With tremendous uncertainty clouding geopolitics and the economy, incentives can be the difference between an organization adopting or rejecting a capital investment or technology development project in Canada. But the emergency government supports — in addition to an already robust, generous, and integrated incentive ecosystem — make Canada an attractive place for businesses to develop technologies, attract top talent, and make capital investments. Here are some areas where Canada thrives and what is available for those companies looking to explore options.

Technology Development and Innovation

Canada has emerged as a favorable location for technology development due to its highly diverse and educated workforce, a vast and growing international free trade network, and one of the most generous research and development (R&D) tax incentive programs in the world. In 2019, the federal government spent approximately $6.5 billion in R&D funding, while nonprofit and provincial government sectors contributed an additional $3.75 billion. The largest single funding program for R&D in Canada is the Scientific Research & Experimental Development (SR&ED) Tax Incentive Program. The Canadian Revenue Agency indicated that the program alone provided approximately $3 billion in federal credits last year.

The SR&ED program is available to companies across the country at all stages of growth. It provides a 35 percent refundable (cash) tax credit in most instances, for small to mid-sized businesses with less than $10 million in taxable capital. Large and/or foreign corporations also benefit from the program through a 15 percent nonrefundable tax credit. The additional provincial tax credits range from 10 percent to 30 percent, bringing the total credit on eligible R&D expenses to 25–65 percent, depending on the province where the expenses were incurred, taxable capital, and corporate structure of the claimant. Regardless of where your company falls in that range, SR&ED is a very generous incentive program.

Incentives can be the difference between an organization adopting or rejecting a capital investment or technology development project. In addition to SR&ED tax credits, there are numerous federal and provincial discretionary grants available for R&D. In recent years, the federal government has made efforts toward streamlining its programs through sector-specific strategies with economic growth targets leading into 2025 — agri-food, resources of the future, health and biosciences, clean technology, digital industries, and advanced manufacturing are all included. Instead of numerous small and rigid programs, the intention is to have an integrated and coordinated approach to its funding ecosystem, along with increased coordination with provinces. Most of these programs have size limitations of 500 or fewer employees, but there are also opportunities for large corporations. A few programs worth noting are:

National Research Council’s Industrial Research Assistance Program (NRC-IRAP):

For small to medium-size companies (1–500 employees), NRC-IRAP can be a significant source of grant funding for technology innovation projects. As of 2018–2019, NRC-IRAP has an expanded mandate with the ability to fund up to $10 million per R&D project, with a total budget of $700 million over five years. Eligible expenditures include salaries and subcontractors.

Sustainable Development Technology Canada (SDTC):

This incentive is available to Canadian small to mid-sized businesses advancing innovative technologies that are pre-commercial and have the potential to demonstrate significant and quantifiable environmental and economic benefits. Since 2001, SDTC has funded $1.15 billion, and the 2017 federal budget announced an additional $400 million over five years. Although the applicant must be a Canadian company, the grant can be applied to projects with only 50 percent of expenses being incurred in Canada. Eligible expenses are quite broad in this program and, unlike many of the other R&D incentives, can include some capital investments.

There are a number of job-creation and training grants available, particularly for companies looking for highly skilled technical people or students. Strategic Innovation Fund (SIF):

In conjunction with the NRC-IRAP’s expanded mandate to fund projects up to $10 million, SIF was established for larger innovation projects through a consolidation of various existing innovation programs. Interestingly, a SIF contribution can be repayable, non-repayable, or a combination, with the repayment conditions determined on a case-by-case basis. Discretionary contributions of over $10 million per project are provided under two main categories:

Business Innovation and Growth helps support R&D and commercialization, the growth and expansion of firms, and the attraction and retention of large-scale investments in Canada. Applicants must be a Canadian for-profit corporation conducting the proposed project in Canada. The minimum project size is $20 million with a SIF contribution of $10 million. The applicant must also be willing to make long-term commitments to Canada through job creation, R&D, and investments.

Collaborations and Networks helps support industrial research, development, and technology demonstration through collaboration between academia, nonprofit organizations, and the private sector.

Attracting and retaining the right people is key to any successful business endeavor. There are a number of job-creation and training grants available in Canada, particularly for companies looking for highly skilled technical people or students. Most of these incentives are at the provincial level, but some noteworthy federal programs include the Canada Summer Jobs, Canada Job Grant, Mitacs, NSERC-IRAP Youth Employment, and the Apprenticeship Job Creation Tax Credit.

Capital Investments

One of the important deciding factors for U.S. companies looking to expand in or relocate to Canada is the level of capital expenditure support offered to them. Beyond the historically favorable exchange rates, there are numerous incentives available for capital investments.

One relatively new indirect incentive enacted by the government of Canada in 2019 is the ability to significantly accelerate the depreciation of certain capital assets — particularly for manufacturing and processing or clean energy, including full expensing on a temporary basis.

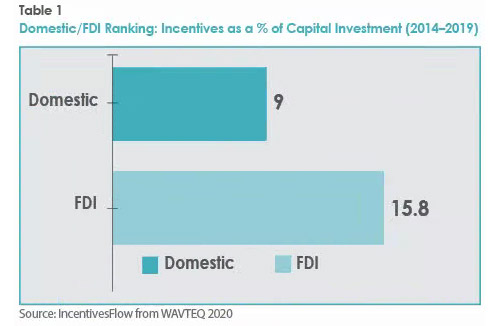

Data from 2014–2019 shows that most incentives for capital expansion and job creation went to companies in the Basics Materials sector, including chemicals, mining, plastics, steel, aluminum, and wood products, among others. This was followed by the non-renewable energy sector and then the automotive sector. Additionally, the data shows that foreign direct investments (FDI) were significantly more incentivized than domestic investments (Table 1), which demonstrates Canada’s commitment to building global competitiveness for FDI.

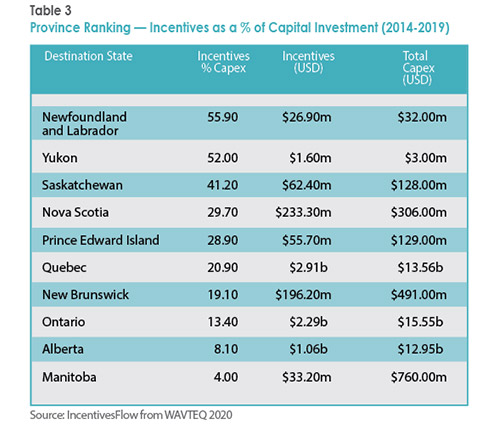

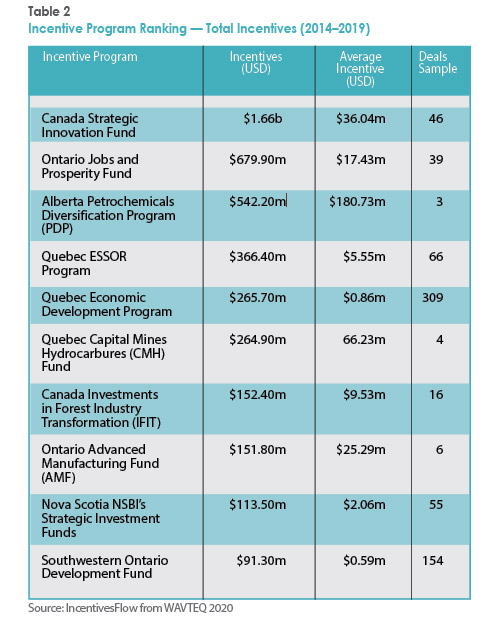

Canadian provinces are very actively involved in direct incentives — Table 2 outlines the top 10 direct programs across the country. Table 3 further demonstrates how these programs are distributed among provinces. Larger provincial investments (USD$200 million or more) include Ontario, Quebec, Nova Scotia, and New Brunswick. Although Alberta ranks low on this list, it’s likely due to individual deals being larger than average.

In the midst of current global affairs, businesses are looking for stability. Canada offers an attractive, low-risk social and political investment destination with many direct and indirect incentives available for technology development, talent attraction, and capital investments — and more continuing to come to the forefront due to COVID-19. Companies considering relocating or expanding to Canada should work with the appropriate stakeholders and advisors to navigate the complex incentive landscape. Due to the discretionary nature and stringent eligibility criteria, working with the right partners to reduce risk is crucial to fully leverage the significant opportunities that incentives can provide.