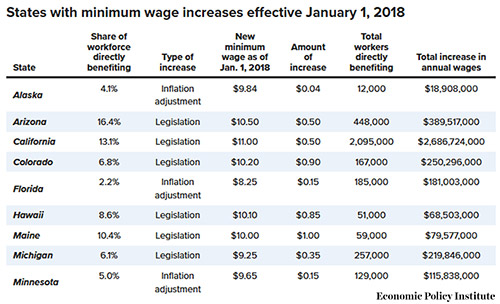

With the increases, there are now 29 states with laws mandating higher pay than the federal minimum wage of $7.25 per hour, which has been in place since 2009. By 2022, 17 percent of Americans will live in a city or state with a $15 minimum wage, according to Fortune.

For employers, one factor that makes it easier to deal with mandated minimum wage increases is that they do not come as surprises, as is often the case with other types of expenses. “Typically, minimum wage increases are ‘baked into’ a legislative act that either ties increases to some kind of fixed schedule or a cost-of-living increase,” says Rick Guzzo, co-leader of Mercer’s Workforce Sciences Institute.

One of the variables is that individual states often have minimum wages that are higher than those mandated by the federal government. And, today’s tight labor market means an upward trend in wages across most, if not all, industries, Guzzo notes. The manufacturing sector is less susceptible to minimum wage increases than it used to be, because technology has mostly eliminated minimum wage jobs from the factory floor.

“The manufacturing sector has already gone through a movement away from minimum wage as a meaningful base wage. True, minimum wage jobs are elsewhere, such as in the retail sector,” Guzzo told Area Development.

Source: EPI analysis of Current Population Survey microdata 2017

What strategies can employers use to compete in a tight labor market? Guzzo suggests “looking to alternative pools, for example, people who haven’t been working in manufacturing. They might be able to draw folks from retail or try to bring people from retirement back into the workforce. But there is a limit to how much you can do that. It’s not going to be the be-all, end-all answer.”

…a significant number of individuals who were previously in automatable employment are unemployed in the period following a minimum wage increase. Grace Lordan and David Neumark, researchers, National Bureau of Economic Research Guzzo also says employers might ask, “‘What is the whole deal we can offer? Along with higher wages they might also include some scheduling flexibility, or some other aspect of benefits that weren’t on the table previously.”

A developing issue is how employers will decide to spend their federal tax break “windfall,” he notes. “Some have made announcements they are going to pay out bonuses, but are not ramping up the minimum wage.”

Last year, two researchers from the National Bureau of Economic Research reported findings that increasing the minimum wage drives employers to automate jobs held by low-skilled workers. In the paper “People Versus Machines: The Impact of Minimum Wages on Automatable Jobs,” Grace Lordan and David Neumark found that “…a significant number of individuals who were previously in automatable employment are unemployed in the period following a minimum wage increase.”

The study found that increasing the minimum wage by $1 decreased the share of low-skilled automatable jobs by 0.43 percent in general and by 0.99 percent in manufacturing as employers expand the use of machines to avoid higher wage costs. While artificial intelligence can be used to replace workers, small manufacturers are less able to make that kind of investment in new infrastructure, Guzzo points out.