Who are the responding consultants?

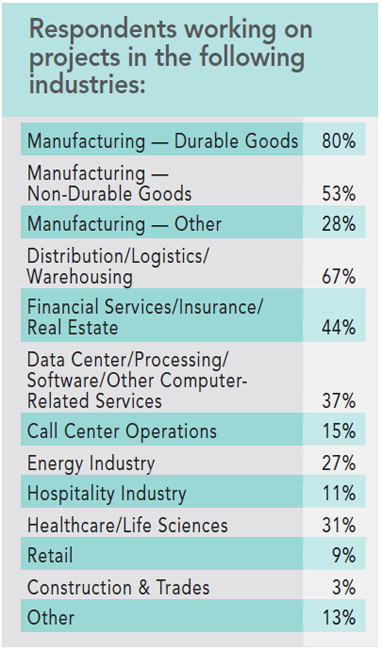

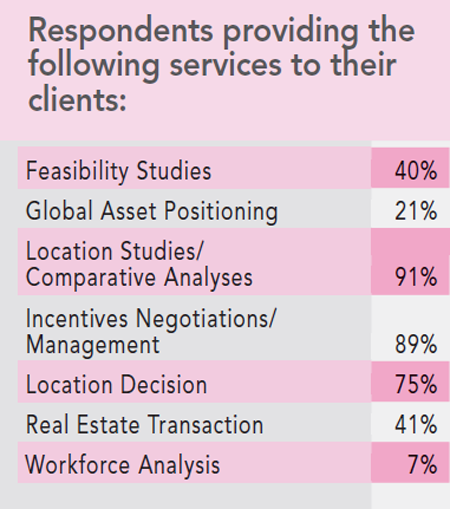

Eighty percent of the responding consultants say they are working on projects for durable goods manufacturers, while two thirds say they are also working on projects for distribution/warehousing operations. Nearly all (91 percent) say they provide their clients with location studies/comparative analyses, as well as incentives negotiation/management (89 percent make that claim).

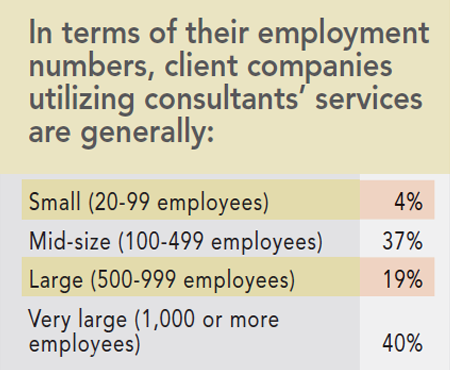

In terms of employment numbers, a third of those responding to our Consultants Survey work primarily with mid-size companies (100–499 employees), while a fifth work primarily with large companies (500–999 employees), and 40 percent focus on very large firms (1,000 or more employees). These three employee cohorts only account for slightly more than half of the Corporate Survey respondents.

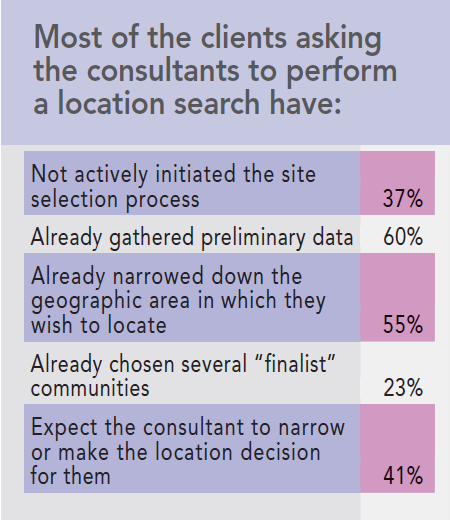

Sixty percent of the Consultants Survey respondents claim that most of their clients who ask them to perform a location search have already gathered some preliminary data on the locations of interest, with 55 percent saying their clients have narrowed down the geographic area in which they wish to locate. Nonetheless, about two fifths of these consultants say their clients expect them to narrow or make the location choice for them.

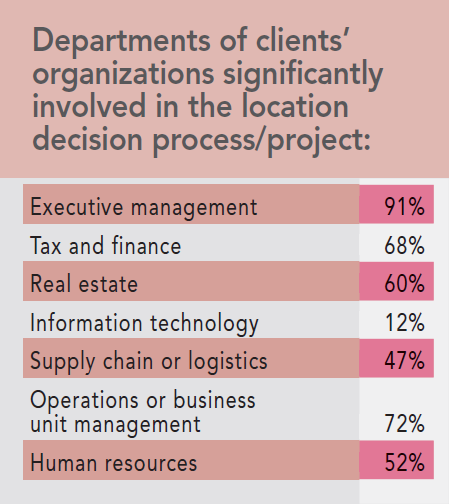

Most of the consultants (91 percent) acknowledge that executive management at their client companies is involved in the location decision process; 68 percent say their clients’ tax and finance departments are also involved; and 72 percent say operations or business unit management teams play a large role in the process as well.

Will their clients open new facilities and/or expand existing ones?

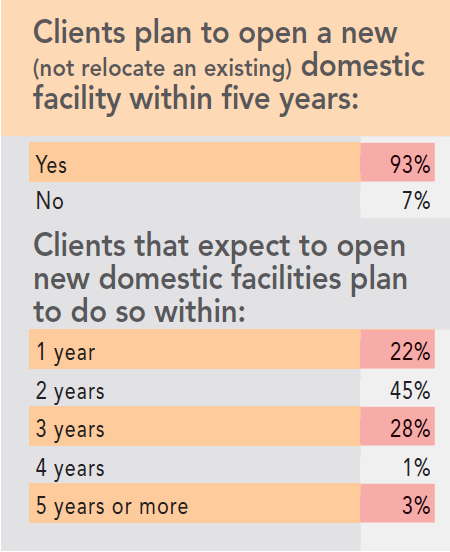

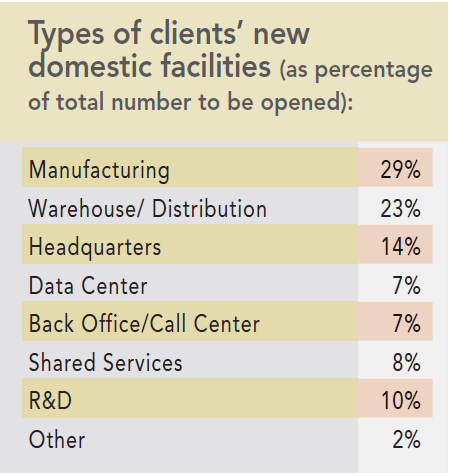

About three quarters of the respondents to our Consultants Survey also expect economic conditions under the new Trump administration to be favorable to their clients’ moving ahead with new facility or facility expansion plans. In fact, 93 percent say their clients will open a new (not relocate an existing) domestic facility within the next five years. Almost all (95 percent) say these new facilities are actually planned within a three-year window, according to our survey results.

13th Annual Consultants Survey Results

-

Chart A

-

Chart B

-

Chart C

-

Chart D

-

Chart E

-

Chart F

-

Chart G

-

Chart H

-

Chart I

-

Chart J

-

Chart K

-

Chart L

-

Chart M

-

FChart N

-

Chart O

-

Chart P

-

Chart Q

-

Chart R

-

Chart S

-

Chart T

-

Chart U

-

Chart V

-

Chart W

-

Chart X

-

Chart Y

-

Chart Z

-

Chart AA

-

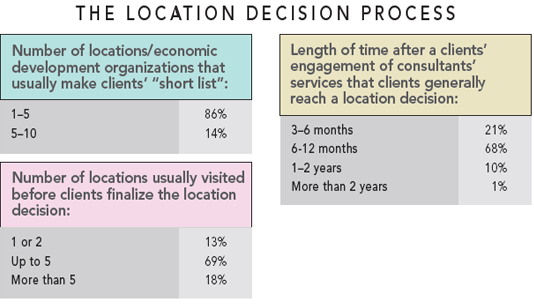

The Location Decision Process

-

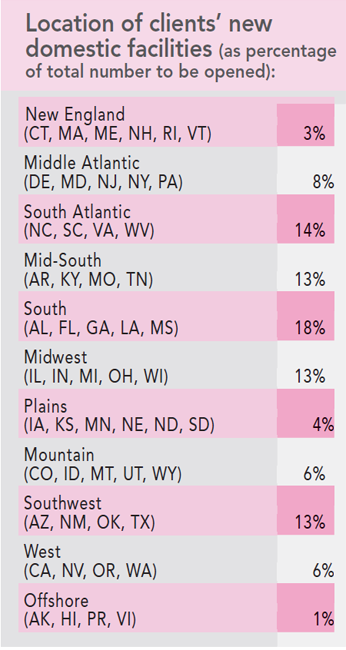

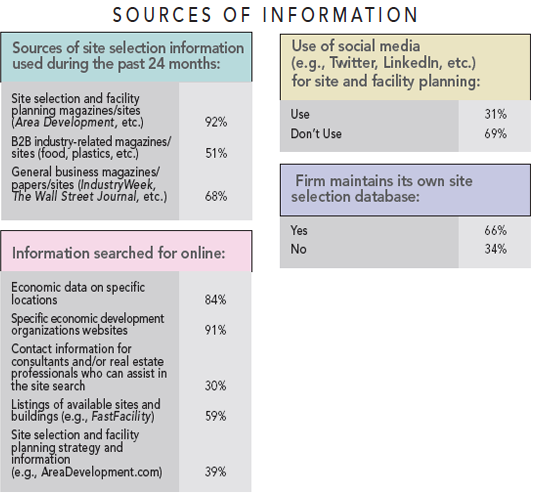

Sources of Information

The majority of their clients’ new domestic facilities are planned for the southern U.S. — 18 percent for the South region (Alabama, Florida, Georgia, Louisiana, and Mississippi); 14 percent for the South Atlantic region (North Carolina, South Carolina, Virginia, and West Virginia); and 13 percent for the Southwest (Arizona, New Mexico, Oklahoma, and Texas). The Midwest (Illinois, Indiana, Michigan, Ohio, and Wisconsin) will also garner 13 percent of the new facilities projects the consultants are working on. These are the same regions favored by our Corporate Survey respondents.

Most of our Corporate Survey respondents were unsure about whether the Trump administration’s proposed plan to penalize companies that move offshore would affect their companies’ plans for new foreign facilities (more than half did not respond). The consultants are much more certain in their opinions: Nearly two thirds believe such penalties will have an effect on their clients’ plans for new foreign facilities.

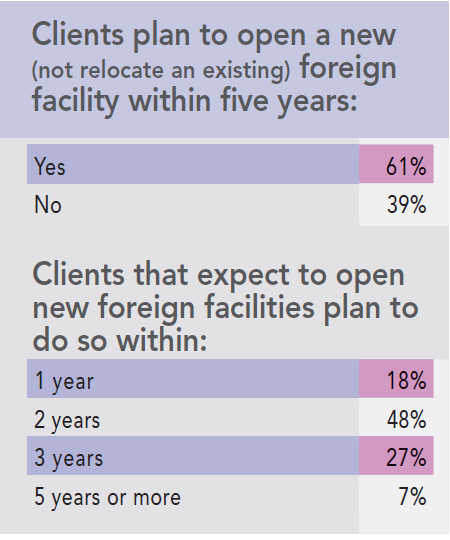

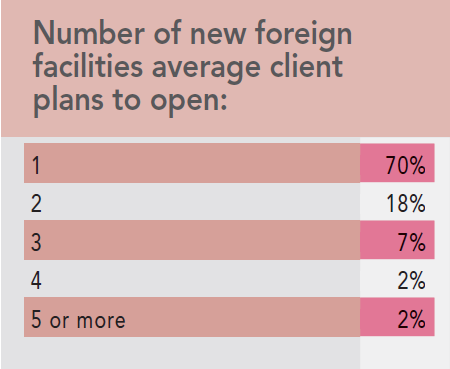

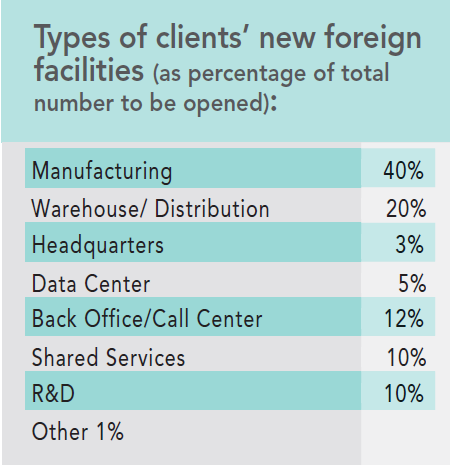

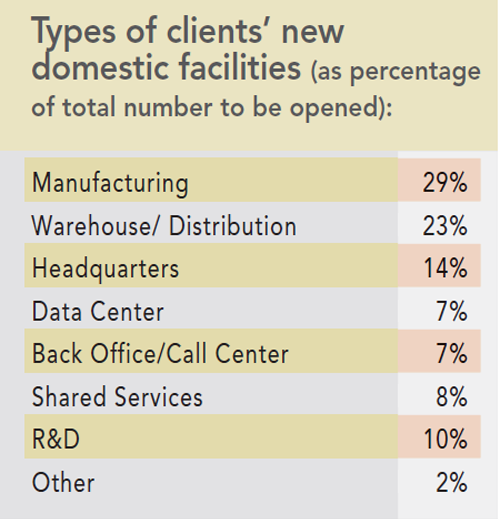

Nevertheless, about 60 percent of the responding consultants say their clients expect to open a new foreign facility within five years, with two thirds of the respondents saying this will happen within two years. Seventy percent say their clients will open just one new foreign facility. And, the most favored foreign location is Mexico, expected to garner a quarter of the new facilities projects on which the consultants are working. Our Corporate Survey respondents also are planning a similar percentage of new facilities for Mexico. However, whereas they claim to be planning 27 percent of their new facilities for Asia (half of them in China), the consultants say just 18 percent of their clients’ new foreign facilities are planned for Asia, with 38 percent of these going to China.

Finally, nearly 90 percent of the respondents to our Consultants Survey say their clients plan to expand an existing domestic facility within the next five years. In fact, nearly three quarters say their clients will actually do so within one to two years.

What are their clients’ relocation plans?

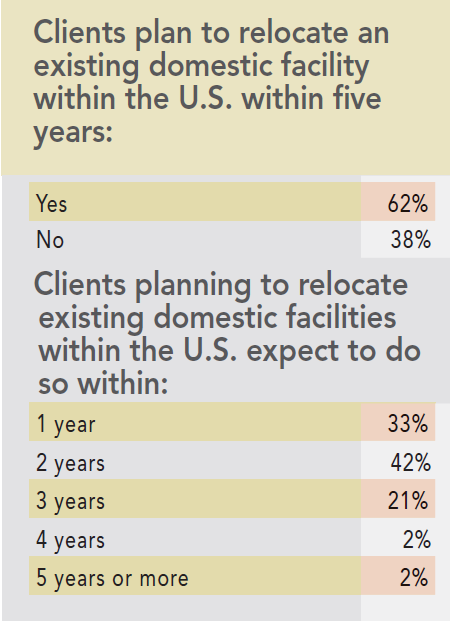

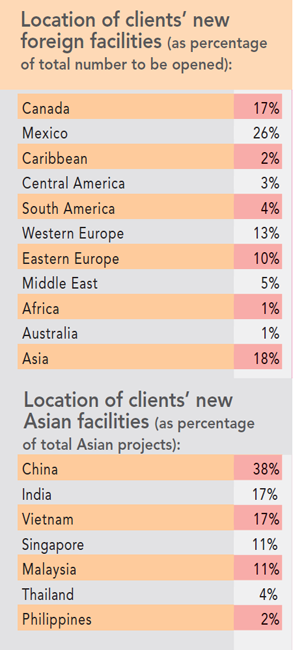

More than 60 percent of the respondents to our 13th annual Consultants Survey say their clients plan to relocate an existing facility within the U.S., with three quarters saying their clients will do so within one to two years. The primary reason cited for their clients’ domestic relocations is labor availability (cited by 89 percent of the consultants). Market proximity/new markets (cited by 70 percent), tax concerns (cited by 66 percent), and labor costs (cited by 64 percent) are other important impetuses for relocating.

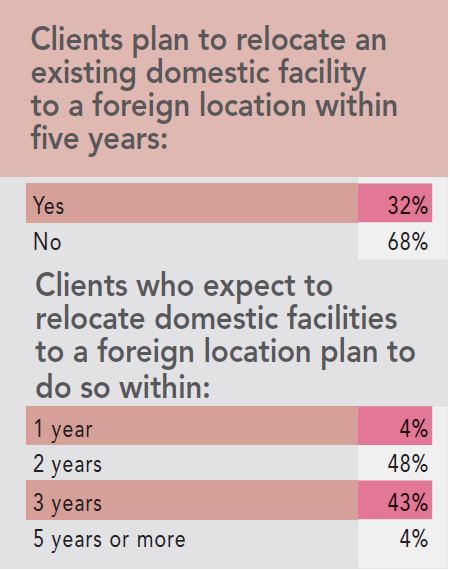

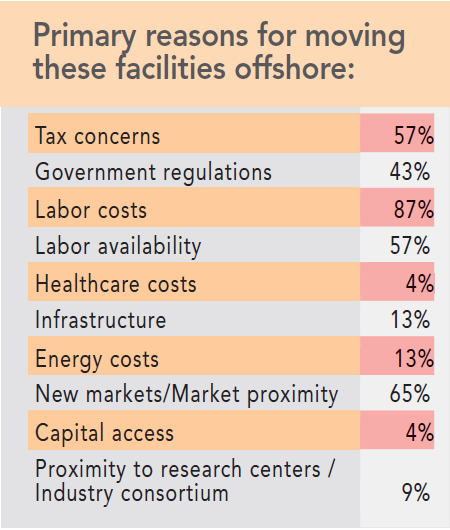

Only a third of the respondents say their clients will relocate a domestic facility to a foreign location. Half acknowledge that potential penalties for relocating facilities/jobs offshore under the new Trump administration will have an effect on their clients’ relocation plans. Interestingly, three quarters of the Corporate Survey takers did not respond to this question.

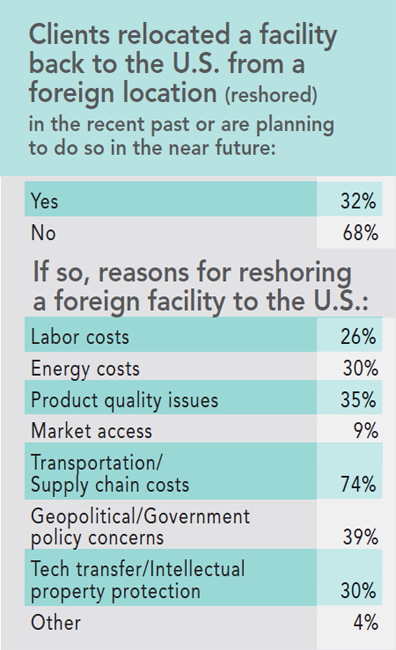

Only 2 percent of the Corporate Survey respondents say they plan to move a foreign facility back to the U.S., i.e., reshore. However, a third of the responding consultants say their clients have reshored in the recent past or are planning to do so in the near future. Three quarters say the need to reshore is prompted by transportation/supply chain costs; 39 percent cite geopolitical concerns; 35 percent mention product quality issues; and 30 percent cite overseas energy costs as well as intellectual property protection. More than 60 percent also believe there will be financial inducements for clients to reshore under the new Trump administration. Only 13 percent of our Corporate Survey respondents believe this will happen, with 85 percent not responding to the question.

Which location factors are most important to their clients?

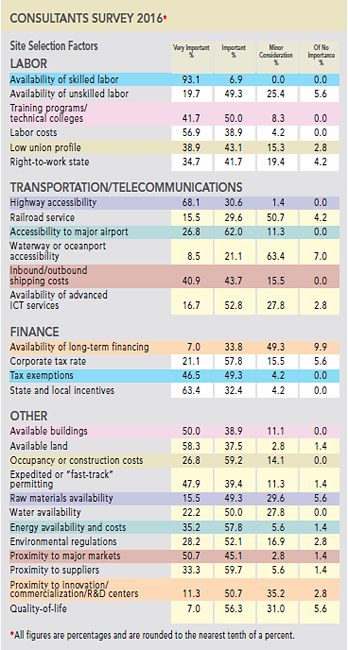

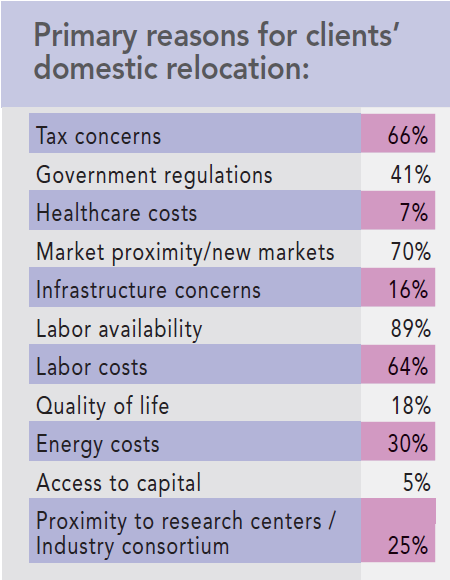

We also asked the consultants to rate the location factors their clients take into consideration when making new facility, expansion, or relocation plans as either “very important,” “important,” “minor consideration,” or “of no importance.” Then we added the “very important” and “important” ratings together in order to rank the factors in order of importance.

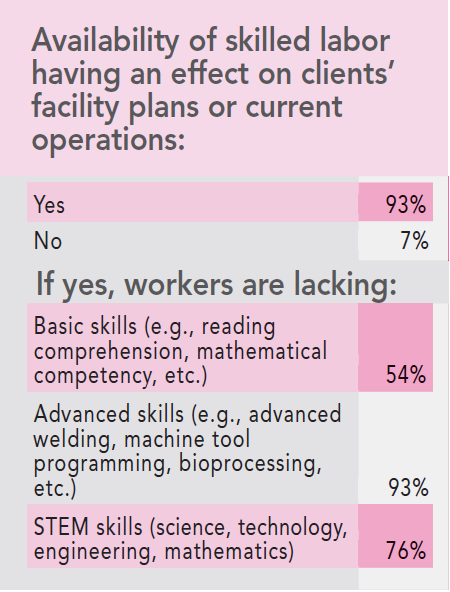

Interestingly, the respondents to our Consultants Survey rank the same three factors as most important to their clients as do the respondents to our Corporate Survey. Availability of skilled labor ranks No. 1 in the Consultants Survey (the Corporate Survey respondents ranked this factor No. 2) and is considered “very important” or “important” by 100 percent of the responding consultants. It received the same rating in 2015’s Consultants Survey. In fact, 93 percent of the surveyed consultants say availability of skilled labor is having an effect on their clients’ facility plans or current operations, with the same percentage saying it’s the advanced skills such as machine tool programming, bioprocessing, advanced welding, etc. that are lacking. And three quarters cite a dearth of STEM (science, technology, engineering, and mathematics) skills. It makes sense then that training programs/technical schools is in the consultants’ No. 10 spot among the site selection factors.

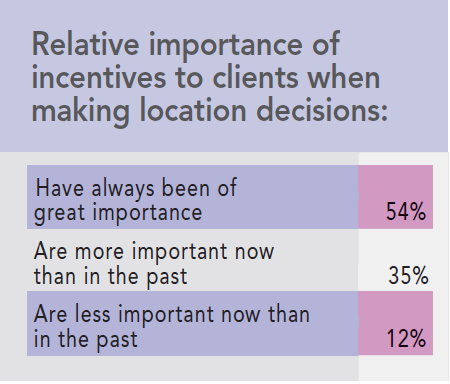

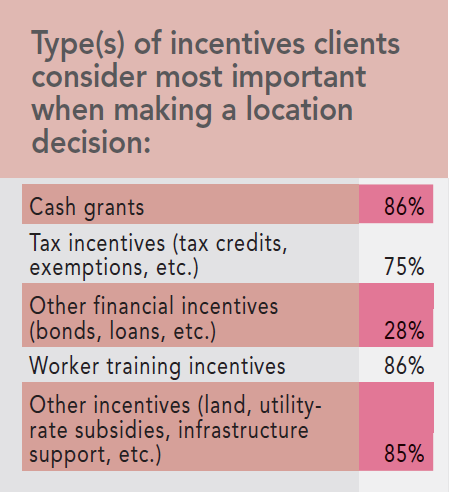

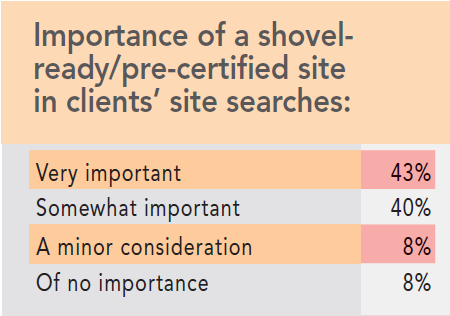

Tied in the consultants’ rankings with labor costs for the No. 3 spot are tax exemptions and state and local incentives. Half of the responding consultants say incentives have always been of great importance to their clients when making location decisions, while 35 percent say incentives are more important now than in the past. Although three quarters claim tax incentives are the most important, about 85 percent say the most important types of incentives are cash grants, worker training incentives, and other types such as land, utility rate subsidies, infrastructure support, etc. And more than 80 percent cite the importance of a shovel-ready or pre-certified site to their clients.

Also tied for the No. 3 spot with a 95.8 percent combined importance rating are proximity to major markets and available land. With customers today demanding next-day and even same-day deliveries, it makes sense that the consultants’ clients would need to be near their markets. However, as the supply of available industrial facilities has been shrinking, clients may need land for build-to-suit facilities.

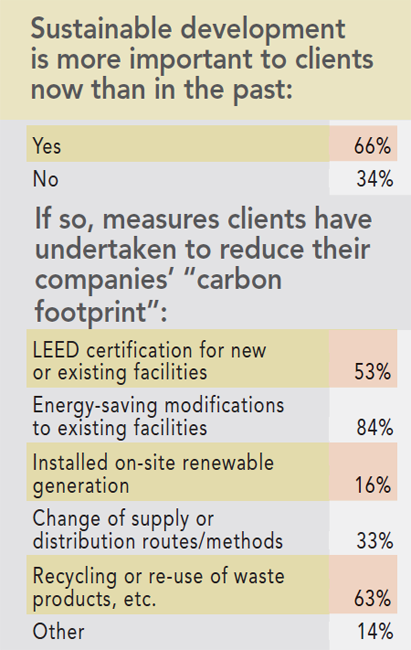

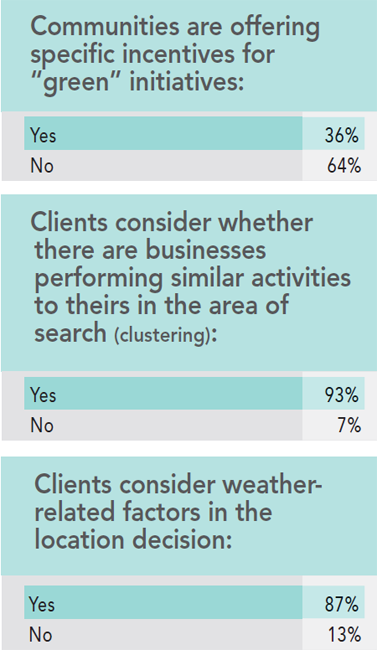

Tied for the No. 8 position in the rankings are energy availability and costs and proximity to suppliers, both receiving a 93 percent combined “very important” or “important” rating from the responding consultants. Also, these factors showed large percentage increases in the ratings and jumped from their previous 13th and 14th place rankings, respectively. When it comes to energy, nearly 85 percent of the respondents say their clients have made energy-saving modifications to their facilities; nearly two thirds say their clients are recycling or re-using waste products of their operations; and more than half claim their clients are seeking LEED certification for new or existing facilities.

Additionally, although the respondents to our Corporate Survey placed quality of life in the No. 10 spot with a 76.4 percent combined importance rating, the respondents to our Consultants Survey ranked quality of life No. 24 among the factors with a 63.3 percent combined importance rating. The responding consultants may believe that a prospective location’s quality of life is of less importance in the final decision than perceived by corporate executives.