In addition to fuel switching from natural gas to renewably-sourced electric, vehicle electrification is rising to the surface in an impactful way to reduce Scope One emissions — those that are directly owned or controlled by a company. According to a recent study by Europe’s leading clean transport campaign group, Transport & Environment, electric vehicles (EVs) emit three times less CO2 than their gas-fueled counterparts. From owned corporate fleets to personal vehicles to warehouse forklifts, EVs and the infrastructure required to charge them are top of mind with real estate owners and tenants.

Apartments and retail environments must provide EV charging as a key amenity to attract new residents and shoppers. Industrial properties need to accommodate short-haul delivery electrification and eventually long-haul trucking solutions, while office buildings need to accommodate a range of needs from fleet electrification to personal vehicle use to talent recruitment.

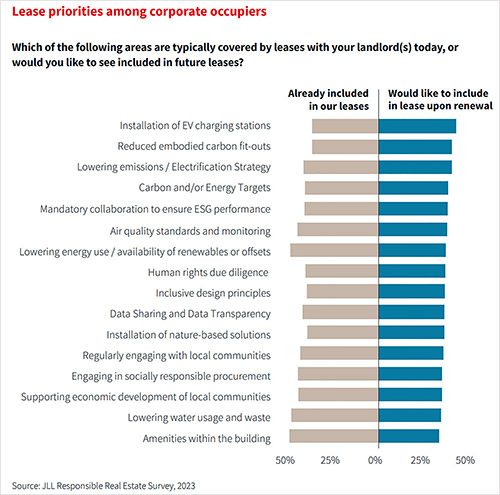

Vehicle electrification is rising to the surface in an impactful way to reduce Scope One emissions. According to JLL’s Green Leasing 2.0 report, corporate occupiers specifically are clearly targeting carbon-centered language to meet their net-zero and talent recruitment goals, and EV charging is squarely at the top of the priority list. To make this happen, landlords need to provide the charging stations and the power than runs them, whether that means retrofitting into an existing property or adding to a development plan prior to construction. And tenants need to negotiate into their leases the pricing and parameters around accessing those charging stations. Sounds simple, right?

Green Lease: a new way of working centered around education, engagement, and shared equity

When negotiating a lease between a landlord and tenant, competing priorities and a desire to avoid risk and unnecessary cost are at play. Both parties need to come together to find mutually beneficial solutions, and green leases are emerging as that critical path forward. This requires a shift from the adversarial and at times contentious relationships that historically existed between owner and tenant.

In a commercial setting, the practical implementation of green leasing is having both sides of sustainability representation at the table with an equal voice. The goal is to align on key issues necessary to operate sustainably — data management, utility use and responsibility, future improvements, and EV charging are complicated issues that require planning and agreement.

Charging infrastructure requires property on which to host charging stations. Therefore, companies leasing space must consider working with property ownership in support of their priorities, whether they are focused more on fleet electrification or the charging of employee owned EVs for recruitment purposes — or both. How can property owners and tenants work together to implement charging infrastructure, define access to it, pay for it, and protect against risk?

There are some key questions for landlords and tenants to explore to provide a roadmap to achieving shared goals:

- What types of vehicles are used, e.g., passenger, vans, commercial vehicles, or personal vehicles?

- Are vehicles used all day, every day, or occasionally?

- Do vehicles stay in the general vicinity or travel long distances?

- How often do vehicles return to home base and for what period of time?

- Do vehicles remain overnight or only for loading/unloading?

- Are fleet expansion plans in the works?

- Will the fleet need to be charged overnight?

- What’s their actual usage rate and equipment up time?

- Will vehicles charge while loading to optimize efficiency or will a parking lot be used to enable fleetwide charging overnight?

- How will day-to-day access be managed when there are more vehicles than charging stations?

- How can we encourage users to not “sit” on a station for an extended period of time?

- Will the proposed locations of charging stations accommodate convenience and practicality?

Initially, green leases were proposed as a potential solution to navigating the split incentive problem whereby one party, usually the owner, incurs capital expenses for an energy retrofit, while the other, usually the occupier, receives the benefit, e.g., reduced operating costs.

It’s complicated when it comes to equitable share of costs for EV infrastructure. The addition of EV charging stations gives a building owner another amenity that requires management, in addition to higher power and operating expenses. The property management team needs to make sure that it’s always engaged, and then it becomes a tenant relationship management challenge because of equipment up-time or user interface challenges.

Let’s not forget the cost of the equipment itself. The most installed EV charging stations are Level 2, which achieve full charge in 6–8 hours, and Level 3, also known as DC fast charging, which provide a full charge in 30–60 minutes. The cost difference between the two is substantial, reaching up to $80,000 or more for fast chargers.

Weighing the upfront and ongoing cost against potential benefits is an important exercise for both parties. Not surprisingly, pricing becomes one of the biggest hurdles of green lease negotiation.

As more companies realize the immediate carbon reduction impacts of electrifying their fleets, demands are steeply rising. Pricing of the EV charging infrastructure needs to be something built into the long-term management plan for both the landlord and tenant. Perhaps the tenant agrees to pay a higher pro-rata share of the building’s operating expenses for access to EV charging. Alternatively, there could be a split of the upfront capital costs, with the landlord and tenant agreeing on the ongoing charges. Or, depending on a station’s metering capabilities, a tenant can be charged individually only for the actual time they are plugged in. The point is, there is no one-size-fits-all solution — rather, it’s about early and upfront discussion.

Infrastructure Planning, Outside the Vacuum

The devil is in the details. Careful planning and negotiation are required as we embark on building the necessary structures to accommodate EV charging demand. It won’t be easy. As more companies realize the immediate carbon reduction impacts of electrifying their fleets, demands are steeply rising. As more corporate occupiers seek to provide EV charging to their employees, building owners will need to act fast with infrastructure upgrades and tangible solutions.

There’s so much to gain from working together on the infrastructure planning, from reducing carbon emissions to receiving Inflation Reduction Act tax credits to increasing the value of a property. Green leases are a powerful tool to move us forward because they require early, honest, and ultimately productive communication that achieves results.