China, Canada, Germany, and the UK round out the top-five markets with the highest confidence rankings, in that order. Per the A.T. Kearney report, global business leaders indicate that they plan to continue to invest more internationally, as they believe doing so will be an increasingly important factor in corporate profitability strategy and competitiveness in the coming years.

Companies investing have options in terms of where to place their investment. Research activities, software development, and production of goods with modest transportation costs can be located almost anywhere. The range of location options for mobile activities has expanded dramatically as many countries have stabilized their macroeconomic policies, opened their markets, improved their infrastructure, strengthened their academic institutions, and upgraded the skills of their workforces. Countries that used to attract activities only on the basis of natural resources or inexpensive labor can now vie for activities/businesses that rely on more skill and involve more complex manufacturing or services.

- Labor availability and wage rates

- Complexity of tax codes

- Effectiveness of the political systems

- Strength of the public education systems

- Macroeconomic policies

- Transparency of the regulatory environment

- Condition of infrastructure and ongoing commitment to maintain

Historical Strengths

The United States historically offers strengths that are well suited to many high-value, firm-wide functions of a global company interested in investing and growing a business. Strengths include:

Culture of innovation — According to the 2016 Global Innovation Index, the United States ranks fourth in innovation, most notably due to the strength of its global-facing markets, value of stock trades, and widespread implementation of Internet technology. Additionally, U.S. patent and trademark costs are some of the lowest in the world. These trademarks are critically important in protecting a company’s investments. The IP (intellectual property) of foreign companies in the United States is safeguarded by the stable and predictable regulatory system.

Diverse/educated and productive workforce — Executives making location decisions recognize that a diverse set of experiences, perspectives, and backgrounds is crucial to innovation and the development of new ideas and productivity. The United States offers such diversity, thus making it one of the most attractive labor markets globally. The American worker has a comparatively high level of qualification and is considered to be one of the most productive and innovative in the world.

Business-friendly — American policies on taxation and regulation provide investors with significant management freedom. U.S. business regulations are fairly transparent and exporting is easy and inexpensive. The United States provides a predictable and transparent judicial system and a highly developed infrastructure providing access to the world’s most lucrative consumer market.

With a population of over 300 million people and one of the world’s strongest economies, the United States represents one of the most important markets in the world. According to the 2017 Doing Business Report published by World Bank, the United States ranked eighth out of 190 economies in terms of quality of business climate. And the Global Investment Trends Monitor ranks the United States first among the most attractive counties in terms of FDI for the period 2016–2018.

Some FDI Examples

Many companies understand the importance and benefits of investing in the United States. Some examples follow:

- Honda, a Japanese multinational conglomerate, has the longest sustained manufacturing presence in the United States of any international automaker. Honda has made $17 billion in capital investment in its U.S. operations, has 75 facilities domestically, and, as recently as 2016, opened a $70 million advanced production facility in Marysville, Ohio.

- Nestle, a Swiss transnational food and drink company, employees more than 51,000 workers in the United States and boasts 87 factories in 47 states. In February of 2017, Nestle USA announced plans to relocate its corporate headquarters to Arlington County, Virginia, from California. Nestlé’s relocation within the U.S. vs. offshoring indicates the importance of having access to a great talent pool for future growth, as well as the importance of proximity to business operations, customers, and stakeholders.

- Novartis, a Swiss multinational pharmaceutical company, employs more than 26,870 workers in the United States. This leading global healthcare business performs research and development, manufacturing, and sales and marketing efforts in 15 states and Puerto Rico. Novartis Chief Executive Joe Jimenez told Reuters, “When we build a new manufacturing site we think about the tax rate, we think about the economy of the country, we think about jobs, so a booming U.S. economy would make the United States more attractive for investment.”

- Bridgestone has more than 50 production facilities and 55,000 employees in the United States. In 2014, Bridgestone Americas opened a $970 million OTR plant (off-the-road radial tires) in Aiken County, South Carolina. This was the first time, the radial OTR tires would be manufactured outside of Japan and the second Bridgestone plant to open in Aiken County. Bridgestone Americas is the U.S. subsidiary of the Tokyo-based Bridgestone, the world’s leading tire and rubber maker.

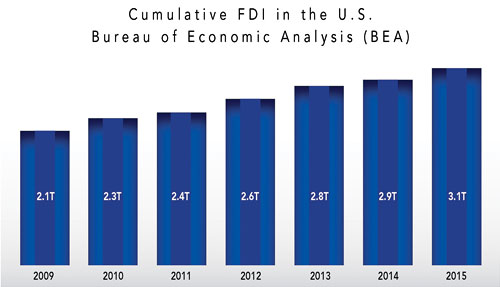

The Bureau of Economic Analysis (BEA) indicates that FDI investment in the United States reached a record high $348 billion in 2015, contributing significantly to the country’s economic growth and demonstrating continued global competitiveness. There is no doubt that this record high level of investment correlates to the United States having strong location advantages such as:

- World-class university and community college systems

- Strong intellectual property protection

- Sophisticated managerial talent

- Ready access to capital

- An expansive domestic market

- An entrepreneurial culture of innovation and risk-taking

Economic Developers Recognize the Importance of FDI

The International Trade Association (ITA) released a study in 2016 illustrating how important FDI is to the U.S. economy. Economists for ITA’s office of Trade and Economic Development estimate that 12 million jobs or 8.5 percent of the entire U.S. labor force were attributed to FDI.

According to the data, nearly 6.1 million people were directly employed by U.S. affiliates of majority foreign-owned companies in 2013 (most recent data). Other international companies like Siemens, Unilever, and Toyota have U.S. operations that employ American workers.

The impact of this foreign investment goes beyond direct employment. International companies help drive innovation, connect American companies with the world, and bring new technologies to improve productivity. Billions of dollars are spent annually on American research and development.

The investment creates additional activity at the local, regional, and national economic levels as these companies rely on other companies within their supply chains. Employees earn money that is then spent within their communities and on other goods for their families. Employees are receiving training and developing new skills that will benefit them for the rest of their lives.

With these statistics in mind, it is easy to understand why economic developers are keen to attract FDI to their states, regions, and communities and have targeted plans to do so. Foreign firms considering investment in the U.S. can work directly with regional, state, and local economic development agencies to facilitate site location. Economic development agencies — public, private, and some that are a combination of public and private — have unique and powerful resources, which may include:

- Identification of available real estate that meets project criteria

- Workforce availability/educational attainment levels/training

- Regulatory processes

- Economic data

- Business climate statistics

- Utility rate information

- Capital access programs

- Targeted industry sectors

- Quality of life insight

- Educational institutions

- Research and development connectivity