A key part of that standard of living is Canada’s internationally acclaimed postsecondary education system, which produces thousands of highly skilled graduates every year, across all fields. The result is a diverse workforce that has one of the highest proportions of postsecondary graduates of any Organization for Economic Cooperation and Development (OECD) country — an increasingly important site selection factor for knowledge-based companies. According to Aon Hewitt’s 2013 People Risk Index, three major Canadian cities — Toronto, Montreal, and Vancouver — are among the 10 lowest-risk cities in the world for recruiting and employing workers. Canada’s immigration system is also highly effective in attracting and retaining top talent from other countries.

Another Canadian strength is its modern, well-maintained transportation infrastructure for moving goods, especially for international trade. The Asia-Pacific Gateway and Corridor Initiative consists of nearly 50 large-scale infrastructure projects totaling up to $3.4 billion, which will enhance connectivity with foreign markets, especially those in Asia.

“In Canada we have access to a highly skilled workforce and are close to many of our major clients and partners,” comments Colin Folco, modernization manager for Dieffenbacher North America, an OEM for the wood, plastics, and metal industries. “Establishing a plant here in Ontario is a strategic decision that we have never regretted, and which we continue to support through new investment and innovation.”

Having a great transportation system doesn’t mean much if you don’t have a place to go. One of the best reasons for doing business in Canada is that is has many outstanding connections to top markets around the world.

It starts in North America, where Canada has access to almost 500 million consumers. Its strongest relationship is with the U.S. — in fact, no country has an economic connection with the United States like Canada does. Three-quarters of Canada’s total exports are delivered to the U.S. Canada is also the United States’ largest foreign supplier of energy.

Canada has enjoyed consistent growth across a variety of markets, ranging from traditional industries like agriculture, forestry, and energy to knowledge-based industries like information and computer technology, aerospace, and life sciences. From 2008 to 2012 Canada led the G-7 with an average real GDP growth rate of 1.2 percent. Canada has also maintained the G-7’s lowest net debt-to-GDP ratio. Canada is also expected to remain a top G-7 performer through 2017 (Forbes predicts a GDP growth rate of 1.8 percent in 2014) and to return to a balanced budget in 2015–2016.

This kind of fiscal responsibility is an important factor in spurring investor confidence and economic growth. In 2013, for the sixth year in a row, the World Economic Forum ranked Canada’s banking system the soundest in the world. Banks in Canada are highly capitalized and, during the Great Recession, not a single Canadian bank or insurer failed.

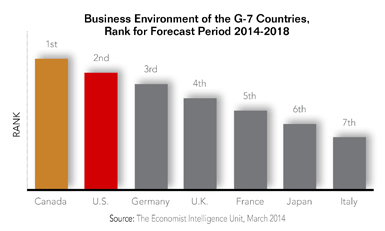

Therefore, it is no surprise that Canada is consistently ranked among the “top-countries-for business” on numerous surveys. The Economist Intelligence Unit (EIU) has identified Canada as the best country among the G-7 in which to do business over the next four years (2014–2018). A key reason for this is Canada’s steadily falling tax rates. Federal corporate tax rates have been reduced from 28 percent in 2000 to 15 percent in 2012 — bringing the combined provincial and federal rate to an average of 26 percent, well below the comparable rates of most other G-7 countries, and well below that of the United States. A 2013 KPMG study also indicates that Canada’s corporate income-tax rate has decreased more rapidly than that of any other country.

Trade and Investment

Canada’s robust, business-friendly environment continues to stimulate both domestic and foreign investment. According to The Economist Intelligence Unit’s business environment rankings, Canada is ranked as the fourth-best investment location in the world for 2014–2018 (up from seventh place for 2009–2013) behind Singapore, Switzerland, and Hong Kong.

“It ranks extremely well on market opportunities, owing to high levels of GDP per capita, strong trade flows, and a wealth of natural resources, which will continue to be a source of macroeconomic strength,” writes the EIU. “Foreign trade and exchange controls also remain an area of strength, despite some protection in some sectors and incomplete efforts to diversify export markets. Tight regulation and relatively cautious lending policies will maintain the soundness of the banking sector.”

Thanks to the North American Free Trade Agreement (NAFTA), Canadian businesses have easy access to one of the largest and highest-value consumer markets in the world (Canada, the United States, and Mexico), with an annual economic output valued at US$18 trillion. Millions have been spent by Canada and the U.S. to streamline border commerce, including improved clearance processes for pre-authorized shipments and bilateral teams of Customs officials at key crossing points.

Besides NAFTA, Canada is also committed to opening new markets around the world to diversify its economic opportunities. Canada recently reached a historic trade agreement in principle with the European Union (EU). Once the Comprehensive Economic and Trade Agreement (CETA) becomes active, foreign investors in Canada will have preferential access to both NAFTA and EU consumer markets. Combined, these two markets are valued at US$35 trillion — nearly 50 percent of the world’s total output of goods and services.

The Canada-Korea Free Trade Agreement, which represents Canada’s first free-trade agreement in the Asia-Pacific region, is projected to create thousands of new jobs and boost the Canadian economy by $1.7 billion once activated. In fact, Canada has concluded free-trade agreements with nine countries over the past five years. Negotiations are also under way with multiple Pacific-Rim countries through the Trans-Pacific Partnership, as well as bilaterally with India and Japan. Bilateral negotiations have been carried out or are ongoing with other countries, including China, Indonesia, Pakistan, Vietnam, Mongolia, and several Sub-Saharan Africa nations.

For its first corporate location outside of China, the China Investment Corporation (CIC) selected Toronto over other international financial centers such as London and New York. “There are countries with comparable economic characteristics to Canada, but with much less friendly environments,” comments Gao Xiqing, who recently retired as president of the CIC. “In our dealings with the Canadian government, various parts of the government, and the businesspeople, we feel that Canada is a lot more congenial to our investments.”

Canada is also the first G-20 country to make itself a tariff-free zone for manufacturers by eliminating tariffs on manufacturing inputs, machinery, and equipment. When factoring in the accelerated capital cost allowance (CCA) for machinery and equipment, along with other deductions and credits, foreign investors are pleased to discover that Canada has one of the lowest overall tax rates on new business investment among OECD countries and the G-7.

Quality of Life

Surveys continue to place Canada in the top 10 for quality of life (for example, Harvard Business School’s Social Progress Imperative, which ranks 132 countries based on social and environmental factors, scored Canada first in 13 of the 54 categories, including access to advanced education, health and wellness, access to basic knowledge, and personal safety).

Canada is well known for its spectacular natural landscapes, well-educated and multicultural population, world-class universities, universal healthcare system, and modern, diverse, and safe cities.

“Canada has been home to my family over the last five years,” says David P. Homer, president of General Mills Canada. “Canadian cities have strong neighborhoods, a lot of public and open spaces, and great schools. It’s a great place to enjoy life — a really vibrant and fun place to be.”

“Investing in Canada makes excellent business sense,” concludes Ed Fast, Canada’s Minister of International Trade. “We offer access to a North American market of more than 470 million consumers. We also offer a strong, stable financial system, low taxes, one of the highest standards of living in the G-20, a business-friendly environment, world-class cities, spectacular natural landscapes, and an innovative, well-educated and multicultural workforce. Canada truly provides a preferred destination for global investment.”