One approach is to construct a matrix built upon analyzing key factors that make a site suitable for business growth. To account for the relative importance of these factors, they can be ranked and weighted to determine the comparative strength of a particular location to another. A typical approach might include the evaluation of standard factors such as human capital, business climate, quality of life, and infrastructure availability.

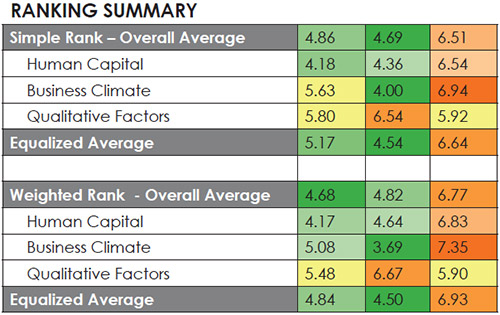

These factors, while not comprehensive for all projects, are quantifiable and can be ranked. Through various methods of comparison, these ranks can then be used to translate large amounts of data into values that are easy to interpret and considered in the decision-making process. As an example, the accompanying chart shows how data in each category has been ranked resulting in comparable scores that are then color coded — red indicating higher/better scores, green lower scores, etc. in order to highlight the best site in each category and overall. This in turn can be used as the basis for justifying on a quantifiable basis a site selection decision.

What’s the Community’s “Collaboration Score”?

What may be missing from this approach, but should absolutely be a consideration in the site selection process, is the community “collaboration score.” Though less defined and more qualitative in nature, a collaboration score is the measure of the extent to which the community is fully aligned with its economic development efforts. In other words, a highly collaborative community would be one that has an agreed upon an holistic approach to business attraction and retention. All agencies, public and private, that will be involved in the successful outcome of the project are in sync and understand the project objectives.

The challenge and true risk to the site selection process is the realization, sometimes too late in the game, that a community is not well aligned, that they do not work collaboratively, or worse, that the community is divided and at odds with their approach to business attraction and economic development strategies. Site selection decision-makers, whether internal or external to the company, seeking a new location should beware, as this non-collaborative spirit within a community and its leadership can have devastating short- and long-term impacts on a project. Negative results — such as delayed operational timelines, increased project costs, and compromised objectives —can occur as a result.

Having been in the site selection business for 15+ years, our firm has observed and navigated projects within both types of communities. We have seen strong job-creation and investment projects, which were focused on a particular site, shift focus quickly when it became apparent that there was a lack of cohesion among community stakeholders. Once confidence in project success is shaken, and it becomes known that the collaboration score is low, our recommendation — and the general instincts of those clients that we represent — is to move on to the next available site being considered as a way to mitigate risk and increase the likelihood of success.

How Can the “Collaboration Score” Be Measured?

How can a community’s true collaboration score be known before a project moves too far down the road? As a firm, our practice is to constantly be doing our homework at the state, regional, and local levels. Reading local publications, reviewing council and commission meeting minutes, attending school board meetings, and interacting with the regional economic development professionals can all be very telling sources for how those involved in the process interact, support, and treat new and existing business growth opportunities.

Though less defined and more qualitative in nature, a collaboration score is the measure of the extent to which the community is fully aligned with its economic development efforts. Of particular interest is understanding the level of collaboration in securing economic development incentives that have a meaningful financial impact by offsetting project costs. State and local Incentive tools are oftentimes available to companies that are competitively evaluating where to locate new investment and create new quality jobs. If such tools are available to support a project, understanding the administrative and approval processes and the collaboration score for those entities involved in project review and approvals becomes vitally important. If a project were to move forward with reliance on the value of a particular incentive benefit, such as real estate tax expense offset, only to learn that those responsible for approving are not in favor of utilizing the incentive tool as a means to attract investment, that could result in a devastating financial impact for the company.

In contrast, communities that work together and are successful at instilling confidence score high on the collaboration meter. Confidence that there are no hidden agendas, that all requests will be handled with the utmost professionalism, and when — not if — problems arise, that they will be worked through in a positive manner and within efficient time lines is paramount to a successful project. Site selectors, both internal and external, should be in the practice of seeking out those communities that assist the location process by moving forward in a timely manner, with minimal delays in approval processes, so long as the company is doing its part. Our experience indicates that businesses are much more willing to invest for the long term and grow in a community that demonstrates it can work collaboratively, is financially stable, and has strong community leadership. With a strong collaboration score evidenced by these practices and priorities, along with great communication and total transparency, all involved can have peace of mind that the project will result in success.