Data centers invest in complex building management systems that can monitor and provide a tremendous amount of information on energy consumption. This data is used to develop strategies and investments to reduce the facilities’ PUE (power usage effectiveness metric) and therefore save energy.

Another area that should have the same level of focus is energy procurement. Energy procurement needs to be analyzed, monitored, and evaluated constantly to assure the operator has an understanding of the dynamics of the market and can make informed energy-related decisions (conservation investments, site location, leases, renewables, etc.).

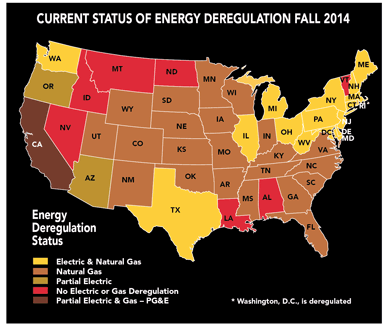

Data centers operate in two energy environments:

Regulated markets: The cost of energy will be a function of the supplying utilities energy mix (nuclear, gas, oil, renewables), tariffs, and cost to supply service (delivery charge). The operator has little room to manage costs other than alternative methods to reduce consumption (conservation, cogeneration, renewables). Those operating in a regulated market should:

- Have a strong level of communication with their utility

- Understand the utility tariff and the many subsections or provisions

- Take advantage of any incentives (conservation, renewables, economic development, etc.)

- Be active in large energy users groups (if one doesn’t exist, start one)

- Monitor state impacts on energy policy (new or modified laws, energy commission actions, etc.)

- Know their cost of energy

- Understand their options:

- Retail

- Purchase energy from the utility

- Purchase through a third-party provider

- Wholesale

- Purchase direct

- Develop an energy purchasing strategy:

- “Float” the market

- Fixed cost contracts

- Block and index

- Do all of the items suggested in a regulated environment

Last year’s “polar vortex” came as a severe shock to the energy industry and users. The spot market price for natural gas (the primary source for energy production in many markets) peaked at over $20/dth in the Northeast. This caused the price of electricity to rise, with the average monthly price for some users in excess of $0.20/kWh in January 2014, compared to an average of $0.09kWh for the market. The current energy market provides a completely different view, with energy prices in steep decline.

The year-end 12-month strip price for natural gas is approximately $3.20/dth with the price falling about 20 percent from where it was a little over one month prior. This decrease will have a positive effect on electricity prices. These events, all within one year, illustrate the volatility of the energy market.

Despite this drop, there are factors that will have a negative impact on natural gas prices for the long term. These include:

- Exporting - The price of natural gas in Europe is double the domestic price.

- Coal plant retirement and the shift to natural gas for electric production

- Transportation (conversions from diesel and gasoline)

Regulated markets: There will be little impact on tariff rates, unless the cost of natural gas stays low for an extended period. Utilities usually have a hedging strategy for fuel purchases and, as a result, cannot take full advantage of spot market prices; therefore, savings will lag the market.

Unregulated markets: Because of the drop in fossil fuel prices, there will be downward pressure on electric prices. Because of fuel hedging strategies, the drop will not be proportional to the drop in natural gas and oil. Hourly and spot market rates will be favorable, while fuel prices stay low. The current outlook is for a continued drop in fossil fuel prices.

The hourly price of electricity is still exposed to volatility due to weather-related events. These events can cause capacity shortages and drive up the spot market price for natural gas in affected markets and, therefore, the price of electricity, as proven by the polar vortex.

Recent events and the volatility in the energy market only amplify the need for data center operators and users to do their due diligence and have a resource (internal/external) that can provide input on a strategy for energy purchasing. This level of knowledge can then be used to minimize the facilities energy costs/risk and provide valuable information for the economic evaluation of equipment purchases based on energy efficiency.