Climate Change Concerns Begin to Take Center Stage

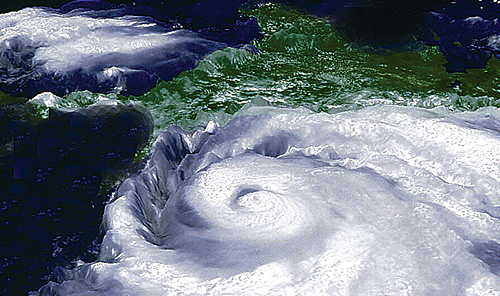

Locations that invest in resilience measures against climate change and catastrophic weather may be more attractive to investors.

Q4 2020

Such concerns are outlined in detail in a report released recently from the Urban Land Institute (ULI) and Heitman entitled Climate Risk and Real Estate: Emerging Practices for Market Assessment. It finds that investors have moved from assessing risk for individual properties to deciding whether to pull out of entire cities.

“Leading real estate investment managers and institutional investors are increasingly recognizing climate risk as a core real estate issue that is beginning to affect their decisions at the market level as well as at the asset level,” according to the study.

Executives elsewhere indicate concern. Mark Williams, president of Strategic Development Group, notes that beginning about 10 years ago, his firm noticed some clients requesting higher standards of floodplain data greater than 100 years. “There is increased concern about flooding of inland areas and a desire to move higher related to flood plains,” he says.

Investors have moved from assessing risk for individual properties to deciding whether to pull out of entire cities. Williams reports that rising sea levels, which have been accelerating for a least the last 50 years, have significant implications for coastal development of all kinds — ports, terminals, cities like Miami and Charleston, and manufacturing facilities that are waterside.

Inland locations also share concerns. Chattanooga, Tenn., for example, faces weather risks related to extreme heat and inland flooding.

“While extreme heat poses a risk primarily to vulnerable communities that are located in dense urban [areas], it does not pose a substantial risk to industrial projects,” reports Michael Walton, executive director, green|spaces, a nonprofit that, among other things, helps support a business culture of sustainability in Chattanooga. “Inland flooding is of more concern, but local leadership is taking steps to plan ahead and mitigate associated risk.”

Chattanooga has had back-to-back years of record rainfall. “In these extreme events, some limited business closures have happened, but these are generally very temporary,” Walton says. “We are not aware of any businesses that haver relocated because of this.”

The stakes are high for local governments that must provide sufficient infrastructure and implement smart climate change policy. Some locations are on the positive end of the issue. Jon Snell, president and CEO of Sun Corridor, Inc., points to Tucson, Ariz., as an example. “Many companies are attracted to the southern Arizona region due to our stable weather,” he says. “Our clear skies — 350+ days of sunshine a year — and dry climate have attracted aerospace-related businesses.”

One example is Sandvik Materials Technology, which recently expanded to Tucson, in part due to the need to expand production capacity in a stable environment close to existing customers and a talented workforce.

The ULI/ Heitman report emphasizes, however, that the stakes are high for local governments that must provide sufficient infrastructure and implement smart climate change policy to protect vulnerable citizens and businesses in order to continue attracting investment as climate change accelerates.

“As understanding of market risk increases, cities that proactively invest in resilience measures may become more economically attractive to real estate investors,” says the report. “Conversely, a lack of proactive investment in resilient infrastructure and prioritized policies could lead to a spiral of decreased capital, ultimately making it even harder to fund much needed investments to protect their communities from the impacts of climate change.”

Project Announcements

Hadrian Establishes Mesa, Arizona, Manufacturing Operations

02/02/2026

Canada-Based Cyclic Materials Plans McBee, South Carolina, Operations

02/02/2026

PC3 Health Plans Jeffersonville, Indiana, Operations

02/02/2026

Legacy Paper Group Plans Port Huron, Michigan, Manufacturing Operations

01/31/2026

DDP Specialty Electronic Materials US Expands Midland, Michigan, Manufacturing Operations

01/30/2026

Aerospace Lubricants Expands Columbus, Ohio, Production Operations

01/30/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025