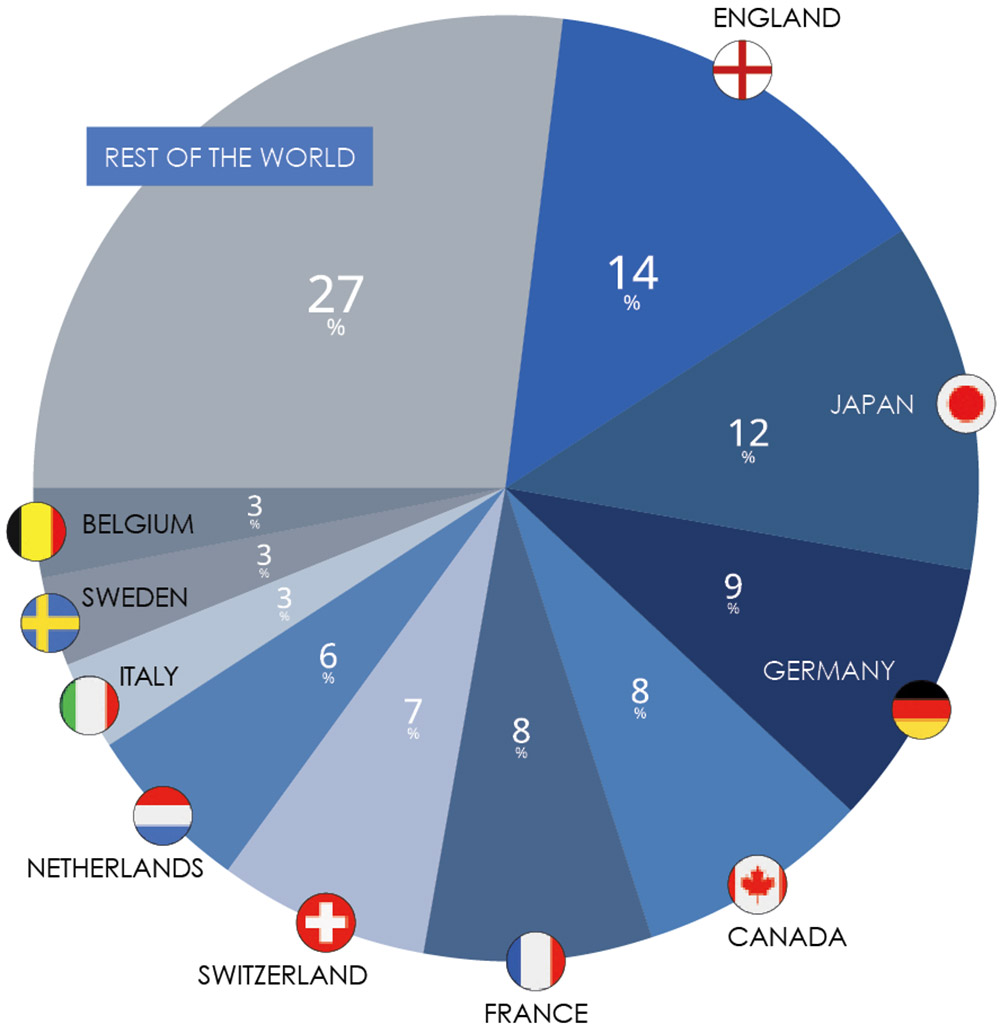

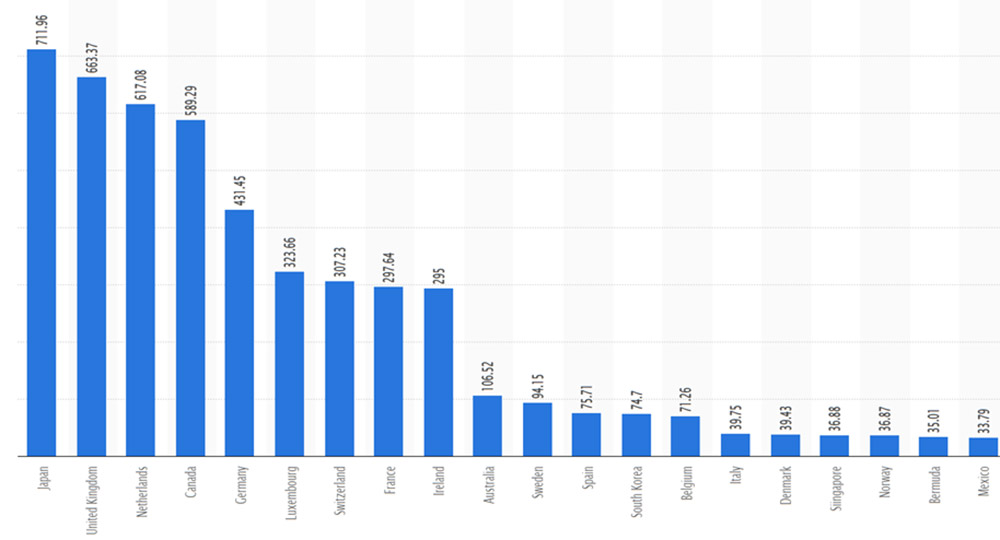

The countries with the greatest amounts of foreign direct investment in the United States to date are Japan, the U.K., and the Netherlands.

British, Japanese, and German companies have created the greatest number of direct jobs.

There are several geopolitical uncertainties which are currently influencing global investments. Interest rates are forecasted to fall in Europe and in the U.S. as inflation is seen as likely continuing to decrease. The pending presidential election in November 2024 is creating some uncertainty, however the Inflation Reduction Act (IRA), as well as the Chis Act (UK) still attract and incentivize many foreign companies to consider the U.S. for their new plant locations.

As tension between the U.S. and China grows, reshoring, or the trend of relocating manufacturing facilities in the U.S., has become very popular. Due to the war in Ukraine, energy costs have risen dramatically in Europe. Therefore, many companies, especially those in heavy manufacturing and other substantial energy users are favoring the U.S. for new plant locations. Simultaneously, a continuous flow of Chinese companies, and in particular, battery suppliers for the burgeoning electric vehicle (EV) activities are bringing about an additional wave of FDI to the U.S. Nevertheless, due to the growing political tension, these Chinese investors are facing an increasingly challenging landscape.

Current Site Selection Challenges for FDI Projects

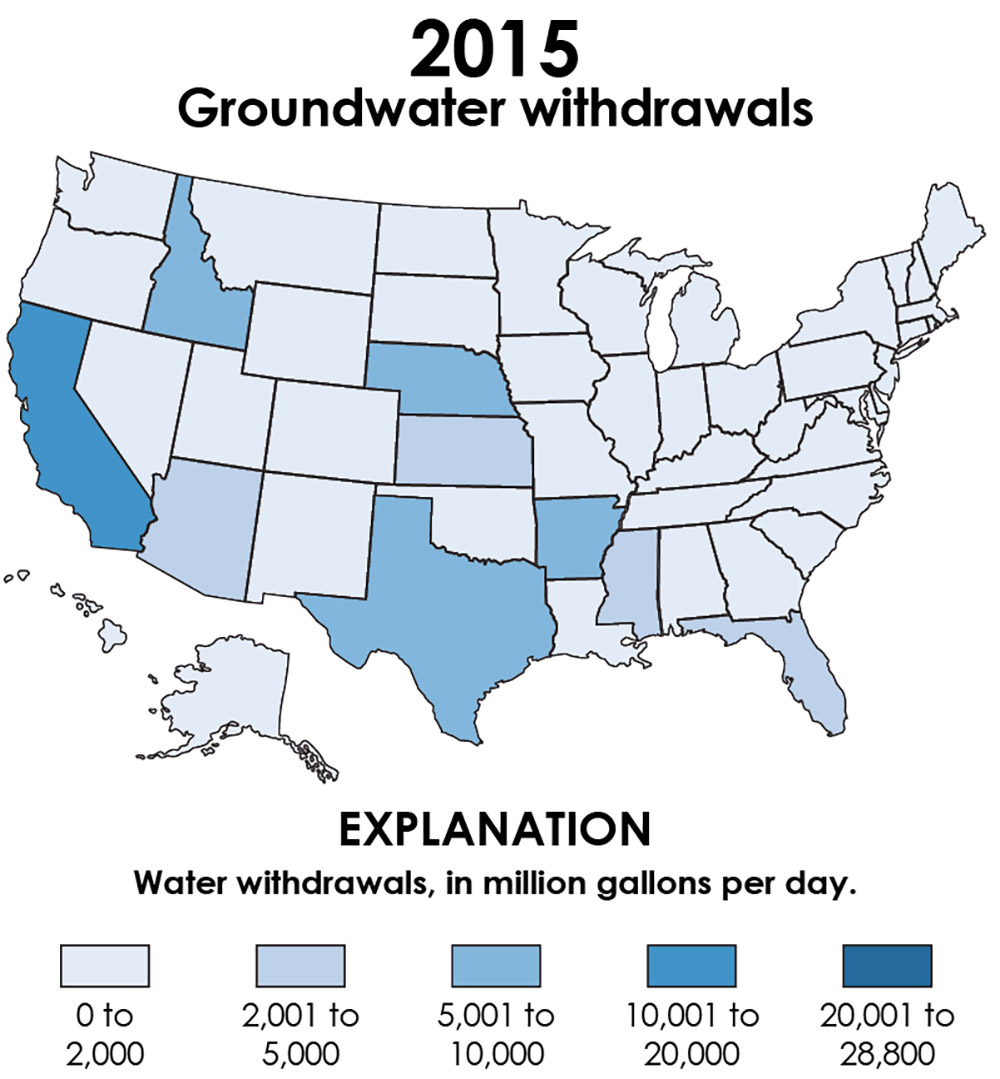

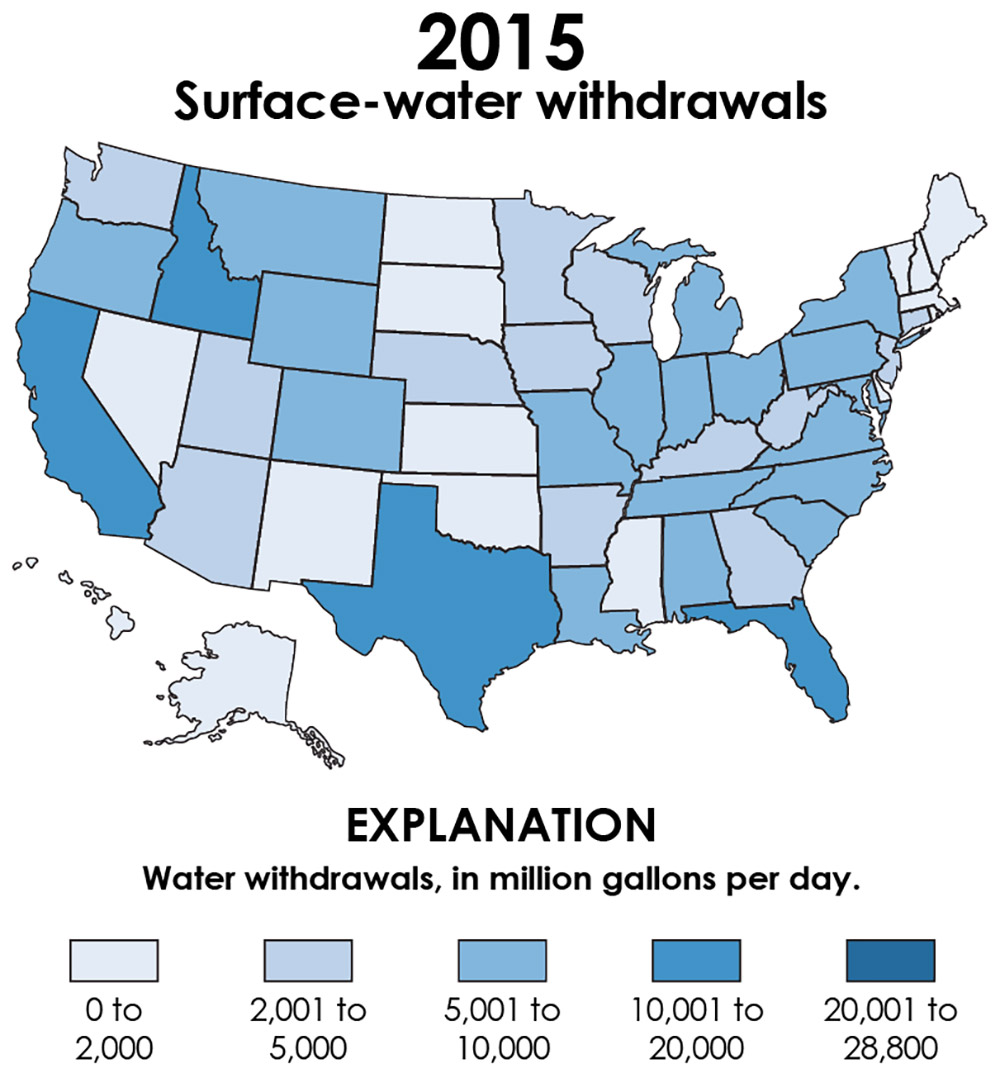

Finding a site which meets the requirements for any kind of manufacturing is a real challenge at the moment. Some states have limited or no inventory for smaller or midsize projects (100 acres and larger). As lead times for the start of production (SOP ) continue to shrink, available utilities are an ever more critical topic. Water scarcity in the United States is an increasing problem. It is estimated that more than 50% of the Continental U.S. has experienced drought conditions since 2000.

The lead time to obtain transformers is now up to 18-24 months.Fast track permitting is also now on top of the list for many clients.

Renewable energy usage has become a mandatory topic for many clients, and therefore, countries such as Morocco and Egypt, with abundant natural resources, are becoming very popular for new plants. These countries are very innovative in their ability to offer plenty of renewable energy sources. For example, the Renault OEM plant in Tangier (320,000 vehicles/year capacity) is the first zero carbon, zero emission automotive plant. According to the IPCC, industry and their emissions caused by energy consumption are responsible for 31% of global greenhouse gas emissions. Renault is using local biomass: an “olive cake mix” of skins, pulp residues and olive stone fragments. The mixture is continuously burned and sent to their 3 boiler rooms. Even the ash is collected and used as fertilizer by local agriculture. 100% of the plant’s thermal needs is covered by biomass. In the ASEAN region, Singapore, Indonesia, Vietnam and Thailand are leading the FDI net inflows.

Geography

The latest Houthi attacks on shipping in the Red Sea show how the global supply chain remains vulnerable to disruption. As a result, many firms are switching to decentralized manufacturing to gain the benefits of:

- Greater flexibility and responsiveness — Decentralized production can respond much faster to changing customer requests and market trends, as production can be adjusted at each location depending on the necessary steps.

- Lower transportation costs — Products can be manufactured and distributed locally, reducing transportation costs and lead times.

- Reduced vulnerability to disruptions — Spreading production across multiple locations means that problems at one plant can be isolated, minimizing the risk of supply chain interruptions.

- Increased administrative costs — Decentralized production requires duplication of many resources, like labor, equipment, and utilities.

- Greater difficulty in standardizing product quality — Since production processes are spread across multiple operations, securing consistent product quality can be more difficult.

- Greater capital investment — Decentralized manufacturing usually requires greater capital investment, as a new plant must be built, and additional equipment purchased.

Numerous American states have completely rejected all Chinese investment projects. Some have passed legislation prohibiting the sale of land to Chinese nationals or Chinese-owned companies. Moreover, several states have declined to offer any incentives for even large Chinese-owned investment projects, which would have been unthinkable in the recent past. Additionally, these well publicized anti-Chinese investment policies have resulted in making Chinese companies feel uncomfortable and uncertain whether their new manufacturing facilities will be welcome.

50% that’s the percent of the Continental U.S. that has experienced drought conditions since 2000. The Role of CFIUS.

The Committee on Foreign Investment in the United States (CFIUS), is an interagency committee authorized to review certain transactions involving foreign investment in the United States and certain real estate transactions by foreign persons. It is chaired by the United States Department of the Treasury. The purpose of CFIUS is to determine the effect of foreign investment transactions in the United States on the country’s national security.

Although CFIUS has existed since the mid-1970s, in order to study foreign investment and determine whether it impacts national security, it has been significantly strengthened under the prior and current administrations. Changes in 2018 under the Trump administration were seen as primarily effecting Chinese investment. Broadly, CFIUS’s role is to investigate proposed mergers, acquisitions, and takeovers where the acquirer is acting on behalf of a foreign government and affects national security. Even a passive real estate purchase transaction may trigger CFIUS review.

CFIUS must assess whether a transaction could undermine the protection or integrity of data in storage or databases or systems housing sensitive data; interfere with U.S. elections, U.S. critical infrastructure, the defense industrial base, or other cybersecurity national security; or result in the sabotage of critical energy infrastructure, including smart grids. Foreign investments in the U.S., including acquisitions and real estate transactions, if in certain sensitive technology and critical infrastructure sectors, or in close proximity to military bases or critical supply chains, are subject to review by CFIUS.

CFIUS can review any investment or acquisition that could result in a foreign person acquiring ‘control’ (i.e., the affirmative or negative power to determine important decisions) over any person or entity operating a business in the United States from any other person. With respect to CFIUS review of a proposed transaction, there are both mandatory and voluntary filings.

A mandatory filing is required when a foreign person gains “control” of or any of the following discrete information or governance rights with respect to a U.S. business that “produces, designs, tests, manufactures, fabricates, or develops” any “critical technology” (i.e., technology controlled in certain ways under US export control laws):

- Access to “material nonpublic technical information” in the possession of the US business.

- A board seat or board observer right.

- “Involvement” in the US business’s “substantive decision-making” regarding “critical technology,” “critical infrastructure” or “sensitive personal data” as defined in the CFIUS regulations.

It is also possible for a foreign person planning a transaction to make a voluntary CFIUS filing. This includes such transactions such as:

- Any transaction that could result in foreign “control” of a U.S. business.

- Transactions which will give rights to a foreign person in a U.S. business in certain critical technologies or infrastructure.

- Certain real estate transactions involving the purchase by, lease by or concession to a foreign person that gives them certain enumerated property rights.

In light of the perceived risks of granting incentives to a Chinese-owned investment project, which could potentially be deemed to be a covered transaction by CFIUS, on several recent occasions, public officials have mandated that foreign investors make voluntary CFIUS filings as a condition precedent for offering economic development incentives. While it is not yet clear what the near- and long-term impact of this current contentious climate for Chinese investments will ultimately be, it may result in Chinese companies looking elsewhere to locate their projects. Other North American locations may be present viable options, however, there are also existing regulatory regimes that may give rise to scrutiny and review of certain foreign investor-owned projects.

Mexico

Foreign investment projects locating in Mexico are generally allowed without restrictions or the requirement to obtain prior authorization from an administrative agency. Nevertheless, there are certain industry sectors subject to restrictions, including acquiring any equity in Mexican companies engaged in land passenger and freight transport services within the Mexican territory, development banking, and in certain other industry sectors limited solely to Mexican nationals. Foreign investment projects in these sectors may be subject to review and approval.

Mexico has targeted the near shoring of Chinese investment projects which have decided against a U.S. location. It passed the IMMEX legislation (Industria Manufacturera, Maquiladora y de Servicios de Exportación, or Manufacturing, Maquiladora and Export Services Industry) in order to benefit from the current contentious environment for Chinese investments in the U.S., and is consequently winning many Chinese investments and new jobs.

Canada

Although Canada has been generally very receptive to foreign investment, it has its own legislation similar to CFIUS which allows review of such investment projects. The “Investment Canada Act” (ICA) is Canada’s statute that regulates foreign direct investments (FDI) in Canadian businesses by non-Canadians. The Canadian government is authorized to review any transaction (including minority investments) in which there are “reasonable grounds to believe that an investment by a non-Canadian could be injurious to national security.”

There are no penalties for not making a voluntary CFIUS filing, it is prudent to seek such review. The Investment Review Division (IRD) is part of Ministry of Innovation, Science and Economic Development Canada (ISED). The IRD interacts with investors and other parties as part of a preliminary (informal) review of an investment to determine whether there are potential national security concerns. If concerns arise after the preliminary informal review, the matter may be referred to the Cabinet (the Canadian Prime Minister and his appointed ministers, formally known as the Governor in Council), who may order a formal review if the investment could be injurious to Canada’s national security.

The national security review process is supported by Public Safety Canada, Canada’s security and intelligence agencies and other investigative bodies described in the National Security Review of Investments Regulations.

Also similar to CFIUS, foreign person investments that are not subject to mandatory review or notification (such as the acquisition of a non-controlling investment or setting up new Canadian entities that do not qualify as “businesses”) may be notified voluntarily to obtain national security clearance. Even if a non-notifiable investment (no mandatory review), it is potentially subject to review during a five-year period following the investment.

While many observers follow FDI trends, one aspect of the strong flow of FDI into the Southeastern U.S. is the growth of an entire industry of expert service providers dedicated to serving and supporting the inward-bound investment flows. Manufacturing projects with significant job creation have needs well beyond an initial site selection search, due to employee recruitment and specialized job training. In response to the location and growth of foreign-owned companies into the region, a specialized parallel services support industry has emerged, with language and cultural capabilities in addition to legal, tax, human resources, construction, project management and engineering. German-speaking service providers have created a remarkable niche since the 1990s, following a number of German OEM automotive manufacturers, as well as substantial investments in aerospace, steel, chemicals and other manufacturing industries. The number of foreign consulates, trade offices and chambers of commerce located in Atlanta alone serve as a clear indicator of the critical importance of FDI for the region.

An efficient due diligence process and successful site selection require the input of a qualified site selection expert with deep knowledge of engineering principles, building codes, permitting requirements, and regional characteristics that affect industrial operations. Simultaneously, it is prudent to seek qualified legal counsel and tax advisors to properly foresee and structure the necessary tax, corporate, business and immigration needs for most foreign-owned investment projects. Due to ever shorter lead times and constantly emerging challenges, avoidance of delays through experienced counsel’s identification and explanation of potential complications is crucial.

There is no shortage of businesses claiming to offer site selection services. But note that it is best to hire an experienced consultant with the client’s best interests at heart, rather than someone chasing a sales commission. An experienced consulting engineer will ensure that no issue is overlooked and efficiently manage the process. This will help the company minimize headaches, delays, and cost overruns. While incentives can also reduce certain costs of a plant location, the long-term success of the project will depend upon the thoroughness of the site selection process and a decision based on the critical factors necessary to build and operate a facility.