The United States is both the largest recipient of FDI and the world’s largest source of direct investment. In 2012, the stock of direct investment into the United States was valued at nearly $2.7 trillion, equivalent to nearly 15.4 percent of all foreign-owned assets in the United States. At the same time, U.S.-based firms were the source of approximately $4.5 trillion in direct investment in foreign countries. Foreign direct investment plays an important — and valued — role in the U.S. economy, employing nearly 5.6 million U.S. workers. Business investments have led to the creation of jobs, an increase in wealth and living standards, and overall growth and innovation that drive U.S. economic competitiveness. From the federal to the state and local level, there is clear recognition of the importance of FDI, and both President Barack Obama and Commerce Secretary Penny Pritzker have made it a priority to encourage business investment in the United States.

Cross-border investment is a fundamental component of U.S. economic competitiveness. Investment Inflows

U.S. subsidiaries of multinational companies are owned by firms headquartered around the world. According to the U.S. Bureau of Economic Analysis (BEA), the latest estimates of FDI stock in the United States by ultimate beneficial owner (UBO) reveal that the United Kingdom, Japan, Germany, Canada, and France are the five largest country sources of FDI in the United States. Together, these five economies alone accounted for nearly 61.5 percent of total FDI stock in 2012.

In addition, markets across Asia, Latin America, and Europe have substantially increased their FDI position in the United States in recent years. Among the countries for which data is provided by the Bureau of Economic Analysis (BEA), FDI into the United States from China grew at an average annual rate of nearly 71 percent between 2008 and 2012, making it the fastest-growing country source of FDI in the United States (followed by Hungary, Indonesia, Norway, and Malaysia). Uruguay emerged as the fastest-growing Latin American economy for FDI in the United States, with compound average growth of FDI at nearly 21 percent since 2008. While these markets cumulatively represent a small percentage of direct investment stock in the United States today, their growth is poised to continue.

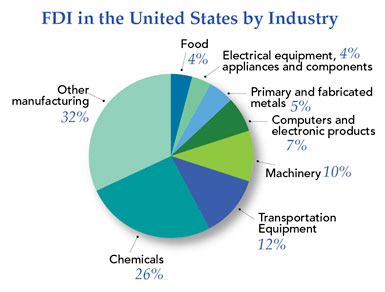

Direct investment in the U.S. economy flourishes across industry sectors, most notably in manufacturing, professional and financial services,ii and other industries, such as nonbank holding companies, agriculture, mining, and utilities. According to BEA estimates, more than one third of FDI into the United States is in the manufacturing sector; international companies maintain operations in chemical, primary and fabricated metals, transportation components ranging from aerospace to motor vehicle manufacturing, textiles and more. Because of technological advances and the boom in the production of shale gas, the U.S. Energy Information Administration (EIA) estimates that the United States could be close to self-sufficient in energy by 2035. This ultimately will result in lowering the U.S. trade deficit and enhancing our manufacturing competitiveness, particularly for manufacturing companies in energy-intensive sectors.

The United States is also increasing investments in its talented, innovative, and productive work force to stay competitive in manufacturing. In 2012, President Obama created the National Additive Manufacturing Innovation Institute (NAMII) to bolster the U.S. competitive advantage in 3D printing technologies. Branded as “America Makes,” this initiative brings together public and private sector partners to accelerate the development of advanced manufacturing technologies. By utilizing advanced materials and digital production techniques in the United States, manufacturers can reduce the time needed to move a product from design to the U.S. market — a clear advantage in today’s fast-paced marketing cycle. All of these factors contribute to the recent reshoring trend seen with companies ranging from large firms like Ford and NCR, to smaller U.S. manufactures of durable goods such as kitchenware, plastic coolers, and headphones, moving production to the United States.

Business Confidence

Overall confidence in the U.S. business environment is on the rise, reflected in independent rankings. The World Economic Forum’s (WEF) Global Competitiveness Index recognizes the United States among the top-10 economies based on its strengths in innovation, education, and its overall size, citing renewed macroeconomic stability and expected steady economic growth in 2014. Recently, The Economist reported that the conditions that underlie a general resurgence of optimism around the U.S. economy might have started in 2013, with booming exports and investment in business equipment. The United States is likely to have achieved economic growth of 2.7 percent in 2013, further boosting confidence.

According to the IBM Institute for Business Value, the United States is the top destination for direct investment as measured by the estimated number of jobs created by FDI in 2012. Further, the United States has begun to show signs of economic recovery, confirming corporate confidence in the country as a key market. In its June 2013 FDI Confidence Index, A.T. Kearney awarded the United States the top spot.iii Business executives believe that U.S. workers are becoming more competitive, and investors are optimistic about solid fundamentals. As the United States maintains an open investment policy, investors recognize that the free movement of capital across international borders, along with global trade, is essential to growth in the global economy.

This confidence is reflected as President Obama recently emphasized his commitment to attracting FDI at the SelectUSA 2013 Investment Summit in Washington, D.C. The summit welcomed approximately 1,300 participants, including a mix of global investors, U.S. companies, business associations, and representatives from more than 200 U.S. economic development organizations (EDOs) from 48 states, the District of Columbia, and four U.S. territories. More than 650 company representatives came from 450 companies in 60 countries. Seventy federal employees from 14 government agencies were on site to answer investor questions. The President made it clear that foreign investment attraction is a core priority, with responsive, global teams actively working together. Hand-in-hand with the U.S. Department of State, the Department of Commerce through SelectUSA is providing the training, resources, and access necessary to ensure that investors and economic development organizations receive world-class services.

Cross-border investment is a fundamental component of U.S. economic competitiveness. As the single point of contact for investors looking to create jobs and establish production in the United States, SelectUSA serves as an information source for the global investment community, an ombudsman for investors, and an advocate for U.S. cities, states, and regions. SelectUSA works in partnership with U.S. economic development organizations that are looking to attract business investment, and coordinates investment-related resources across U.S. federal agencies, foreign embassies, other economic development stakeholders, and industry trade associations.

Keida Ackerman is an International Investment Specialist with SelectUSA. SelectUSA exercises geographic neutrality, and represents the entire United States. The program does not promote one U.S. location over another U.S. location. To learn more about SelectUSA services for investors and U.S. economic development organizations, visit www.SelectUSA.gov.

i In 2011, the U.S. Department of Commerce reported that the U.S. trade in goods on a total census basis was $1.48 trillion, and that majority-owned U.S. affiliates of foreign firms contributed $303.7 billion to U.S. exports of goods.

ii Includes depository institution (banking); finance (except depository institutions) and insurance; real estate and rental and leasing; professional, scientific, and technical services

iii This annual index is based on a survey of more than 300 executives from 28 countries, which ranks countries