In some companies, siting decisions are centralized and require executive-level approval; in others, these decisions are made and authorized at a business-unit level. Ideally, and typically in larger companies, siting decisions are aligned to a broader location and real estate portfolio strategy, framed by business needs, workforce planning, and real estate demand management.

Let’s look at some of the underpinning drivers of location selection decisions and some of the key players involved:

Perspectives

At the C-suite level, location strategy and site selection decisions are:

- Long-term investment decisions

- Trade-offs of risk, cost, and opportunity

- All about value-add to the bottom line

Location investments are big decisions, with serious resources, risks, capital, and opportunity costs.

Even for less capital-intensive industries, the lead-time and alignment with predictions of market growth and supply chain requirements become critical parameters. Consultants and internal site selection teams will be focused on developing a feasible business case for the investment, driven by the payback and upfront financial hurdles.

Trade-offs of risk, cost, and opportunity: Every location decision is about a trade-off or choice point. An obvious one, for example, is a choice between minimizing lead time by selecting an existing building or shovel-ready site in Location A versus what might be a better long-term site solution or labor market in Location B. The classic trade-off is cost versus operational advantage — at what price point does the company need to be positioned to attract the talent it needs in Location A versus Location B? Every decision point has a consequence — optimizing the advantages and minimizing the risks drive the right solution.

Value-add to the bottom line: Sound business decisions are ultimately about additive value to the company and its shareholders. Being in a location with a sustainable talent pool will contribute to company value by enabling innovative solutions to customers. Payroll represents the biggest operating expense in most companies and, as such, geographic variability in labor costs and labor regulation become critical location selection factors. But costs do not necessarily equal value. Decision-makers may accept higher costs — if that is what it takes to find the best talent to meet company objectives. Value-add trumps cost.

Costs Are Critical, But in Context

Rarely are site selection decisions all about costs…and sometimes company management downplays costs, but ultimately, management nearly always drives toward a cost-effective result. Here is a description of how “cost” weaves through the cadence of stages in the decision-making process in terms of thresholds, alternative solutions, and decisions.

The threshold stage is often cost-driven. Screening to a manageable group of locations from a universe of hundreds of potential places is an exercise in efficient resource utilization — finding the needle in the haystack requires sifting through a lot of straw that looks the same. In siting a facility, cost is one of the first qualifiers, and typical site selection threshold criteria might read as “consider only metro areas with an average wage of 90 percent of the national average or 75 percent versus our current labor markets.”

The solution stage is typically value-based: Once a reasonably small pool of candidate locations is identified, the decision team can concentrate limited resources on finding the right set of alternative location solutions that best fit company objectives. Relative to selecting a business location, value from the company decision-maker’s perspective is about satisfying business objectives at an acceptable level of start-up and operating costs and determining which location solution does this best.

Costs do not necessarily equal value. Decision-makers may accept higher costs — if that is what it takes to find the best talent to meet company objectives. Value-add trumps cost.

The decision stage is based on a sound business case: This is when the company’s site selection team needs to, if you will, “sell the solution” internally…perhaps to the CEO, CFO, COO, head of real estate, and those who may be asked to relocate. The business case must be based on a sound, documented methodology that demonstrates tangible benefit to the company, satisfies investment hurdles, and minimizes potential risk.

A Framework for Location Decisions

Here is one of several simple tools to evaluate how alternative locations satisfy company objectives and which location provides the strongest business case. It consists of three sets of factors that help determine the best location for a particular project. Factors within each dimension can be weighted to develop a score for each dimension, with each location plotted to the scores.

The dimensions are:

- Performance factors such as talent, workforce scale, business climate, access, and other operational drivers

- Financial return including net present value, return on investment, upfront cost hurdles, and other economic measures

- Delivery factors including site, infrastructure availability, and other factors to determine how quickly the project can be up and running

Parties to the Location Decision

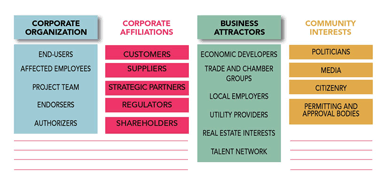

There are typically four groups of stakeholders involved in location decisions: the corporate internal organization, external corporate affiliates, community interests, and business attractors.

Within the corporate organization, the decision rests with those who have the authority to take action, whether at the executive, VP, or manager level. However, there are other internal groups who will influence or gate-keep the decision process. These range from end-users (such as affected employees) to endorsers (helping to build support). Of course, the project team is at the center of developing the solution and business case to management. This team might consist of representatives from corporate real estate, human resources, finance, and the operational and technical experts specific to the project.

Other external affiliates — such as customers, suppliers, and strategic partners — play an important role too. Service-level agreements and other arrangements may play an important part in the location decision. In some industries (financial services, government contracts, and pharmaceuticals come to mind), there may be regulatory requirements and stakeholders that place constraints on where to locate.

Community interests may become involved as well, particularly for large or otherwise highly visible projects (for example, those with significant employment impact, large capital investment, unique talent requirements, or prestige). On the opposite end of the spectrum, some projects may not be perceived as desirable due to environmental or other controversial aspects. In either case, the political arena enters into the equation, and this becomes the linkage point to negotiating incentives and/or mitigations for the project. Those involved with project permitting (site, zoning, construction, environmental, etc.) are part of this group as well.

Key partners throughout are the business attraction professionals and allies who market the community, support delivery of the project, and, more fundamentally, help to shape the economic development “product” of the location, i.e., infrastructure, workforce, business climate, quality of life, and other attributes that define the “place.” These include economic development professionals, chambers of commerce, the local real estate community, utility providers, employers, educators, and others who play a role in shaping and promoting the business attributes for investment in the location.

Aligning all of these interests makes for a successful location decision and transition to starting up a new or expanded operation.

Closing Thoughts

This brief review has presented some perspectives around how location selection decisions are made, by whom, and the factors of importance to company leadership. In sum, location investments are big decisions for companies, with serious resources, risks, capital, and opportunity costs in play. Those charged with making these decisions care about:

- Benefit and opportunity in achieving company goals

- Financial hurdles and investment return

- Delivery and project start-up when needed They are less specifically concerned about traditional site selection factors other than how these enable broader corporate imperatives and add value to the company’s bottom line.