Overview

When a company plans to develop a new facility in the U.S., it needs to gather information about potential sites and communities for its project. This information is often gathered by submitting a Request for Information (RFI) followed by one or more RFPs to the candidate communities.

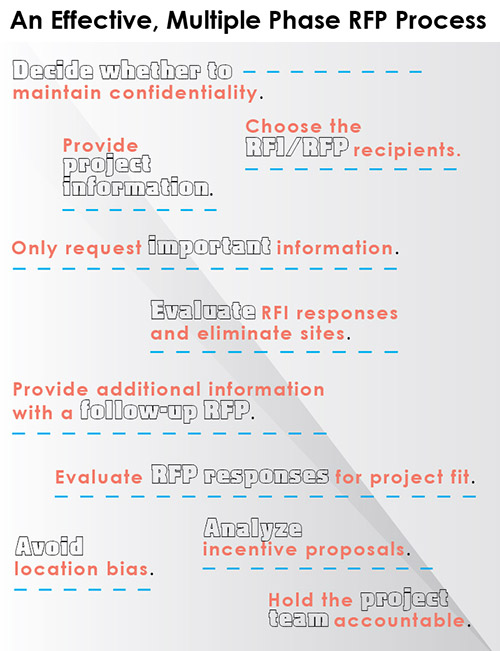

Use multiple phases.

While it is often called an RFP, the first document submitted to a community should actually be an RFI (Request for Information). Many companies focus too heavily on incentives early in their site selection process. While important, the incentives discussion should come later in the process. As such, a company should not request a specific proposal for incentives in its initial contact with a community. Instead, it should gather information about the communities and their available sites to determine whether a community may be a good fit for the project. An RFP should be submitted once the information from the RFI has been digested and the number of eligible sites has been reduced.

Decide whether to maintain confidentiality.

Most companies still run their RFI/RFP process on a confidential basis. This is particularly important when jobs may be at stake at another location in the U.S. or abroad. Companies often prefer to keep their projects confidential to avoid revealing their growth strategy to competitors as well. To help maintain confidentiality, it is best to include a confidentiality requirement in the RFI/RFP as well as any cover e-mails or letters when transmitting the documents. If confidentiality is of paramount importance, the company should not include its name in the RFI/RFP documents nor should company e-mail addresses be on transmittal e-mails.

At the appropriate time, RFP recipients should sign confidentiality and non-disclosure agreements. Site selection service providers can help maintain confidentiality by interfacing with the communities on the company’s behalf.

There are times, however, when a public RFP process might be advantageous. If a company’s project does not require confidentiality, a public RFP process can create a competitive environment and may reveal which communities are most willing to work with a company to win the project. A public RFP process poses risks as well. Unsolicited responses to the RFP can reduce efficiency of the project team; uninformed news articles could cause distractions; and public bias may interfere with the company’s process.

Each project will warrant a different level of confidentiality, and the RFP process should be adjusted accordingly. Many states have open records acts that could compel disclosure of sensitive documents, which may include RFI/RFPs, and project agreements. Companies should have a plan in place if project information is leaked or disclosed through a state’s open records process.

The company must first narrow the geographic scope of the RFI. Once the initial group of states is determined, the RFI is typically sent to each state’s primary economic development agency, which then distributes the RFI to its eligible communities. As sites are narrowed, subsequent RFI/RFP documents may be sent directly to the local communities as well as the state, depending upon the relationship between the parties.

Provide project information.

The RFI should not only request information, but should also provide useful information about the project and the company. In order to receive the best information from a community and determine whether it might be a good fit for the project, the company must accurately describe the key parameters and requirements of the project.

This RFI should include job numbers, ideally broken down by job category or Standard Occupational Classification, and an estimated wage range, dependent on labor availability, prevailing rates, etc. If possible, the RFI should also state the breakdown between full-time, part-time, direct, and indirect (contract labor) positions.

The RFI should describe the project’s utility requirements at a detailed level. For example, the electricity requirements should include load, demand, and redundancy requirements, at a minimum.

If environmental factors will be an issue, then a statement about the estimated emissions or other environmental considerations should be included. For example, if a site is in an environmental “non-attainment” zone and the project is a major emitter of particulate matter, then the community should know this on the front end to avoid issues later in the process.

The RFI should inform the recipient if there is a particular area of the state that works best for the project. For example, the RFI might require that sites be within 100 miles of a key supplier or within 10 miles of an on-ramp to a particular interstate.

It’s important to remember that the RFI/RFP process not only enables the company to review the communities, but the communities must evaluate the project as well to determine whether it is a good fit for their region. By providing sufficient information, the company will eliminate a barrage of inquiries from each recipient of the RFI.

Only request important information.

Keep it simple. Don’t request unnecessary information in the initial RFI. Instead, focus on “non-starter” items and issues that are critical to the success of the project and initial round of site eliminations. It is important to differentiate between “nice-to-haves” and “must-haves.” For example, if having a rail-served site would be “nice-to-have” because a supplier could bring in raw product by rail for a few cents cheaper per ton, but this would not offer a material savings, then the RFI should include a rail-served site as a preference, but not a requirement. To do otherwise will result in a significant number of non-rail sites being eliminated, even though those sites might be more favorable based on other criteria.

One of the early projects on which I worked included a 30-page initial RFI. This document produced responses from the states that were several hundred pages long and included a significant amount of unnecessary information for that phase of the project. Not only did this waste each community’s time in preparing their responses, but the project team spent many needless hours combing the documents for the most important data. A better approach is to request the correct amount of information for the stage of the project and follow-up for more information as needed.

It’s also important to specify the format for responses. For example, the RFI might include a table for communities to fill out with utility information. For states that will be submitting multiple sites, it’s helpful to request an overall state map with site locations and coordinates identified.

While it is often called an RFP, the first document submitted to a community should actually be an RFI (Request for Information).Evaluate RFI responses and eliminate sites.

Even with a perfectly crafted RFI, some communities will still provide too much unnecessary information and others will fail to provide critical information. The goal of the project team is to efficiently distill the information provided into a useful comparative format so that the initial desktop analysis can be performed. At this stage, the project team will identify gaps in key information and will eliminate sites that do not meet the critical requirements of the project.

Provide additional information with a follow-up RFP.

After the RFI responses have been reviewed, the project team should prepare a Request for Proposal. The RFP not only provides an opportunity to solicit proposals, it provides the company with an opportunity to convey more information about the project to a narrower pool of candidate communities. States and local communities are more likely to make strong proposals if they know the company and understand the project. If a community perceives a project with a high degree of uncertainty, then they view it as a riskier investment and will not be willing to commit at the same level as a project with a lower level of risk perception.

If the company has not already done so, it should consider whether to disclose its name at this time, provided that confidentiality and nondisclosure agreements are in place and open records laws have been considered. The company should use the RFP as an opportunity to raise the profile of the project and reduce the perception of risk.

Evaluate RFP responses for project fit.

When evaluating RFP responses, companies should look for the overall best fit for the project; not just the location with the highest incentives. This evaluation should include an analysis of quantitative components such as labor availability and wage rates, logistics considerations, and tax profile; as well as more qualitative components such as community fit, the permitting process, and site due diligence items.

Analyze incentive proposals.

A good incentive package is tailored to meet the needs of the project. The RFP should specify these needs. If the company has narrowed the list of eligible sites to three locations, the individual RFP that is sent to each community may be different from the others. It should be tailored to the needs of the project in each site and community.

As a general rule, incentives should not be evaluated on the overall size of the incentive package, but rather on the cost savings provided by the incentives to the company. For example, if Site A has a property tax rate that is double the property tax rate of Site B, and each community offers a 50 percent abatement, the incentives offered for Site A will correspondingly be twice as much as for Site B; however, the tax burden net of the incentives will still be twice as high for Site A. Rather than looking at the value of the incentive, the company should consider the total cost of operations at a particular site, net of incentives. These operating costs should be forecast over an appropriate time period (usually 10 years or more) and discounted to present value using a discount rate that takes into consideration the company’s time value of money. By discounting future costs (net of incentives) to present value for each potential project site, the company may evaluate each site side-by-side for an effective comparison.

The RFI should not only request information, but should also provide useful information about the project and the company. Remember that your operations will likely extend far beyond the duration of the incentives, so the company should also consider the operating costs once any ongoing incentives have expired. Additionally, certain incentives may include “clawbacks,” “recapture provisions,” or other performance-based requirements. The company should evaluate the compliance risk as well when considering the value of the incentives.

Avoid location bias.

Most company’s project teams enter the process with a bias toward a particular location or develop a bias along the way. While it is helpful to analyze subjective variables and community fit for a project, these should be distinguished from personal bias for or against a particular location. Once location bias creeps in, this bias may find its way into the objective analysis and may skew the ultimate recommendations of the project team to the company’s executive team.

For example, if the project team member responsible for financial analysis is partial to Site A, and the incentives for Site A are offered over a shorter period of time compared to Site B, then that project team member might suggest a higher discount rate for the comparative analysis, thereby causing Site A’s incentive package to appear more favorable.

Maintain momentum.

Companies should seek to maintain momentum throughout the RFP process. When projects stall out and project teams become unresponsive, the community’s perception of credibility around the project may decrease, and this may have a negative impact on their willingness to support the project.

Hold the project team accountable.

After the company completes its RFP process, it should be in a position to work directly with a limited number of remaining communities and continue with site due diligence, incentive negotiation, and overall evaluation of these locations for its project. To achieve this result, it is important for members of the project team, internal and external, to be able to hold each other accountable for deadlines, responsiveness, and performance. While there is much to do after the RFP process is complete, an effectively managed process will lead to better results on a shorter timeline.