Industrial Sector Is Firming

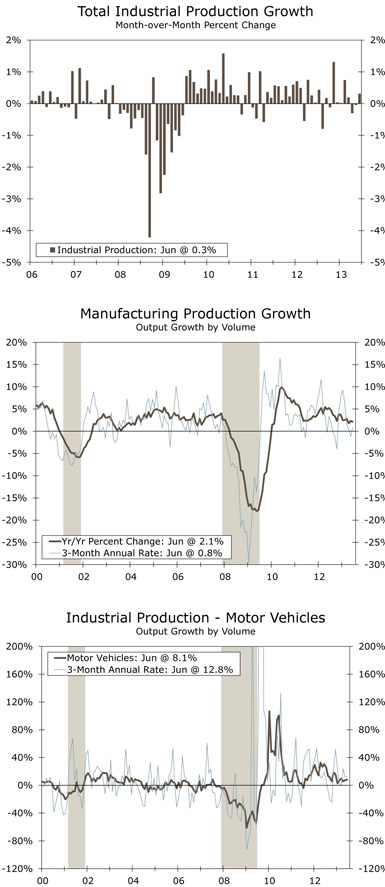

Coming off a flat reading in May, industrial production rose 0.3 percent in June. The gain was in line with market expectations and, while modest, marked the best print for the sector since February. Encouragingly, output in the manufacturing sector strengthened. Recent weakness in the manufacturing sector, which accounts for about three-quarters of industrial output, had been weighing heavily on total output. Production in the manufacturing sector rose 0.3 percent over the month, while May’s print was revised up a tenth. The auto sector continues to stand out. With sales to dealers having increased to their best pace since before the recession, it was not surprising to see the solid 1.3 percent increase in motor vehicles production in June.

The manufacturing sector also looks to be benefiting from a more optimistic consumer. After having fallen the previous two months, production for finished consumer goods rose 0.5 percent in June. While autos pushed up production of consumer durables, nondurables output rebounded a bit from negative readings in the prior two months as well. Business investment is also looking firmer, with business equipment up 0.5 percent and business supplies ticking up in June.

Utilities output fell for the third consecutive month, with May production revised lower to a drop of 2.8 percent. June utilities output fell much more moderately, 0.1 percent, as a drop in natural gas production outweighed a 0.1 percent increase in electricity output. After having fallen in the first quarter, mining production continued its second quarter advance in June and finished the quarter at a 4.9 percent annualized rate.

Industrial Production Set to Improve a Bit in Coming Months

We expect to see industrial production pick up a bit over the coming months. Utilities look likely to flatter next month’s production numbers as temperatures have heated up across much of the country. In addition, today’s print on manufacturing output supports our view that activity in the factory sector is firming. Purchasing managers’ indexes (PMIs) for June generally improved, although many still hover near their breakeven marks.

The Empire State Manufacturing Index, the first of the July PMIs, suggests factory activity may perk up further in July. The headline rose only 1.6 points, but underlying details were stronger with notable improvement in shipments and new orders. That said, a substantial pickup in activity that will contribute to GDP in a meaningful way remains elusive. Global growth is still relatively weak, with conditions no longer worsening in Europe but flagging in China. Moreover, GDP growth of around 2 percent will likely keep many businesses relatively cautious with their investments. We look for industrial production to quicken to around a 3 percent annual pace in the third quarter.