Location Factors for Cell and Gene Therapy Companies

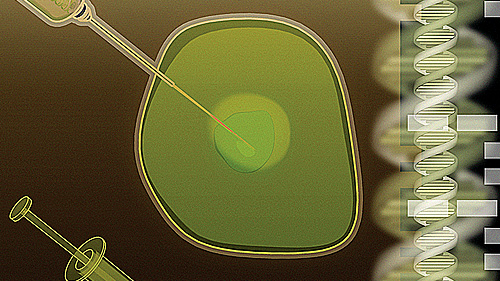

The rise of cell and gene therapy (CGT) demands a strong supply chain, manufacturing operations, and specialized talent.

Q4 2021

Presently, there are approximately 900 companies worldwide focused on these advanced therapies, and over 1,000 cell and/or gene therapy clinical trials currently under way. A rise in the clinical pipeline, coupled with a rising number of regulatory approvals for advanced therapies, has significantly driven the market.

The global cell and gene therapy manufacturing market size is expected to reach $57.4 billion by 2028, according to a new report by Grand View Research, Inc. The market is estimated to expand at a compound annual growth rate (CAGR) of 20.3 percent from 2021 to 2028.

Traditional supply chain models will not effectively meet the needs of these companies that are producing personalized therapies that must quickly and efficiently be delivered to their customers and patients. Supply chains that support the manufacturing and delivery of cell and gene therapies are long, complex, and highly controlled. As such, companies across the globe are looking to the United States to find locations with a thriving innovation ecosystem and a strong mix of a highly skilled workforce, robust supply chains, and manufacturing centers to meet their growing needs.

The global cell and gene therapy manufacturing market size is expected to reach $57.4 billion by 2028. Ideal Location Factors for CGT Companies

Ability to hire specialized talent: The cell and gene therapy industry is growing rapidly and there is deepening demand for a highly educated, highly trained workforce. Cell and gene therapy manufacturing is a complex, largely manual process that requires numerous skilled employees in an extremely monitored environment. Markets with a large pharmaceutical footprint are often the most appealing, as manufacturers can utilize the talent pool from industries where traditional, chemical-based medicines are made, or markets where other regulated industries manufacturing products for human consumption, like cosmetics and nutraceuticals, are based.

To address workforce needs, the New Jersey Institute of Technology (NJIT), in collaboration with New Jersey Innovation Institute (NJII) is offering a professional science master’s degree program and professional graduate certificate in cell and gene therapy — the only one of its kind in the United States. In addition, NJII developed a cutting-edge apprenticeship program where select students are trained for the field of bio-manufacturing over an 18-month period.

Proximity to robust transportation systems: The highly specialized manufacturing process required for cell and gene therapy imposes significant burdens due to the complexities associated with transporting, storing, and processing raw materials and shipping finished products. The production of cell therapies requires even greater vigilance against threats that can degrade purity, potency, and efficacy.

To date, the majority of cell and gene manufacturing companies are located in the northeast United States. The highly connected, affluent, and concentrated Boston–New York City–Philadelphia–Washington, D.C., markets offer logistical supply chain solutions for cell and gene therapy companies that need to move drug products quickly. The East Coast’s vast transportation system can easily expedite express deliveries to maintain the integrity of cell and gene therapies, and access to transportation systems make it easy to move products across the country or around the world.

Markets with a large pharmaceutical footprint are often the most appealing. Cluster of Contract Development and Manufacturing Organizations (CDMOs) and Contract Research

Organizations (CROs): Cell and gene therapy developers benefit from cities and regions featuring a “cluster” of CDMOs and CROs to move “from bench to bedside.” CDMOs help companies translate a drug into scalable, commercialized treatment, while CROs manage clinical trials. As many CDMOs in Europe have been booked since COVID-19, this presents a unique opportunity for the United States to attract international companies to establish their operations here.

A supportive ecosystem where innovation thrives: As cell and gene therapy developers are struggling with global constraints, there are a number of markets across the United States that offer a supportive ecosystem for these developers to thrive. Cell and gene therapy companies succeed when they can tap into an innovation ecosystem that includes incubators and accelerators, research parks and hubs, and the ability to partner with research universities, medical schools, and hospitals. Much of the initial stage research is happening in Boston, and companies that are further along in product development have turned their focus to the New York-New Jersey area.

The production of cell therapies requires even greater vigilance against threats that can degrade purity, potency, and efficacy. Looking Ahead

Cell and gene therapy, while still a burgeoning industry, presents a real opportunity for future economic growth for select markets across the country. Despite significant disruptions in the supply chain caused by the COVID-19 pandemic, cell and gene therapy R&D and commercialization continued to accelerate in the marketplace. As we look ahead, the U.S. market should be focused on ways to attract, support, and retain cell and gene therapy companies, which will ultimately drive investment, employment, and — most importantly — save lives.

Project Announcements

Novartis Plans Winter Park, Florida, Radioligand Manufacturing Operations

01/20/2026

Johnson & Johnson Expands Wilson County, North Carolina, Production Operations

01/16/2026

TransMedics Group Plans Somerville, Massachusetts, Headquarters Operations

01/16/2026

Lithium Battery Company Plans Tampa, Florida, Battery Pack Production Operations

01/10/2026

Eurofins Lancaster Laboratories Expands Lancaster County, Pennsylvania, Research Operations

01/03/2026

Samsung Biologics Plans Rockville, Maryland, Manufacturing Operations

12/31/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

The New Industrial Revolution in Biotech

Q4 2025