Following the presidential election, Moody’s forecasted the U.S. economy to expand 2.2 percent in 2017 — up from about 1.6 percent in 2016 — driven by healthy job and wage growth. Of course, this projection depends a lot on policies implemented under our new President Trump. “… there could be an upside to growth in the short term from increased fiscal expenditure, tax cuts, or higher infrastructure spending,” noted Madhavi Bokil, a vice president and senior analyst at Moody’s. However, Bokil warns, “A restrictive stance on trade would be detrimental in the medium term.”

Nonetheless, in early 2017, Cushman & Wakefield’s economists also noted the U.S. economy is positioned to perform well in 2017, with upwardly revised growth of 2.3 percent in 2017 and 3.0 percent in 2018.

“Even before the election, the U .S. economic fundamentals were showing signs of heating up,” said Kevin Thorpe, Cushman & Wakefield’s global chief economist. “Now when you layer in the expected tax cuts and spending multipliers from the new administration, it creates an even stronger economic backdrop for the property markets heading into 2017.”

Although it will take some time for the new administration’s policies to form and be implemented, it seems economists are looking on the bright side. The manufacturing executives surveyed by PricewaterhouseCoopers for its Q4/2016 Manufacturing Barometer also displayed increased optimism, with three quarters saying the U.S. economy is growing, 85 percent expecting positive revenue growth this year, and 60 percent planning to increase capital spending.

A detailed look at the responses to our annual Corporate Survey will let us know if our readers are as optimistic as the economic analysts and those responding to PwC’s survey of industrial manufacturers and, importantly, whether that sentiment is reflected by their plans to open and/or expand facilities at home and abroad.

31st Annual Corporate Survey Results

-

Figure 1

-

Figure 2

-

Figure 3

-

Figure 4

-

Figure 5

-

Figure 6

-

Figure 7

-

Figure 8

-

Figure 9

-

Figure 10

-

Figure 11

-

Figure 12

-

Figure 13

-

Figure 14

-

Figure 15

-

Figure 16

-

Figure 17

-

Figure 18

-

Figure 19

-

Figure 20

-

Figure 21

-

Figure 22

-

Figure 23

-

Figure 24

-

Figure 25

-

Figure 26

-

Figure 27

-

Figure 28

-

Figure 29

-

Figure 30

-

Figure 31

-

Figure 32

-

Figure 33

-

Figure 34

-

Figure 35

-

Figure 36

-

Figure 37

-

Figure 38

-

Corporate Location Decision Process

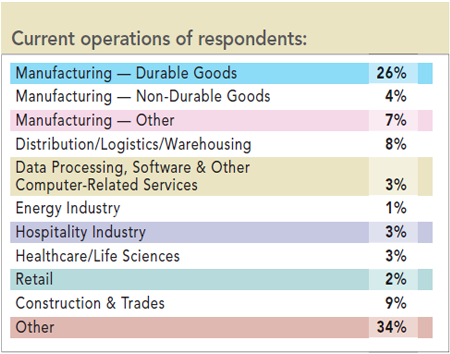

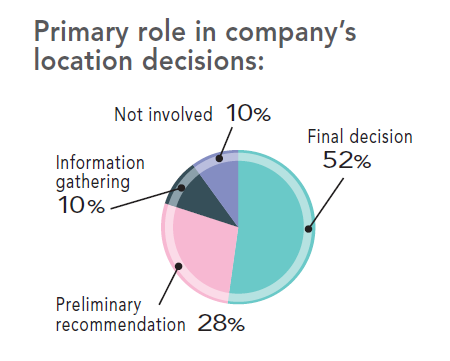

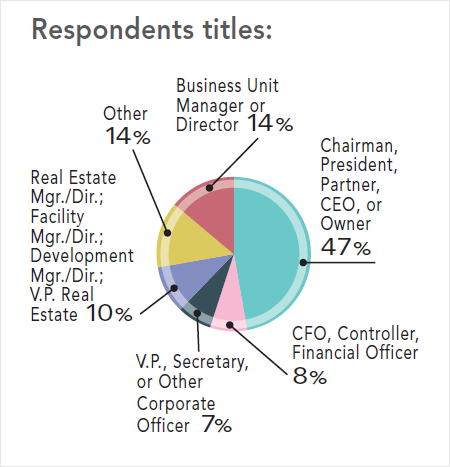

Of the 136 respondents to our 31st annual Corporate Survey, 37 percent are with manufacturing firms, 9 percent in the construction and trades industries, and 8 percent with distribution/warehousing operations. More than half are their companies’ CEO, president, CFO, or other top-ranking executive, and more than half are involved in their companies’ final location decision.

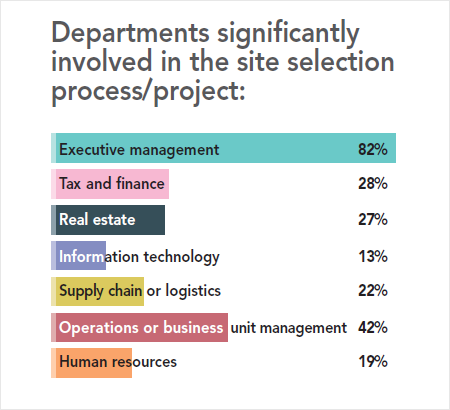

While 82 percent of the survey respondents say executive management is involved in the site selection process, 42 percent also say operations and business unit management play a large role, and nearly 30 percent cite the importance of the tax and finance as well as real estate departments to the location process.

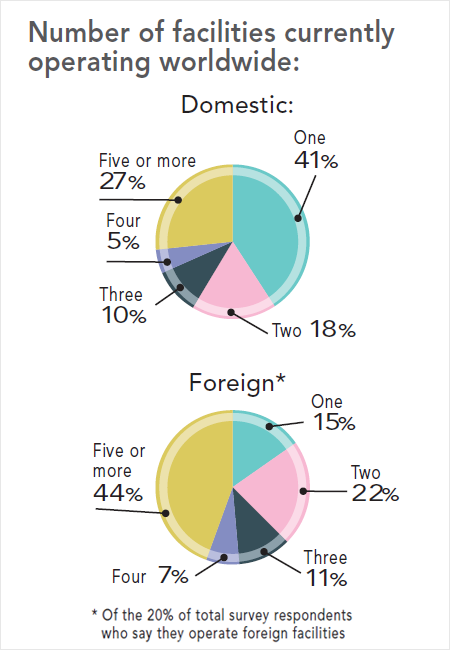

Approximately 40 percent of our Corporate Survey respondents claim to operate just one domestic facility, while nearly a third operate four or more. While just 20 percent of the respondents say they operate foreign facilities, more than 40 percent of those individuals say their firms operate five or more foreign facilities.

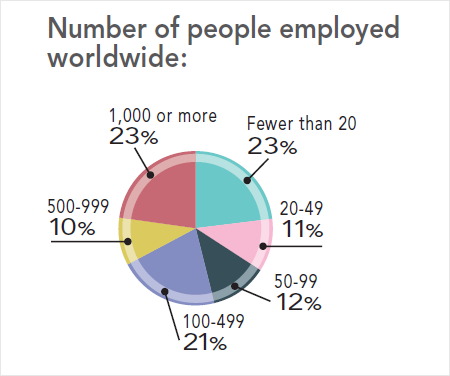

Nearly a quarter of the respondents say their companies employ 1,000 or more people, while another 23 percent say their firms have fewer than 20 employees. A fifth note their firms are mid-sized in terms of employment numbers, with 100–499 individuals on their payrolls.

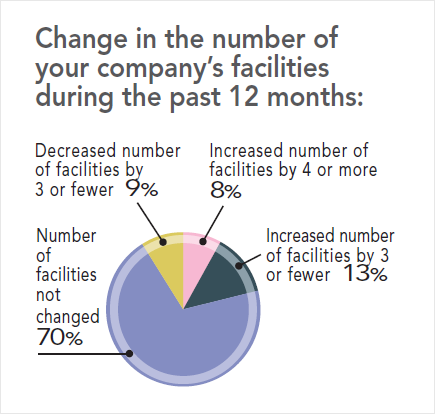

Seventy percent of the Corporate Survey respondents say the number of their companies’ facilities has not changed over the last 12 months. However, a fifth say their companies have increased their number of facilities. Of those who have decreased their number of facilities over the past year, none claim to have closed more than three operations.

More than two thirds of our Corporate Survey respondents believe that economic conditions under the new Trump administration will be favorable to moving ahead with new facility or expansion plans. This optimism on the part of the respondents echoes what other C-level executives have been saying. For example, post-election, Thomas Williams, CEO of Parker Hannifan Corp., told Bloomberg news, “I think a lot of things that Trump is thinking about, whether it’s tax reform, regulatory reform, infrastructure, are all things that would help Parker.”

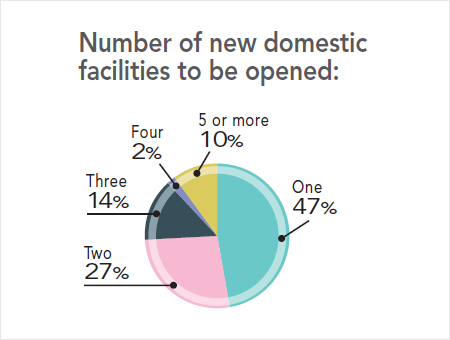

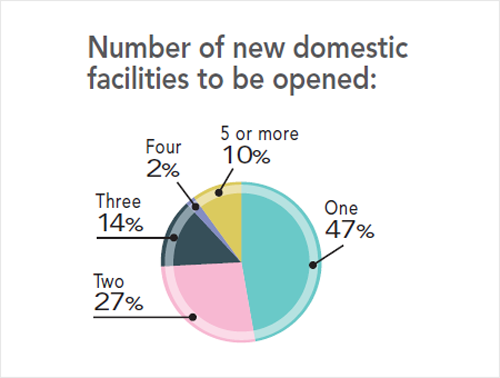

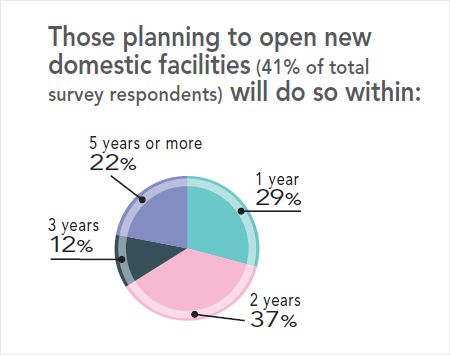

Nearly half (47 percent) of the respondents to our Corporate Survey plan to open a new (not relocate an existing) facility within the next five years, with the majority of them (41 percent) planning to open new domestic facilities. Two thirds of these respondents will do so within the next year or two. Nearly half plan on opening just one new domestic facility, with more than a quarter expecting to open two.

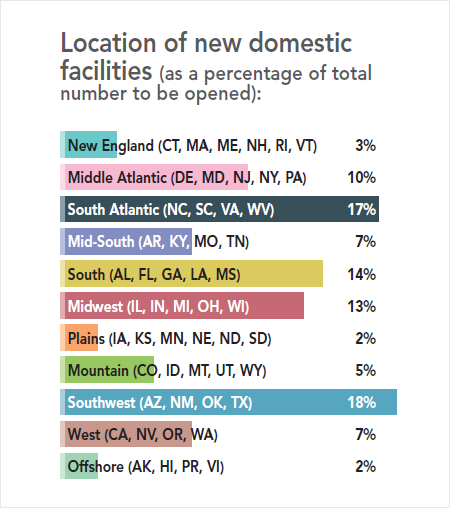

When it comes to location of new domestic facilities, the Southwest (Arizona, New Mexico, Oklahoma, and Texas) will garner the most activity, responsible for 18 percent of the total number to be opened, followed by the South Atlantic (North Carolina, South Carolina, Virginia, and West Virginia) with 17 percent of the total, and the Southern states of Alabama, Florida, Georgia, Louisiana, and Mississippi with 14 percent. Interestingly, there appears to be renewed interest in the Midwest states (Illinois, Indiana, Michigan, Ohio, and Wisconsin), with 13 percent of the new domestic facilities slated for this region.

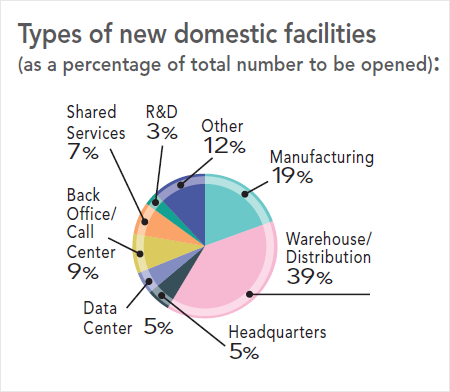

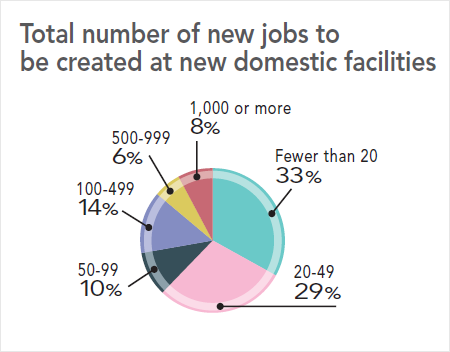

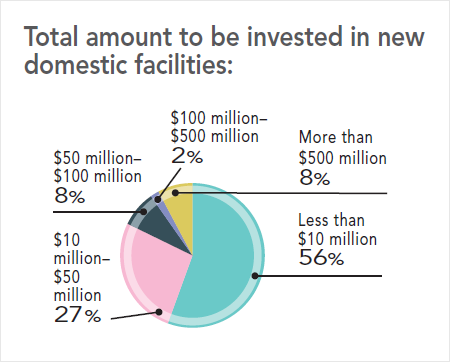

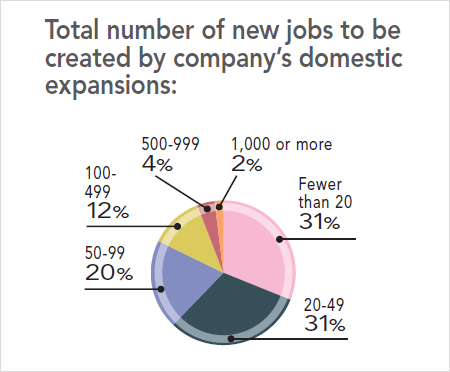

While the plans for new facilities appear to be robust, only a fifth of these will be manufacturing plants that create high value-added jobs. About two-fifths are to serve as warehouse/distribution operations. Also, more than 70 percent of the respondents expect these new domestic facilities to create fewer than 100 new jobs, and more than half say their new domestic facilities will represent less than $10 million in investment.

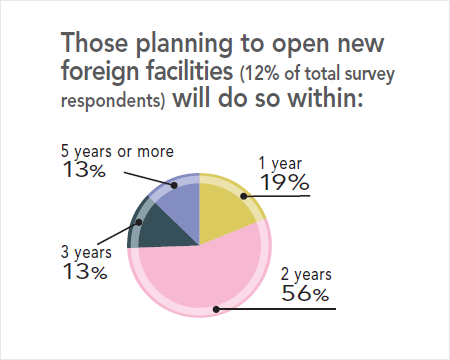

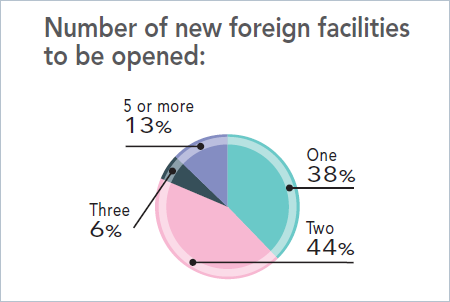

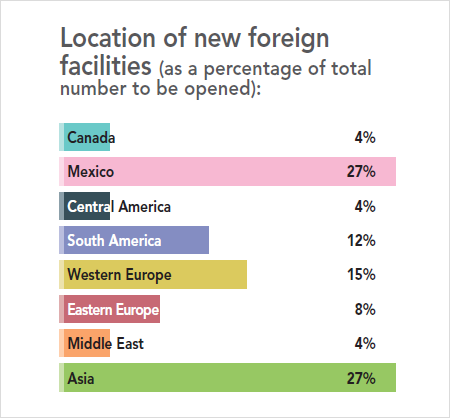

Only 13 percent of the respondents to our Corporate Survey believe potential penalties for moving operations/jobs offshore under the Trump administration will affect their plans for new foreign facilities (more than half of the survey-takers did not respond to this question). We aren’t sure if this has any bearing on the small percentage of respondents (just 12 percent of the total) who expect to open new foreign facilities. Of those with plans, three quarters will open new foreign facilities within the next two years, with 82 percent planning to open just one or two new foreign facilities.

Despite Trump’s threats about penalties for opening operations in Mexico, our neighbor to the south will garner more than a quarter of these planned new foreign facilities, with an equal percentage slated for Asia and 15 percent going to Western Europe. China still seems to be the destination of choice when it comes to new Asian facilities, garnering half of those planned for that region of the world.

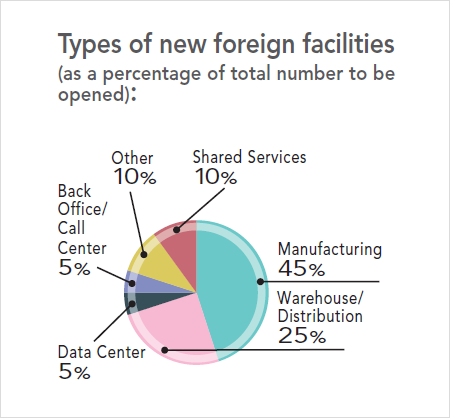

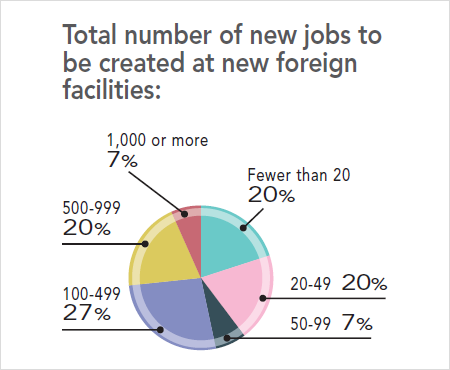

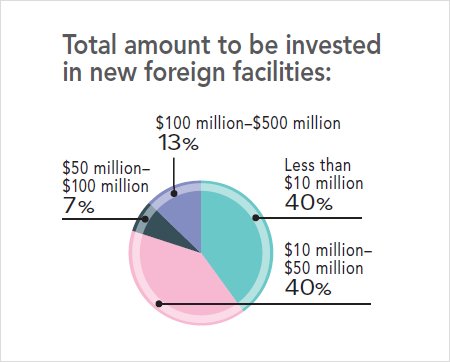

In juxtaposition to the planned new domestic facilities, 45 percent of the new foreign facilities will house manufacturing operations, with a quarter being warehouse/distribution operations — so much for companies not moving manufacturing offshore! And these new foreign facilities will create many more jobs than the domestic ones, with 27 percent of the respondents saying they will create 100–499 jobs, and an equal percentage saying they will create 500-1,000+ jobs. Additionally, 40 percent say between $10 million and $50 million will be invested in these new foreign facilities.

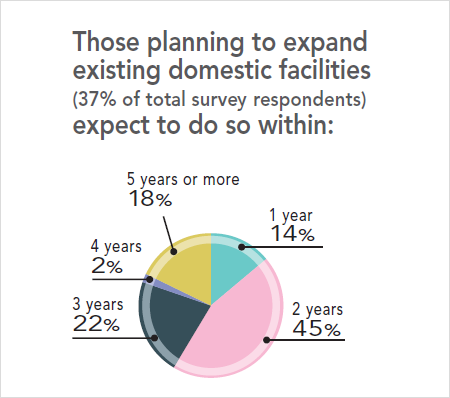

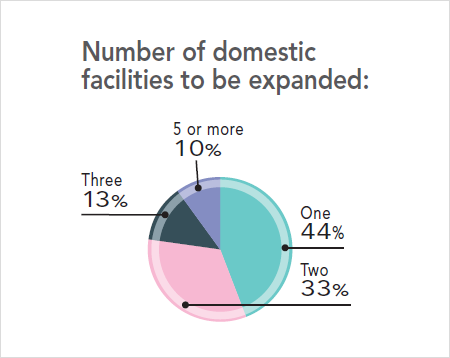

Nearly 45 percent of the respondents to our 31st annual Corporate Survey expect to expand an existing domestic or foreign facility. Of the 37 percent of respondents with plans to expand a domestic facility, most (nearly 60 percent) are expecting to do so with one to two years. Nearly half (44 percent of those with domestic expansion plans) say they will expand just one facility, and 82 percent claim their domestic expansions will create fewer than 100 new jobs.

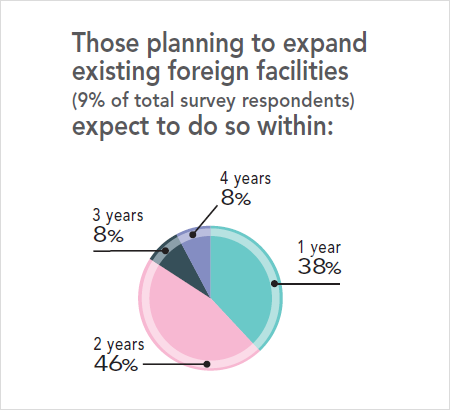

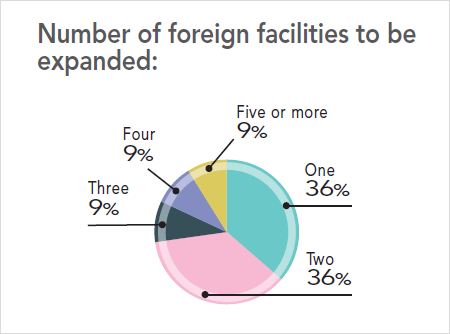

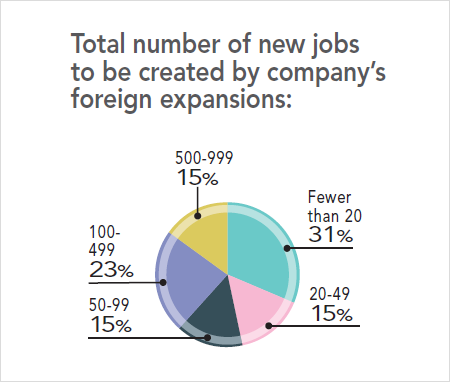

Just 9 percent of the total of Corporate Survey respondents plan to expand an existing foreign facility, with the majority (84 percent) saying they will do so with a year or two. More than 70 percent of those respondents will expand one or two foreign facilities, with 61 percent saying these foreign expansions will create fewer than 100 new jobs.

Will they relocate existing facilities?

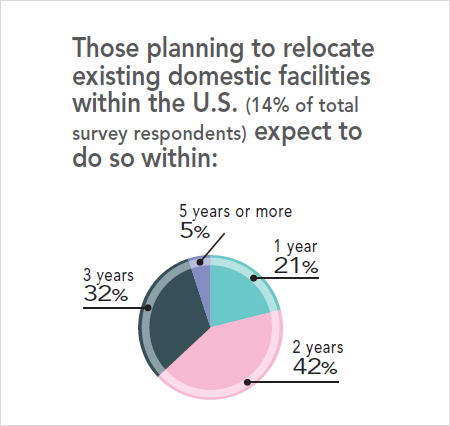

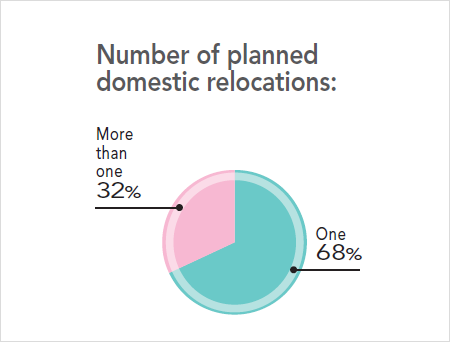

Eighty percent of the Corporate Survey respondents are not planning to relocate an existing domestic or foreign facility within the next five years. Of the 14 percent of total survey respondents who do plan to relocate an existing domestic facility, 68 percent plan just one domestic relocation, and nearly two thirds plan to relocate in one to two years.

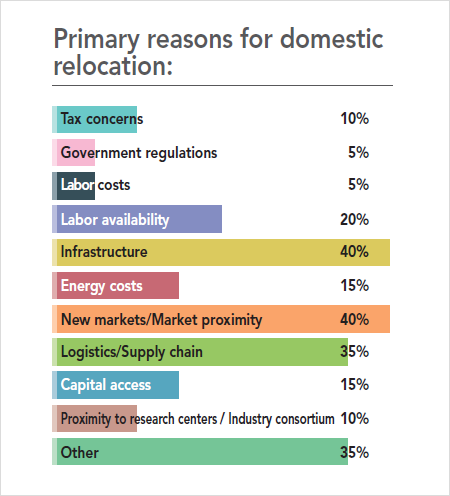

The primary reasons for relocating domestically are access to new markets or market proximity and infrastructure concerns — each cited by 40 percent of the respondents with domestic relocation plans. A fifth are also very concerned about labor availability in their present location.

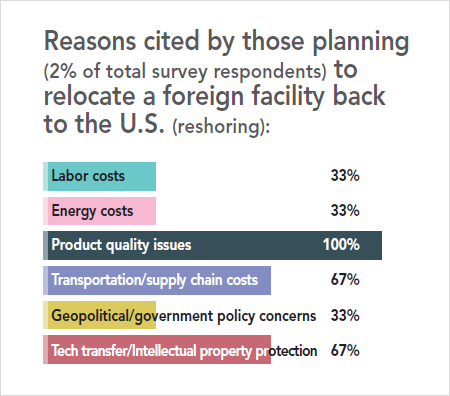

Interestingly, just 13 percent of all the Corporate Survey respondents believe there will actually be financial inducements to move foreign facilities back to the United States or reshore. Even if there are inducements, most analysts note that those production jobs that have been moved offshore aren’t coming back. According to an MIT Technology Review released in November 2016, Trump’s promise to bring back production jobs ignores the realities of advanced manufacturing. With that in mind, just 2 percent of all the Corporate Survey respondents plan to reshore facilities. Of these individuals, all are concerned about product quality issues overseas, while two thirds also worry about transportation/supply chain costs and intellectual property protection.

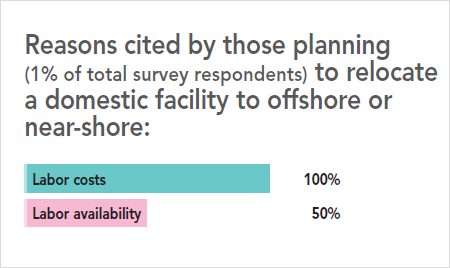

Despite the fact that only 2 percent of all Corporate Survey respondents say potential penalties under the new Trump administration will have an effect on their plans to relocate a domestic facility/jobs offshore, just 1 percent of our survey respondents claim to have plans to do so. Labor costs and availability are the reasons they find relocating offshore to be necessary.

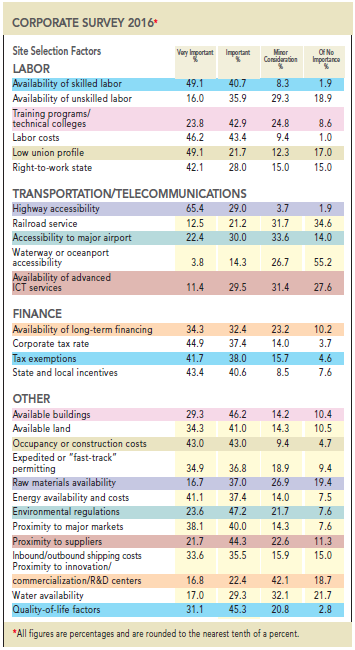

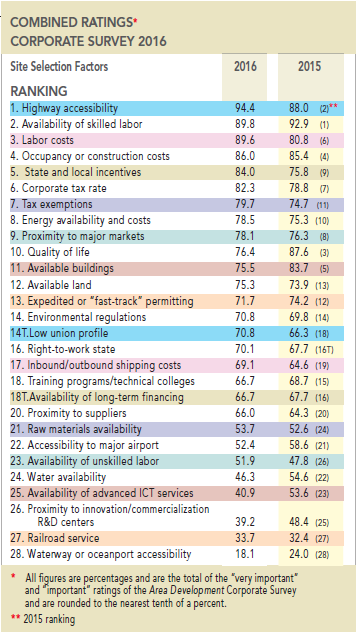

As in years past, we asked our Corporate Survey takers to rate the location factors they take into consideration when making new facility, expansion, or relocation plans as either “very important,” “important,” “minor consideration,” or “of no importance.” We then added the “very important” and “important” ratings together in order to rank the factors in order of importance.

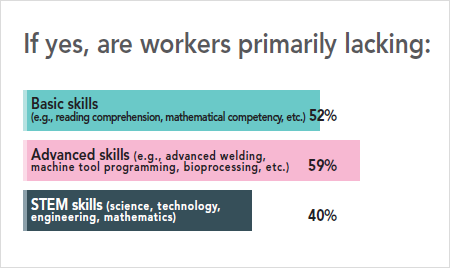

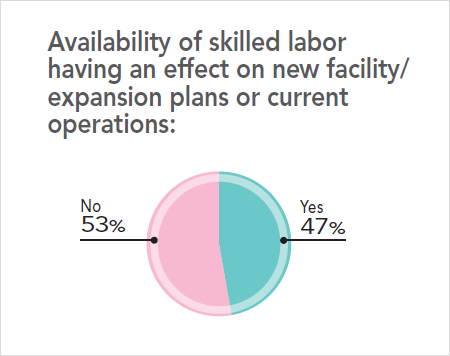

Once again, the top factors are highway accessibility and availability of skilled labor, ranking No. 1 and 2, respectively, and flipping in order from the 2015 Corporate Survey. This time, 94.4 percent of our Corporate Survey respondents rate highway accessibility as “very important” or “important,” and 89.8 percent give that rating to availability of skilled labor. In fact, 47 percent of the respondents say availability of skilled labor is having an effect on their new facility and expansion plans. More than half the respondents say workers are lacking basic reading and math competency skills, with nearly 60 percent saying they are also lacking the advanced skills pertinent to today’s advanced manufacturing industries, e.g., advanced welding, machine tool programming, etc.

As the U.S. economy has started to heat up and wages have started to increase, labor costs have also become more important on a year-over-year basis. This factor increased 8.8 percentage points — the largest percentage increase in the ratings — and is now considered very important” or “important” by 89.6 percent of the Corporate Survey respondents, jumping from No. 6 to No. 3 in the rankings.

Maintaining its No. 4 ranking among the site selection factors is occupancy and construction costs, with an 86 percent combined importance rating. It’s not surprising that this factor remains quite important. Overall construction costs are expected to continue to rise in 2017 in the 2 percent to 3 percent range, according to the latest forecasts.

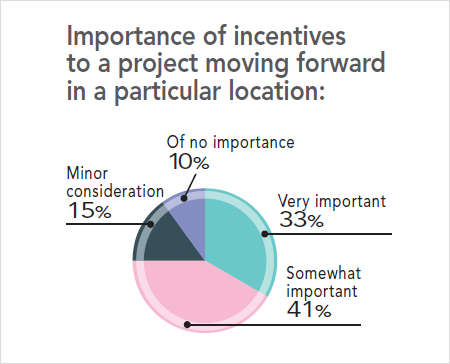

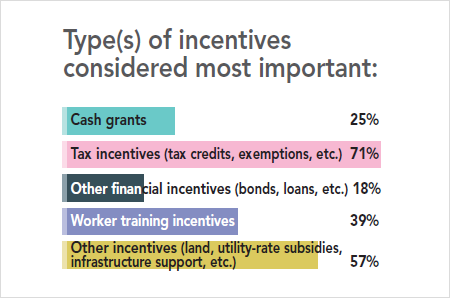

Three related factors — corporate tax rate, tax exemptions, and state and local incentives — also continue to increase in importance. State and local incentives moved up four spots and is now the No. 5 ranked factor. It showed the second-largest percentage increase, rising 8.2 percent, and now considered “very important” or “important” by 84 percent of the Corporate Survey respondents. In fact, 74 percent of the respondents separately note that incentives are very or somewhat important to a project moving forward in a particular location. More than 70 percent consider tax incentives the most important type, and 39 percent cite the importance of worker training incentives.

The high ranking of state and local incentives is not surprising, considering the fact that corporate tax rate, with an 82.3 percent combined importance rating, and tax exemptions, with a 79.7 combined importance rating, are ranked No. 6 and 7, respectively, among the site selection factors.

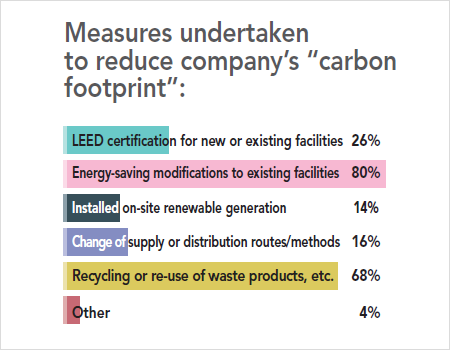

Although energy costs vary by location, energy availability and costs is ranked No. 8, considered “very important” or “important” by 78.5 percent of the Corporate Survey respondents. In fact, 80 percent of the survey respondents say they’ve made energy-saving modifications to their existing facilities.

Proximity to major markets is ranked No. 9, considered “very important” or “important” by 78.1 percent of the survey respondents. The rise of e-commerce, with customers expecting next-day or even same-day delivery, continues to increase the significance of this factor.

Although quality of life showed the second-largest percentage decrease in the ratings (11.2 percentage points), this factor still made it into the top-10 with a 76.4 percent combined importance rating.

Despite the fact that quality of life is not the primary consideration when a company is choosing a location, experts say it cannot be overlooked. It’s not only important to attracting young, tech-savvy workers but also mature workers who require good schools for their children and access to quality healthcare, as well as cultural and recreational amenities.

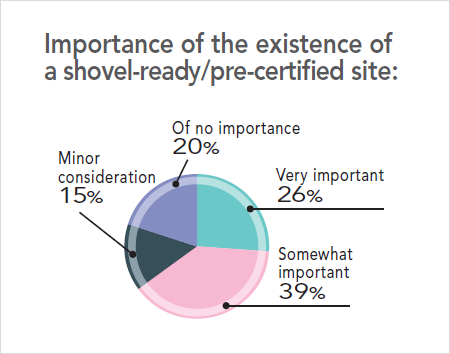

The only factor dropping out of the top-10 from last year is available buildings. It dropped from No. 5 to No. 11 this year, decreasing 8.2 percentage points and now rated “very important” or “important” by 75.5 percent of the Corporate Survey respondents. This drop in the ratings and rankings is hard to explain considering the fact that the supply of available industrial buildings has been dwindling, as speed to market has been more important than ever, with companies needing to get their operations up and running as quickly as possible. However, perhaps for this year’s pool of respondents, an available building would not fit their parameters for a new or expanded facility and they would most likely consider a build to suit. In fact, about two thirds of the respondents note the relative importance of a shovel-ready or precertified site.

Finally, the factor showing the largest percentage decrease in the combined “very important” or “important” ratings is availability of advanced ICT services, dropping 12.7 percentage points to achieve a 40.9 percent rating, although it only dropped two spots in the rankings to No. 25. As these services become more ubiquitous, they may have become less critical when compared with other factors influencing the location decision, thus garnering a lower combined importance rating from our survey respondents.

How do they conduct the location decision process? What information sources do they utilize?

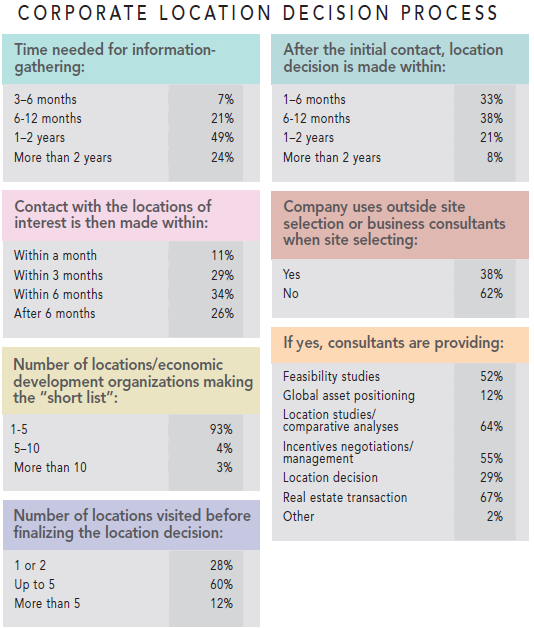

Nearly half of the Corporate Survey respondents take one to two years to gather information for making their next location decision. Contact with the locations of interest is then made within three to six months by nearly two thirds of the respondents.

More than 90 percent of the respondents put between one and five locations on their “short list.” Sixty percent of the respondents say they visit up to five locations before finalizing their location decision, with a third making the final decision within six months of initial contact being made. Another 38 percent take between six months and one year to make their final location selection.

Only 38 percent of the respondents to our 31st annual Corporate Survey utilize the services of site selection or business consultants when making location decisions. Of those that do, about two thirds say the consultants provide location studies/comparative analyses as well as help with the real estate transaction. And 55 percent say the consultants negotiate/manage incentives on their behalf.

More than 80 percent of the respondents utilize site magazines like Area Development as a source of site selection information, and three quarters also use general business magazines and financial newspapers. When searching online, 78 percent claim to be looking for economic data on specific locations, two thirds are looking at listings of available sites and buildings (e.g., FastFacility), and half hone in on specific economic development agencies’ websites.

What do the results mean for economic growth?

After years of slow growth, will the economy shift into high gear? If Trump follows through on his promises to invest in the nation’s infrastructure, revise personal and corporate taxes, and get rid of onerous business regulations, economic analysts are projecting stronger growth in the year ahead. Like others, the Organization for Economic Cooperation and Development (OECD) has also predicted the U.S. will grow 2.3 percent this year and 3 percent in 2018.

Our Corporate Survey respondents seem to be riding on this wave of optimism. As stated, more than two thirds of the survey respondents believe that economic conditions under the new Trump administration will be favorable to moving ahead with new facility or expansion plans — and most of those location and expansion moves will take place in the U.S. But, along with others, the OECD’s chief economist, Catherine Mann, warns that Trump’s anti-trade proposals could have negative consequences for economic growth. And as of this writing, President Trump just withdrew the U.S. from the Trans-Pacific Partnership (TPP) and was calling for the renegotiation of NAFTA.

It’s too soon to tell if our Corporate Survey respondents’ optimism is justified and they will follow through with — or maybe even increase —their new facility and expansion plans. However, the new administration does need to pay attention to business’ need for skilled workers — a primary concern according to the results of our survey. The manufacturing jobs President Trump wants to bring back to the U.S. aren’t the same as the ones that left, as noted by Scott Paul, president of the Alliance for American Manufacturing, in a reaction to the President’s inaugural address: “The offshored jobs President Trump has promised to return will not look like those that left. Manufacturing industries change rapidly, and so do the skill sets they require of workers upon entry. His administration must lead the way in preparing our workforce for this changing economy, so they can participate and reap its benefits too.”