Vacancy Rates and Supply Trends

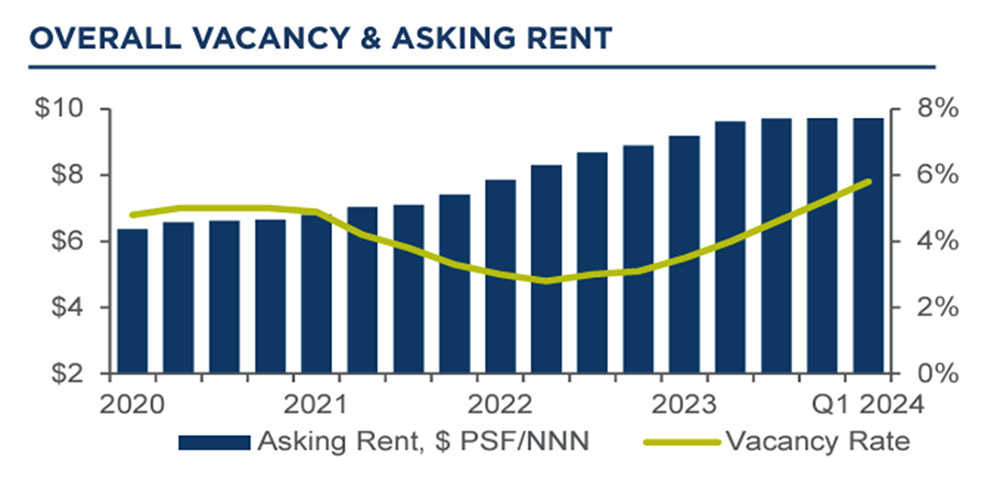

Industrial sector vacancy rates are on the rise as new speculative building completions exceed tenant demand. As of the first quarter of 2024, the vacancy rate stands at 5.8%, up from previous quarters but still below the historical average of 7%. Rent growth, which had skyrocketed over the past two years, is also stabilizing. In the first quarter of 2024, industrial rents grew at an annual rate of 6%, compared with 10% in 2023 and 20% in 2022.

While the industrial sector is cooling off, it appears to be undergoing a soft landing. Leasing Activity and Demand

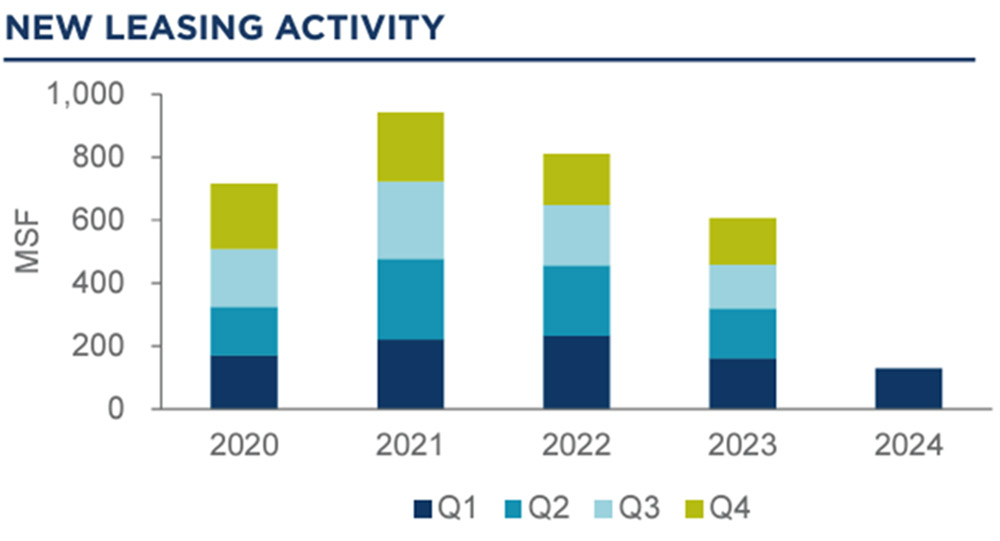

Leasing activity in the first quarter, although down from previous quarters, was relatively healthy with 128.7 million square feet of new transactions, 3% higher than the pre-pandemic average (2010-2019). The key markets driving this activity were the Inland Empire, Dallas-Fort Worth, and Houston, with 11.2 million square feet, 10.1 million square feet, and 9.1 million square feet, respectively. Notably, there were 15 deals involving leases of 1 million square feet or greater in the first three months of 2024, with 10 of these deals related to e-commerce.

Net absorption, which measures the difference between space occupied and space vacated, slowed significantly in the first quarter of 2024. It dropped to 14 million square feet in the first quarter from 77 million square feet in the same quarter last year. This slowdown might raise concerns, but it’s not uncommon for demand to fluctuate. On a brighter note, 43 out of 83 U.S. markets recorded positive absorption in the first quarter, with notable gains in Houston, Savannah, Chicago, and Austin.

The Midwest had the lowest vacancy rate at 4.9%, while the South had the highest at 6.6%, reflecting where most new supply is located.

50% - the year over year decline in industrial project construction starts. Outlook for the Industrial Sector

While the industrial sector is cooling off, it appears to be undergoing a soft landing. Vacancy rates are rising, but it’s mainly due to new supply. Rent growth is slowing, but to more sustainable levels long-term, while absorption has cooled but has and will remain positive. The shrinking construction pipeline suggests that the sector will recover once the current supply wave is absorbed.

Overall, the market seems to be balancing out after the explosive growth following the pandemic. While there are concerns about demand and absorption, the market remains resilient, with signs pointing toward a possible rebound as the construction pipeline thins and new demand emerges. Occupiers in the market now have more choice in their site selection and will certainly take advantage of the more stable, and more normalized, market conditions.