25th Annual Corporate Survey

The economy's gradual recovery during 2010 has resulted in increased business optimism, a rise in new facility plans, and some changes in site selection priorities.

Winter 2011

CEO's confidence increased in turn. Chief Executive magazine's CEO Confidence Index increased 14.7 points in late November 2010. Consequently, we see that business investment in equipment and software grew as well (at a 15 percent rate in 2010's third quarter), and companies began to hire. Jobs were added in 41 states last October, although we must admit that this was not enough to significantly reduce unemployment numbers.

So while the 2009 Corporate Survey results reflected the nation's economic downturn, we expected that the results of the 2010 Corporate Survey would validate the economy's return to growth, albeit at a slow pace. Let's look at these results now to see if they reflect the latest U.S. economic news.

The Respondents

Some 158 executives responded to our 2010 Corporate Survey. Of those, fully two-thirds are with manufacturing firms (Slideshow, Figure 1). More than 40 percent are the owners or highest-level executives of their firms (e.g., CEO, chairman, president), and another quarter are high-level corporate officers (e.g., vice president, treasurer) (Slideshow, Figure 2).

It follows, therefore, that 43 percent of the 2010 Corporate Survey respondents are responsible for their companies' final location decisions. More than half of the remaining respondents are involved in either the preliminary site selection decision or information gathering (Slideshow, Figure 3).

Forty-six percent of the corporate respondents operate five or more domestic facilities, while only slightly more than a quarter of these executives operate just one domestic facility. Nearly a third of the respondents say they operate foreign facilities. Of these, more than two-thirds claim to operate five or more foreign facilities (Slideshow, Figure 4).

When considering all their facilities worldwide, 30 percent of the respondents to our 2010 Corporate Survey say they employ 1,000 or more people. A similar percentage say they employ fewer than 100 individuals worldwide, and another third of the respondents say they employ between 100 and 499 workers (Slideshow, Figure 5).

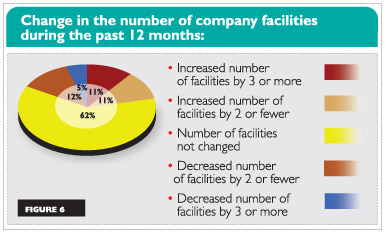

More than 60 percent of the respondents report that their companies did not add or decrease their number of facilities over the 12-month period prior to the survey. However, 22 percent claim to have increased their number of facilities and 17 percent claim to have decreased their number of facilities over the aforementioned period (Slideshow, Figure 6).

Nearly 40 percent of the respondents who claim to have increased their number of facilities attribute those additions to growth in sales/production. More than 40 percent point to the need to serve new markets as a primary reason for adding facilities. When it comes to decreasing their number of facilities, 75 percent of those respondents who have done so over the 12-month period prior to the survey cite the need to consolidate facilities, with nearly 30 percent focusing on a need to lower operating and labor costs, and more than 20 percent pointing to decreased product sales (Slideshow, Figures 7 and 8).

Did the Great Recession affect our 2010 Corporate Survey respondents' facility plans? Interestingly, about 20 percent say "no" - they still plan to open new facilities and hire more workers. However, many of the respondents say "yes" - the Great Recession led them to seek new ways to optimize current facility layouts (33 percent); caused them to defer capital spending (30 percent); put new facility plans on hold (25 percent); and reduce current employment (22 percent) (Slideshow, Figure 9).

When asked about when they expected the economy to improve significantly, last year, 40 percent of the 2009 Corporate Survey respondents said they expected that to happen by 2011. Now, however, nearly 50 percent of our 2010 Corporate Survey respondents think the economy will not improve significantly until 2012, and nearly 40 percent have set the timeline for improvement back until 2013 (Slideshow, Figure 10).

Project Announcements

Amgen Expands New Albany, Ohio, Manufacturing Operations

04/28/2025

United Kingdom-Based Balmoral Tanks Plans Mentor, Ohio, Operations

04/28/2025

E & E Hardwoods Expands Bell County, Kentucky, Saw Mill Operations

04/27/2025

Aegis Sortation Expands Louisville, Kentucky, Operations

04/26/2025

Process Machinery Expands Shelby County, Kentucky, Production Operations

04/26/2025

HL Mechatronics Expands Williams Township, Michigan, Operations

04/26/2025

Most Read

-

Run a Job Task Analysis

Q4 2024

-

The Location Economics of Advanced Nuclear

Q1 2025

-

39th Annual Corporate & 21st Annual Consultants Surveys: What Business Leaders and Consultants Are Saying About Site Selection

Q1 2025

-

NEW NIMBYism: A Threat to The U.S. Economy

Q4 2024

-

Why Workforce Readiness Can’t Wait

Q1 2025

-

Power, Policy, and Site Selection in 2025

Q1 2025

-

Forging Solid Foundations

Q1 2025