Innovation, resilience, and economic growth are hallmarks of the life sciences sector. From pioneering pharmaceutical breakthroughs to advancements in biotechnology, the industry has consistently pushed the boundaries of human health and scientific discovery. However, like all industries, it is subject to cyclical market fluctuations, regulatory shifts, and the evolving demands of health care systems worldwide. As we navigate through 2025, the sector faces a mix of challenges and opportunities that will shape its trajectory for years to come.

The Market: Supply, Demand, and Strategic Opportunity

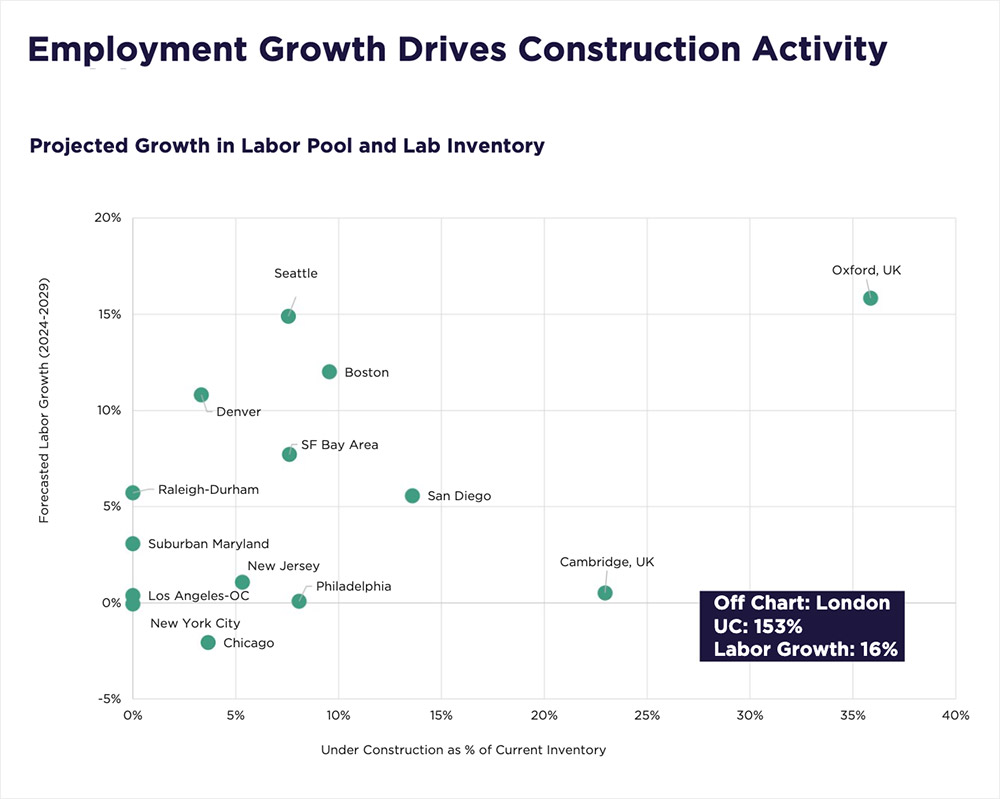

In recent years, the life sciences real estate sector has seen a surge in demand, driven by a boom in research and development investment, rapid growth in biotechnology, and the race to deliver groundbreaking therapies. In response, developers accelerated construction activity, with life sciences projects under construction accounting for 17 percent of the total U.S. life sciences inventory in the second quarter of 2023.

Since then, however, momentum has tempered. According to Cushman & Wakefield’s latest Life Sciences Update report, supply is now outpacing demand in several key markets. This imbalance has led to rising vacancy rates, slower rental growth, and a pause in new construction starts as the sector recalibrates to bring supply and demand back into alignment.

Today, nearly 16 million square feet of life sciences space is under construction nationwide, with 14 million square feet slated for delivery by the end of 2025. This influx of new inventory is increasing availability, giving occupiers greater choice and opportunities to secure high-quality space in top-tier innovation hubs such as Boston, San Diego, and the Bay Area—often at more competitive rates and with greater lease flexibility.

Meanwhile, life sciences investment activity is showing early signs of renewed momentum. In 2024, research and development property sales volume reached $7.2 billion—a 33 percent increase year-over-year—across 233 transactions, up 32 percent from the previous year. The average deal size remained steady at $31 million, signaling continued investment interest in high-quality assets despite ongoing financial pressures.

Yet, despite this uptick, the market is far from its 2021–2022 peak and continues to face ongoing headwinds that are reshaping investor strategy. Capitalization rates rose to 6.7 percent by year-end 2024—100 basis points above 2022 lows, as elevated interest rates tighten financing conditions and dampen pricing. On average, pricing fell 14 percent year-over-year to $255 per square foot, down nearly 38 percent from the height of the market. For three consecutive years, returns have been negative, prompting investors to prioritize established life sciences hubs with strong fundamentals.

Overall, the sector’s investment outlook remains cautiously optimistic. Elevated interest rates will likely keep deal volume subdued, but long-term prospects remain strong, driven by aging demographics, biotechnology innovation, and sustained funding. For strategic investors with a long-term view, the current environment offers a rare window to enter the market at more attractive valuations.

$7.2B

The Drivers: Talent, Trials, and Capital

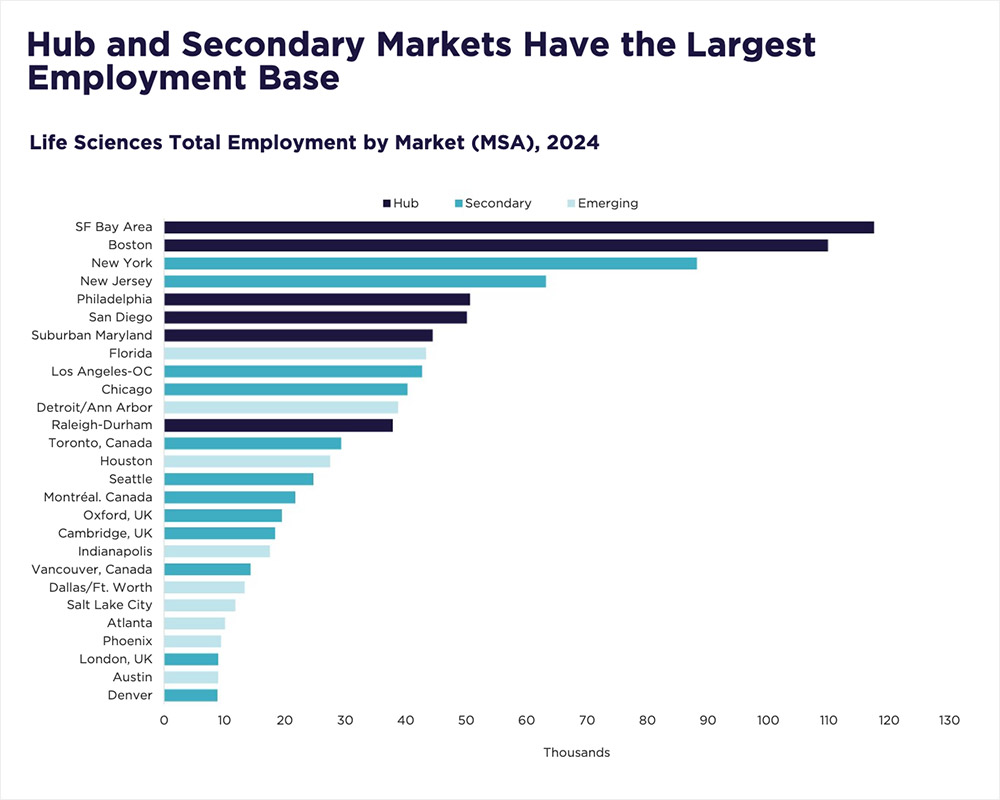

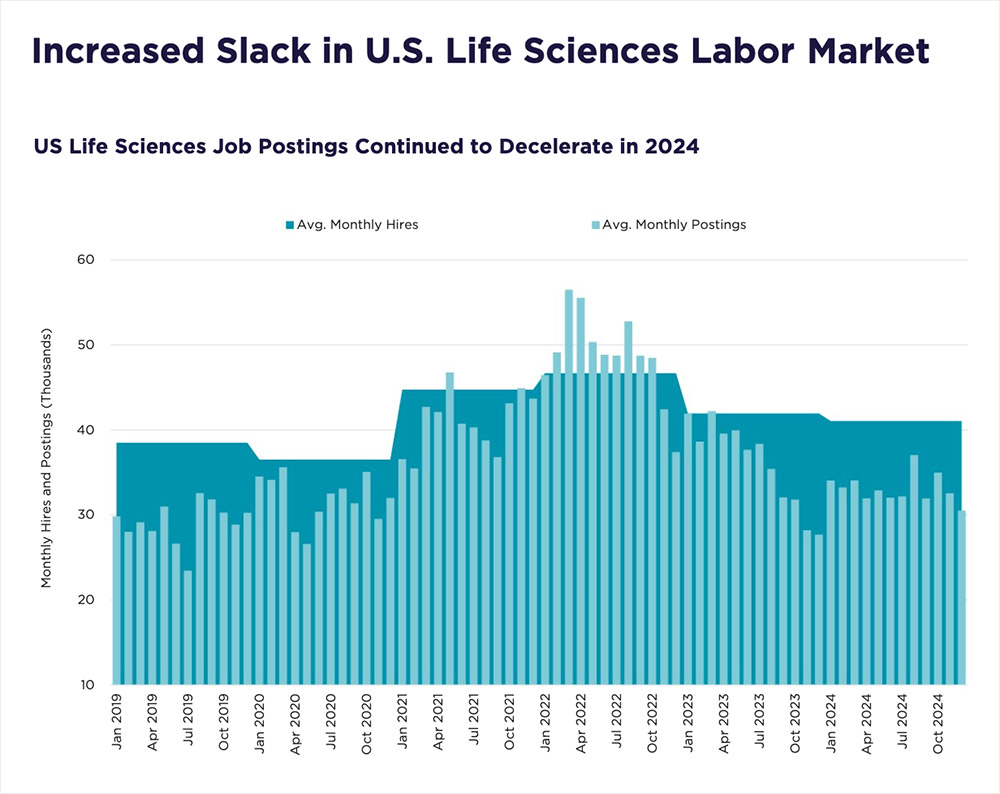

Talent continues to be a major driver—and challenge—for the life sciences sector. While recent layoffs have added some slack to the labor market, specialized roles in areas like biomanufacturing, clinical research, and artificial intelligence–driven drug development remain tough to fill.

In 2024, job postings were down 8.3 percent year-over-year and hirings were down 2.1 percent, yet hiring still outpaced postings by 24 percent, suggesting some roles are being filled more easily than in the past few years. Still, a posting intensity ratio of 3-to-1 highlights ongoing difficulty in staffing high-demand positions. To address this, companies are expanding training programs, partnering with universities, and tapping into broader talent pools through remote and hybrid work.

While workforce dynamics evolve, clinical trials and drug approvals entered 2025 with healthy momentum. Following a slower year in 2024, the pipeline is picking up pace in 2025, propelled by breakthroughs in genomics, personalized medicine, and AI-enabled research. Regulatory bodies, including the Food and Drug Administration, are hoping to streamline approval pathways, accelerating the development cycle for promising therapies. This activity is not only supporting demand for specialized lab space but also driving new investment in manufacturing infrastructure needed to produce next-generation treatments.

Today’s market conditions may feel uncertain, but the fundamentals of the life sciences sector remain strong.

Fueling both talent and trial activity is capital—an essential engine for innovation in the sector. Although total life sciences funding rebounded in 2024, levels remain below the peaks seen earlier in the decade. With questions around future U.S. government research budgets, the private sector—especially venture capital—remains a vital source of investment. Global venture capital funding rose 4 percent year-over-year, surpassing the 10-year average by 6 percent, signaling a renewed sense of investor confidence. Europe and North America led the charge, with European venture capital deals up 19 percent to $8.6 billion and North American deals rising 17 percent to $31.5 billion.

Investors continue to focus on early-stage biotechnology firms with high-growth potential, fueling innovation across drug development, medical devices, and digital health. The initial public offering market, while still cautious, showed signs of life in 2024 with offerings totaling $11.6 billion globally—a 22 percent increase from the previous year. Uncertainty has impacted funding in the first quarter of 2025 as investors weigh volatility in the markets. However, venture capital remains a cornerstone of life sciences growth—supporting companies as they scale operations, expand their physical footprints, and accelerate the path from lab bench to bedside.

The Trends: AI, Tariffs, and Domestic Manufacturing

Artificial intelligence is rapidly reshaping the life sciences industry, offering new ways to accelerate drug discovery, streamline clinical trial design, and personalize patient care. In 2025, adoption of AI-powered platforms continues to grow, enabling companies to sift through massive datasets, identify promising drug candidates, and even predict treatment outcomes with greater accuracy and speed. However, these advancements come with growing concerns around data privacy, regulatory oversight, and the ethical use of machine-driven decision-making in health care. Companies that can navigate these complexities while embracing AI’s potential will be well-positioned to lead the next wave of innovation.

Hiring still outpaced postings by 24 percent, suggesting some roles are being filled more easily.

At the same time, the policy landscape remains fluid. A new administration has introduced renewed uncertainty around drug pricing and the possibility of tariffs on pharmaceutical imports. These potential changes are prompting companies to reevaluate cost structures, supply chain strategies, and long-term investment plans.

The U.S. government’s push for increased domestic pharmaceutical manufacturing aims to reduce reliance on foreign suppliers, strengthen national security, and create jobs. While this shift presents logistical challenges—especially for companies with overseas manufacturing footprints—it also opens the door for new investment in U.S.-based facilities and partnerships with domestic contract development and manufacturing organizations.

The life sciences sector is at a crossroads, balancing the excitement of technological breakthroughs with the realities of economic and regulatory challenges. While market conditions have shifted, the underlying fundamentals of the sector remain strong, with plenty of opportunities to be seized for those who remain agile and forward-thinking.