For example, low oil and gas prices over the past several years have hurt this industry, especially in North Dakota. The downturn has reduced energy production, exploration, shipping, and related construction. Idle rigs and worker layoffs have impacted energy-based communities. Less oil and gas equipment is being manufactured and sold. Agriculture, too, is suffering from low crop and livestock prices, which drive down farmer incomes. With less money to spend, farmers are not buying as much farm equipment, which reduces orders for equipment manufacturers and suppliers.

As a result of these large-scale influences, GDP growth is mostly negative or flat in these states. At the end of the first quarter of 2016, the only state with positive percent change in real GDP, according to the State Bureau of Economic Analysis, was Kansas (2.0 percent).

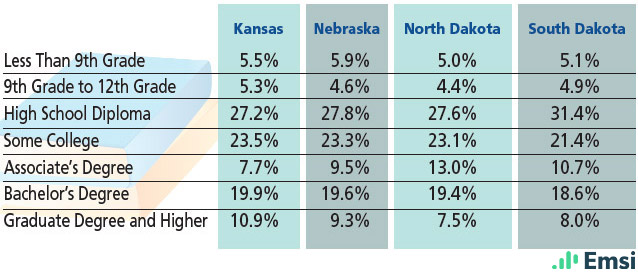

Even with the economic slowdown, it is encouraging to note that unemployment rates have stayed below the seasonally adjusted national rate of 5 percent; as of September 2016, unemployment among these states ranged from 2.9 percent in South Dakota to 4.4 percent in Kansas.

Plains Region Demographics and Industries

-

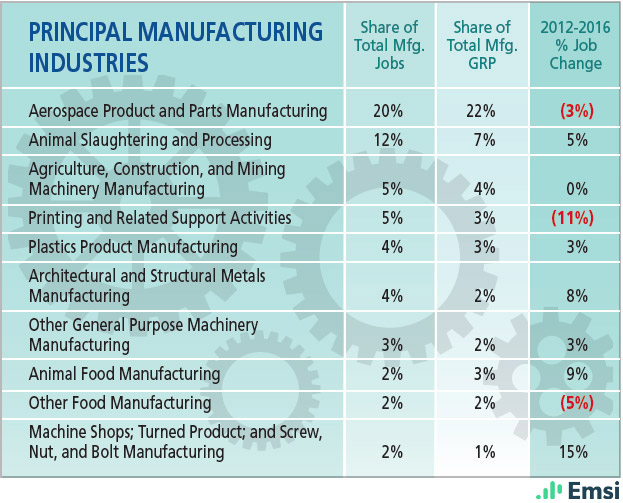

Kansas: Principal Manufacturing Industries

-

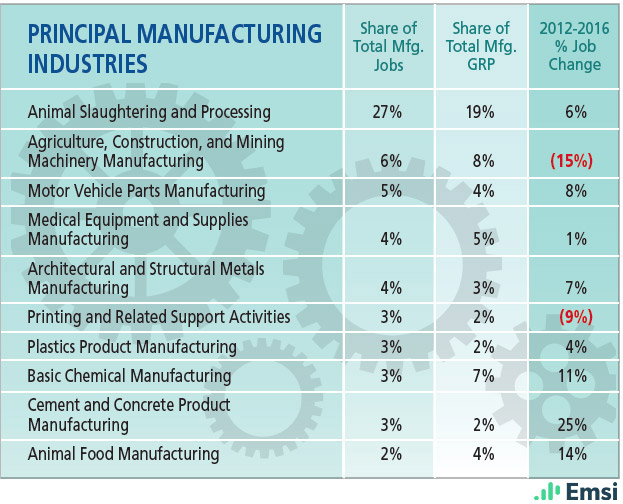

Nebraska: Principal Manufacturing Industries

-

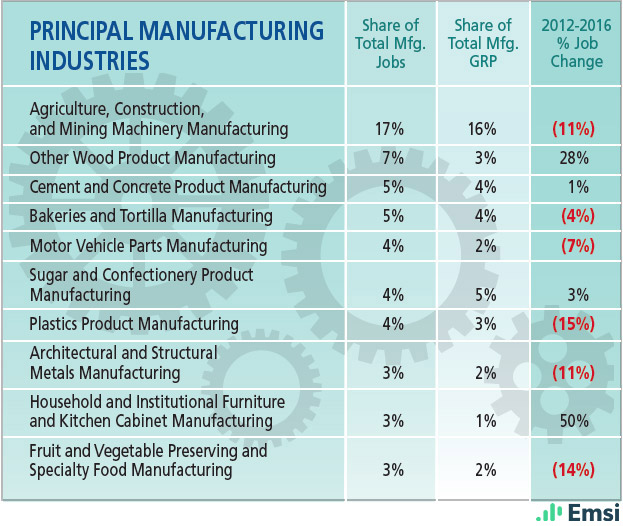

North Dakota: Principal Manufacturing Industries

-

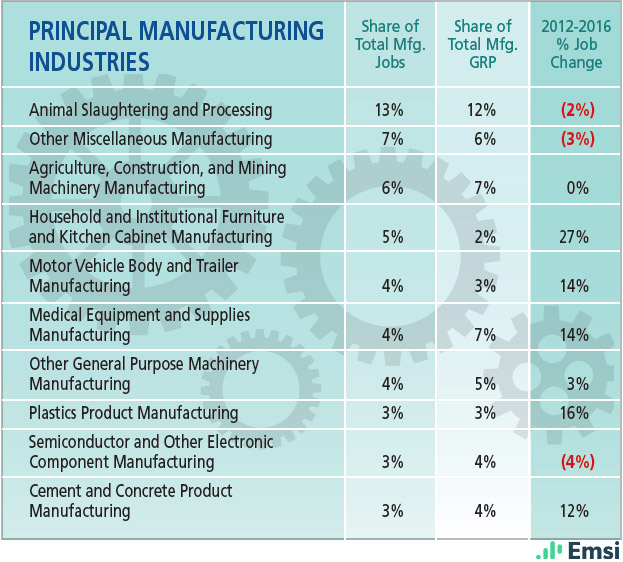

South Dakota: Principal Manufacturing Industries

-

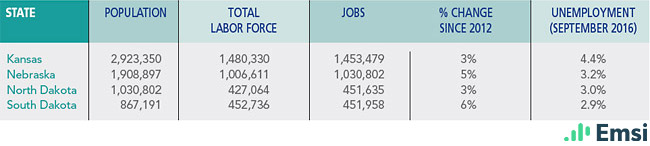

Plains Region: 2016 Educational Attainment

-

Plains Region: Demographics

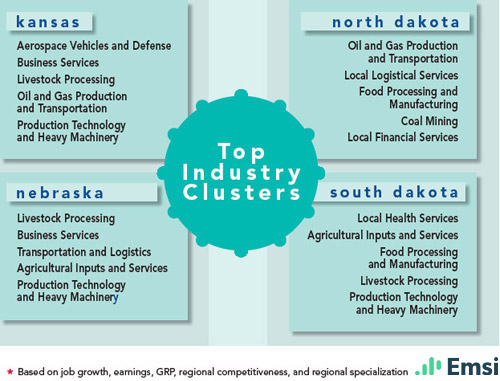

Fortunately, the Plains States have been diversifying their industries for decades to create more stable and sustainable economies. State governments have created pro-business climates, incentives, and new infrastructure to support high-growth industries. These include advanced manufacturing, pharma and biotech, alternative energy, financial services, and call centers.

Overall, these efforts have had positive impacts for business investment in the Plains. For example, for the fifth consecutive year, North Dakota has earned the nation’s second-best ranking for business climate competitiveness, according to the 2015 edition of the Beacon Hill Institute’s (BHI) annual State Competitiveness report.

In its 2016 “Rich States, Poor States” annual report, the American Legislative Exchange Council ranks states based on economic competitiveness, according to 15 policy variables, including regulatory policies and tax policies. North Dakota ranked third-best in the country, followed by South Dakota (11), Kansas (27), and Nebraska (33). North Dakota’s strong performance included high rankings for low property tax burden, low debt service, effective tax policy, and a low income tax burden.

Although trailing behind, Nebraska and Kansas are starting to gain some traction. Nebraska recently surpassed the one million jobs threshold for the first time, an indication of a strengthening economy. And although Kansas has a 4.4 percent unemployment rate, and is still waiting for the promised economic rewards from the deep tax cuts the legislature enacted in 2013, the state did post the best GDP growth of the four states in first quarter of 2016 — another good sign.

Plains Recent Industry Announcements

Companies that have announced new and/or expanded facilities in the Plains region.

-

Amazon.com

Lenexa, KSIn July 2016, Amazon.com announced plans for a new fulfillment center in Kansas City, Kansas, creating over 1,000 jobs.

-

Figeac-Aéro

Wichita, KSFigeac-Aéro recently broke ground on a new North American headquarters in Wichita, and is also expanding its manufacturing facility there.

-

Centrix Solutions

Lincoln, NEA software company that provides financial institutions with products that detect fraud and manage risk, also opened a new facility in Lincoln.

-

NorthStar Financial Services Group

Omaha, NENorthStar Financial Services Group, a financial services holding company, recently opened its second Omaha office and plans to hire about 350 employees.

-

AGT Foods

Nedrose, NDAGT Foods, a Saskatchewan-based supplier of pulse crop food products, which recently opened a $30 million expansion of its food processing plant in Minot.

Economic growth in other sectors — for example, manufacturing — is keeping the Plains economy moving forward. Manufacturing is one of South Dakota’s largest industries, accounting for 10 percent of its workforce. Among the top manufacturing sectors are food products and machinery. A survey by the Governor’s Office of Economic Development indicates that South Dakota manufacturing companies planned to spend a combined $410 million on new or expanded facilities in 2015. One of these companies is AGT Foods, a Saskatchewan-based supplier of pulse crop food products, which recently opened a $30 million expansion of its food processing plant in Minot.

Aerospace is another key manufacturing sector, especially in Wichita, Kansas, which produces more than one third of the world’s general aviation aircraft. Figeac-Aéro recently broke ground on a new North American headquarters in Wichita, and is also expanding its manufacturing facility there. The Kansas Department of Commerce and Textron Aviation have recently announced a workforce services training agreement that will support hundreds of millions of dollars of investment in new product development and production in Wichita.

Financial services is another sector showing growth. In Lincoln, Nebraska, NorthStar Financial Services Group, a financial services holding company, recently opened its second Omaha office and plans to hire about 350 employees. Centrix Solutions, a software company that provides financial institutions with products that detect fraud and manage risk, also opened a new facility in Lincoln.

The Plains has an outstanding transportation infrastructure, including Interstate 80, one of the nation’s busiest transportation routes, and several Class 1 rail systems. These assets are centrally located within the NAFTA trade corridor, making them attractive for distribution facilities. For example, in July 2016, Amazon.com announced plans for a new fulfillment center in Kansas City, Kansas, creating over 1,000 jobs.

In general, most of the Plains States are cautiously optimistic about their transportation and logistics sectors, especially for trucking. However, warned economist Eric Thompson, director of the Bureau of Business Research at the University of Nebraska-Lincoln, increased shipping by truck could be significantly hindered by a shortage of qualified drivers.