The investigation began last year when President Trump directed Commerce to determine whether steel and aluminum imports were in fact threatening U.S. national security.1 The investigation was conducted pursuant to a trade restriction mechanism known as Section 232, a provision of the Trade Expansion Act of 1962 used to determine the impact of imports on national security, historically in times of emergency. Section 232 has been invoked sparingly since the height of the Cold War, but it has now taken center stage in global trade negotiations. If your business uses steel and/or aluminum, you need to understand how the tariffs will affect your business and prepare your business for the short and long-term consequences of the tariffs.

Background

Section 232 investigations can be initiated by an interested party, a request from a department or agency head, or may be self-initiated by the Secretary of Commerce. Commerce then will conduct an investigation into specific product imports and present its findings and recommendations to the President. If the imports are determined to threaten U.S. national security,1 the President has 90 days to determine whether he agrees and then may adjust import restrictions accordingly. The statute notably does not place a limit on the nature of trade remedy restrictions or set out a limit on the tariffs to be implemented.

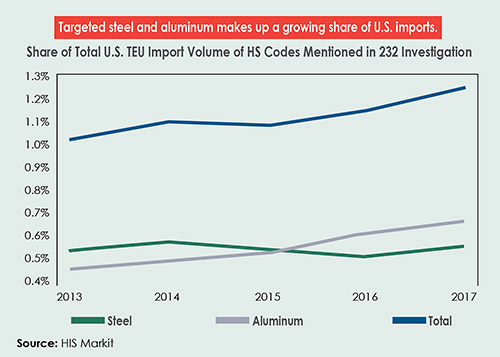

Section 232 national security investigations have been initiated judiciously in the past. There have only been 14 investigations conducted by Commerce since 1980, and very few have resulted in Executive actions that serve to restrict imports. However, in April 2017, President Trump requested that the Department of Commerce initiate a Section 232 investigation into whether steel and aluminum imports were threatening U.S. national security. Due to excess international steel and aluminum production, global markets have been flooded in recent years, leading to U.S. import volumes far above historical levels.

In January 2018, Commerce released the findings of its report to the President. The report concluded that the excess quantities of steel and aluminum in the global market were severely hampering domestic industry, reducing U.S. jobs, and threatening U.S. security under the broad, multi-factor definition of national security in Section 232. The report found that U.S. steel imports were nearly four times its exports, and that aluminum imports had risen to 90 percent of total demand for primary aluminum.

The global excess steel capacity was found to be 700 million tons — almost seven times the annual total of U.S. steel consumption. Both domestic industries were further described as critical to the U.S. Department of Defense and to U.S. infrastructure. Thereby, the recent surge in imports was concluded to have seriously harmed domestic production. Commerce recommended a menu of options for restricting imports, including a global tariff of at least 24 percent on steel imports from all countries, and a 7.7 percent tariff on aluminum exports from all countries.

The President took Commerce’s recommendations a step further when he directed that 25 percent and 10 percent tariffs on steel and aluminum, respectively, be formally imposed across the board beginning March 23. The tariffs affect all steel products under U.S. Harmonized Tariff Schedule (HTS) Codes 7206.10 through 7216.50, 7216.99–7301.10, 7302.10, 7302.40–7306.90. The 10 percent tariffs affect unwrought aluminum under HTS Code 7601, wrought aluminum under 7604–7609, and castings and forgings under 7616.99.51. Customs and Border Protection began formally collecting the 25 percent and 10 percent import duties on products entered on March 23.

The global excess steel capacity was found to be 700 million tons — almost seven times the annual total of U.S. steel consumption. Exclusions, Exemptions, and Next Steps

Both product-based exclusions and country-based exemptions to the tariffs have been implemented since the duties were formally announced. First, temporary country-based exemptions were issued for Argentina, Australia, Brazil, Canada, the European Union, and Mexico until May 1. South Korea was granted a permanent exemption as part of a separate bilateral free trade negotiation. Hours before the deadline expired on May 1, President Trump delayed the imposition of the tariffs for Canada, the EU, and Mexico until June 1. In addition, Argentina, Australia, and Brazil were able to reach agreements with the U.S. for permanent exemptions from the metals tariffs, the details of which will be released in the coming weeks.

Additionally, individuals and entities operating in the United States that utilize steel or aluminum in their business activities may apply to Commerce for specific product-based exclusions. Commerce has signaled it intends to issue specific exclusions only sparingly and will grant an exclusion only if the steel and aluminum articles that are imported are not produced in the United States in a sufficient and reasonably available quantity or of a satisfactory quality. It will also take into account the national security factors outlined in Section 232.

Businesses can seek exclusions based on the HTS Code for the type of steel or aluminum they are seeking to import tariff-free with a detailed description of the product, its quantity, and its properties. The Department of Commerce’s Bureau of Industry and Security has made available the forms for exclusion requests and objections to exclusion requests for steel and aluminum on its website. Exclusion requests will be publicly posted for a 30-day comment period, and processing exclusion requests in full generally should not take more than a 90-day period.

Response from Steel Exporting Countries

In response to the Section 232 tariffs, China imposed its own new tariffs on 128 imports of U.S. goodsthat went into effect on April 2. A 25 percent tariff was imposed on eight goods, including U.S. pork products and aluminum scrap, and 15 percent tariffs were imposed on 120 other goods, including various agricultural products such as fruits, nuts, and wines. China has also initiated a legal challenge on the U.S. tariffs at the World Trade Organization.

On March 23, 2018, 25 percent tariffs on steel and 10 percent tariffs on aluminum imports formally entered into effect in the United States. Japan has lobbied extensively for an exemption to the tariffs, yet it is the only key U.S. ally that has not yet received a temporary exemption. President Trump has made it clear that he would like to see a bilateral trade deal with Japan first, although Japan has pushed for the updated 11-nation Trans-Pacific Partnership as the best route for trade relations moving forward.

The EU has also begun to implement responsive measures to the tariffs. First, EU Trade Commissioner Cecilia Malmström has stated that before any future trade talks are conducted with the United States, the temporary EU tariff exemption must be extended into a permanent and unconditional exemption. Further, to protect the European steel industry from the anticipated import surplus, the European Commission launched a safeguard investigation into steel imports on March 26. The notice of initiation of the investigation explicitly mentions the recent Section 232 tariffs as a likely cause for additional increases in steel import levels as countries with overcapacity reroute their exports to the EU. While the extension of the temporary exemption may prolong a potential trade war for now, the EU has in place a list of retaliatory tariffs worth approximately $3.5 billion on imports from the U.S. that it will impose if it loses its exemption, including key U.S. exports such as blue jeans, motorcycles, and whisky. Finally, the U.S. has also agreed to enter into separate consultations with the EU and India at the World Trade Organization over the tariffs.

Key Takeaways for Imported Steel and Aluminum Users

- There is no cost to file an exclusion application, so if you believe that your company has the grounds to file for a product exclusion, you should do so as soon as possible to avoid any uncertainty in your supply chain.

- Commerce is currently understaffed to work on this matter, and it is critical to submit a complete application as soon as possible.

- Follow the ongoing trade negotiations between the United States and its allies, as further country-based exemptions or extensions may be announced in the near future.

1 See 19 U.S.C. §1862(d). Under Section 232, the Secretary examines the effect of imports on national security by considering, among others, factors such as the domestic production needed for projected national defense requirements; the capacity of domestic industries to meet such requirements; existing and anticipated availabilities of the human resources, products, and raw materials essential to the national defense; the importation of goods in terms of their quantities, availabilities, and use as those affect such industries; the close relation of the economic welfare of the United States to its national security; the impact of foreign competition on the economic welfare of individual domestic industries; and any substantial unemployment, decrease in revenues of government, loss of skills, or any other serious effects resulting from the displacement of any domestic products by excessive imports.