Despite the criticality of millennials to every company’s labor strategy, evidence indicates most still don’t know what it takes to attract and engage this generation. The best organizations are now crafting location strategies designed to better attract the millennial workforce when expanding, relocating, or consolidating their facilities. This focus on young talent is playing out at both the national and city level, causing companies to augment or completely rethink their location strategies.

Millennials Have Chosen to Live In Urban Areas in Larger Numbers

Today’s urban environments, specifically urban core areas, are enjoying a renaissance. Cities have leveraged their cultural endowments to become some of the fastest-growing residential markets in the country. The 2010 U.S. Census data found that downtowns in the nation’s largest cities (more than 5 million) grew by 13.3 percent over the previous decade and the trend shows no sign of slowing. Some of this renaissance can be attributed to the residential choices of the highly educated, a demographic group that is prized for their tech-savvy skills and an understanding of consumer trends. As a result, more and more companies have shifted away from a suburban campus model in favor of locating in downtown areas for improved access to this labor pool.

- 62 percent of millennials prefer to live in the type of mixed-use communities found in urban centers where they can live in close proximity to a mix of shopping, restaurants and offices.

- Two thirds of millennials are renters, which better aligns with an urban housing stock.

- Young people aged 16 to 34 drove 23 percent fewer miles in 2009 than they did in 2001 — a greater decline in driving than any other age group. Moreover, people aged 16 to 24 who have a driver’s license fell to 67 percent in 2011, its lowest level in a half century.

This residential shift has affected the location choices of business, particularly in the post-recession years. While the suburban corporate campus gained favor as generations of talent relocated to suburbs, central cities have now emerged as the favored environments for businesses to invest and grow. Downtown locations are now viewed as the optimal and most dynamic option for many businesses — especially those in technology and creative industries.

Cities have leveraged their cultural endowments to become some of the fastest-growing residential markets in the country. A Case Study

A Connecticut-based asset management firm located in a suburban business park wanted to create a headquarters to attract the next generation of talent. In addition to examining a collaborative workplace, the company also explored a test office or complete headquarters relocation to Manhattan. This move was driven by the desire to improve access to talent while rebranding the company to compete with the best in its business. While the cost of a New York office was significant, the benefits of an accessible location, energized employees, and an improved client experience far outweighed the cost. The company has since opened a small office used by local employees and as meeting space with clients. The existing Connecticut headquarters building is being sold with the intent to completely relocate operations based on the success of the Manhattan office.

High profile examples of companies moving to urban environments include Kraft Heinz, United Continental Holdings, and McDonald’s in Chicago; Pinterest in San Francisco; Accenture in Arlington, Va.; GE in Boston; and Quicken Loans in Detroit. Even those that have not embarked on a full-scale move have adopted a strategy to open marketing and/or tech offices in central cities to attract talent and generate excitement in the area. Examples of these satellite offices include Walgreens and Discover Financial in Chicago, PepsiCo and Heineken USA in New York City, and Yahoo in San Francisco.

The renewed emphasis on central business districts does not mean that suburban submarkets are dead. The merits of each submarket and its access to the professional millennial population will play a part in their future demand and relevance. The presence of city-like amenities such as public transportation, a mix of uses (retail, residential, etc.), and a walkable environment will continue to positively impact submarkets. Moreover, some central business districts will miss out on the resurgence of demand, particularly those lacking strong public transportation systems, an intact and/or engaging urban fabric, and a mix of uses including retail, entertainment, and residential development (new or rehabilitated).

Millennials Are Attracted to Cities With Specific Attributes

As millennial populations make different location choices within regions, this group is also choosing to locate in metropolitan areas that offer an appealing quality of life. A common belief is that this generation chooses a place to live based on quality-of-life factors first and job availability second. While this is probably overstated, hard data and casual observation have made it clear that certain metropolitan areas attract a larger share of highly educated millennials. These meccas include Washington, D.C.; San Francisco; Brooklyn, N.Y.; Portland, Ore.; and countless other urban centers that thrive on proximity to cultural attractions and employment.

The concentration of this desirable labor pool in defined metros has resulted in new millennial-focused site selection attributes not only for IT and marketing companies, but also for any business selling to the growing millennial consumer market. While the West Coast’s information-centric economy has been a favored destination for decades, companies are now geographically dispersed for access to talent and a lower operating cost. Cities in “fly-over country” now have healthy information economies of their own, the most visible of which is Austin, Texas, with its low cost of doing business and consistent growth rate of millennials. This mix has motivated Facebook, Apple, and Dropbox to establish operations in the region.

The continued interest in these “cool cities” has been led by today’s most dynamic companies in response to business growth as well as concern about labor market saturation in their original locations. To comprehensively assess a market, typical location figures in education and skills are now combined with cultural metrics and the ability to attract and retain talent. C&W regularly considers alternative attributes that both retain and attract educated mlllennials: presence of a large educational institution, vibrant cultural scene, and a thriving downtown area with a mix of uses and demographic diversity. While this data relies more heavily on hard-to-quantify “quality-of-life” factors, a mix of data points and site tours helps express the culture of the location.

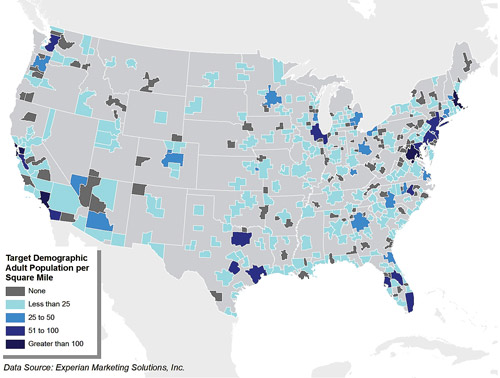

While the suburban corporate campus gained favor as generations of talent relocated to suburbs, central cities have now emerged as the favored environments for businesses to invest and grow. Another useful data point is a location’s psychographic profile, which combines multiple demographic attributes including age, education, and income level. Each psychographic category defines behavioral and purchasing aspects of the population in housing style, entertainment, retail shopping, and recreation. Translating the educated millennial cohort to a psychographic category allows for a deeper dive into cities and neighborhoods of choice. The relevant category for most employers is what C&W identifies as the “Young Professionals” cohort, which is made up of several Experian Mosaic® segments. These segments reflect upper-middle-income professionals and college graduates now employed in white-collar positions. They rent apartments in cities or close-in suburbs, have a progressive sensibility, and enjoy alternative music and a lively nightlife.

When measuring the concentration of the “Young Professionals” group in established creative hotbeds like Brooklyn, N.Y., and Silicon Valley, Calif., C&W found 44 metro areas with very high concentrations of this cohort. Usual suspects dominant in the information industry like Boston and Seattle are represented, but so are newly recognized hotbeds in Denver, Salt Lake City, and Minneapolis. This level of dispersion has generated hip microcosms of startups and entertainment that have raised the profile of the entire metropolitan area. Economic developers now tout these areas and their companies alongside traditional stories of new manufacturing plants and highway interchanges. Savvy companies now know to look a little closer at typically overlooked metro areas when chasing the talent.

In Sum

A paradigm shift in labor attraction has resulted in a fresh look at metropolitan areas and downtowns for increased competitiveness in employee productivity, attraction, engagement, and retention. Demographic trends and resulting corporate relocations have demonstrated that attraction of the millennial workforce requires a different approach than previous decades. Understanding new indicators in talent attraction can drive growth and generate advantages for companies that are always looking for an edge against the competition.