Local Knowledge Key Asset in Location Decisions

The ideas of local leaders who handle the day-to-day management of operations can be successfully applied by corporate leadership to the rest of the company.

Winter 2011

Let's look at an example from our consulting practice: A local manager of a national manufacturing company was preparing to open a new parts depot. This store would sell spares, accessories, and maintenance materials for its product line. He asked a simple question: Based on the locations of my customers and competitors, where is the best spot in town to reach them? We conducted a straightforward study.

A Simple Request

First, we worked with a local commercial broker to identify three clusters with strong access and available buildings. Next we viewed each cluster through three lenses: residential density, population growth, and employment density. To this we added the company's contractor customers, the institutions that use their equipment, and their competitors.

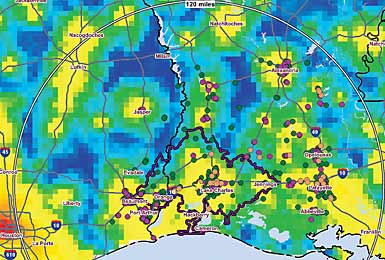

Next, we plotted 10- and 20-minute drive time "amoebas" showing how many customers they could reach from each of several possible locations. This also provided tabular data on demographics, number of customers and competitors for each location, and drive time. Together, these pointed to an area adjacent to an interstate.

Corporate Gets Involved

Things got interesting when the local managers showed the report to regional leaders who immediately requested a plot of active customers in the region. The regional leaders asked us to generate the same maps, zooming out to consider the larger sales territory that included our starting point. The locals had done a nice job of identifying a facility, but the maps also raised the question, "What about those customers and all the other towns that also appear on this map? Are we sure the depot should even be in your city?" Our early conversation with the local leader had not mentioned that this facility would serve the region and neighboring states.

Regional leaders provided customer and competitor data from their national database. At this point, local knowledge kicked in. Though this was a national database, local leaders did not use it consistently. In some cities, "customer" included everyone who had ever bought something. In others, the data included sales levels, and were scrubbed to remove inactive customers. Likewise, the industries they served varied by region - hospitals, casinos, and schools all had varying degrees of importance. Through a series of laborious interviews with local leaders, we standardized the data set to arrive at a targeted result.

From this, we generated maps targeting potential parts facilities locations in multiple locations in the region, essentially replicating the original exercise in each city. This showed geographic distribution that was relatively even across the territory, not focused in the target city. For customers who were not near a particular city, a 60-minute radius seemed more appropriate. Ultimately, the client selected a location well east of the original market, but reaching another major market as well.

Project Announcements

Apex Plastics Opens Expanded Production Plant In Brookfield, Missouri

09/22/2014

Japan-Based Bridgestone Rubber-BSA Opens Biorubber Process Research Center In Mesa, Arizona

09/22/2014

SpencerARL Expands Its Plattsburgh, New York, Manufacturing Facility

09/22/2014

Hill International, Inc. Relocates Corporate Headquarters To Philadelphia, Pennsylvania

09/22/2014

Prysmian Group Plans $8.2 Million Expansion At Abbeville County, South Carolina, Manufacturing Center

09/22/2014

Japan-Based Kowa Kentucky Plans $8.3 Million Manufacturing Facility In Corbin, Kentucky

09/22/2014

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026

-

The Skilled Trades Are Ready for a Digital Future

Q4 2025