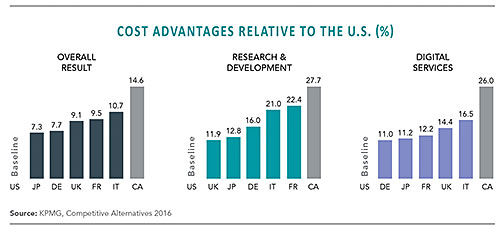

In 2017, Canada remains a favorable destination for foreign direct investors. According to a study conducted by KPMG, Canada currently has the lowest business costs among the countries that are part of the G7, with a 14.6 percent cost advantage over the United States. In comparison to the United States, Canada’s average business costs are even lower in knowledge-based areas, including 27.7 percent lower in research and development services and 26 percent lower in digital services.

Additionally, Canada’s ease of access to key global markets makes it an excellent platform for doing international business. As a key member of NAFTA, Canada is entitled to preferential access to the wider North American market. From an area-covered point-of-view, NAFTA is the largest free-trade region in the world and has a combined GDP greater than US$20 trillion and consists of more than 480 million consumers. Furthermore, the upcoming Canada-European Union Comprehensive Economic and Trade Agreement (CETA) will allow investors in Canada to access an additional 500 million consumers and a GDP of US$17 trillion. The aforementioned two agreements will allow Canadian investors to access markets covering over US$37 trillion and close to one billion consumers.

In addition to its effort on facilitating international trade, Canada is working on eliminating regulatory inconsistencies across provinces that cause unnecessary barriers to doing business. The federal, provincial, and territorial governments have made collaborative efforts to renew and modernize the 20-year-old Agreement on Internal Trade (AIT). Announced in April 2017, the new Canadian Free-Trade Agreement replaces the AIT and will improve the flow of goods and services and reduce the cost of doing business across provinces.

For the purpose of this article, three provinces, Ontario, Quebec, and British Columbia, have been randomly selected to further exemplify the business environment in Canada.

In its 2016 budget, the government of Ontario announced the Business Growth Initiative (BGI) to support Ontario’s transition to the new economy. The province has already built a strong foundation for innovation and entrepreneurship, with internationally recognized research institutions, and more than 574,000 Ontarians employed in science and engineering occupations in 2016. The BGI was created to make Ontario’s economy more innovative, help small businesses scale up into medium-sized and large enterprises, and reduce the regulatory burden on businesses. The BGI will also allow Ontario to experience an increase in the creation of quality employment. Since the 2016 budget announcement, the government has started to implement a number of key commitments to deliver on the BGI. Such commitments are illustrated in the accompanying chart.

Due to the fact that trade accelerates innovation, increases foreign investments, and creates jobs, the promotion of international trade has also been important for the province of Ontario. It is important to note that this initiative creates opportunities for Ontario businesses to grow its economy locally via global market presence. In 2016, the value of Ontario’s international exports was more than one third of the provincial GDP.

Additionally, the Ontario government is continuously incentivizing foreign multinationals in order to attract strategic investments. The latter increases exportation levels and creates and retains employment in the automotive sector. According to the government of Ontario, “Since 2004, Ontario has committed $1.35 billion, leveraging $15.62 billion in private-sector investments, which has helped support 70,524 direct jobs, as well as thousands more in the auto supply chain.”

Every Canadian province welcomes Foreign direct investment. Since 2017, the government has already announced two large investments. In January 2017, Ontario committed up to $41.8 million to Honda to conduct upgrades at its Alliston assembly plant in order to secure the automaker’s $492 million global investment. The governmental support will provide the facility with a new state-of-the-art paint shop and leading-edge vehicle-assembly technologies, as well as help to increase R&D activities. The investment will also create 4,000 direct jobs.

Two months later, in March of 2017, the Ontario government secured a $1 billion investment by Ford, which includes the upgrade of its Windsor Engine Plant, by committing up to $102.4 million. Additionally, the project will preserve 500 jobs. The investment also establishes a global Connectivity Innovation Centre that will create approximately 300 new engineering positions in Ottawa, Waterloo, and Oakville, along with significant additional R&D expenditures.

Transitioning to Digital Technology, Stimulating R&D in Quebec

In 2017, the government of Quebec seeks to further encourage businesses to modernize, increase their productivity, and develop new production capacities in order to increase its presence on international markets. As such, the 2017 Quebec Economic Plan encourages business transition to digital technology by providing an additional 35 percent deduction in the capital cost allowance and incentivizes large investment projects by extending the tax holiday until Dec. 31, 2020. In addition, Quebec has already established incentives such as a rebate on electricity to encourage business investments by companies in the manufacturing and natural resource development sectors.

Furthermore, the Quebec Economic Plan provides additional initiatives totaling over $830 million by 2021-2022 to stimulate research and innovation in several advanced activity sectors. Notably, the government allocates $305 million to encourage scientific innovation and $100 million to develop an artificial intelligence super-cluster. It will also invest $125 million to promote the development of the innovative manufacturing sector.

In its 2016 budget, the government of British Columbia announced that an independent Commission on Tax Competitiveness would be established to advise the province on how to modernize British Columbia’s business taxes.

- The Commission’s report included four key recommendations:

- Exempt business capital expenditures, including machinery and equipment, from PST (Provincial Sales Tax);

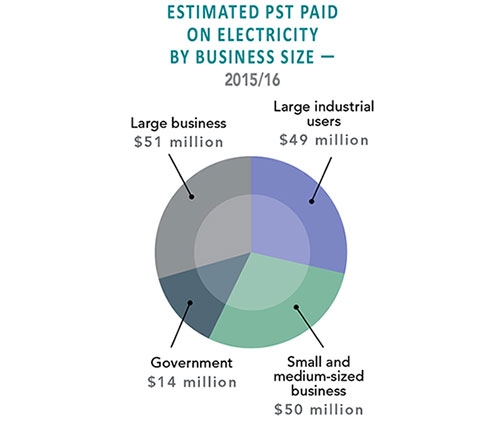

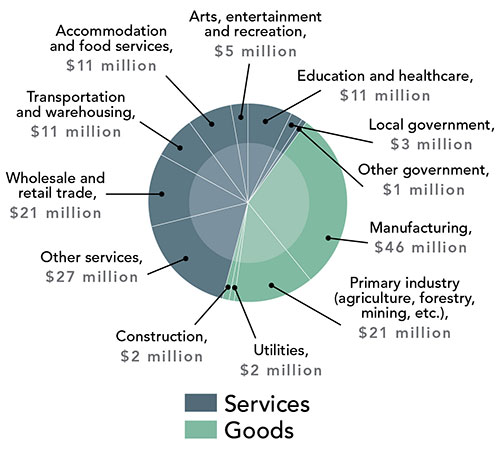

- Exempt business use of electricity and other energy inputs, software, and telecommunications services from PST;

- In the long-term, engage the public in a process to consider and design a made-in-BC value added tax; and

- Introduce a framework within which major investors and municipalities can negotiate long-term property tax arrangements to increase certainty.

Although this article concentrated its efforts on depicting the local business incentives in three provinces, it is important to note that every Canadian province welcomes business expansions and foreign direct investments. The latter is what truly enables Canada to remain on top as one of the best countries in attracting foreign investments and economic growth.

Ontario Initiatives Commitments/Initiatives

Cleantech Equity Fund —

A new $55 million fund to make equity investments in cleantech firms, supporting Ontario SMEs. In January 2017, an Expression of Interest was issued for a fund manager.

Perimeter Institute —

Investing $50 at the Perimeter Institute, a world-class research center for theoretical physics, to provide funding through 2021–22. This investment will support research that helps foster the next generation of technological advancements in areas such as quantum computing.

Scale-Up Voucher Program —

Investing $32.4 million over four years to provide high-impact firms with vouchers to access business development tools and services. This will help firms in Ontario with high-growth potential reach the next stage in their development. The program was scheduled to be launched in spring 2017.

Small Business Innovation Challenge —

A $28.8 million pilot to help Ontario SMEs demonstrate innovative technological solutions to problems identified by the government. The program was officially launched in March 2017.

ScaleUP Ventures Fund —

Ontario committed $25 million to a new venture capital fund targeting a final size of over $75 million. The fund will also provide mentorship to entrepreneurs. To date, the fund has invested in seven companies.

Colleges Applied Research and Development Fund —

A three-year, $20 million fund to support industry-academic collaboration between Ontario businesses and colleges. The fund was launched in January 2017.

Automobile Supplier Competitiveness Improvement Program (ASCIP) —

Investing $5 million over two years to establish ASCIP, which launched in October 2016 to support the automotive parts sector in adopting industry-leading software and hardware and to provide related training to increase the competitiveness of the industry in Ontario. Up to March 31, 2017, ASCIP has provided funding to 22 industry projects.

Ontario Investment Office —

The recently established Ontario Investment Office will provide a one-window concierge service for businesses looking to invest and expand in the province. In March 2017, the first Chief Investment Officer was named.

Source: Ontario Ministry of Finance, 2017