It’s hard to find many silver linings connected to the Great Recession. But for some companies planning facilities, the recession left behind the gift of available real estate. That’s helpful, because the availability of buildings moved from 15th to eighth on the list of most prominent factors in Area Development’s 2012 Corporate Survey.

“No question existing buildings have become more important,” says Larry Gigerich, managing director of the Indianapolis-based site selection consulting firm Ginovus. “As you look at the last few years, there’s been a slow, steady economic improvement,” he says. “In this economic environment, companies have tended to wait as long as they can to do a project. If they have to invest capital and hire people, they want to make sure there’s momentum in their business, and they want to be sure they have done everything they can to leverage their facility and their people.”

That kind of timetable, says Gigerich, often rules out build-to-suit. “They want to go quickly because they waited as long as they can,” he says. Such a strategy works hand-in-hand with the supply of buildings, at least in some markets.

“Because of the downturn, there are a lot of quality buildings available,” he notes. He cites Columbus, Ohio, as an example, noting that a spec building spree had taken place just before the economy tanked. Yesterday’s problem is today’s opportunity. “They’ve had a lot of good quality buildings available,” Gigerich adds.

Availability Is Mixed

The generous supply of available industrial buildings has been steadily declining in a lot of markets, though, as the economy has slowly recovered. Colliers International tracks vacancy rates and, in the company’s mid-year 2013 report, noted that U.S. industrial warehouse and distribution center vacancies had been on the decline for eight straight quarters, to just over 8 percent.

Available spaces vary significantly from one place to another, of course. According to Colliers, going into 2013 the vacancy rate in Las Vegas, for example, was three times the rate in Omaha. New construction, meanwhile, is increasing but, not surprisingly, it’s primarily build-to-suit.

In fact, some of the fast-growing users have little use for available buildings because their needs are so specialized, according to Rich Thompson, managing director and leader of the Supply Chain and Logistics Solutions practice at Jones Lang LaSalle. That includes big e-commerce companies in search of distribution space; they’re more likely to go build-to-suit. “They’re really defining exactly what it needs to look like — how high the ceilings are, the column spacing,” he says. “There are very few buildings existing that can fit their requirements.”

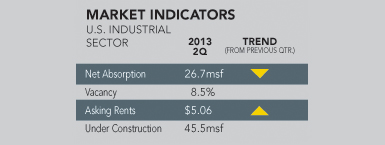

Data from Cassidy Turley shows ongoing improvement in the industrial sector, slowly drying up the roster of available buildings. “Among the primary demand drivers fueling the gains are the auto sector, housing construction, e-commerce, and manufacturing of durable goods,” according to the real estate firm’s U.S. Industrial Trends Report for the second quarter of 2013.

Source: Cassidy Turley Research

Available buildings and space certainly can’t be found everywhere, or across all kinds of property. For example, John E. Robbins, co-founder and principal of Turner & Townsend Ferzan Robbins, does a lot of Manhattan office work. “By and large, for large tenants with multiple floors, the inventory is pretty limited in buildings that they find acceptable,” he says. And what tenants find acceptable has a lot to do with IT infrastructure. “Even companies that five years ago would have been less sophisticated in their technology needs are looking for buildings that have robust infrastructures.”