Taking an Expanded View of Climate Change

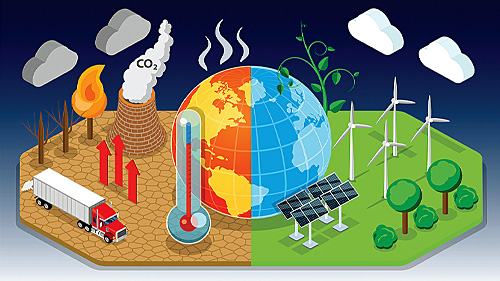

Climate change, corporate sustainability/ESG ratings, and the use of renewables are becoming increasingly important to companies as the planet heats up.

Q4 2022

During a triple-digit wave in California, Governor Gavin Newsom issued a state of emergency, ordering some manufacturers to cease operations, encouraging electric vehicle drivers to charge at night, and allowing ships in harbor to keep their engines on instead of using shore power from the grid.

With climate data showing that summer 2022 was part of a long-term trend, and not a fluke occurrence, it’s no wonder that climate change has become a more urgent factor for companies in many industries, particularly manufacturing. In fact, the Urban Land Institute and LaSalle Investment Management recently released a new report on how climate risk assessment can help protect people and property.

The reliability of the local electrical grid has grown in importance as a site selection concern. Part of the Site Selection Equation

The risk of natural hazards has always been part of the site selection equation, says Gregg Wassmansdorf, senior managing director of Global Consulting for Newmark. Risks like hurricanes, earthquakes, and floods have always been assessed either as a “fatal flaw” to eliminate a particular location, or as part of the short list considerations to pick one location over another, he says. But in recent years, “more and more climate change-related factors are expanding the field of view around natural hazard risk,” Wassmansdorf says.

These concerns have begun to affect facility design, according to Wassmansdorf. He has worked with a client who wants to have a manufacturing facility using “new to the world” renewable power. Also, in the event of power loss from the grid, how can solar or a company’s own resources combined with batteries or backup generators provide better continuity?

Will climate concerns cause manufacturing companies to start favoring locations in more northern latitude locations, or farther inland? It’s too soon to say, Wassmansdorf says, “but I think that will be a natural outcome and a specific function of what a specific business needs for that operation.” For example, “if your process relies heavily on water for cooling or being consumed in process, as in food and beverage manufacturing, the likelihood you would go to drought-prone locations is going to be reduced.”

Reliability of the Electric Grid

Cory Wendt, a principal with Baker Tilly who focuses on manufacturing and distribution advisory, says the reliability of the local electrical grid has grown in importance as a site selection concern. One example: for manufacturers whose processes discharge a large amount of water, a municipality’s capacity to handle high-strength wastewater — or its ability to expand its capacity — might be major factors in choosing a locale.

Companies are also re-evaluating their supply chains with the goal of reducing “upstream” shipping-related impact on the environment. One of Wendt’s manufacturing clients doesn’t want to source energy from coal, so it factored in the percentage of renewable kilowatts a local utility could deliver. Doing so would reduce its environmental impact and also lower the carbon intensity score, which is part of the company’s ESG (environmental, social, and governance) rating, he says. The client company hopes to take advantage of wind production offsets offered by a particular locale.

ESG is a proposed corporate sustainability disclosure by the U.S. Securities and Exchange Commission, which other non-SEC companies are adopting as a common standard to benchmark how their corporate commitments, performance, and business model compare with their peers.

Companies are also re-evaluating their supply chains with the goal of reducing “upstream” shipping-related impact on the environment, Wendt says. He notes that the 2022 Inflation Reduction Act includes multiple incentives for manufacturers to invest in infrastructure that helps reduce their energy footprint — changes that can also help make many otherwise non-economical sites now possible. One incentive example is investing in a digester that can be used to turn high-strength wastewater into energy. Doing so can earn an Investment Tax Credit to cover 30 to 50 percent of capital costs, Wendt explains.

Project Announcements

La Colombe Coffee Roasters Expands Norton Shores, Michigan, Operations

02/23/2026

GRVTY Plans Tysons, Virginia, Headquarters Operations

02/23/2026

Hudson Industries Expands Appleton City, Missouri, Operations

02/23/2026

Israel-Based Katz 1899 Plans Dayton, Ohio, Manufacturing Operations

02/23/2026

Chick-fil-A Supply Plans Winter Haven, Florida, Logistics-Distribution Operations

02/17/2026

Annandale Millwork and Allied Systems Plans Newport News, Virginia, Operations

02/17/2026

Most Read

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025

-

Strategic Industries at the Crossroads: Defense, Aerospace, and Maritime Enter 2026

Q1 2026

-

The Skilled Trades Are Ready for a Digital Future

Q4 2025