While there is still much to be determined about the long-term economic effects of the pandemic (daily cases continue to reach all-time highs in the United States, as of the writing of this piece), we have already seen incredible impacts on the workforce, supply chain, and government support for business. All of these factors will play significant roles in the location decision-making process for business leaders for years to come.

Shifting Workforce

Immediately ahead of COVID-19 reaching American soil, the nation was in a full employment situation. Jobless claims were at 50-year lows as the unemployment rate sat at 3.5 percent. Businesses were facing hiring challenges across the country with extremely tight labor markets.

Fast forward a matter of weeks to find a virtually opposite situation. In what seemed to be an overnight phenomenon, the unemployment rate spiked to 14.7 percent, according to the Bureau of Labor Statistics (BLS) April 2020 Jobs Report (and many economists estimate that the actual number may be in excess of 20 percent).

Although these economic pains were felt across the United States, the effects were not uniform, and the swift changes in the employment situation did hit certain markets harder than others. Among the worst hit was Los Angeles County, where as many as one in four adults find themselves out of work.

With these variances across U.S. markets, many business leaders may face challenging situations, while others may find new opportunities. COVID-19 has led to several markets seeing talent leave their respective regions to avoid the crisis. According to The New York Times, approximately more than 400,000 residents left New York City alone between March and May, a troubling figure, especially in the finance, creative, and technology sectors. No one knows how many will ultimately return, which creates an uncertain environment going forward. Serious discussions have picked up around a major return of suburban corporate campuses as a result, along with changing views on public transportation, open office designs, and remote working.

Markets seeing the largest spikes in unemployment had a direct correlation with their occupational concentration by industry. When considering unemployment rates across the American landscape, the markets seeing the largest spikes had a direct correlation with their occupational concentration by industry. For example, the state of Nevada quickly saw its unemployment rate jump above 30 percent over several weeks. With an economy heavily dependent on hospitality and tourism, the state went from 2,300 jobless claims in early March to over 90,000 in a two-week span.

Leveraging Bureau of Labor Statistics data, we’ve taken a look at their index of the most impacted markets due to the pandemic spread, those that were facing a crisis with unique industry impacts. This index allows for location strategists to evaluate for concentration risk — a heavy reliance on markets that place ultimate risk to the business.

According to the index, the following are the markets facing the highest impact from unemployment:

- Las Vegas-Henderson-Paradise, NV Metro Area

- Kahului-Wailuku-Lahaina, HI Metro Area

- Atlantic City-Hammonton, NJ Metro Area

- Lake Havasu City-Kingman, AZ Metro Area

- Myrtle Beach-Conway-North Myrtle Beach, SC-NC Metro Area

While these downturns are tough on communities and effected companies, the loss of employment can spawn opportunity for other companies. For example, e-commerce giant Amazon was able to take advantage of a newly available workforce as they ramped up to address rapidly growing consumer demands. In the opening weeks of the pandemic, Amazon reportedly hired 175,000 temporary workers for fulfillment centers. Most of these jobs won’t end up being just short-term hires, as the company has pledged to bring on at least 125,000 as full-time employees.

We expect to see this trend continue into the future as businesses focus on talent as a major driver in location decisions. Companies will leverage these available workers — even if from a completely different sector — for their future growth strategies.

Disruptive Supply Chain

Over recent years, companies have invested extensively in optimizing their global supply chains so that within a couple days, or even in a couple hours for some, consumers began to have desired goods delivered to their doorsteps. However, due to increasing costs and geopolitical risks, including a trade war between the United States and China, businesses have been diversifying their global supply chains. Then, entering into a once-a-century pandemic that has impacted the entire world, we have a broader environment that has heightened awareness for diversification as an expedited mandate.

With this constant evaluation, new markets are emerging as key pressure points in the domestic and global supply chain. Heavy dependence on critical ports like Los Angeles and Long Beach may be giving way to a drastic change in importing and exporting out of the Port of Virginia and Savannah, for example.

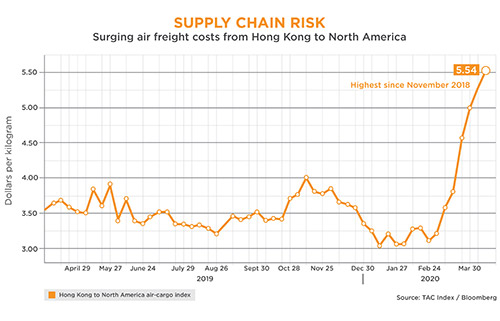

As the pandemic began impacting the Asia-Pacific region in early 2020, the global supply chain was immediately disrupted, especially for goods coming out of China. Disruptions didn’t just lead to shipping delays, logistics operators also witnessed unprecedented spikes in costs.

According to data analyzed by Bloomberg experts, shipping costs out of Hong Kong and Shanghai more than tripled in early 2020. Within hours of these costs being realized, along with extended, often unpredictable lead times, manufacturers began looking toward alternative suppliers in other global markets, many never previously considered.

Several national governments have established fiscal and trade policies to support and incentivize supply chain diversification. In 2020, the Japanese government approved over USD $2.2 billion in direct assistance for its businesses to diversify their supply chains, with a particular focus on exiting China. Approximately USD $2 billion was allocated to support high-value industries to return production back to Japan, with USD $200 million to aid in shifting their supply chain to other trading partners, especially in key ASEAN markets. We expect this trend to continue around the world as the United States, France, and others are implementing similar fiscal measures.

Pivoting Support

As businesses evaluate their future strategies and look to new markets, governments and economic development organizations are pivoting the way they provide support. As previously mentioned in the case of Japan, policymakers are developing support mechanisms to provide direct assistance bespoke to their national and community needs and industry targets.

With effective evaluation and benchmarking, businesses can find opportunities for growth, while alleviating their concentration risk. In recent years, we’ve seen governments shift their support for certain industries in favor of new and nascent sectors. For example, markets like Bangalore and Manila — known for software development and business process outsourcing, respectively — have shifted their incentives to more knowledge-intensive and high-growth businesses.

In the United States, we’ve seen similar trends as governments have pivoted their focus toward industries such as life sciences. When evaluating and benchmarking markets, decision-makers need to understand these trends within the locations being considered.

Furthermore, as budget challenges heighten due to the economic crisis, government incentives may be on the chopping block across the country. While we don’t believe there will be major reductions in program support, we do anticipate further focus on taxpayer return-on-investment and transparency, post-performance programs, and statutory wage and job creation thresholds.

With that said, we are also witnessing multiple rounds of emergency relief and economic stimulus packages totaling over $10 trillion globally. Initially supporting struggling healthcare sectors and supporting vulnerable citizens, these programs are now shifting to directly aid industries as they try to recover.

Looking toward the future, the global economy is filled with uncertainty. As supply chains shift and industries pivot, key markets are changing for business leaders. Many may see this as a monumental challenge for companies. However, with effective evaluation and benchmarking, businesses can find opportunities for growth, while alleviating their concentration risk.