Sustainability, Resilience and Wellness: Pulse of the Industry in 2017

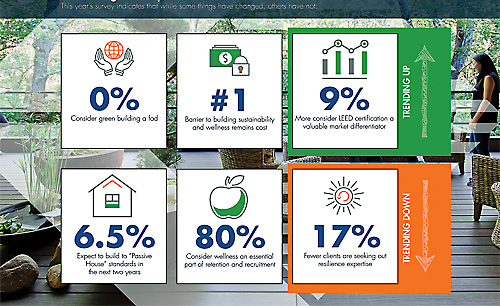

A recent survey of the real estate and construction industry reveals that sustainability in the built environment continues to grow year after year, despite real or perceived added costs.

Q4 2017

We sent our survey to a list of long-standing, key clients, primarily at senior positions in corporate real estate or facilities management. Sixty-six percent of respondents stated that their square foot responsibility was greater than one million square feet. The following findings and analysis summarize what they said about a number of sustainability-related topics.

Sustainability: Room to Grow

We know that client demand is a key driver for sustainability in the built environment. That demand can be driven by any number of factors, including regulation, reporting, incentives, and ROI. Our survey findings show that sustainability in the built environment continues to grow year after year even though added “costs, or at least the perception of costs,” as one client states, continue to be the number-one barrier to incorporating sustainability in the built environment.

The survey also shows a distinct need among end-users for continued help with building the case for sustainability and creating greater “knowledge of the opportunities and costs/benefits.” As one survey respondent put it, decision-makers need to be “moving past low-hanging fruit opportunities with limited incentives offered.” Established patterns can also be a challenge, including “institutionalized ways of doing things, from construction management to leasing decision-making. It’s difficult to coordinate all the parts to execute system-level sustainability changes in the industry,” as noted by another respondent.

Thanks to a groundswell of support dating back to the early 1990s, sustainability has become a critical component of the built environment. However, our survey data may indicate that a commitment to continued growth and innovation in green buildings, such as those that drive further energy efficiencies and fossil fuel reductions, may be weakening as fewer respondents see sustainability as pushing the envelope.

Still, many of our clients report that they are seeking opportunities for innovation in their facilities “At Boston Properties, environmental, social, and governance issues are increasingly important to our customers, investors, employees, and communities we serve,” says Ben Myers, Boston Properties’ sustainability manager. “There’s a sound business case for aligning our values with the values of our stakeholders.”

The number of our clients looking for such services as commissioning and retro-commissioning has remained steady, with 57 percent this year stating they would expect their projects over the course of the next two years to include this requirement. When asked if they would look to include an energy-modeling requirement within the next two years, the number basically remained the same as last year, with 55 percent stating that they would.

Third-Party Rating Systems: LEED Is Still King

The plethora of green building rating systems on the market has even the most sustainability-savvy respondents reeling a bit. One client simply stated that a lack of education about emerging rating systems continues to be a barrier. At the same time, our results show clients are more actively seeking LEED certification again.

When asked what the most important consideration is when looking to use any third-party rating system, the number-one reason respondents gave was reducing operating costs, followed by providing a healthier and more productive workplace. Lowering global emissions and increasing building value held the lowest two slots.

Emerging rating systems are still fairly unfamiliar to respondents. The percentage of end-users that have an understanding of the Passive House standard was split relatively evenly among “yes,” “no,” and “maybe.” Just over 6.5 percent stated that they would embark on a Passive House project in the next two years.

Thanks to a groundswell of support dating back to the early 1990s, sustainability has become a critical component of the built environment. The Living Building Challenge (LBC) is garnering more attention in commercial projects, and its consideration as a well-respected third-party certification is trending up; however, the largest percentage of those polled about the system’s reputation (39 percent) responded, “I don’t know.” Those looking at doing an LBC project in the next year decreased from last year’s surprisingly high 8 percent to 2 percent this year.

When looking at another quickly emerging rating system, the WELL Building Standard, an overwhelming 49 percent agreed that WELL is a respected third-party rating system, and 25 percent stated they would be doing a WELL project in the next year.

BREEAM, the oldest of all the rating systems, was released in the U.S. in October 2016. This rating system comes out of the United Kingdom, so it’s not surprising that 39 percent marked “I don’t know” when asked if BREEAM is a respected third-party rating system. Conversely, 28 percent did agree that it is respected and 6.5 percent stated that they would be pursuing a BREEAM project in the next year. These findings indicate that more education may be needed for BREEAM to gain more traction in the U.S. market.

Wellness: It Has Arrived

Last year’s survey showed that wellness in the built environment was an emerging need; this year it is overwhelmingly an essential requirement. Interest in pursuing WELL projects came from all sectors, but most strongly from our commercial office clients. The conversation around health and wellness in the workplace strikes right at the heart of most companies’ attraction and retention policies, though what the industry really craves is data. As one client stated, a barrier to wellness is the “lack of data demonstrating the cost benefits,” adding that it is “hard to justify the added costs.”

With 80 percent of our clients affirming that they will or may seek external expertise to incorporate wellness in their built environments, the trend is distinctly upward. In fact, this year 80 percent also stated that wellness is a key part of their retention and recruitment plans. While attraction and retention remained the number-one driver behind wellness initiatives, this year it was followed closely by increasing employee satisfaction, with increased productivity, reduced healthcare costs, and reduced absenteeism taking the remaining spots. Last year attraction and retention led the others by a larger margin.

The plethora of green building rating systems on the market has even the most sustainability-savvy respondents reeling a bit. Finally, when looking at the most desired wellness attributes in a space, indoor air quality remains number one, but this year it’s in a tie with comfort, which is up from third place last year. Other major shifts include mental well being, rising from fourth to second most important, and lighting dropping to number three from last year’s second most important attribute. The aforementioned rankings are all determined by the mean data, meaning they represent the average of the selections when ranked from most to least important. When looking simply at which attribute received the most number-one votes, in a surprising turn, mental well being rose to the top after its relatively low ranking last year.

Resilience: Out of Sight, Out of Mind?

The industry’s attitude toward resilience also seems to have shifted. This year we found a striking disparity between the percentage of clients that see the importance of buildings that are built with resilience in mind and those that are, through outside expertise, looking to protect or strengthen their buildings from disastrous events. This apparent dip in concern over resilience could be due to the absence of a recent catastrophic weather event (survey and its analysis were completed before this year’s devastating hurricane season) and waning attention to the topic in U.S. national policies and media.

Despite these increasingly concerning conditions, resilience seems to be trending to a lower priority for building owners. Our data shows a slight shift away from the importance of designing a building to withstand extreme weather and climate change, though 54 percent still agree it is important, down from 61 percent the year prior. Passive survivability, a building’s ability to maintain critical life-support conditions if major utility services are lost, maintained its significance with two thirds (66 percent) still believing it matters. The steepest decline from 2016 shows that fewer clients are seeking external expertise in resilience, with 2017 showing a 17 percent drop in interest for resilience subject-matter experts in commercial real estate.

Project Announcements

Germany-Based KettenWulf Plans Auburn, Alabama, Production Operations

01/28/2026

Frontieras North America Plans Mason County, West Virginia, Operations

01/28/2026

North Wind Plans Rosemount, Minnesota, Research Operations

01/27/2026

DSV Global Transport and Logistics Plans Mesa, Arizona, Headquarters Operations

01/24/2026

Poland-Based JGB Brothers Plans Bamberg County, South Carolina, Production Operations

01/23/2026

Electric Research and Manufacturing Cooperative Plans Waddell, Arizona, Transformer Production Operations

01/23/2026

Most Read

-

The Workforce Bottleneck in America’s Manufacturing Revival

Q4 2025

-

Data Centers in 2025: When Power Became the Gatekeeper

Q4 2025

-

Speed Built In—The Real Differentiator for 2026 Site Selection Projects

Q1 2026

-

Preparing for the Next USMCA Shake-Up

Q4 2025

-

Tariff Shockwaves Hit the Industrial Sector

Q4 2025

-

Top States for Doing Business in 2024: A Continued Legacy of Excellence

Q3 2024

-

Investors Seek Shelter in Food-Focused Real Estate

Q3 2025