“With information streaming in from every corner of the world, organizations struggle to understand where and how to best manage and process their data to deliver instant, reliable access to information for consumers and businesses alike,” says Bo Bond, Central Region lead for JLL’s Data Center Solutions Group. “Cloud services, digital content, and new data sovereignty laws are setting the data center market on fire,” he continues. “Demand is historically strong, so the onus is on the data center operators to build space fast enough, while also accommodating shorter, more flexible lease structures that have become highly popular as data strategies have evolved.”

2016 North America Data Center Outlook

-

Top 2016 Data Center Trends

-

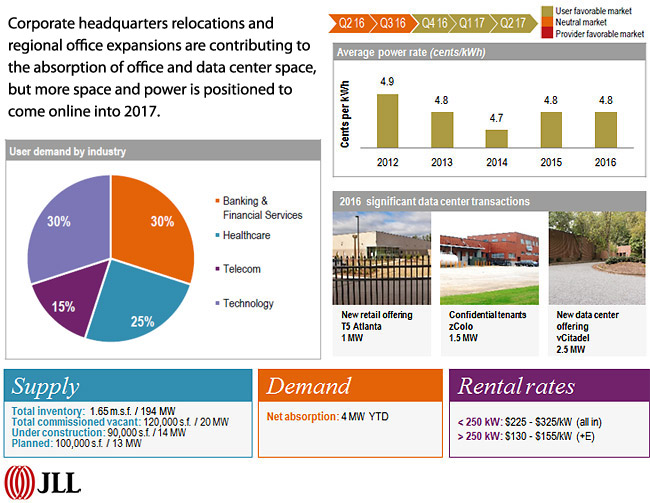

Data Center Markets - Atlanta

-

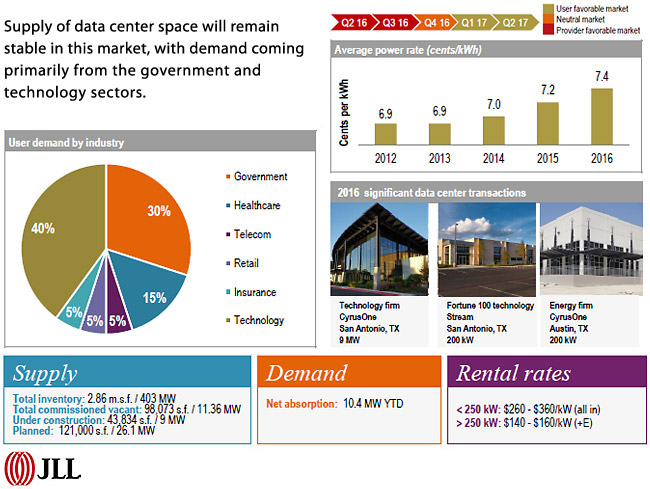

Data Center Markets - Austin & San Antonio

-

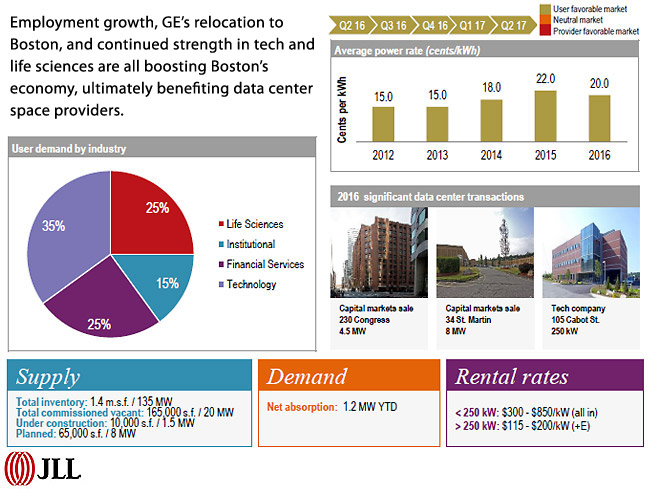

Data Center Markets - Boston

-

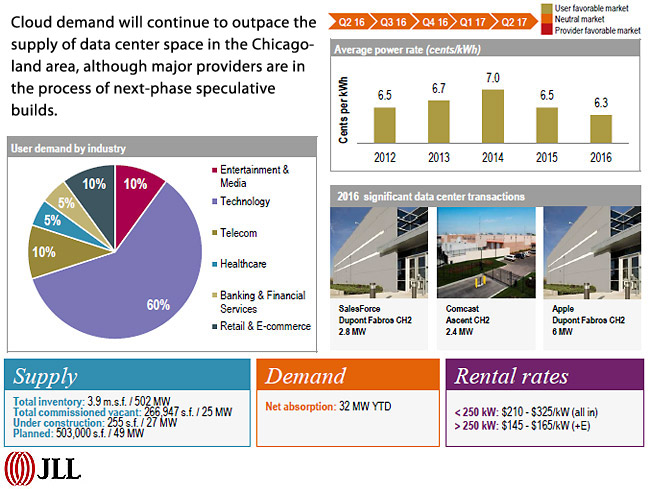

Data Center Markets - Chicago

-

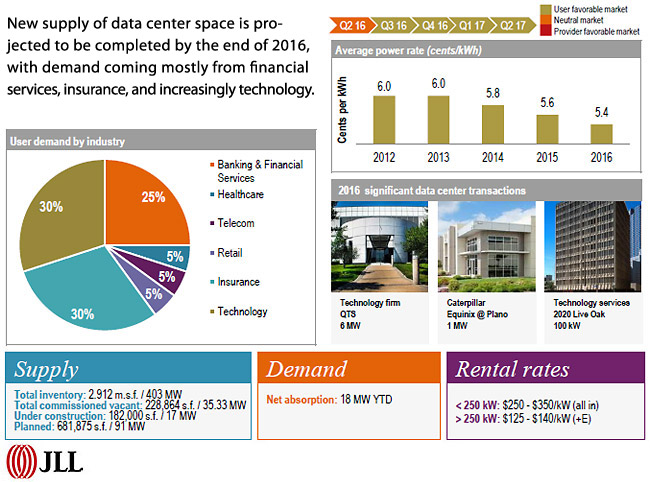

Data Center Markets - Dallas

-

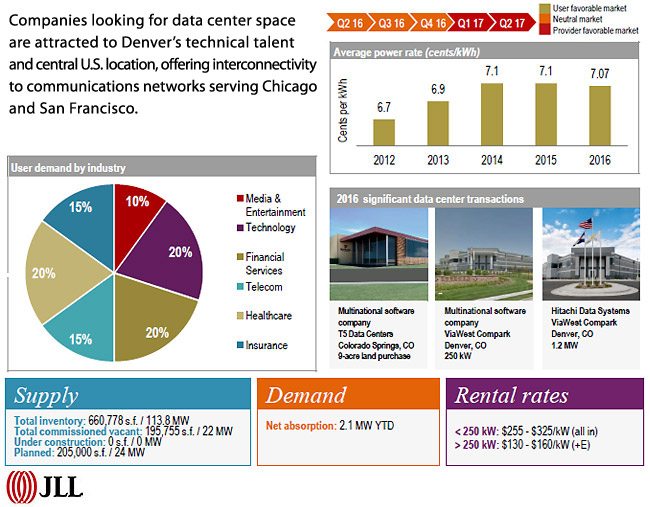

Data Center Markets - Denver & Colorado Springs

-

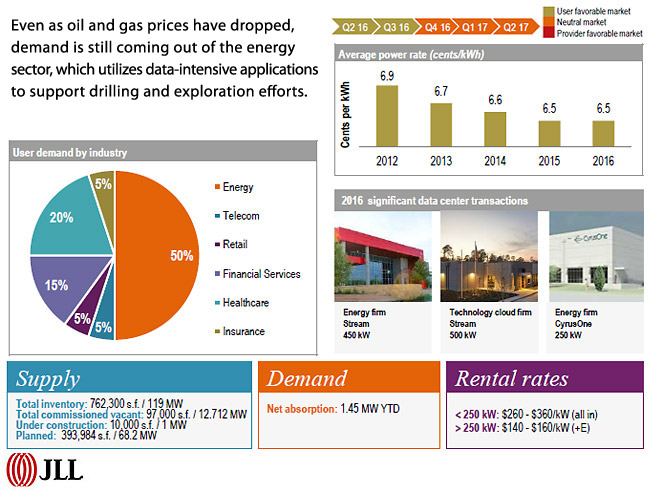

Data Center Markets - Houston

-

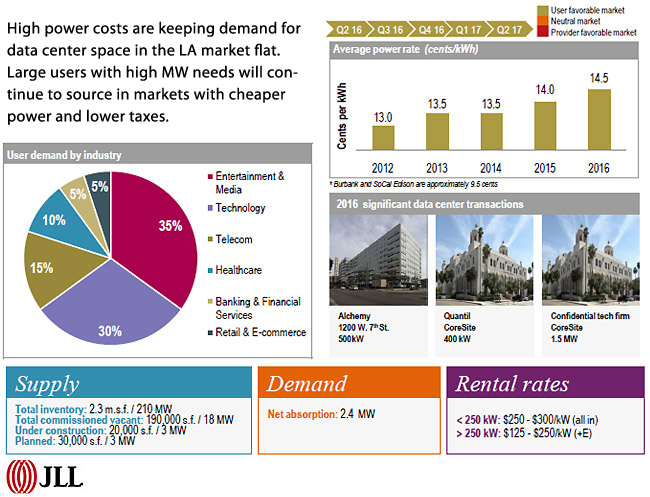

Data Center Markets - Los Angeles

-

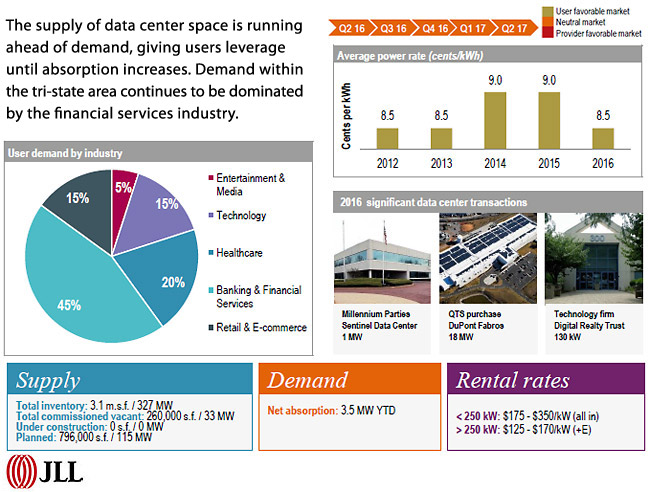

Data Center Markets - New Jersey

-

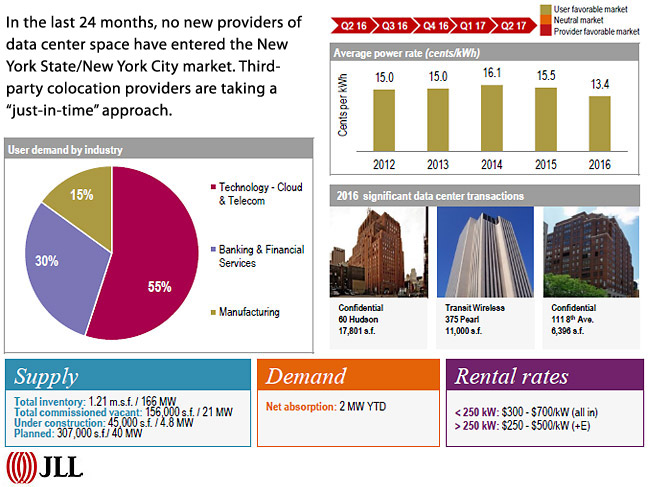

Data Center Markets - New York City

-

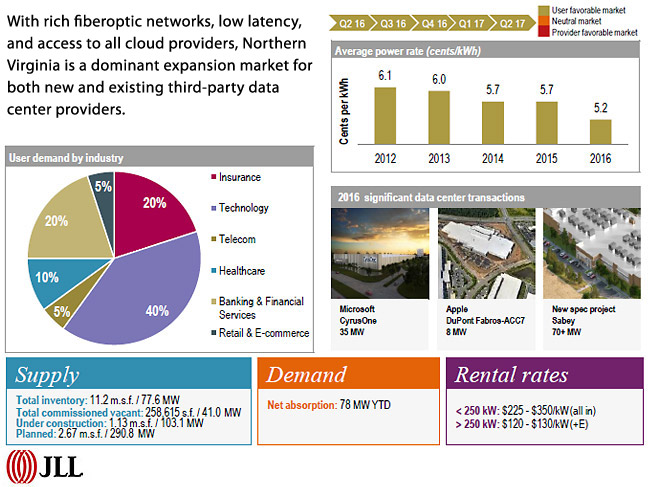

Data Center Markets - Northern Virgina

-

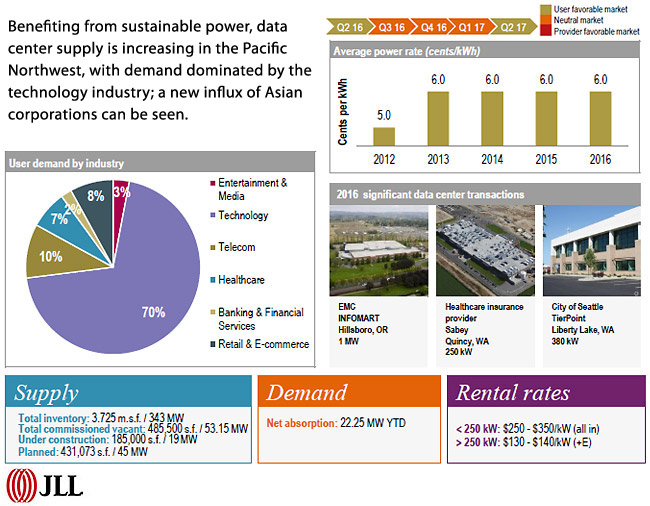

Data Center Markets - Northwest (Greater Seattle Area / Central Washington / Hillsboro, Oregon )

-

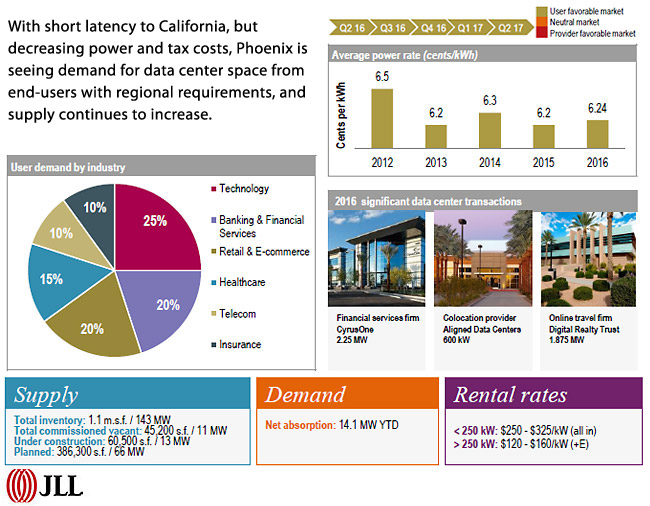

Data Center Markets - Phoenix

-

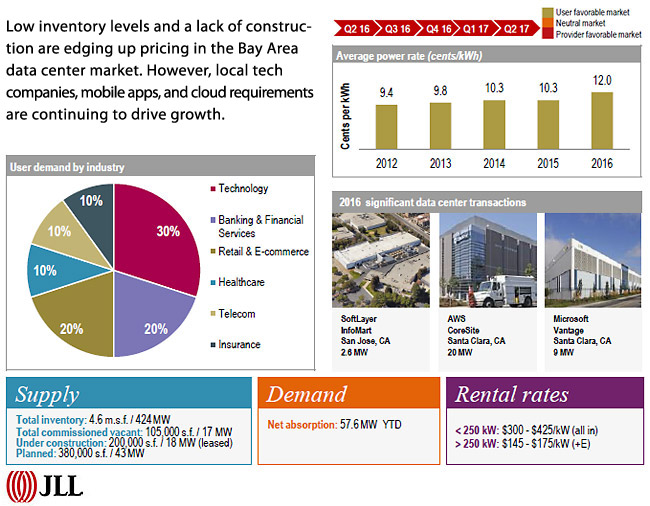

Data Center Markets - San Francisco Bay Area

-

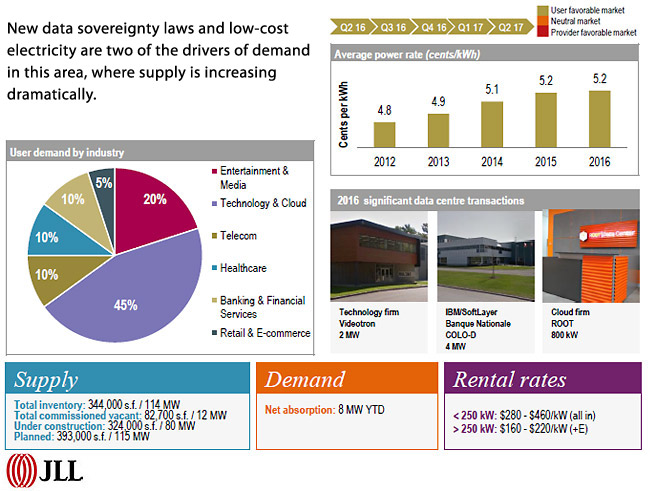

Data Center Markets - Greater Montreal Area

-

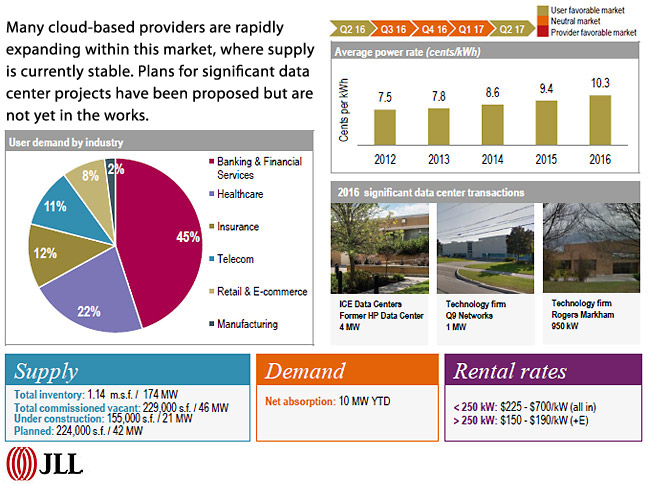

Data Center Markets - Greater Toronto Area (Including Barrie & Kitchener/Waterloo Region)

-

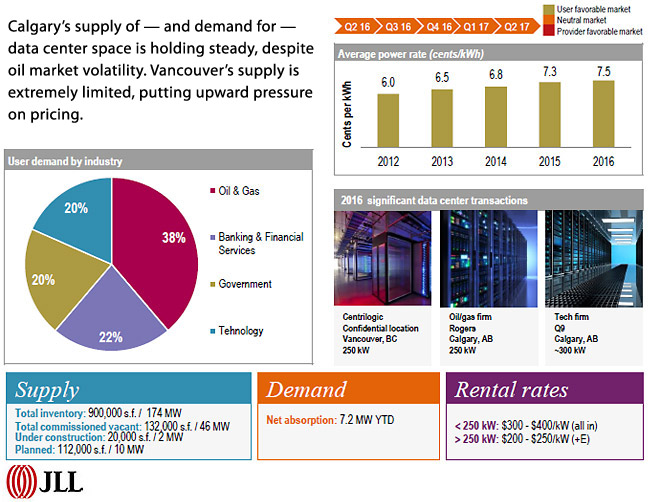

Data Center Markets - Western Canada

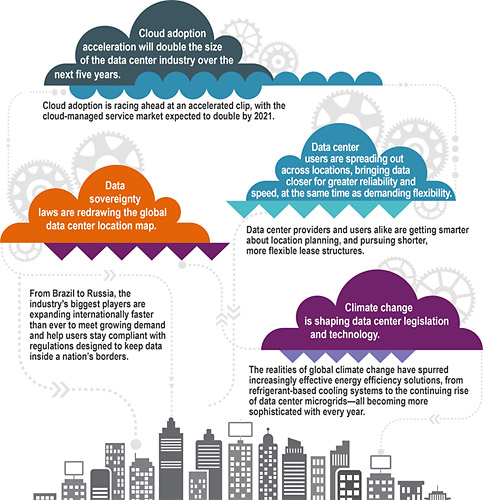

Top Trends

The JLL report, which covers 17 North American markets for data center facilities, reveals the top trends influencing U.S. data center locations, as follows:

- Cloud adoption will double the size of the data center industry over the next five years.

- Data center users are disbursing data across locations, aligning with smarter data management strategies.

- Data sovereignty laws are redrawing the global data center location map.

- Climate change is shaping data center legislation and technology.