The life sciences sector is undergoing a transformative surge, driven by breakthroughs in biologics, medtech, diagnostics, and personalized medicine. As companies expand footprints and invest in next-generation facilities, the site selection process has grown more complex and more consequential. Today, workforce strategy has emerged as a critical, and often decisive, component of site location decisions.

For business decision-makers, that shift demands a recalibration. Success in attracting and sustaining life sciences investment now hinges on a region’s ability to deliver specialized, scalable, and future-ready talent — and to do so in a way that aligns with the nuanced demands of each life sciences subsector.

Crossroads of Talent, Site, and Ecosystem

Let’s be clear: workforce strategy doesn’t replace other site selection fundamentals. Life sciences companies still need sites that are “ready to go” — with robust utilities, access to compliant lab or GMP space, and clear regulatory pathways. They also seek out ecosystems with research institutions, capital access, clinical partners, and supply chain connectivity.

However, talent is the thread that connects all these factors. A state-of-the-art facility without the skilled workforce to run it is simply a stranded asset, and not all “life sciences” labor markets are equal. Genomics firms may seek AI-aligned data science talent, while medtech manufacturers may prioritize precision assembly skills and FDA regulatory experience. Understanding and articulating those distinctions is vital.

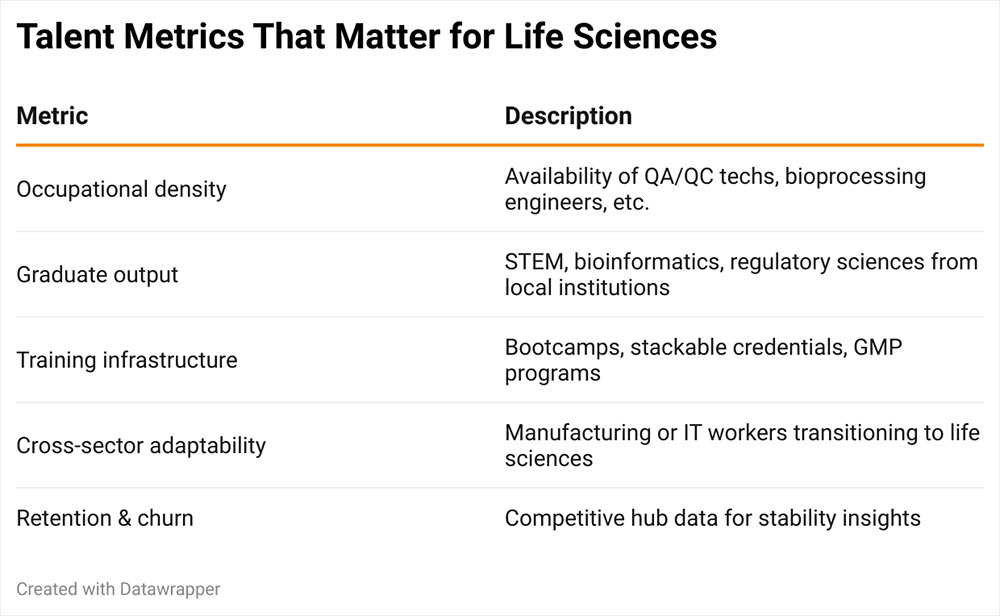

The Talent Metrics That Matter

As companies assess potential locations, their workforce evaluation goes far deeper than headcounts and average wages. Sophisticated projects now consider occupational density in targeted roles — such as QA/QC techs, bioprocessing engineers, or clinical data managers — as well as graduate output from nearby institutions, especially in STEM, bioinformatics, and regulatory sciences. They evaluate existing training infrastructure, including biotech bootcamps, stackable credentialing programs, and GMP certification. They also look at cross-sector labor adaptability, such as manufacturing workers or IT professionals transitioning into life sciences, along with talent retention rates and workforce churn, especially in competitive hubs.

Talent is the thread that connects infrastructure, real estate, and ecosystem readiness.

When markets fall short on these dimensions, they risk losing out, even with strong incentive packages. When they excel, they can outcompete even better-known destinations.

The Untapped Potential of Upskilling and Career Pathways

One of the most overlooked — and highest-impact — opportunities for regional growth lies in unlocking new talent pipelines through upskilling and career mobility.

Life sciences isn’t only the domain of Ph.D.s and lab researchers. Increasingly, roles in biomanufacturing, regulatory affairs, logistics, and digital health can be filled by mid-career professionals from other industries — given the right training.

Veterans and supply chain managers can bring process discipline and compliance experience into pharmaceutical logistics. IT professionals and software developers are shifting into roles in bioinformatics, AI-powered diagnostics, or digital therapeutics. Even sushi chefs, as surprising as it sounds, have the precision, hygiene discipline, and dexterity well-suited for sterile cleanroom environments.

300

These examples underscore a broader truth: companies should look for communities that invest in expanding their life sciences workforce not just by competing for existing talent, but by creating new onramps for adjacent industries. That requires active investment in credentialing, partnerships with employers and community colleges, and messaging that positions life sciences as accessible, not exclusive.

Three Workforce Strategy Moves That Matter

If workforce is now a top-tier site selection factor, how can decision-makers evaluate whether a region is ready? Here are three priorities to consider when assessing potential markets:

First, does the region co-create future-focused training infrastructure? Academic institutions often serve as talent engines, but their alignment with industry evolves slowly without intentional collaboration. Smart regions broker partnerships between local employers and educators to co-develop training programs tailored to current and emerging roles — whether that’s AI-powered drug discovery or aseptic manufacturing. In North Carolina’s Research Triangle, for example, biotech training centers supported by the NC Biotech Center are directly linked to employer needs. This kind of institutional alignment sends a clear message: this region doesn’t just have talent, it’s actively growing it.

Second, do they build accessible, accelerated career pathways? Communities that support career mobility will have a more resilient and inclusive workforce. That means investing in short-cycle training for mid-career transitions, stackable credentials that build toward advanced roles, apprenticeship models with employer sponsors, and recognition of transferable skills — not just formal degrees. From rural manufacturing towns to suburban tech corridors, there are thousands of workers who could thrive in life sciences roles with just-in-time training. Look for regions that have clear workforce development programs in place to tap into this talent.

A state-of-the-art facility without the workforce to run it is just a stranded asset.

Third, does the community tell a clear, segmented talent story? Just as life sciences companies don’t treat all markets the same, regions should avoid painting with a broad brush. Instead of promoting general STEM talent, look for messaging tailored to specific sectors. For cell and gene therapy firms, are there genomics programs, BSL-2 lab capacity, and clinical trial infrastructure? For medtech manufacturers, is there engineering talent, an FDA-savvy workforce, and quality assurance training? For digital health startups, do they emphasize AI/ML programs, healthcare tech accelerators, and crossover with the local tech ecosystem? And do they back that story with data showing not just who’s graduating — but who’s staying, who’s training, and how the region is proactively building the workforce of tomorrow?

Greater Philadelphia: A Workforce Strategy in Action

Consider the Greater Philadelphia region, where a workforce-forward strategy is actively reshaping the life sciences landscape. Known globally for its leadership in cell and gene therapy, the region has built a robust talent pipeline through initiatives like the Keystone LifeSci Collaborative, which connects industry with education providers to anticipate and meet evolving skill needs. Programs like The Wistar Institute’s Biomedical Technician Training Program offer accelerated, inclusive entry points into biomanufacturing and lab careers, particularly for underrepresented and mid-career workers.

3

What sets Greater Philadelphia apart is the ecosystem’s commitment to upskilling across all experience levels — from technical certifications in GMP to advanced academic programs in bioinformatics, AI, and regulatory science. This approach allows the region to support both early-stage startups and global biopharma firms scaling advanced therapeutics.

By aligning workforce investments with the region’s scientific strengths, Philadelphia isn’t just filling roles, it’s building a sustainable competitive advantage. For companies considering new facilities, it’s a model to evaluate: don’t just chase talent — look for markets that are creating it.

Emerging Talent Markets: Nashville and Oklahoma City

Other markets are also gaining attention for their workforce-forward momentum. In Nashville, the strength of Vanderbilt University and the city’s healthcare legacy is converging with an emerging digital health and life sciences scene. Organizations like Nashville Biosciences are helping translate clinical research capacity into commercial opportunities, while efforts to expand data science and tech-aligned talent are positioning the city for growth in medtech and diagnostics.

Companies shouldn’t just look for talent — they should ask how regions are creating it.

Meanwhile, Oklahoma City is quietly building a life sciences workforce ecosystem around its medical research anchors. The University of Oklahoma Health Sciences Center and the Oklahoma Medical Research Foundation are central to a growing biosciences cluster, and the city is investing in biomanufacturing training and infrastructure through its innovation district. With a low cost of living and coordinated workforce planning, OKC is positioning itself as a cost-effective, talent-ready location for future growth.

Conclusion: Talent, Site, and Ecosystem — Together

The next generation of life sciences hubs won’t be defined by a single advantage. Winning regions will combine site readiness, workforce strategy, and ecosystem strength — each reinforcing the other.

In this landscape, business leaders have an opportunity to lead — not by chasing incentives, but by choosing markets that are shaping the workforce of the future. That starts with investing in people, designing pathways into the sector, and aligning talent pipelines with the real needs of the industry.

In today’s life sciences economy, the regions that win talent aren’t just supporting innovation — they’re enabling it.