The Wall Street Journal’s Robbie Whelan took a deep look at fully autonomous robots, one of the latest technologies to catch the eye of major grocers and retailers who spend millions - and employ thousands—to package and distribute their goods.

For retailers, the objective in automating warehouses is controlling the three big costs of conventional human-staffed distribution centers—labor, time and real estate—to meet the demand of the high-cost, low-margin industry.

“Every project we look at, we look at automation as a potential part of it,” said Frank Bruni, Kroger Co. ’s vice president of supply-chain operations.

About 6% of Kroger’s distribution centers are fully automated, Mr. Bruni said, and a warehouse-worker shortage, rising wages and other factors are driving the company to look at more robotic systems. “Twenty-five, 30 years ago, there were a lot of folks who made careers working in warehouses. Today I don’t think that dynamic exists as much.” (Emphasis ours.)

Around 800,000 people in the U.S. are either making a career or holding a job in warehousing and storage. Do all or most of these people have to worry about their jobs becoming extinct as robots take over? Not necessarily. But some warehousing jobs are more susceptible to automation than others, and the metros areas where warehousing employment is most densely concentrated have a greater chance at losing jobs.

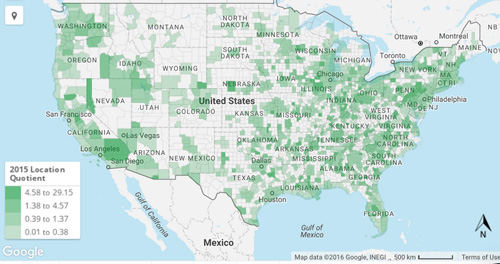

Metros Areas Susceptible to Warehousing Automation

In 2015, 79 metropolitan statistical areas had more than 2,000 warehousing and storage jobs (NAICS 493). Of those, 30 had a concentration - as measured by location quotient - at least twice that of the nation. This means that the share of warehousing jobs in these metros is at least two times greater than the national share (0.6%).

This list includes large metros like Riverside-San Bernardino-Ontario, California, which has the most warehousing jobs in the nation and a location quotient of 5.00, as well as Memphis (LQ of 3.24) and Louisville (3.18). And it includes smaller places like Pottsville (12.8, the highest LQ in the country for MSAs with 2,000-plus warehousing jobs) and Chambersburg-Waynesboro (10.34), both in Pennsylvania.

These are cities where economic and workforce development professionals should be aware of the impact that warehousing automation might soon have on the local workforce and business community.

Warehousing and storage is also strongly concentrated and growing insanely fast in Cedar Rapids, Iowa, and Trenton, New Jersey. Job growth from 2012-2015 eclipsed 300% in both metros, and both have LQs near or above 3.00.

Occupations Likely to Be Affected

According to McKinsey, automation will wipe out very few occupations in the next decade, but “it will affect portions of almost all jobs to a greater or lesser degree, depending on the type of work they entail.” This is where the news isn’t so encouraging for warehousing-related fields: McKinsey’s research showed that occupations that include predictable physical activities have a 78% feasibility of being automated.

For the most common warehousing occupations, a large portion of the work is predictable manual labor. More than 40% of workers in the warehousing and storage industry are employed as hand laborers and freight movers, stock clerks, and hand packers and packagers—three occupations that pay $12 per hour or less nationally.

It seems likely that at least some of the 350,000 jobs in these three occupations, not to mention other common positions at distribution centers (see table at original Emsi post), will be affected as autonomous robot technology improves and more companies try to save on labor costs.

An interesting follow-up to this analysis would be to look at the metro areas that have the highest percentage of predictable manual labor-intensive occupations in the warehousing and storage industry. The more hand laborers and packers a region has in warehousing, the more concerned it should be that those jobs could be lost.

This analysis was originally posted on the Emsi blog. Data for this post comes from Emsi Developer, a labor market and economic data analysis tool that hundreds of economic development organizations and workforce boards use on a daily basis.