In the short run, places that suffered the steepest job and income losses will struggle most, which bodes especially ill for the Northeast and tourism-dependent Hawaii and Nevada. But what happens after that? Much depends on the course of the virus, such as whether outbreaks in the South and West are contained and if large cities manage to avoid a second wave. But the places that boast the best prospects in the years to come will be those with a strong work force and the ability to capitalize upon changing preferences.

Population Density, Workforce Quality, and College Degrees

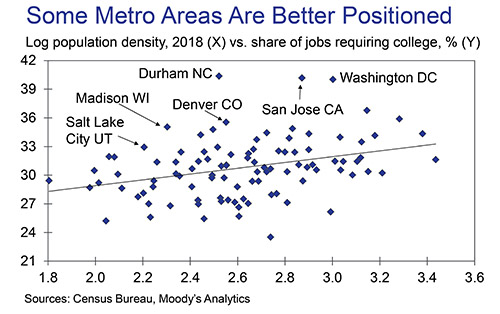

Specifically, the key trade-off will likely be that between workforce quality and population density. The two metrics are highly correlated, as skilled workers are more likely to congregate in big cities. But individuals will increasingly seek more space to protect themselves against COVID-19 transmission or future outbreaks. Further, the cost disadvantages borne by firms in the nation’s most densely populated markets will grow far less palatable given the seamlessness with which companies have transitioned to remote work.

Elsewhere, Denver and Salt Lake City are very well-positioned to retake their crown as two of the fastest-rising metro areas in the U.S. Washington, D.C., is among the more densely populated metro areas in the nation, but extremely high educational attainment and lower density than other big Northeast hubs — owing in part to a longstanding height limit on buildings — leave it in better shape than the rest of the region. Somewhat more isolated places in the Midwest that face few land constraints including Omaha, Neb., and Des Moines, Iowa, could benefit as well, especially if the farm sector stabilizes under a new administration that pursues a less confrontational approach to trade.

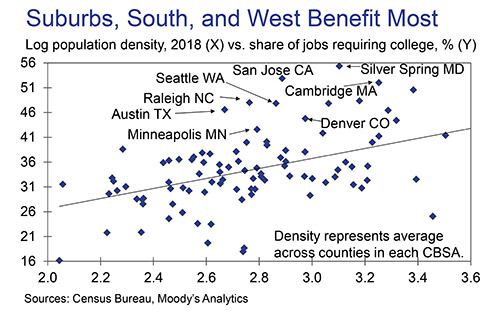

The places that boast the best prospects in the years to come will be those with a strong work force and the ability to capitalize upon changing preferences. Another related comparison involves density and the share of adults with a college degree. An advantage of this measure is that it allows metro divisions to be included in the analysis, whereas educational requirements are generally available only at the broader metro-area level.

Fast-growing tech hubs in the West and South lead based on this metric. Silicon Valley is nobody’s idea of an up-and-coming economy. But there is a notable contrast between the San Jose area, with its sprawling tech campuses, and tightly packed San Francisco. Similarly, Raleigh, N.C., and Austin Texas — two rapidly growing metro areas — could prove even more attractive in a new, post-COVID-19 world.

Other areas to watch include Seattle and Minneapolis, both of which are not as densely populated as alternative white-collar hubs in their regions but feature highly educated workforces. Meanwhile, the draw of suburban areas should not be overlooked. The Silver Spring, Md.; Montgomery-Bucks-Chester County, Pa.; and Cambridge, Mass., metro divisions could become appealing alternatives to their neighboring cities in a world in which physical proximity is viewed as inherently risky.

But a shift toward less densely populated areas will come at the expense of some of the large cities that led the way out of the last recession.

New York City, which was decimated by the virus during spring, will be especially scarred. Its greatest asset is a large, skilled workforce that is drawn to the fast-paced and highly interactive nature of life in the Big Apple. Boston and San Francisco boast a similar profile. Although each city is resilient enough to eventually regain its footing, increased net outmigration is likely in the medium term.

While urban flight will eventually abate, the perception of cities among today’s young adults and teenagers may be colored by the impact of COVID-19. That would make them more likely than their predecessors to eventually opt for less densely packed pastures.

Many firms are beginning to reconsider whether an address in a large city justifies the cost. These patterns would dilute the labor force advantage that big cities boast. Combine this with the diminished importance of physical proximity in a world in which remote meetings and conferences are now commonplace, and many firms are beginning to reconsider whether an address in a large city justifies the cost. Many New York City-based banks were already shifting operations to the South and West before COVID-19, and this trend will accelerate in the coming years. Further, increased remote work means that the value of living near one’s office will diminish, putting downward pressure on residential real estate prices in big cities.

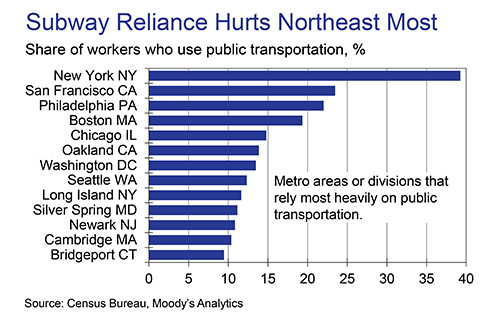

The potential for pain in cities is also evident when examining commuting preferences across the nation. According to the American Community Survey, 9 of the 13 most public transportation-reliant metro areas in the nation are located in the Northeast. Although the risks of riding the subway to work, for example, can be mitigated through proper precautions, the perception of danger could be enough to repel some potential residents.

This stands in stark contrast to places in the South and Midwest, such as Kansas City, Mo.; Indianapolis, Ind.; Nashville Tenn.; and the Fort Worth, Texas, division. All four are home to at least one million workers, of which less than 1 percent commute via public transportation. This will likely prove appealing in the years to come as young, educated workers consider the trade-off between compact urban spaces and more car-dependent areas.

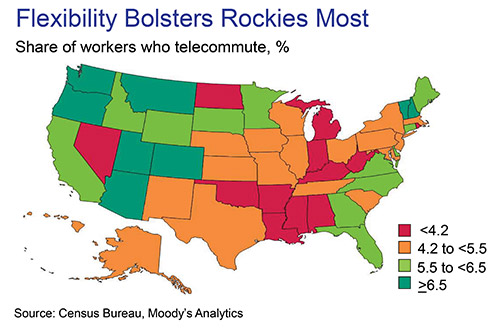

Similarly, the prevalence of remote working tells an important story. Not only does the ability to work from home shelter workers from the risks associated with disease spread, but if an outsize share of workers telecommutes, it signals that an area is desirable for non-work reasons.

As more workers make location decisions based on personal considerations, those areas that have attracted remote workers for years are especially well positioned.

Such places are generally those that are considered desirable to live in but relatively isolated. The Mountain West fits this description quite well, with Colorado easily the most work-from-home reliant state in the nation. The West Coast, Southeast, and northern New England are also above average in this regard.

Among metro areas, those with a large tech sector are especially friendly to remote arrangements. Flexible requirements, such as asking employees to come to work once or twice per week, should grow more common in the aftermath of COVID-19. This will make long commutes less problematic, while putting second-tier cities with desirable amenities and a healthy tech economy in the sweet spot. Austin, Texas; Denver, Col.; Portland Ore.; and Raleigh, N.C. all fit the bill, and they already boast the highest share of remote workers among metro areas with at least half a million people.

Desirable weather and amenities also put areas such as Phoenix, Ariz.; and Tampa and West Palm Beach, Fla., near the top of the list. But an elevated reliance on tourism for these economies can undermine any advantage given that jobs in leisure/hospitality generally require an in-person presence. This especially holds back popular work-from-home metro areas like Las Vegas and Orlando.

Many of these places read like a who’s who of fast-growing areas in recent years. Generally, low costs and skilled workforces have been their recipe for success. Typically, that edge would diminish in the early stages of a recovery, as disinflation narrows cost differences and pushes big cities to the fore. This time around, however, the places that were flying highest entering 2020 will likely be the first to approach their previous peaks, while their larger counterparts embark on an arduous uphill climb.