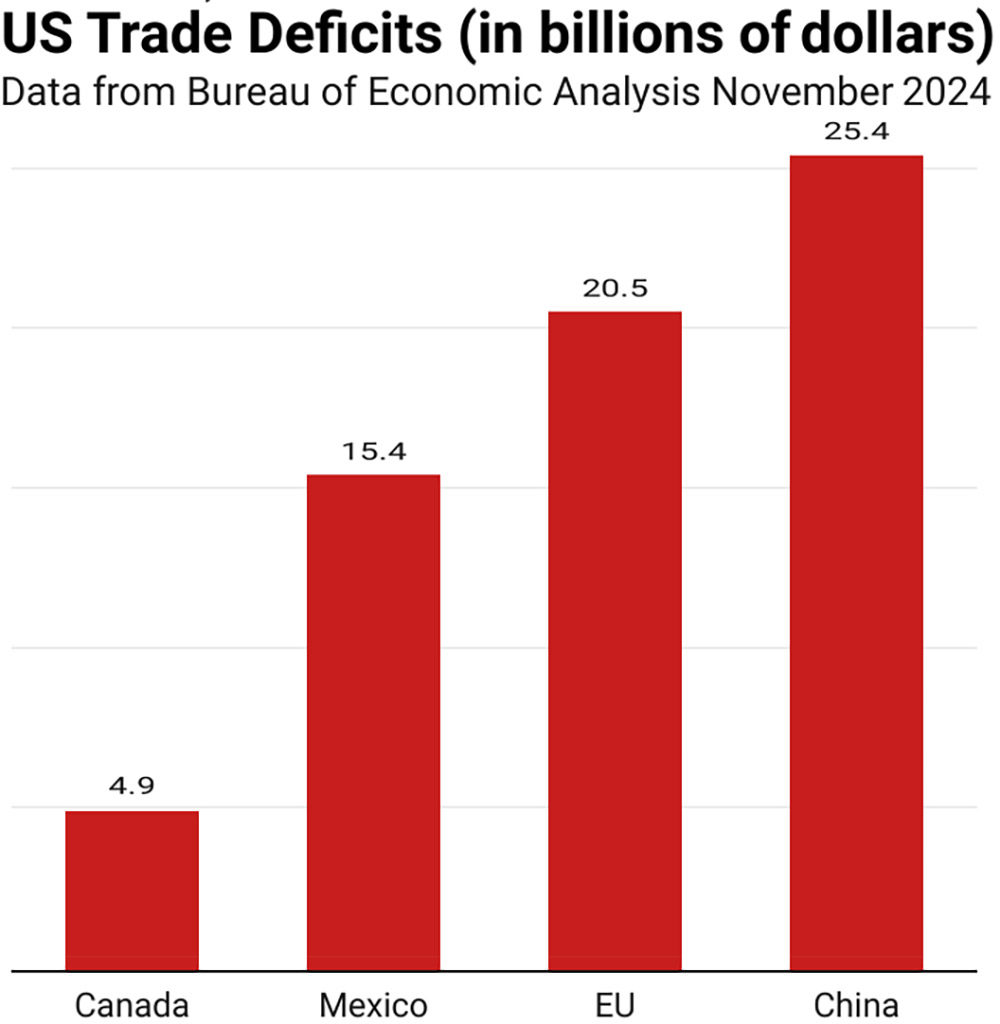

Tariffs are rising in prominence as a key variable and economic tool in the global macroeconomic conversation, creating a new era in global trade.

At the core of this conversation are ongoing trade dynamics between the US and China. China’s economic position continues to be driven by broad-based export growth and global dominance in manufacturing, spotlighting US competitiveness in key strategic sectors. China’s strength in advanced manufacturing and security-relevant sectors is a large focus for US officials, and US politicians maintain a cautious stance toward the country. Indeed, the tariffs laid out in the first Trump Administration were expanded during the Biden administration, reflecting the bipartisan appeal of this economic tool.

In recent months, the discussion of tariffs has extended to countries and regions such as EU, Mexico and Canada – the latter two of which are members of the US-Mexico-Canada Agreement (USMCA), a free trade agreement, and are the United States’ top two trading partners (followed, of course, by China).

Given that tariffs are already being deployed in the early days of the new US administration, keeping an eye out for directional signals can indicate which way tariffs are moving in the near-term and help economic developers, governments and businesses prepare.

To this end, this piece reviews some major US trade partners and signs that may signal reduced or increased tariff pressure for them.

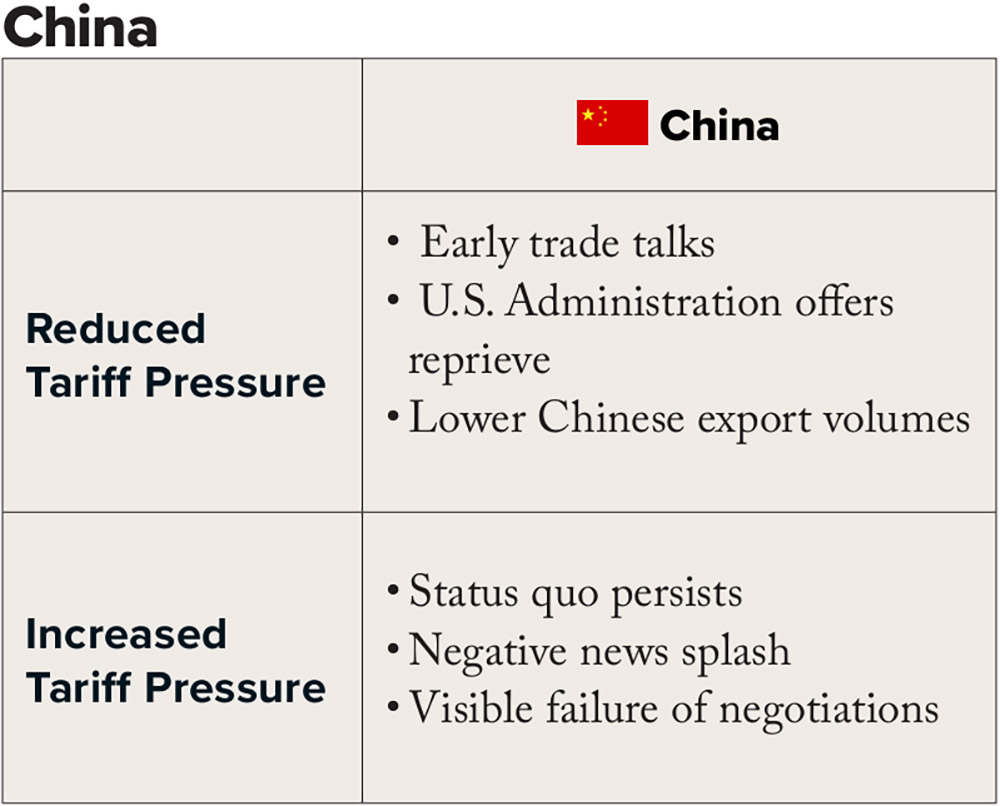

Signs of Increased US/China Tariff Pressure

Status quo persists

Tensions between the US and China are high and the new administration continues to focus much attention on economic competition between the two countries. The bilateral relationship eased a bit in 2024, due to internal dynamics in each country. Otherwise, the trend has otherwise persisted.If this status quo persists, both countries are under pressure to respond to the other, creating a likely scenario for tariffs and offering fewer opportunities for de-escalatory paths.

Weighted Media Attention

Relations between the US and China continues to be a leading discussion in the media. With the possibility of security, social or economic incidents hitting the front pages, as has occurred in the media over the past several years, tariffs and other policies would be a natural tool – among others – for a response.

For example, the spotting of a high-altitude balloon originating from China held wide attention in the US for an extended period, but also directly led to state-level laws across the US restricting or prohibiting the purchase of land by firms or citizens linked to China, as well as other investment restrictions.

Negotiation complications

Tariffs are generally not an end in and of themselves but serve a desired end goal and deal. In the instance of US-China tariffs, the stakes are higher than trade conflicts of the past. Wrapped up in their complexity are matters of not only economic, but also political, military and social importance.

The perceptions of tariff negotiations among the US and Chinese populations are a key component. Negotiations would be a tool of communication by one or both sides that the tariff threat is real and, perhaps, imminent. Odds for tariffs would rise in this scenario.

100%

Signs of Reduced US/China Tariff Pressure

Early trade talks

As its trade balance is heavily weighted towards exports rather than imports, it is likely that China would favor more trade and fewer tariffs. The reverse is the case for the US, whose trade balance is more heavily weighted towards imports. As such, this signal is most meaningful if initiated by the US.

Indications by the US that there is interest in talks opens a window for discussion. Should these talks continue with positive framing by both sides, then a lower/no tariff outcome could be more likely. But it would take Sustained, tangible progress would be necessary for the lower/no tariff outcome to extend into a longer-term scenario.

US administration offers reprieve

China has already taken more proactive measures towards potential tariffs than when they were initially introduced in 2018. These include economic measures (including tariffs of their own) and non-economic measures to bolster of their position, reducing the likelihood of China being the first to offer a trade-oriented reprieve. The US, then, may be in a better position to offer a tariff or trade reprieve.

By making a gesture of reprieve, the US offers goodwill to China in the hopes of reciprocal extractions. If that does take place, then a more collaborative dynamic could emerge, ranging from a postponement of possible tariffs to firmer agreements.

Lower Chinese export volumes

Underscoring its economic position, China’s trade of global exports continued to grow in the past few years, stimulating calls for economic responses domestically. However, should China’s export volumes decrease, it could provide less incentive for US tariffs on China.

This export decrease could come about from either Chinese government efforts or reduced demand from the market. China has long provided support to domestic industries, so if this stops or slows then it could be either a short-term or long-term solution, depending on the government’s appetite. Reduced market demand may well entail a global economic slowdown given the cost competitiveness of Chinese exports, a scenario that is longer-term in nature.

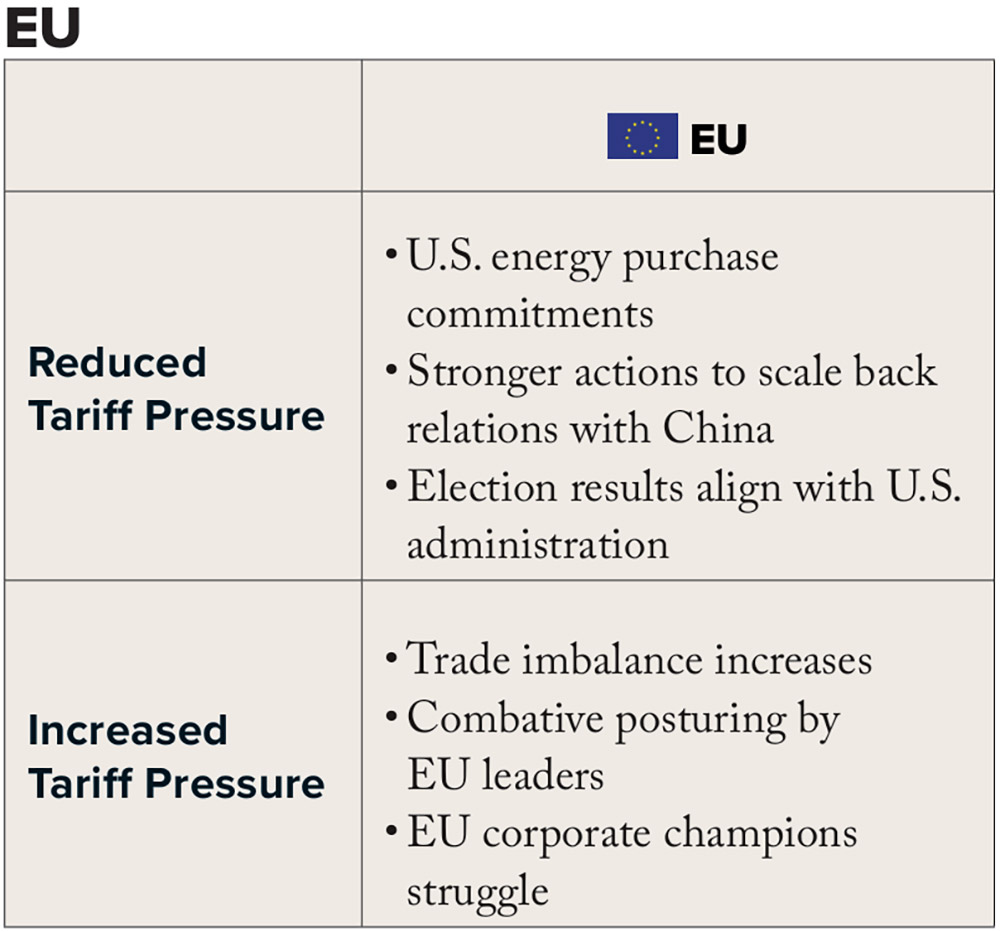

Signs of Increased US/EU Tariff Pressure

Trade imbalance increases

As mentioned, the US trade imbalance with the EU drives the discussion around tariffs and how best to manage the imbalance. EU exports are weighted heavily towards a few sectors, such as pharmaceuticals, machinery, chemicals and vehicles. These are not the low-cost items that China exports in more volumes, but high value-added products that play sensitive roles in US consumption and supply chains. That reason may have provided some tariff deterrent up to now.

Should trade dynamics increasingly favor of EU exports, though, there may be more support for tariffs. This dynamic could suggest that structural factors are driving the imbalance, prompting suggestions for structural tools – including tariffs – that can address them. One consideration here may be an effort to attract more FDI to the US, encouraging local manufacturing rather than exporting. Discussion of this facet on the heels of an increasing trade imbalance may heighten tariff likelihood.

Posturing by EU leaders

On the flipside of election results aligning with the US administration, EU leaders and governments could choose alternative postures towards the US. Local officials may see domestic political benefits to this posturing to encourage support. Looming elections possibly provide a more fertile environment for this approach.

Doubling down on a defensive political posture may incentivize the US to respond assertively, leading to an escalatory environment for both sides. There could be a pathway where firm responses lead to more considerate negotiations, so more a matter of posturing rather than implementation. However, this escalation comes with the risk of higher tariffs along with the opportunity of quicker resolution.

EU corporate champions struggle

The EU is home to iconic industrial champions, such as VW, Siemens and Telefonica, which bring both economic impact and social visibility. Dynamic changes in the global economy offer new opportunities and risks for these firms. There are good reasons for countries to support their globally leading companies; think of US support for the automotive industry after the Global Financial Crisis.

Should EU corporate champions have publicized challenges, local governments may be interested in protectionist measures to better protect them. These may include tariffs, but even if not, the political and economic moods could be less inclined to negotiate with the US for better tariff terms, instead seeking to prioritize national champions.

Signs of Reduced US/EU Tariff Pressure

US energy purchase commitments

The EU holds a significant positive trade balance with the US, which is a point of attention for the US administration. Addressing a trade imbalance is not a simple proposition since trade is made up of countless decisions made by businesses and consumers on either end. That said, the US administration has called out US energy exports as a top area of opportunity for increased EU purchases.

Scenario planning isn’t about predicting the future - it’s about ensuring resilience in an unpredictable world.

The US is the largest oil and gas producer in the world, so the scale needed to make an impact on the trade balance is there. The EU is already shifting its energy supply chain away from Russia, including higher purchases from the US. Announcing additional energy purchases by the EU would be a public show of its desire to collaborate with the US to head off or mitigate a possible tariff situation.

Stronger actions to scale back relations with China

In its attempt to establish stronger economic footing globally, the US has worked with partner countries to align on related policies. Notably, US restrictions on the sale of advanced semiconductors to China have been adopted by other countries such as the Netherlands and Japan.

Should the new US administration continue to prioritize this global positioning, it would likely welcome similar acts by other countries. As one example, the EU is currently more open to Chinese electric vehicles than the US. Changing this, or other policies, in favor of a more restrictive stance toward imports from China would be a signal of support for US positions, possibly as an attempt to avoid tariffs.

Election results align with US administration

The EU is set to hold several major elections this year. Germany, Poland, Romania and others are holding national elections, setting the tone for near-term policy in those countries. This includes the prospect of wins by political parties and candidates whose views more closely align with the US administration. Indeed, some politicians in Europe are selling themselves as more effective interlocutors with the US administration due to shared goals.

This political alignment could lead to more constructive negotiations around new tariffs, including outcomes where they are reduced or avoided. Moving closer to the US on any range of issues – China, security, technology, corporate taxation, etc. – could preclude the reasons for implementing tariffs in the first place.

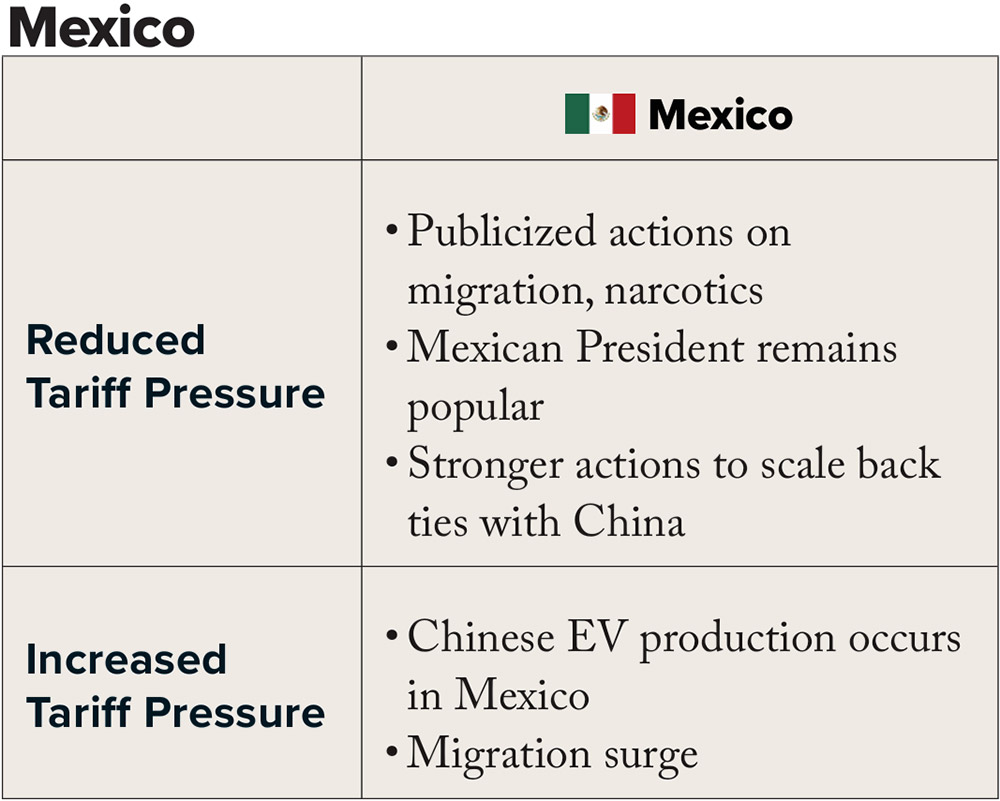

Signs of Increased US/Mexico Tariff Pressure

Chinese EV production occurs in Mexico

A Mexican manufacturing plant for Chinese automaker BYD has been floated, with US responses suggesting that this could affect the entire US automotive industry. With a low cost and competitive quality of Chinese EVs compared to US counterparts, BYD’s entry into the US via Mexico may destabilize long-time US electric automakers. With US tariffs on Chinese EVs already at 100%, the intent to shift vehicle manufacturing to North America is clear.

Should the BYD plant, or other Chinese EV manufacturing facility, come to fruition, there may be less willingness to accede on other US interests and increase the odds of tariffs as a result. It is worth noting that an opposite decision, to more visibly reduce or eliminate the possibility of Chinese EV manufacturing in Mexico, would reduce tariff tensions and fall under the “scaling back ties to China” category.

Migration surge

Migration into the US via the border with Mexico is, as noted, an issue tied to potential tariffs. In 2024, efforts by Mexican authorities to limit the ability of migrants to reach the US border lowered the number of apprehensions tallied by the US Border Patrol. This suggests that the ability to control migration is partly administrative, although patterns could shift if the numbers change.

A surge in migrants may come down to two explanations. Either the Mexican government chooses to have more migrating people reach the US border, or Mexico becomes less able to control the flow, likely due to an increase in numbers. Given that Mexico has taken actions already on the former, the latter may be more possible. Rising political and climate issues in the Western Hemisphere (political repression in Venezuela, erratic growing conditions in Central America, etc.) are motivating factors for people to immigrate to the US, and a spike in migration would heighten tensions in the tariff negotiating context.

Security concerns escalate

There are issues on both sides of the border regarding the security situation. For Mexico, these can be around US demand for narcotics and a flow of firearms from US sources to drug cartels. For the US, there are concerns around violence stemming from the drug trade.

These are not new issues, but their persistence despite mitigating efforts over the years can increase tensions and prompt the use of escalatory measures, such as tariffs. The possibility of using US military force, for example, could create a backlash in Mexico, leading the country to consider tariffs or other economic tools to change US policy. Since security is a core function of any government, a deterioration on this angle may incentivize strong responses.

Signs of Reduced US/Mexico Tariff Pressure

Publicized actions on migration, narcotics

The US administration’s focus on migration and the illegal narcotics trade continue to be relevant in in tariff discussions. It is not a new topic, and potential tariffs were averted in both 2019 and already in 2025 after the Mexican government announced actions to boost security personnel on their borders.

Border actions may re-emerge as a negotiating point for potential tariffs, which has already proved productive for both sides. Previous instances had the Mexican government publicly announcing about these activities, clearly communicating their actions and intent. Any new public statements by Mexico to address US concerns on the border or narcotics issues would also likely be intended as signals to avoid tariff issues.

Mexican president remains popular

The current Mexican President, Claudia Sheinbaum, won her election in late 2024 with the highest margin since 1982, and she retains over 70% support in recent polls. This comes on the heels of her predecessor, Andrés Manuel López Obrador (or AMLO), who hailed from the same political party and enjoyed similar popularity.

Possessing this level of popularity provides buffer room for more difficult and possibly unpopular decisions. These may include mirrored tariff actions, agreeing to terms sought by the US over the course of tariff negotiations, which could weaken a less popular official with claims of relenting to foreign pressure or similar arguments.

Stronger actions to scale back ties with China

China’s investment in Mexico has risen in recent years, leading to claims that Chinese firms are violating the spirit of the USMCA to avoid tariffs, potentially running counter to the intended purpose of the agreement.

Should Mexico take visible actions to reduce ties with China, there may be less fuel for a tariff argument. Mexico could institute its own tariffs on Chinese goods, restricting the kinds of investment open to China, or publicly cancel more salient projects. At the very least, tariffs on Chinese goods would likely reflect a willingness by the Mexican government to take steps to ease US concerns and potential tariffs.

Early review of the USMCA

It is not lost on Mexico or the US (or Canada, for that matter) that the USMCA is up for review and renewal in 2026. Tariffs among these countries come into conflict with the agreement, setting the stage for a competitive renegotiation process.

To that end, one possible pathway may be an early renegotiation, even as soon as 2025. An earlier revision to the USMCA would signal a willingness to compromise by Mexico, as well as Canada, potentially bypassing tariffs as a negotiating tactic. Moving up the date would address trade uncertainty sooner rather than later, so it could be an attractive option.

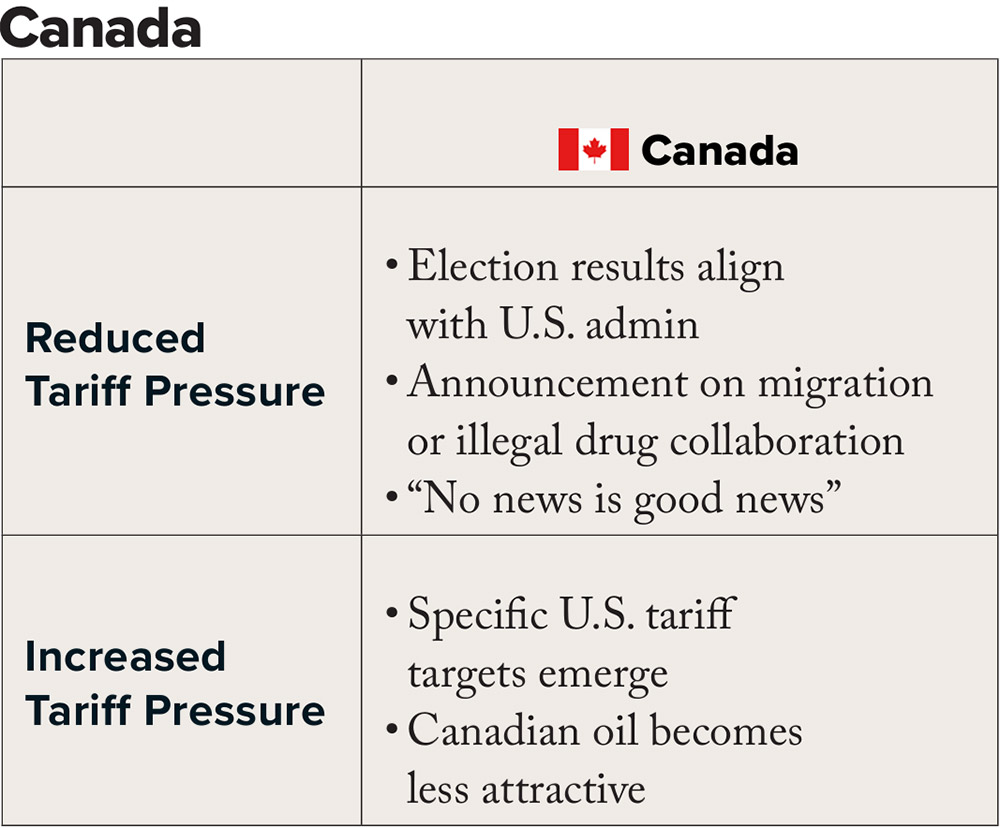

Signs of Increased US/Canada Tariff Pressure

Specific US tariff targets emerge

Because the US and Canada conduct such a high volume of bilateral trade, a flat tariff would affect many sectors on both sides. The US Trade Representative reported over $900 billion in cross-border trade in 2022. Intermediate goods can cross the border several times before final assembly, compounding the tariff impact each time. All of this can disincentivize flat tariffs and reduce their utility.

What could be more plausible are targeted tariffs, such as the steel and aluminum sectors that have already been announced. Specific sectors for tariff application may be selected by the US administration for having fewer side effects for US industry. They could otherwise have a symbolic, but less material, impact. As such, a declaration of targeted tariffs on Canada, rather than a flat tariff rate, could have more credibility and chance for implementation.

Canadian oil becomes less attractive

Canadian oil imports are a critical piece of the current energy mix in the US. The Congressional Research Service notes that Canada provided nearly 60% of all US crude oil imports in 2023. The specific kind of crude oil sent from Canada requires a particular refining process (as well as pipelines to transport it), but the US has that infrastructure set up. Changing this arrangement would be costly, given the pieces that are already in place to change it.

However, the dynamic nature of energy markets over time could shift the underlying fundamentals. More US oil could emerge, renewable energy sources could continue to gain market adoption, and new import sources may become more attractive. Guyana, for example, is only beginning to tap the 11 billion barrels discovered there. If Canadian oil becomes less attractive for US buyers, which would be a medium- to long-term proposition, then the US would have less of a pain point deterring it from using tariffs.

Signs of Reduced US/Canada Tariff Pressure

Election results align with US administration

The current Canadian administration has taken a robust response to tariff announcements so far. The current Prime Minister stated in response to proposed US tariffs that, “We didn't ask for this but we will not back down.” What could change this posture is that Canada is headed for a federal election this year.

As with Mexico and the EU, election results in Canada may change leadership in the federal government to the Conservative party that is more aligned with the US administration. Indeed, Canadian polls have indicated this as a likely outcome for several months now. Pushback in Canada to tariff announcements came from across the political spectrum, though, so this result would not be a cure-all. Stephen Harper, former prime minister of Canada and leader of the country’s Conservative Party, stated recently that if he were still in office he would “accept any level of damage” to preserve Canadian independence.

Commitments on border, drug and military collaboration

The US border with Mexico has taken up more airtime as a political issue, but, famously, the border with Canada is the longest one in the world. Reported numbers of migrants and drug seizures on the US-Canada border are relatively low, but the broader context of heightened security tensions persists.

With that in mind, Canadian announcements of new border and narcotics control efforts may improve the rhetorical environment and reduce chances for tariffs, which would address a top concern for US officials, provide action and offer a near-term offramp for tariff tensions. So, too, are recent Canadian federal commitments to increasing overall military spending and more ambitiously address North American joint security objectives. Such announcements are an open signal by the Canadian government to work proactively on US concerns and deescalate the use of tariffs as negotiating leverage.

“No news is good news”

Canada and the US have long shared a close and critical relationship, being among the top trading partners for each other and having aligned on strategic concerns for many years. Relatively smooth ties mean fewer dynamic headlines about bilateral ties, contributing to a context of steady collaboration.

To that end, simply avoiding being part of headlines associated with tariffs could extend this collaborative dynamic. Tariff discussions shifting focus away from Canada and towards with other countries could signal a reduced desire for a US-Canada dispute and a lower likelihood of tariff implementation.

Wrap-Up

How can economic developers, governments and businesses respond in this environment? As President Eisenhower famously put it, “plans are useless, but planning is indispensable.”

Scenario planning is one critical tool that can be used for a key set of pathways, ranging from high likelihood/low impact to low likelihood/high impact. The past several years show that the only certainty is uncertainty, but even going through the thought exercise of what that can look like will build more flexibility and resilience.

Communities can also prepare themselves now by both mitigating potential risks and positioning for new opportunities. The recent experience of inflation is instructive in showing what sectors may be vulnerable should it return – one possible consequence of higher tariffs. Export-reliant industries will be on the front lines, as well, and may need collaboration with local partners to ride out market turbulence and reorient towards new markets. Advocating for beneficial trade relationships at the state and federal levels also offers the chance for leaders to show where economic value is real and growing.

Close coordination and communication between economic developers and their local industries will help prepare everyone for what might come next. All players in the economic development ecosystem will benefit from understanding strengths, weaknesses and opportunities. Even arranging scenario planning events can reveal ways that partners can work better together.

Many possible scenarios may emerge in the coming months and years, including a combination of some of the ones mentioned here. Also critical will be the timeline of any tariffs; will they arrive immediately, over several months, or take a few years to roll out?

Regardless of how the tariff situation evolves, the most effective responses will rest on some of the greatest strengths the US possesses: innovative ecosystems, workforce development, and cost-effective power generation.