Responding Consultants’ Profile

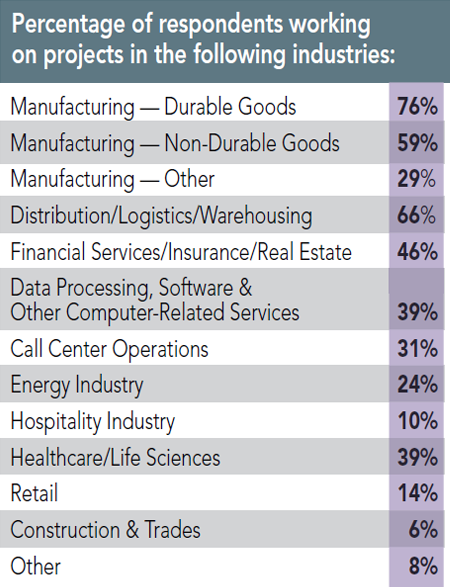

Three quarters of the responding consultants work with durable goods manufacturers, and nearly 60 percent with nondurable goods manufacturers. Two thirds are helping to site distribution/warehouse facilities, and nearly 40 percent are working on projects in the data processing/computer-related services and healthcare/life sciences sectors.

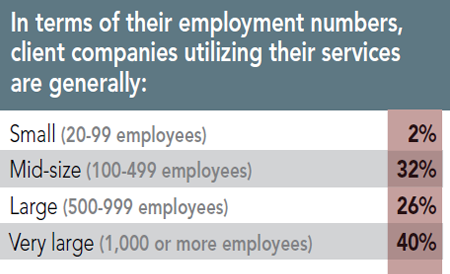

Additionally, the majority of their clients are very large in terms of employment numbers (1,000+), say 40 percent of the responding consultants. This stands in contrast to the respondents to our Corporate Survey wherein 79 percent of the respondents are with firms employing fewer than 1,000 people.

12th Annual Consultants Survey Results

-

Chart A

-

Chart B

-

Chart C

-

Chart D

-

Chart E

-

Chart F

-

Chart G

-

Chart H

-

Chart I

-

Chart J

-

Chart K

-

Chart L

-

Chart M

-

FChart N

-

Chart O

-

Chart P

-

Chart Q

-

Chart R

-

Chart S

-

Chart T

-

Chart U

-

Chart V

-

Chart W

-

Chart X

-

Chart Y

-

Chart Z

-

Chart AA

-

Chart BB

-

Chart CC

-

Chart DD

-

Chart EE

-

Chart FF

-

Chart GG

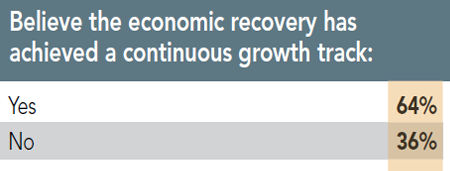

Finally, nearly two thirds of the responding consultants believe the economic recovery has achieved a continuous growth track. These consultants are more optimistic than the Corporate Survey respondents — only 48 percent of them hold that opinion. Needless to say, that is probably because the consultants are primarily working with companies that are in a growth mode.

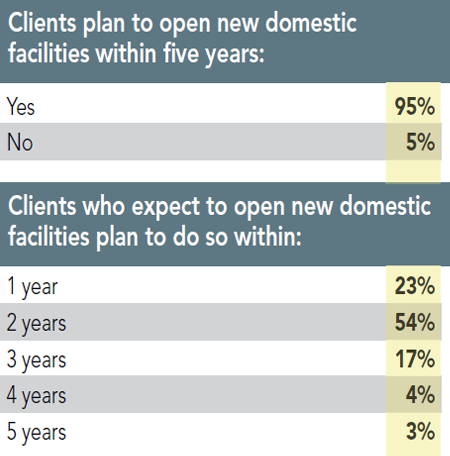

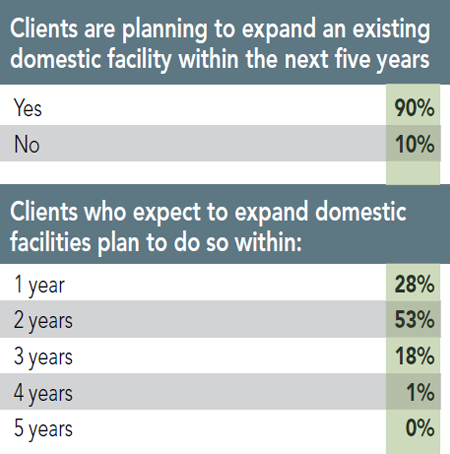

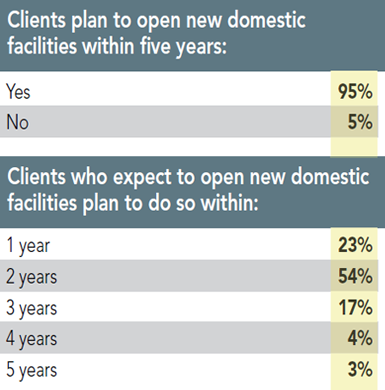

Clients’ New Facilities Plans

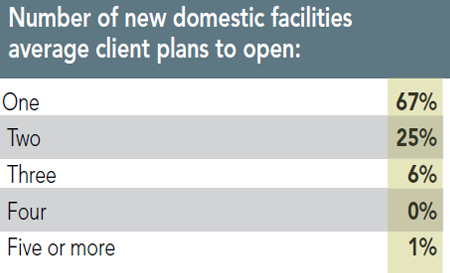

This reasoning is borne out by the fact that 95 percent of the responding consultants say their clients plan to open new domestic facilities within five years (only half of the Corporate Survey respondents have new facilities plans), with three quarters of the consultants saying those clients plan to do so within two years. Two thirds of the respondents say their clients will open just one new domestic facility, while a quarter say they will open two.

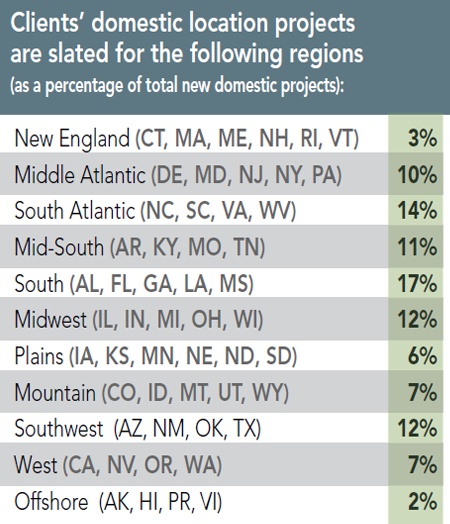

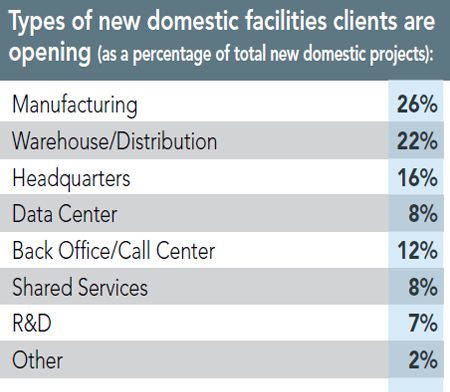

A quarter of these new facilities will be manufacturing plants, say the respondents, with about a fifth housing warehouse/distribution operations, 16 percent being new headquarters operations, and 12 percent back office/call centers. These last two facilities uses are not as heavily represented in the Corporate Survey responses.

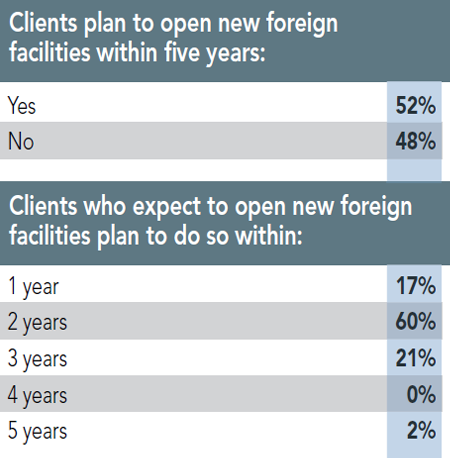

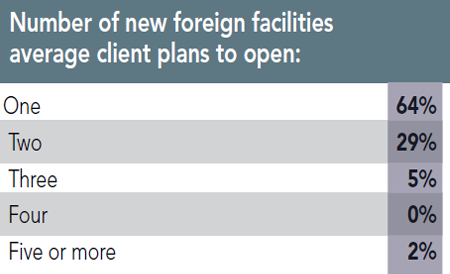

More than half of the respondents to our 12th Annual Consultants Survey also say their clients expect to open new foreign facilities within the next five years — only 25 percent of the Corporate Survey respondents say they have such plans. Three quarters of the consultants’ clients plan to open these foreign facilities within two years, with more than 90 percent having plans for one or two foreign facilities.

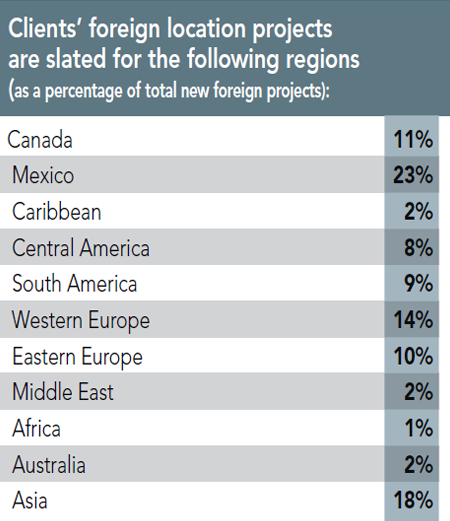

Nearly a quarter of these foreign facilities projects are slated for Mexico, 18 percent for Asia, 14 percent for Western Europe, and 11 percent for Canada. Notably, none of the respondents to our Corporate Survey report plans for new facilities in Canada.

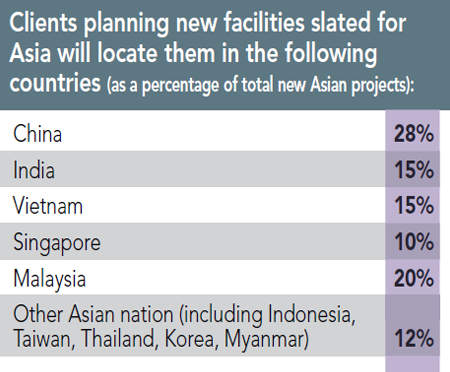

China will receive 28 percent of the consultants’ clients’ projects in Asia, but a fifth are also going to Malaysia, and 15 percent each to India and Vietnam. In contrast, the respondents to our 30th Annual Corporate Survey who have plans for Asian facilities say 71 percent of them will be in China.

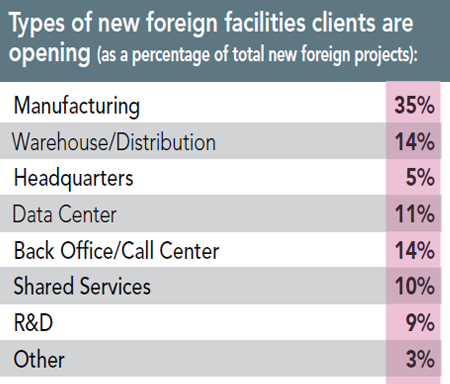

The types of foreign facilities the responding consultants’ clients are opening range from manufacturing facilities (35 percent) to warehouse/distribution and back office/call centers (each 14 percent) to shared services operations (10 percent). Only 5 percent of the Corporate Survey respondents’ new foreign facilities will house back office/call center as well as shared services operations.

Clients’ Relocation and Expansion Plans

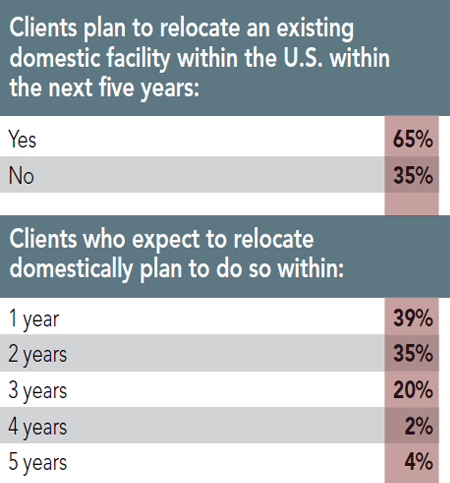

When it comes to their clients’ relocation plans, 65 percent of those responding to our Consultants Survey say their clients plan to relocate an existing domestic facility within the U.S. within the next five years.

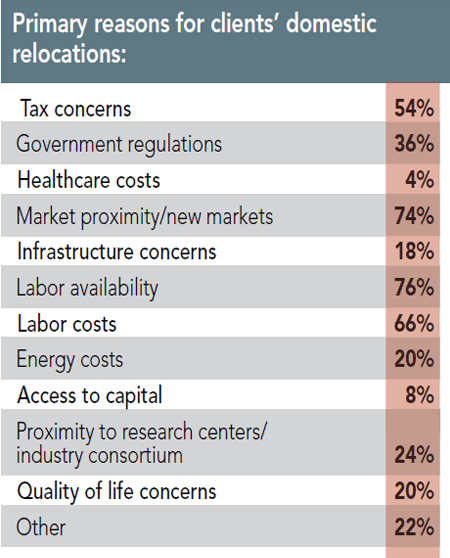

Of those consultants’ clients who plan to relocate domestically, three quarters of the respondents claim they will do so within a year or two. Three quarters of the respondents also say the primary reasons their clients are moving are market proximity/new markets and labor availability. Two thirds also cite labor costs, and half cite tax concerns among the reasons for these domestic relocations.

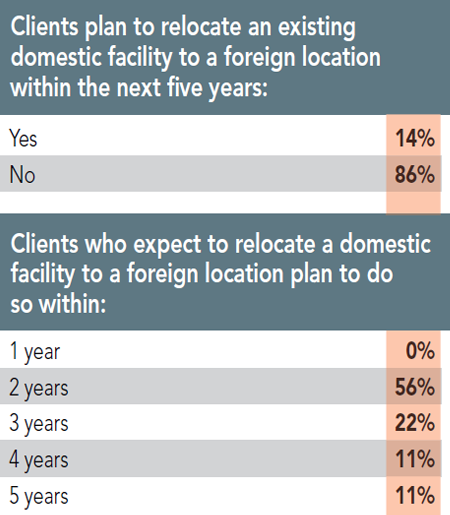

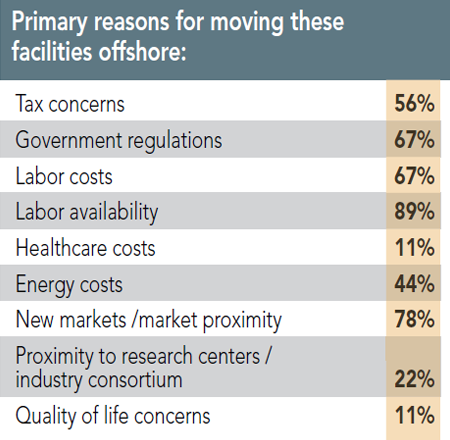

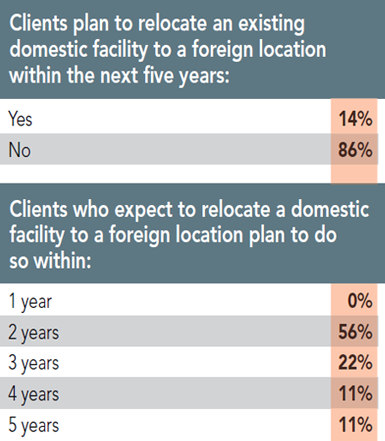

Of those clients that are planning to move a domestic facility offshore, half the responding consultants claim the moves are planned two years out. Nearly 90 percent cite labor availability as the reason for their clients going offshore; more than three quarters again cite market proximity/new markets; and two thirds say government regulations along with labor costs are prompting their clients to consider foreign locations.

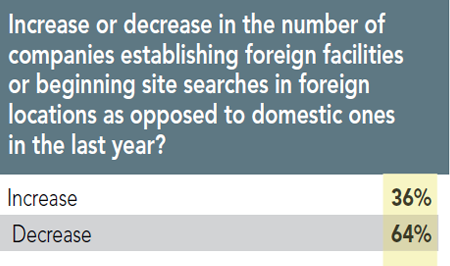

Similarly, two thirds of the respondents say their clients have not relocated a foreign facility back to the U.S. (reshored) in the past year, nor are they planning to do so. (Notably, 90 percent of our Corporate Survey respondents say they do not expect to reshore a facility.) Of those consultants’ clients that have reshored, three quarters of the consultants say their clients have done so because of product quality issues, and nearly 70 percent say transportation/supply chain costs are to blame for their clients’ reshoring moves.

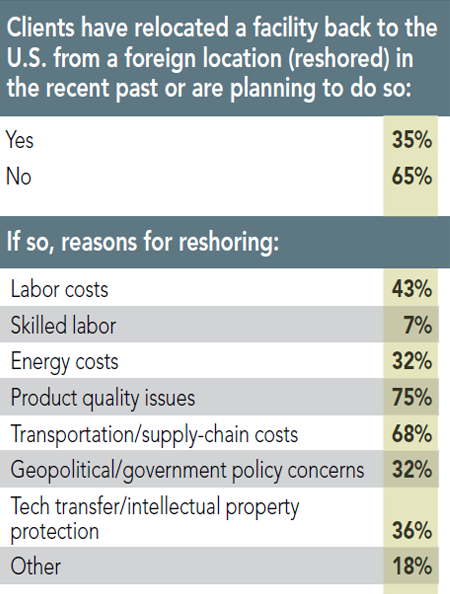

Nearly all of the respondents (90 percent) to our 12th Annual Consultants Survey say their clients are planning to expand an existing domestic facility within the next five years, with more than 80 percent expecting to do so within two years.

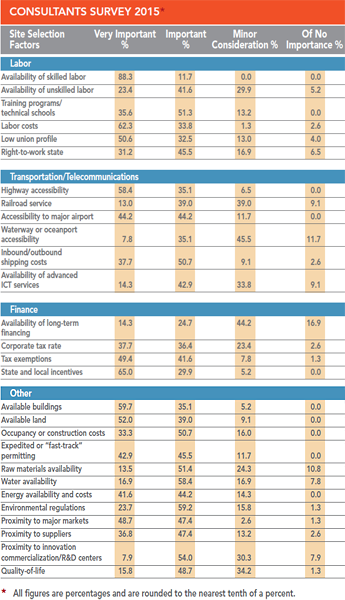

Next: Clients’ Site Selection Priorities