View of the Macro Site Selection Process

As a business begins the process of reaching a site location decision, an extensive analysis is often conducted to determine the optimal location to meet a company’s specific operational needs. This analysis will consist of a variety of factors that are pre-determined by the business and its advisors to make certain the research ultimately provides a relevant, true understanding of the operating environment in each location being considered.

The criteria list will vary depending on your specific operations and needs, but the attributes most frequently considered are (in no particular order): Infrastructure; Labor/workforce; Customer proximity; Taxes/regulatory environment; Supply chain/industry cluster; Incentives; Political/economic stability; Community support.

Why Understanding Workforce Matters

Workforce considerations have always been important in the site location process. Recently, their importance has risen greatly in the weighting of a site location decision, not just for advanced manufacturing and technology positions, but also for office employment, customer service support, and other staffing needs.

Yes, education, skills, and numbers matter, but so do softer influences such as: How close will potential employees live to the facility? How will they commute to work — car, mass transit, walk, telework? Will potential employees choose the city/town/state first and then find you, or will they look for you directly and just accept where you are located? Is the surrounding population transient in nature, or more inclined to stay in place? By “ground truthing” the wage data through mining social media and possibly conducting a local survey, one can develop a view of wages that changes throughout the region to approximate the local market fluctuations

Using outdated or overly broad metrics can lead to dangerous assumptions on the availability of the best workforce for your business. Simply looking at data sources such as information from the U.S. Census or the Bureau of Labor Statistics may lead to the right - or the wrong - conclusions.

It is oversimplified to believe that only the imminent retirement bubble of the baby boomers is of significance in understanding the changing workforce dynamics. The working population is changing, and each age group has a different point of reference, likes, and dislikes. Assigning broad behavioral traits to any generational group can be misguided. If you want to staff your business with the right talent — at the right price — you need to fully understand the mega and micro population traits of your potential locations.

Finding the Right Talent at the Right Price

When studying the labor/workforce environment of a specific location, both the quality and cost of labor must be considered. Effective analysis of these sometime opposing factors relies on identification of the proper data points, geography, and risk.

Before considering the costs of labor in a particular location, your business must ensure a suitable workforce is available and the required skillsets exist. To discover this information, geographies based on a labor catchment area should be identified (either from submarkets or potential real estate options). From there, a localized analysis is needed, which considers such inputs as drive/transportation time, occupational skillsets, educational attainment, age, geographic preferences of a region (particularly in high-tech and innovative industries), and socioeconomic characteristics. In addition, even if it appears a suitable labor pool exists, it is also critical to study the competition in a market for certain employees. If you want to staff your business with the right talent — at the right price — you need to fully understand the mega and micro population traits of your potential locations.

Why Using Primary and Secondary Data Sources Matters

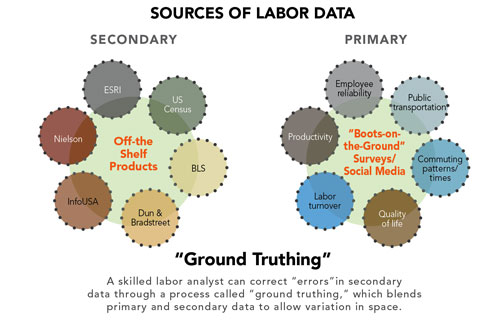

The best labor analytical studies blend primary and secondary source data together using a weighting system to drive the entire analysis. Secondary source data (most commonly used) are data collected by someone else and aren’t specifically collected for any particular project. You might also refer to it as an “off-the-shelf” product. The issue with secondary data is that it’s general purpose might not be perfectly crafted for your project and, therefore, may contain a bias (it’s out of date; it’s perspective is skewed to meet some other purpose; it is too general, etc.). Primary source data are location-specific and collected firsthand. It is great information to have, but can be expensive and tricky to collect. Primary sources of data can come from “boots on the ground” surveys and the virtual mining of data.

A skilled labor analyst, using both primary and secondary data, can take an important step for a more complete understanding of your potential labor pool. A skilled analyst can “correct” secondary data errors through a process called “ground truthing,” which blends primary and secondary data to allow variation in space. Example: The Bureau of Labor Statistics publishes wage data at the county/MSA level, which flattens wages into an average that is constant across the entire region. By “ground truthing” the wage data through mining social media and possibly conducting a local survey, one can develop a view of wages that changes throughout the region to approximate the local market fluctuations.

The best practice for labor analytics is to leverage the best available secondary data (U.S. Census, Bureau of Labor Statistics, Dun and Bradstreet, InfoUSA, and subscription data from sources like Dun & Bradstreet (DB), InfoUSA, Nielson, ESRI, etc.) with “ground truthing” verification using primary sourced inputs (local surveys questioning preferences for and access to public transportation, commuting patterns and times, quality of life, turnover rate, productivity, and employee reliability, as well as data mining on social media).

Every community has unique workforce characteristics. These factors may contrast greatly between particular locations, and if pertinent, may be included in the overall decision-making process.

Challenges of Data Analysis in Global Markets

As companies expand into international markets and become truly multinational, comparing labor across global markets becomes even more necessary. The key is having comparable metrics across countries. Along with the availability of skills, companies must also consider the cost of labor, both actual wages and the associated benefits specific to that market and occupation.

Determining the cost of labor can often be difficult to pinpoint, especially when considering locations in different nations. The usefulness of governmental statistics varies from country to country due to variations in methodology and calculations. For a company to understand the true cost of labor, it must consider factors such as starting wages, experienced level wages, typical benefits levels (expected, union and/or statutorily required), workers’ compensation provisions, training requirements, etc.

With the U.S. model described, the best studies use local resources to help with data collection and validation. As in the United States, use of both primary and secondary sources of data leads to a more complete understanding of the labor pool. When data can be validated as comparable, labor costs and availability in non-U.S.-based operations can be evaluated in comparison to other operations. A growing number of economic development organizations are working closely with workforce boards and academic institutions, especially the community college system, to establish public/private partnerships creating talent pipelines

The Value of Training Support

A community lacking in skillsets and a talent pipeline can still offer a suitable operating environment due to the growing network of training programs throughout the country. A growing number of economic development organizations are working closely with workforce boards and academic institutions, especially the community college system, to establish public/private partnerships creating talent pipelines. In addition, nearly every state and many communities offer financial incentives to businesses seeking to identify, recruit, and train new employees. Existing employees also can benefit from training programs ranging from those focused on specific machinery to safety programs.

In Sum

Today, the site location process is an empirically driven analysis incorporating a number of different factors pertinent to successful operations. Companies must consider these factors to ensure the location they ultimately choose is not only right for their business today, but also able to provide stability long into the future.

Now more than ever, the availability of a suitable labor pool and total cost of labor drives the ultimate placement of a new or expanded facility. It is critical to get beyond the basic statistics and holistically understand the strengths and shortcomings of a location’s workforce:

- You need to understand workforce by location as it impacts your site selection process;

- Actionable labor analytics requires more effort that a simple “secondary source” macro review; and

- Don’t assume talent is readily available until you verify.