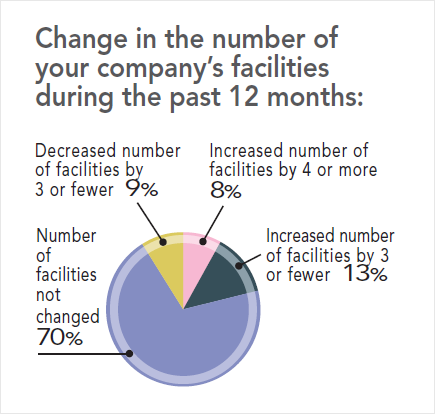

Seventy percent of the respondents noted their number of facilities did not change over the previous 12 months. This suggests that companies may have awaited the results of the U.S. election. This is not unusual, as any election year poses unknowns for regulation and policies. However, specific discussions of trade, tariffs, and reshoring would make any wise corporate investor hold his/her decision.