The primary purpose of the agreement is to promote trade by eliminating tariffs and reducing nontechnical barriers to support the flow of goods, services, investment, and labor. An agreement in principal was reached in Brussels on Oct. 18, 2013; the broad outline of the preliminary details, should they be finalized, will foster growth and employment on both sides of the Atlantic.

The timeline for implementation remains unclear; ratification is not likely until 2015, and the agreement must first be “legally scrubbed” and translated before the chief negotiators initiate the agreement. The European Commission must then seek the European Parliament’s approval, requiring consent by each of the 28 members of the European Union. The full impact of the trade deal will not occur until all provisions come into effect, which is likely to be several years after the trade pact is finalized. Once fully implemented, impacts — many favorable some not so favorable — will be realized by many industry sectors within the Canadian and European economies and perhaps a few other economies as well.

The Benefits

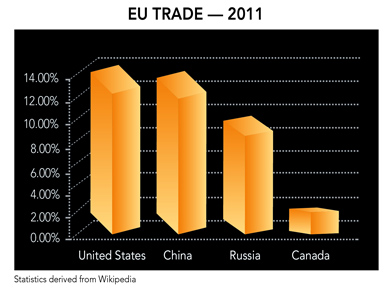

The United States is currently Canada’s largest trading partner and the European Union is the second-largest export destination. Canada ranked 12th in major trading partners with the EU, which, not surprisingly, was led by the U.S., China, and Russia. When the agreement goes into effect though, some 98 percent of all tariff lines between Canada and the EU will immediately be zero, with the remaining duties being eliminated over a period of seven years. Given the export-oriented nature of Canada’s economy, widening the channels for trade with the EU, which accounted for 19.2 percent of world GDP in 2012, would provide benefit to Canada over the long term.

Service Sector Impacts - The Canadian service sector accounts for more than 70 percent of the nation’s economic activity. However, significant barriers exist today for providing cross-border services — one of which is the lack of mutual recognition of qualifications.

One of the goals of CETA is to promote the flow of services including management, engineering and technical, and computer and information services through programs such as the mutual recognition of professional qualifications. This mutual recognition framework would allow the relevant professional organizations or authorities in the EU and Canada to collaborate and jointly work out the technical details of qualifications that would be recognized in professions such as architecture, engineering, and accounting. Mutually credentialed qualifications could then be brought under CETA eliminating barriers to doing business.

Labor - To further support trade in services and investment, CETA will make it easier for firms to move staff temporarily between the EU and Canada. This will make it easier for European and Canadian companies to operate their companies in foreign markets.

Public Procurement - CETA would cover new ground by opening all sub-levels of government to bilateral procurement markets. For example, in 2011 procurements by Canadian municipalities were estimated at C$112 billion or almost 7 percent of Canadian GDP; this municipal procurement spending would, under CETA, be open to EU companies for procurement bidding.

Investment - One of the key pillars of economic relations between the EU and Canada is investment. In 2012, the EU represented the second-largest source of foreign direct investment (FDI) in Canada at approximately $171 billion of total FDI into the country. Similarly, the EU served as the second-largest destination for Canada’s direct investment abroad at $181 billion.

CETA will remove or alleviate barriers, thereby improving legal certainty and predictability for businesses, which will likely increase the FDI comfort level. One of the principal barrier removals involves increasing the investment thresholds that trigger formal review from $344 million to $1.5 billion for EU investments. A clear motivation of the agreement is to make it easier for smaller FDI investments to be made.

Agriculture Impacts - The EU is a very valuable export market for Canadian agricultural and processed agricultural products (PAPs). However, EU tariffs can impose a real burden on Canadian exporters and considerably limit their ability to effectively compete in the EU market. For example, the EU currently levies a tariff equivalent to $114 per ton on Canadian oats, which over the last five years has been estimated to add as much as 51.7 percent to the price. This negative financial impact, created by tariff levies, has been a significant barrier for oat growers interested in doing business in the EU. With the elimination of the tariffs, the barriers are removed and the free market opportunities are opened.

The EU processed agricultural industry will also benefit from CETA as PAPs tariffs will be eliminated, and the EU is Canada’s major import source of wine - about half of its imports. The tariff elimination is complemented by the removal of other relevant trade barriers that will significantly improve access to the Canadian market for European wine and spirits.

Sustainable Development - The EU and Canada have in CETA reaffirmed their strong commitment to the principles and objectives of sustainable development. This means that investment and trade relations should not develop at the expense of the environment or of social and labor rights, but instead foster a mutually supportive environment between economic growth, social development, and environmental protection.

Some Challenges

Despite an overall net positive impact for the Canadian and EU economies, the impact of the agreement may not be a win for all economies. CETA may have far-reaching implications for the U.S.-EU trade negotiations, which makes the timing of the Trans-Atlantic Trade and Investment Partnership (TTIP) negotiations critically important and time-sensitive. The intent of the trade agreement between the U.S. and the EU is very similar to that of CETA in that it aims to remove trade barriers in a wide range of economic sectors to make it easier to buy and sell goods and services. Talks began in July of 2013, and an advisory group made up of 14 individual experts representing balanced interests was created and has been meeting regularly since January of 2014.

The EU-Canada trade negotiations have broad implications for North America. A successful CETA negotiation will make it even more important that the EU and U.S. negotiate the TTIP or U.S. exporters will face increased competition in both markets and some North American supply chains will be disrupted.

Interestingly, when (if) CETA gets completed, it could lay the groundwork for earlier implementation of TTIP, in which case the next step could be to integrate NAFTA. Mexico’s free-trade agreement with the EU was fully implemented in 2010 and is in need of modernization. Integrating the EU — which accounts for some 35 percent of world trade — with NAFTA — which accounts for another 15 percent — would create a trading bloc that accounts for more than half of world trade. A combined TTIP and NAFTA would provide a powerful template for a 21st century trade system.