It’s enlightening to not only examine their views on site selection priorities and challenges, but also compare them to the views of corporate executives, outlined in the companion article spotlighting the Area Development Corporate Survey. Only some corporate execs have location or expansion plans this year, but twice as many don’t. And of those who do, some corporate execs work with consultants, some don’t. Suffice it to say they’re often on the same page, but not always.

A Profile of the Respondents

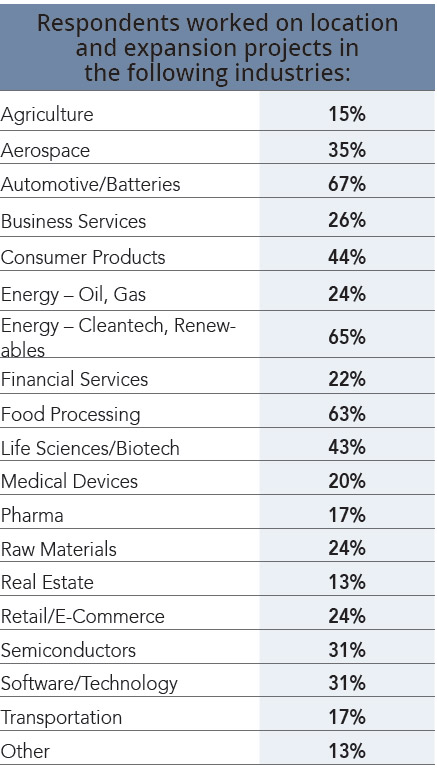

Before we open the envelope and read the results, it’s worth learning about the consultants who shared their insights as well as the industries they’re active in helping. Two-thirds have worked on location and expansion projects in the automotive and battery sector, and about that many have had projects in clean and renewable energy. Nearly as many have clients in food processing. A little under half have been active in projects involving life sciences or biotech, and a similar share in consumer products.

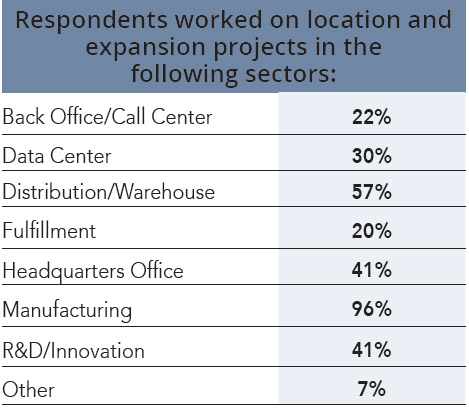

Nearly all of the responding consultants have been working on manufacturing location or expansion projects, nearly three-fifths on distribution and warehouse deals, and two-fifths on R&D facilities. A similar number have worked on headquarters deals.

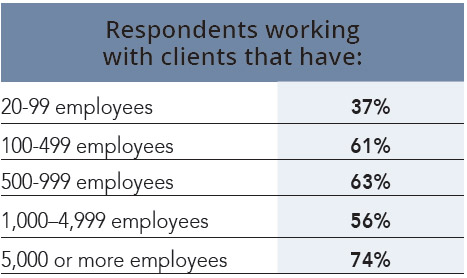

They’ve worked with clients of all sizes. Three-quarters have represented clients with 5,000 or more employees, three-fifths have clients employing between a hundred and 499 employees, about that many have clients with 500 to 999 on the payroll, and a little over half represent clients with employee counts between a thousand and 4,999.

20th Annual Consultants Survey

-

Chart 1

-

Chart 2

-

Chart 3

-

Chart 4

-

Chart 5

-

Chart 6

-

Chart 7

-

Chart 8

-

Chart 9

-

Chart 10

-

Chart 11

-

Chart 12

-

Chart 13

It goes without saying that pretty much all of the consultants surveyed have some plans on the drawing board for expansions and/or new facilities for their clients. It is, after all, why clients call them. But what kinds of plans are they making, and what things are influencing those plans?

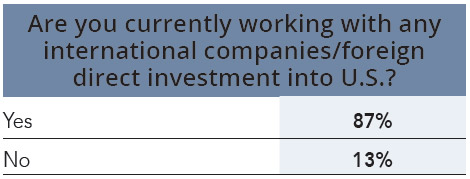

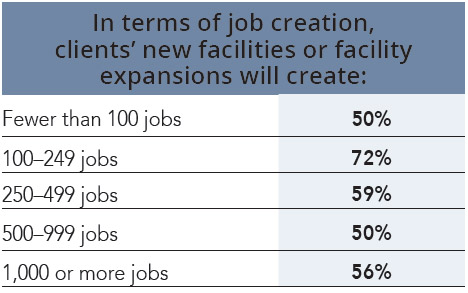

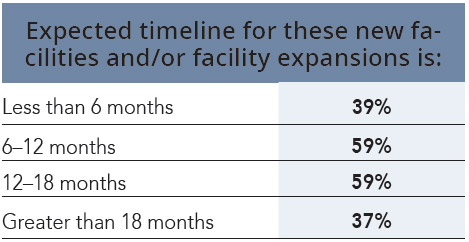

Of the consultants responding, more than half are working on projects worth at least a thousand new jobs. Half are helping facilitate initiatives that’ll create at least 500 jobs, while three-fifths have a hand in new deals that’ll deliver between 250 and 499 jobs. The majority are in on projects that’ll take shape in the next six to 18 months, and two-fifths have projects with timelines even faster than that. And most of these consultants are working on some projects involving international companies or foreign direct investment.

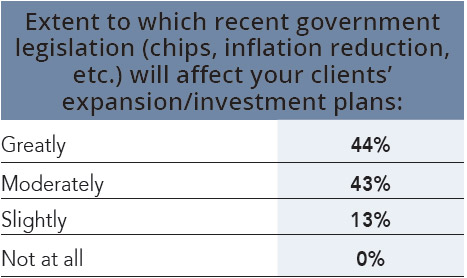

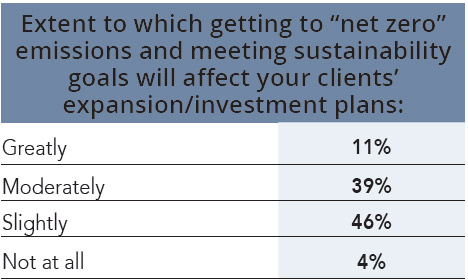

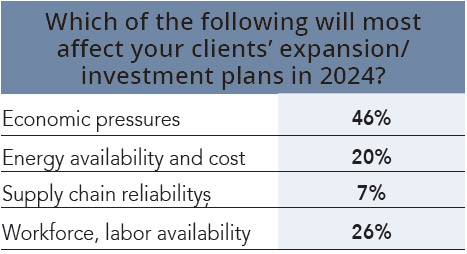

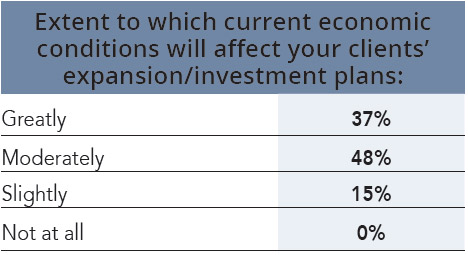

Of the consultants responding, more than half are working on projects worth at least a thousand new jobs. Nearly 90 percent of the consultants responding say they have client projects that are either greatly or moderately affected by recent government legislation, such as the CHIPS and Science Act or the Inflation Reduction Act. The vast majority report plans that are greatly or moderately impacted by current economic conditions, and nearly half say economic pressures carry the biggest potential impact. Half of the consultants say clients will be either greatly or moderately impacted by the need to meet sustainability goals and even achieve “net zero” emissions.

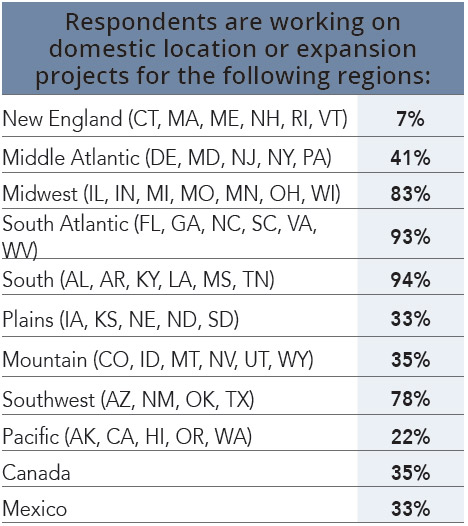

As for where in the country they’re looking, nearly all consultants are working on projects in the South and South Atlantic states, four-fifths list projects in the Midwest, and more than three quarters also have locations or expansions going on in the Southwest. Two-fifths are dealing in the Middle Atlantic region. About a third have projects in Mountain states, about a third in Plains states, and the same can be said for both Canadian and Mexican locations.

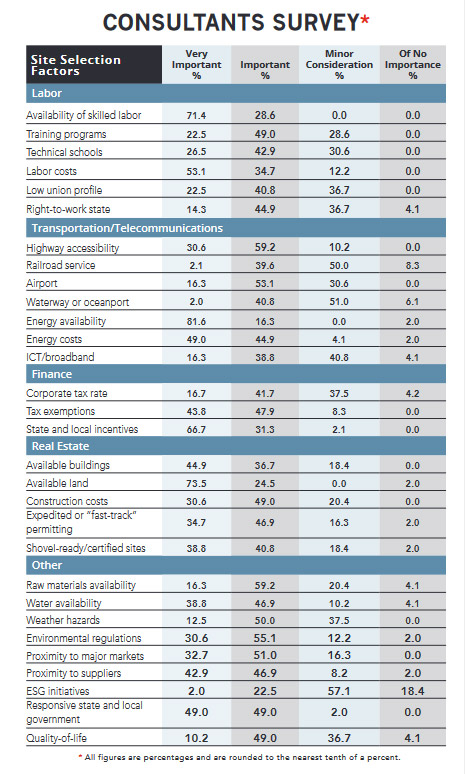

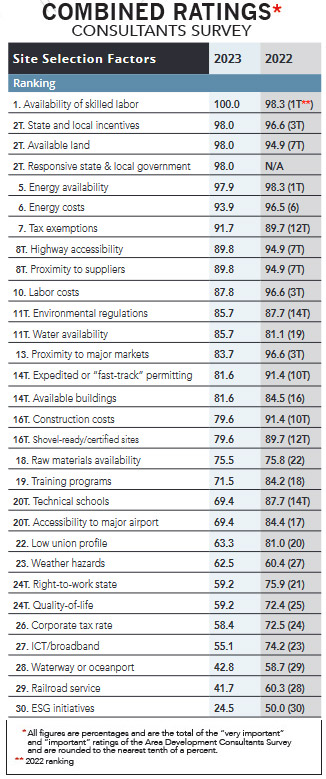

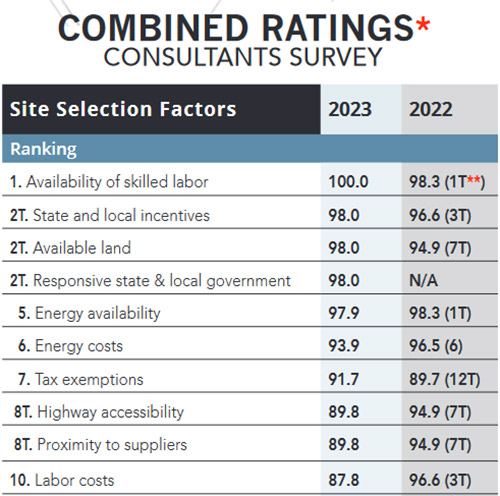

The top 10 site selection factors on the minds of consultants for 2024 are largely similar to what had their attention a year ago. Like the corporate executives surveyed, labor concerns top their list, with a bit of a twist. Practically everyone agrees that availability of skilled labor is “very important” or “important” this year, though consultants’ collective rating of labor costs as an issue slides from a third-place tie in the previous survey to 10th place in the current one. Both labor cost and availability are highest on the corporate executives’ list.

Many of the other top factors on the minds of consultants are matters closely tied to getting good deals done. They’re paying close attention to state and local incentives, as well as available land and energy availability and costs, which were all top 10 factors last time around, too. No surprise that they are quite attuned to how responsive state and local governments are, given that they deal with those folks daily. It’s not that these nuts-and-bolts considerations are unimportant to those responding to the Corporate Survey, but these factors tend to be slightly further down the executives’ list.

Half of the consultants say clients will be either greatly or moderately impacted by the need to meet sustainability goals and even achieve “net zero” emissions. As for the old adage about “location, location, location,” which some say was first uttered about a century ago, consultants are still paying pretty close attention. Proximity to suppliers and major markets rate fairly high on their list (eighth and 13th, respectively, both a fair amount higher than they are on the corporate executive ranking). Both consultants and executives list highway accessibility as a major factor, though.

The Consultants Survey shows an 11th-place tie for interest in environmental regulations and water availability. That’s a slightly higher ranking for environmental concerns than a year earlier, but a more marked jump for water availability. By comparison, environmental regulations are quite highly ranked in the Corporate Survey, but water is far down the list for the executives.

While labor availability and costs are key concerns for consultants and executives alike, both surveys assign somewhat less (but still noteworthy) significance to technical schools and training programs. These factors matter a fair amount to roughly 70 percent of consultants and a little over 60 percent of executives.