Over the last 10 years, leaders in the U.S. FDI/reshoring movement include GM` (12,000 jobs), Boeing (7,800 jobs), Toyota (6,000), Mahindra (6,000), Volkswagen (4,000), and Volvo (4,000). In addition, Ford, Foxconn, Mercedes-Benz, GE, Caterpillar, Polaris, and Intel have each brought back more than 2,000 jobs.

Factors that are accelerating the reshoring movement include favorable domestic economic conditions; advanced technologies such as automation, robotics, and the Internet of Things; reduced domestic energy costs; the just-lowered corporate tax rate; aggressive tax incentives from various states; as well as increased labor costs overseas.

In particular, the labor cost differential between China and the U.S. has narrowed significantly over the past five years, greatly reducing profits for offshore enterprises. Increased shipping costs further erode the bottom line. Disruption of supply is also a concern with longer supply chains. This is especially true for possible shortages of materials or parts that can only be sourced from a few suppliers, which would have serious impacts on delivery and production schedules. Increasingly, the cost advantage of lower wages overseas is undercut by higher supply chain costs and quality issues. When all these factors are considered together, more U.S. manufacturers are starting to look at the United States as the place to manufacture.

- Advantages of a U.S.-only supply chain include:

- Improved quality control and safety

- More reliable and less costly shipping

- Shorter and more reliable supply chains

- Faster decision-making

- American job creation

- Positive impact on the national economy

- Improved brand through “Made in America”

Total Cost of Ownership (TCO)

The key to successful reshoring is truly understanding, at a deep level, the total cost of ownership (TCO) of your product — the complete cost of every step of making that product overseas and shipping it to the United States. Obvious factors are labor costs, materials, quality and rework, waste, and logistics and shipping.

However, “most companies make sourcing decisions based solely on price, often resulting in a 20 to 30 percent miscalculation of actual offshoring costs,” states Moser. Other factors — overhead, balance sheet, risks, corporate strategy, and other external and internal business components — must also be considered to determine the true total cost of ownership. The Reshoring Initiative has made it easier for companies to accurately determine TCO with a free online TCO estimator that helps determine these cost factors, allowing company leaders to make informed decisions regarding sourcing and reshoring, or winning bids against offshore competitors.

Using this approach, Mitchell Metal Products in Merrill, Wisc., was recently honored with the first National Reshoring Award, sponsored by the Reshoring Initiative and the Precision Metalforming Association.

Mitchell Metal Products is a contract manufacturer that makes products for original equipment manufacturers across a wide range of industries. The company wanted to win a contract to manufacture a cultivator handle subassembly product for a U.S.-based manufacturer of lawn and garden equipment. This company had been obtaining this product from Southeast Asian companies for a number of years. “To win the bid, we had to display our value compared to the total costs involved with, and compared to, the offshore supply chain,” says Tim Zimmerman, president of Mitchell Metal Products. “We used the TOC calculator to document the total cost to our customer of its offshore source, versus purchasing from us.”

To make it a financially successful project for Mitchell Metal Products, a cross-disciplinary team representing several internal departments, two outside consultants, and the customer was assembled to find innovative ways to reduce costs and optimize production. This involved creative redesigning of tooling, equipment, and workflow, including engineering an internal work center that dramatically reduced the amount of time to perform assembly operations. The result was a massive increase in production volume, going from 4,500 made overseas per year to 30,000 made in Wisconsin.

“Not every project is a candidate for reshoring,” warns Zimmerman. “The TCO helps make a data-driven analysis possible. Trust the data.”

The Tax Advantage

The U.S. corporate tax climate is more favorable now than it has been in decades, thanks to the Trump administration’s Tax Cuts and Jobs Act, which cuts the corporate tax rate from 35 percent to 21 percent, the lowest rate since 1939. The legislation also eliminates the corporate alternative minimum tax (AMT), which prohibited companies from deducting research and development costs, or capital investments in low-income neighborhoods. When coupled with competitive state tax credits and incentives, the new tax climate makes reshoring look even more attractive.

For Victaulic, 80 percent of what it sells in the U.S. is manufactured in U.S. plants. “I envision in the next few years that we bring the last 20 percent back from low-labor-cost countries as automation continues to make our U.S. operations even more competitive,” says Malloy. The company also plans to invest tens of millions over the next several years to build a light assembly operations facility that features cutting-edge technologies, as well as to upgrade other existing facilities.

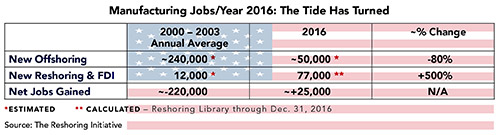

Job Gains as a Result of Reshoring

Companies across the U.S. are reshoring or creating jobs to manufacture products that were previously made overseas.

-

Mitchell Metal Products

Merrill, WIMitchell Metal Products, a contract manufacturer that makes products for original equipment manufacturers across a wide range of industries — was recently honored with the first National Reshoring Award, sponsored by the Reshoring Initiative and the Precision Metalforming Association.

-

Victaulic

Easton, PAEighty percent of what Victaulic sells in the U.S. is manufactured in U.S. plants, and the company plans to bring the last 20 percent back from low-labor-cost countries as automation continues to make its U.S. operations even more competitive.

-

Walmart

Bentonville, ARWalmart is still committed to its 10-year initiative to support U.S. manufacturing jobs and produce $250 billion in additional goods in the U.S. by 2023. According to data from its suppliers, approximately two thirds of Walmart’s U.S. merchandise spending is for items that are made, assembled, sourced, or grown in the United States.

-

Mars Wrigley Confectionery

Topeka, KSAs a result of the Walmart initiative to support U.S. manufacturing jobs, 70 jobs have been added at Mars Wrigley Confectionery.

-

WinCraft

Winona, MNWinCraft, a manufacturer of licensed sports apparel in Winona, Minn., has added 70 jobs as a result of the Walmart initiative to support U.S. manufacturing jobs.

-

Ozark Trail Coolers

Dekalb County, GAWalmart supplier Ozark Trail Coolers has added 150 new jobs in DeKalb County, Ga.

-

Sinomax

La Vergne, TNThe Walmart initiative to support U.S. manufacturing jobs has resulted in 350 jobs being added at China-based Sinomax, maker of polyurethane foam bedding, in La Vergne, Tenn.

-

Trident

Chino, CATrident, a Chino, Calif.-based maker of cell phone cases for Walmart, has added 50 jobs.

- According to talkbusiness.net, some of the jobs created in 2017 as a result of the Walmart initiative are:

- 70 jobs added at Mars Wrigley Confectionery in Topeka, Kan.

- 70 jobs at WinCraft, a manufacturer of licensed sports apparel in Winona, Minn.

- 150 new jobs created in DeKalb County, Ga., to support Ozark Trail Coolers for Walmart

- 350 jobs at China-based Sinomax, maker of polyurethane foam bedding, in La Vergne, Tenn.

- 50 jobs at Trident, a Chino, Calif.-based maker of cell phone cases for Walmart

To explore this idea further, in July 2017 Wal-Mart presented its “Policy Roadmap to Renew U.S. Manufacturing” to representatives of government, industry, and non-governmental organizations from across the country. The purpose was to provide a comprehensive strategy for tackling these high-impact policy barriers, including workforce, coordination and financing, regulation, and tax and trade policies, with specific recommendations for accelerating the growth of U.S. manufacturing.

“As we have worked over the last four years alongside our suppliers toward our goal to source an additional $250 billion in products that support American jobs, we’ve learned a great deal about the challenges our suppliers face in domestic manufacturing,” states Cindi Marsiglio, Walmart vice president for U.S. sourcing and manufacturing. “The good news is we have also learned how to overcome the challenges, and because of our experience, Walmart is uniquely positioned to help facilitate broad engagement in accelerating the expansion of U.S. manufacturing.”

The Boston Consulting Group has estimated that Walmart’s 10-year manufacturing initiative will create 250,000 direct manufacturing jobs and about 750,000 support and service jobs to the manufacturing sector.