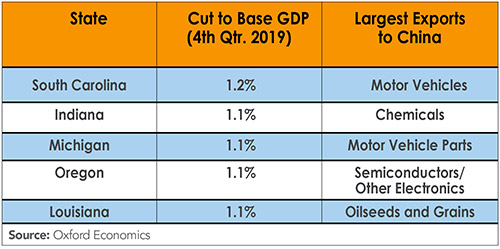

The stakes are high. Oxford Economics estimates that a full trade war with China, where essentially all trade between the two countries is subject to tariffs, would shave nearly 0.6 percent off U.S. GDP growth by 2020, potentially costing hundreds of thousands of jobs unless there are corresponding offsets to other U.S. policies, for example, less restrictive fed policies. The accompanying chart highlights the five states that Oxford Economics forecasts will lose the most under a full trade war scenario without policy offsets.

And it is not just U.S.-China trade that is the worry. There remain U.S. tariffs on steel and aluminum products coming from Canada and Mexico, and this issue remains open under the United States-Mexico-Canada Agreement (USMCA) that is intended to replace NAFTA. In response, each of our neighbors has imposed a host of retaliatory tariffs on U.S. goods, especially targeting agriculture. If this is going to be our new normal, how will business respond?

Oxford Economics has had an opportunity to work with companies considering how the worsening tariff environment will impact their bottom line and, in this article, we share a few of the insights that we have learned. For overall context, recall that if “successful,” tariffs will increase prices of all affected products in the United States. Theoretically, this will encourage more domestic producers to expand output. However, at the same time, prices remain lower everywhere else as foreign producers increase supply in foreign markets.

The key question that we are asked is, when all the dust settles, how will tariffs affect supply chain costs? Businesses can generally calculate the cost of tariffs on products that they directly import. What is more difficult to estimate is how tariffs will affect prices throughout the international supply chain that supports their operations both in the United States and abroad.

To help us predict how relative price levels will stabilize for key industrial and agricultural sectors once the shock of new tariffs has worked its way throughout the global economy, we rely on a computable general equilibrium (CGE) model. The use of a CGE model is standard in the economics profession whenever the goal is to gain insight into how variables such as price and output will likely change in response to a change in trade policy. The CGE model that we use calculates expected price and trade volume changes for key industrial sectors in multiple regions and countries globally. The model anticipates substitution effects over time. In other words, it considers how production will move from high-cost to low-cost locations (given current trading patterns).

In a typical engagement, a company provides us with a description of its current supply chain. For example, how much steel does it import from Mexico? What volume of motor vehicle component parts comes from Japan or electronics from China? Once armed with a profile of the company’s supply chain, we run a scenario on the CGE model that reflects the tariff situation of most concern to that company. Usually, the scenario being considered is the worst-case one currently being discussed in Washington. Sadly, the worst-case scenario being discussed today has too often become the actual policy of tomorrow.

Oxford Economics estimates that a full trade war with China, where essentially all trade between the two countries is subject to tariffs, would shave nearly 0.6 percent off U.S. GDP growth by 2020. The model’s results are then applied to the supply chain of that company. For example, the model might estimate that the price of motor vehicle components coming from Japan will rise by “x” percent because of changing tariffs; or that the price of electronics from China will increase by “y” percent. The price changes that we focus on are those associated with the key components of the supply chain of the company that we have been asked to evaluate. The expected price changes are applied to the current cost structure associated with the current supply chain. The projected increase in costs, after the new price structure is considered, allows for a relatively straightforward analysis of the likely impact on EBITDA (earnings before interest, taxes, depreciation, and amortization).

Companies are currently wrestling with how to incorporate these insights regarding rising costs into their future planning. Some have begun to explicitly balance political and economic risk. In one project, it was clear that the smart economic decision was to shift steel purchases from a U.S. to foreign supplier. However, high visibility moves to shift production offshore or source away from current U.S. suppliers because of U.S. trade policy carry significant political risks. A prominent company with a great degree of political visibility needs to think carefully about how such a move will play out in Washington. To date, it appears that concerns such as these, coupled with uncertainty regarding the duration of tariffs, have essentially frozen business decision-making surrounding this issue. But that situation might be starting to change.

While it remains entirely possible that USMCA will be modified to address the steel, aluminum, and retaliatory tariffs currently in place, the fact is, they have already been in place longer than many in the business community expected. Hopefully, China-U.S. trade tensions will be reduced because of talks reportedly under way. In the meantime, however, companies remain concerned and now seem to be more seriously considering how to operationally respond. State governments, too, might want to follow their cue and consider how the changing trade situation will create some opportunities, but also create many new risks, for their own economies.