This tax reform was intended to improve U.S. competitiveness and productivity through lower corporate tax rates, easier access to foreign cash with a modernized international tax system, and favorable expensing of capital acquisitions. In light of the new law, it is critical that manufacturing companies reassess their business models and look at how recent legislative changes may affect their operations.

The next five years provide a unique opportunity for growth among manufacturing companies. Again, the key term here is growth. So, with the additional cash, how can manufacturers seize this opportunity?

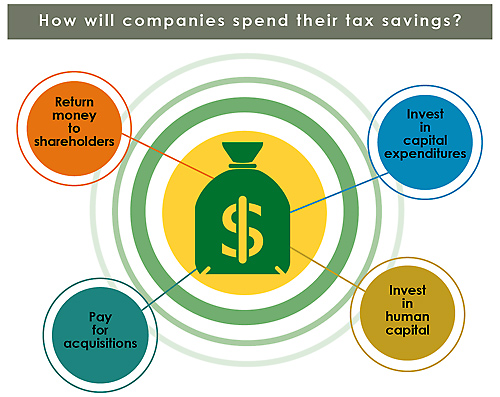

We recently published a report that tackles this very question. Our study takes a look at the business implications of this new tax reform, and we uncovered four growth opportunities for manufacturers to consider:

1. Return Money to Shareholders

The drop in the corporate tax rate from 35 percent to 21 percent brings the U.S. corporate tax rate more in line with other industrial nations, increasing U.S. competitiveness in world markets. Manufacturers will also benefit from the move to a territorial system in which non-U.S. earnings are generally not taxed when repatriated to the United States. The ability to access foreign cash more tax efficiently in the future has created a stronger environment for investment in U.S. manufacturing activities. All of this adds up to stronger balance sheets, where management and boards alike will be faced with decisions to invest in R&D or return money to shareholders.

2. Invest in Capital Expenditures

The new expense provision states that businesses which make capital investments can take a 100 percent deduction for the next five years, greatly reducing after-tax cost. This will benefit manufacturers, especially those that have not yet invested in new technologies in recent years. The expense provision provides them a unique opportunity to modernize operations over the next five years by buying state-of-the-art equipment, boosting IT infrastructure, and expanding digitization of manufacturing facilities and supply chains.

The next five years provide a unique opportunity for growth among manufacturing companies. However, we would like to raise caution for those companies that may rush to complete purchases to take advantage of the 100 percent depreciation rate. We understand that robots are the hot ticket items among manufacturers, but it may not be the best choice in terms of driving overall strategic goals or productivity growth. With so many possible options, it’s important to make choices within the context of your overall strategy to maximize impact.

Supply chains will also be affected by several provisions in the tax bill. Previously, it was relatively simple to analyze the implications of supply chain options by factoring in the tax rates of various countries, but the following three new provisions are making the computation less straightforward:

- The new tax on global intangible low-taxed income (GILTI) effectively imposes a minimum level of tax on the foreign profits of U.S. multinationals, which is intended to discourage U.S. companies from moving value-generating activities outside the United States, particularly to low-tax jurisdictions. It may also discourage some companies from moving future assets offshore.

- Foreign derived intangible income (FDII) provides a tax benefit to companies in high-margin businesses that export goods, license intangibles, and provide services from the United States. There are some questions as to the future of the FDII provision, which may violate the terms of our treaty with the World Trade Organization and could cause retaliatory actions by the EU. Manufacturers will need to take these issues into consideration before making long-term supply chain decisions based on the FDII’s potential benefit.

- The base erosion and anti-avoidance tax (BEAT) is a significant new cost for many non-U.S. companies with operations in the United States and also for many U.S.-headquartered companies with foreign affiliates. The tax will reduce the ability of large multinationals to shift income to their affiliates in lower-tax countries through the use of cross-border payments. Industrial companies, especially those that are foreign-based, may look to offset the higher tax burden by improving their operations or changing their legal entity structure.

3. Pay for Acquisitions

We expect that the tax reform will have a positive effect on deal activity across the manufacturing sector. The lower corporate tax rate and earnings repatriation provisions, coupled with companies being able to fully expense new depreciable assets and used property purchased from an unrelated buyer will boost asset acquisitions. Companies may also be more inclined to divest non-core assets, as lower rates will ease the tax burden on disposals.

Tax reform is a catalyst for change where manufacturers can now shift their focus from cost reduction to growth. One constraining factor to this positive deal-making environment is the provision that limits the business debt interest deduction to 30 percent of EBITDA (earnings before interest, taxes, depreciation, and amortization) for the next five years and 30 percent of EBIT (earnings before interest and taxes) in the following years. Now, the limitations on corporate interest expense deductibility will stretch the ability of some companies to finance deals with U.S. debt, making it more likely they will consider non-U.S. borrowing to finance transactions. As companies look to foreign markets to raise debt to optimize their capital structures, global treasury will quickly rise to the top of the list of critical business functions.

Overall, U.S. tax reform has provided the perfect catalyst for increasing M&A activity domestically as well as making the United States a more attractive market for other dominant global players, including Europe and China.

4. Invest in Human Capital

Employers should begin to evaluate the impact of the tax reform and how the new law will reshape the landscape of employee compensation and benefit programs, such as the tax treatment of employee fringe benefits and the deductibility of certain compensation.

The Tax Cuts and Jobs Act is allowing U.S. companies until mid-September to take advantage of the higher corporate tax rate when deducting their defined benefit pension plan contributions. This can include, but is not limited to, cash from operations, a borrow-to-fund strategy, or contributions of employer treasury stock, company debt, or company real property. It may also be an optimal time for those manufacturing companies that repatriate offshore cash reserves and have partially unfunded pensions to close the funding gap. The new law is also providing an opportunity for companies to consider creating deduction opportunities in ways such as expanding pension plans to fund retiree medical expenses.

Another significant change from the tax bill is executive compensation. Getting away from longstanding rules, compensation based on performance will now be subject to a deduction cap of $1 million, which may result in the use of other incentives such as stock options and deferred compensation for covered employees as well as higher base salaries.

In Sum

Tax reform is a catalyst for change where manufacturers can now shift their focus from cost reduction to growth. While not all companies will benefit equally, most manufacturers will benefit substantially from the tax reform bill. But just because the bill lowers corporate tax rates, provides easier access to foreign cash, and allows for the favorable expensing of capital acquisitions, manufacturers should not hastily make investment decisions just to take advantage of these elements. Investment considerations should align with corporate growth strategies and consider all facets of the business.