’s skilled labor force is large and competent, skilled labor may be the most difficult group of employees to hire. A close look at labor market dynamics will be a critical aspect of site selection.

For the period between 2003 and 2015, the United States received more investment in pharmaceuticals, electronic components, semiconductors, and industrial machinery than any country in the world. Financial Times 2. Don’t make any assumptions about cost. Capital-intensive, build-to-order (vs. build-to-forecast) operations and/or operations with notable inbound and outbound transportation requirements in the United States can compete very well on the basis of cost compared to near- and off-shore alternatives.

3. Capitalize on diversity. English is the dominant language of the United States, but the country now is home to approximately 41 million native Spanish speakers and 11.5 million bilingual speakers, making it the second-largest Spanish speaking country behind Mexico. Among the states, New Mexico, California, and Texas have the most Spanish speakers. However, diversity can be helpful for some companies.

4. Tax incentives should play a role in the decision. Taxes on operations can be significant. Unlike most countries, some states tax the assessed value of personal property and inventory, along with real estate and other taxes. However, many states and municipalities offer incentives to encourage economic development and job growth, and some are particularly inclined to assist manufacturing companies or specific industries such as life sciences or food processing.

5. Seek growth-friendly communities. Some U.S. communities are notorious for challenging new development and are even anti-growth. However, many others welcome economic development with open arms and are eager to bring new employers to town. The key is to understand the mindset of the specific communities under consideration.

In Sum

The United States is a large and diverse country that offers many opportunities for investors. However, companies must understand the significant variability in the investment climate across states and metropolitan areas. Optimizing the placement of an operation requires a methodical review of the wide range of investment opportunities to ensure that the selected location is aligned with the cost and operational objectives of the investing company.

1 From fDi intelligence. All Rights Reserved. JLL is solely responsible for providing this extract, The Financial Times Limited 2016.

©2015 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof.

Matt Jackson Based in Washington, D.C., Matt Jackson is a managing director in the JLL Business Consulting Group. Jackson advises companies on global strategy, cross-border direct investment strategy, location strategy, site selection, and incentives negotiations. He has more than 20 years of experience assisting corporations with complex footprint configuration initiatives that achieve revenue, margin, and innovation objectives.

Matt Jackson Based in Washington, D.C., Matt Jackson is a managing director in the JLL Business Consulting Group. Jackson advises companies on global strategy, cross-border direct investment strategy, location strategy, site selection, and incentives negotiations. He has more than 20 years of experience assisting corporations with complex footprint configuration initiatives that achieve revenue, margin, and innovation objectives. Jackson has conducted more than 200 engagements for corporate clients and negotiated investment agreements for more US$6 billion in direct investment.

Jackson holds a BA degree from Macalester College in St. Paul, Minnesota, and an MA degree from University of North Carolina at Charlotte.

Shannon Curley

Shannon Curley is an experienced location strategy professional, with more than 10 years of experience assisting corporations optimize their operations to achieve revenue, margin, and innovation objectives. She specializes in helping companies with global business platform design, cross-border direct investment strategy, manufacturing platform strategy, office platform strategy, SG&A process configuration, structural cost re-engineering, workplace strategy, location strategy, incentives negotiations, and site selection.

Shannon Curley

Shannon Curley is an experienced location strategy professional, with more than 10 years of experience assisting corporations optimize their operations to achieve revenue, margin, and innovation objectives. She specializes in helping companies with global business platform design, cross-border direct investment strategy, manufacturing platform strategy, office platform strategy, SG&A process configuration, structural cost re-engineering, workplace strategy, location strategy, incentives negotiations, and site selection. Curley holds a BA degree in international business and Spanish from Hollins University and an MA degree in International Affairs from The George Washington University, and is a member of Commercial Real Estate Women (CREW).

Catharine Broadnax Catharine Broadnax is senior associate with the Business Consulting team at JLL. She advises corporate clients on global location strategy decisions, and identifies cost-savings opportunities through portfolio value mining.

Catharine Broadnax Catharine Broadnax is senior associate with the Business Consulting team at JLL. She advises corporate clients on global location strategy decisions, and identifies cost-savings opportunities through portfolio value mining.