Knowledge Clusters in the Automotive Industry

Automotive Site Guide 2012

Sixty percent of motor vehicles made in North America are produced in the Midwest.1,2 Just as the heart of the auto industry is in the American Midwest, auto-related innovation and knowledge clusters are prevalent there as well. Approximately three-fourths of the U.S. industry's annual investment of $20 billion in R&D funding is spent in the Midwest.3 The Michigan automotive R&D industry, for example, employs an estimated 65,000 professionals and is home to more than 330 automotive R&D companies or research facilities.4 The Midwest's automotive R&D facilities include automaker facilities, automotive supplier facilities, the EPA National Vehicle and Fuel Emissions Laboratory (NVFEL), and the U.S. Army Tank Automotive Research, Development and Engineering Center (TARDEC). The EPA lab, established in the 1970s, was an important establishment for attracting further investment in R&D facilities to the area because automakers had to prepare vehicles for emissions testing nearby.

Also in the region, Ontario is home to AUTO21, a university-industry automotive research partnership that fosters practical automotive research in several areas. Ontario is also where the Ontario BioCar Initiative and the Ontario BioAuto Council are located, making the province a hub for bio-based automotive materials.

Other vehicle-related clusters are located in Virginia, Tennessee, and the Carolinas, which host several major automotive safety research centers such as the National Crash Analysis Center, Virginia Tech Transportation Institute, Oak Ridge National Lab, and Clemson University's International Center for Automotive Research.

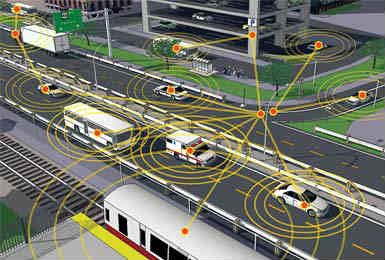

Thanks to its strong university system and Silicon Valley heritage, California is a high-tech research hub and conducts a significant amount of research into alternative fuels and powertrain technologies as well as intelligent transportation systems. California is a key state conducting connected vehicle research, much of which is done by California Partners for Advanced Transportation Technology (PATH) and the California Department of Transportation (Caltrans) along with federal, private, and university partners.

Greenhouse Gas and Fuel Economy Regulation

Recent and proposed changes to federal automotive Green House Gas (GHG) and fuel economy legislation are poised to have a significant impact on the design of the automobile. Corporate Average Fuel Economy (CAFE) legislation was first enacted by Congress in 1975 as a policy to increase fuel economy of passenger cars and light-duty trucks. By 2016, the combined required CAFE for light-duty truck fleets and passenger car fleets will be 35.5 miles per gallon (mpg), approximately double the initial 1970s requirements of 18 mpg for passenger cars only. The increase in CAFE has already had an impact on the fuel economy of vehicles. For the first time, the fleetwide CAFE for passenger cars and light-duty trucks exceeds 30 mpg (see accompanying chart). While increases in CAFE through 2016 have had an impact on the design and performance of vehicles, proposed GHG and CAFE regulations for 2017-2025, requiring vehicles to achieve an estimated CAFE of 54.5 mpg, stand to have an even greater impact on vehicle innovation.

The proposed regulations of California's Advanced Clean Cars (ACC) program are demanding new research to achieve zero-emission technologies through full battery electric cars, newly emerging plug-in hybrid electric vehicles, or hydrogen fuel cell cars. The regulations, when finalized, are likely to be adopted by more than a dozen other states. The state of California estimates there could be 500,000 zero-emission vehicles - either battery electric or fuel cell electric vehicles - on the road in California by 2025.

Fuel economy and GHG emission regulation has created a pocket of investment in proximity to the California Air Resource Board laboratory in California. It has also led to clustering of vehicle manufacturer emissions testing facilities surrounding the EPA mobile sources laboratory in Michigan.

Vehicle Powertrain and Alternative Fuels

Ongoing developments and improvements in various powertrain technologies will be essential to meet federal and state environmental regulations. There remains uncertainty among vehicle manufacturers as to which technologies will best meet GHG/CAFE standards while also being accepted and purchased by consumers. Powertrain technologies can be grouped into three broader categories: advanced internal combustion engine development (gasoline and diesel), vehicle electrification, and alternative fuels. Each of these categories presents a wide range of technology options and cost considerations.

The internal combustion engine (ICE) has undergone remarkable change in the past decade and newly developed advanced internal combustion engines are expected to improve ICE environmental impacts and also have a cost advantage vis-à-vis other powertrain options.

Electric vehicles hold both promise and uncertainty. The Tesla Roadster and Nissan Leaf, two highly visible battery electric vehicles, have entered the mainstream - but certainly not mass market. Vehicle electrification - including mild hybrid, hybrid electric vehicles, plug-in hybrid electric vehicles, extended range electric vehicles, or battery electric - is highly dependent upon further battery development.

Alternative fuels will also have a place in the advanced powertrain mix. Natural gas has been used for light-duty vehicles for many years, but has been mostly limited to fleet applications. Promoters of natural gas suggest that its abundance and relatively clean burning characteristics make it an ideal candidate for increased usage in motor vehicles. Hydrogen is another alternative fuel. Toyota has announced it will market a fuel cell electric vehicle in 2015. Other manufacturers (Honda, General Motors, and Mercedes) continue to develop hydrogen-powered fuel cell technology. In addition, there is much research involving biofuels.

Significant research in alternative drive trains is being performed in Michigan by automakers and major suppliers. In California, the Lawrence Berkeley National Laboratory does work on hydrogen and biofuels. Tennessee's Oak Ridge National Laboratory performs research related to hybrid, battery-powered, or fuel cell vehicles as well as biofuels. Similarly, Argonne National Lab in Illinois conducts research on hydrogen electric vehicles, plug-in hybrid electric vehicles, and alternative fuels such as clean diesel, butanol, ethanol, hydrogen, natural gas, and synthetic fuels. Each of these research centers has attracted interest from nearby universities and companies involved with alternative drive trains and fuels.

Next: Advanced Materials for Lightweighting

Project Announcements

Japan-Based Nidec Motor Expands Mena, Arkansas, Electric Motor Operations

10/01/2025

ZF Chassis Systems Duncan Plans Spartanburg, South Carolina, Operations

09/28/2025

OPmobility Plans Normal, Illinois, Assembly Operations

09/26/2025

Japan-Based Astemo Americas Plans Wixom, Michigan, Regional Headquarters Operations

09/07/2025

Germany-Based MAHLE GmbH Expands Morristown, Tennessee, Operations

09/01/2025

Stellantis Plans Forsyth, Georgia, Distribution Operations

09/01/2025

Most Read

-

2025’s Top States for Business: How the Winners Are Outpacing the Rest

Q3 2025

-

The Compliance Reckoning Is Here

Q3 2025

-

Around the Horn: Data Center Supply Chains — What's Next?

Q3 2025

-

Data Center Demand Stabilizes Amid Changing Market Forces

Q3 2025

-

How Consumer Trends Are Reshaping Food Facilities

Q3 2025

-

Powering the Next Generation of Projects

Q3 2025

-

First Person: Filter King’s Expansion Playbook

Q3 2025