Where to Invest in the Booming Aerospace Manufacturing Industry

The U.S. remains top-ranked globally for aerospace attractiveness, but companies must consider labor, infrastructure, and tax policy among other factors when deciding where to locate their next U.S. facility.

2019 Auto/Aero Site Guide

So, what does all of this mean for those in the heart of this boom, and where are the best places to look for expansion? PwC recently released its 2019 Aerospace Manufacturing Attractiveness Rankings, the sixth consecutive year of analyzing the key states and countries that drive the industry. The report is meant as a helpful tool in planning for future growth, enhancing manufacturing supply chains, and re-examining costs. This is achieved by analyzing the macro considerations around the A&D industry, talent, cost, tax policy, infrastructure, and economy. All of the metrics and data are carefully examined in order to point companies in the direction of the best areas to invest, build, and expand operations.

For the 2019 rankings, the methodology continues to evolve, with the country rankings combining a total of 32 metrics and the state rankings based on a total of 30 metrics. The metrics were spread across the following seven categories: cost, economy, geopolitical risk, industry, infrastructure, labor, and tax policy. Geopolitical risk was excluded from the state rankings due to the similar risk for all states.

Country Rankings

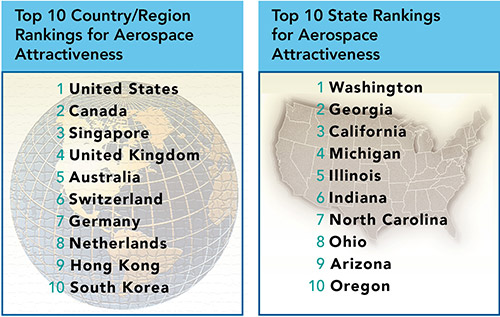

The United States remains in the top-ranking position due to its large aerospace industry with $244 billion in sales last year. The country’s A&D industry accounted for 9 percent of U.S. exports, yielding the country’s best trade surplus of $90 billion, and was dominant in almost all metrics across the seven categories. The U.S. scored in the top 10 in six of the seven categories with the outlier stemming from that of the tax policy category, for which data did not yet reflect the 2018 tax reform. The only other nation to score in the top 10 in at least four of the seven categories was Germany, yet it finished seventh in the rankings due to lower rankings in the following three categories: cost, economy, and tax policy.

Following the aerospace superpower — the United States — Canada takes the second spot largely due to its highly educated labor force, low level of geopolitical risk, and industry size. Also, the country’s launching of the Strategic Innovation Fund has encouraged R&D efforts, which in turn have spurred growth and expansion in the A&D industry.

Rounding out the top five are Singapore coming in at third, United Kingdom fourth, and Australia taking the fifth spot. Those countries ranking sixth through tenth (Switzerland, Germany, Netherlands, Hong Kong, and South Korea) each had a strong economy in common, except for Germany, which made up for this with the top spot in geopolitical risk. Companies should be reconsidering their long-term supply chains due to the current trade environment.

In terms of state rankings, Washington remained in first place, with Georgia jumping up a place to second. State Rankings

In terms of state rankings, Washington remained in first place, with Georgia jumping up a place to second. California, Illinois, North Carolina, and Oregon were all newcomers to the top 10 in 2019; Michigan, Indiana, Ohio, and Arizona remained in the top 10 since last year.

The two states with the largest leaps were Michigan and Indiana. Michigan jumped four spots to #4, largely due to its strong showing in industry (14th), economy (3rd), and its #1 rank in tax policy, helped by its flat corporate tax rate of 6 percent. Michigan has strengthened its A&D sector with the support of the Aerospace Industry Association of Michigan, which represents about 800 companies. Also, being home to over 18 educational institutions with aerospace-related degrees and curriculum has provided the state with a pipeline of skilled workers. Indiana followed similar suit by excelling in the same three categories, led by an overall 2nd place tax policy ranking.

New addition, California, saw itself move from 13th to third in this year’s rankings. California performed particularly well in infrastructure (3rd), industry (2nd), and economy (2nd). Labor and tax policy also finished strong at 13th and 22nd, respectively. Interestingly, at 49th in cost, California found itself in the bottom four of the overall cost rankings of 52 states/territories. California’s aerospace industry, which is made up of approximately 850 companies falls only behind Washington. Also, the presence of three NASA research centers and the Mojave Air and Space Port has encouraged the growth and development of the state’s sector.

Where To Build?

For companies considering where to build a future plant or R&D facility, these categories are indeed important, but there are other significant criteria to consider as well. For example, attracting talent will be a huge key for growth. The A&D industry is growing along with the overall economy and unemployment is low. As a result, there is an increased competition for talent, and A&D companies are feeling pressure to capture that young talent and need to start increasing their appeal to young people to help establish a pipeline of future talent.

For example, PwC highlighted in its report the FIRST Robotics Competition (FRC) for high school students, which assists companies in developing talent and helping guide their career choices. Entering the 13th year of this international competition, the FRC has become so successful that it has created similar type programs for elementary and middle school students. A&D companies can get involved in many ways, including funding, mentoring, and providing equipment. This is an opportunity to keep the industry aligned and growing with the overall economy both now and in the future.

A Caveat

We emphasize that any methodology is imperfect; for example, there is no consistent data available for skilled manufacturing, a priority for the industry. Further, the data should be tailored to each company’s specific circumstances. We believe our report is a useful tool to be used as a framework to evaluate investment decisions and as a guide for future strategy and planning.

Project Announcements

CesiumAstro Expands Bee Cave, Texas, Headquarters-Manufacturing Operations

01/16/2026

Lithium Battery Company Plans Tampa, Florida, Battery Pack Production Operations

01/10/2026

Poly6 Technologies Expands Eastlake, Ohio, Operations

12/26/2025

Portal Space Systems Expands Bothell, Washington, Operations

12/21/2025

Mantis Space Plans Albuquerque, New Mexico, Headquarters-Manufacturing Operations

12/17/2025

JGA Space and Defense Expands Huntersville, North Carolina, Operations

12/05/2025

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025

-

The New Industrial Revolution in Biotech

Q4 2025