Canada’s Plan to Strengthen Domestic Capacity

Having understood the importance of promoting the long-term sustainable growth of Canada’s life sciences and health technology (LSHT) sector, the government had the initiative to undertake decisive actions to ensure access to critical vaccines, therapeutics, and other life-saving medicines by developing a comprehensive strategy to re-build a strong and resilient domestic biomanufacturing and life sciences sector. Some $2.2 billion from the 2021 budget was dedicated toward implementing the strategy, which consists of five pillars:

- Strong and coordinated governance: Integrate decision-making and priority-setting to support Canada’s pandemic preparedness, rapidly understand and respond to health threats, build a pipeline of skilled research and talent.

- Laying a solid foundation by strengthening research systems and the talent pipeline: Offer expanded research and innovation capacity at Canada’s universities and in the life-science ecosystems they support.

- Growing businesses by doubling down on existing and emerging areas of strength: Fund new investments to address the remaining critical gaps in domestic capabilities through the Strategic Innovation Fund (SIF), with $1 billion committed over seven years.

- Building public capacity: Expand key public assets to support pandemic preparedness.

- Enabling innovation by ensuring world-class regulation: Ensure Canada has a best-in-class regulatory system, world-class expertise, and infrastructure for clinical trials through sustained improvements of Canada’s regulatory system and the creation of a new Clinical Trial Fund (CTF).

LSHT — Global FDI Outlook

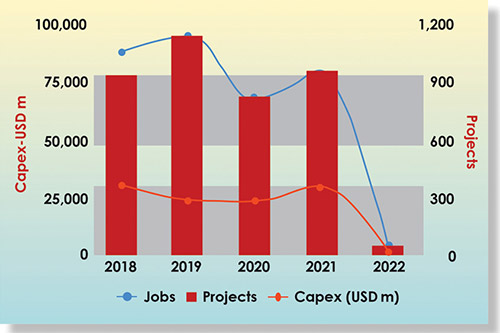

The life sciences and health technology (LSHT) sector peaked in 2019 with 1,142 registered foreign direct investments worldwide for an estimated US$24 billion in invested capital. Certain specific investment trends have increased within the pandemic context as COVID-19 acted as an “adjuvant,” especially in the fields of biotechnologies and medical technologies. The other sectors that make up the cluster, pharma and research services, have also experienced some upheaval but to a lesser extent. By the end of 2021, LSHT was back to its 2018 level, both in terms of the number of projects (around 950) and the level of investment (US$30 billion).

Since 2018, investments have been directed mainly to the United States with 748 projects, Germany with 339 projects, the United Kingdom with 305 projects, China with 200 projects, and France with 179 projects. Canada, meanwhile, has attracted 66 investment projects with US$3.5 billion in investments and 6,766 jobs created. Examples of such projects were Resilience Biotechnologie — $400 million investment in 2021 to increase its manufacturing and fill-finish capacity for a number of vaccines and therapeutics; Sanofi’s commitment in 2021 to build a new vaccine facility in Toronto; and Moderna’s announcement of a new biomanufacturing facility for its mRNA vaccine production.

Moderna’s announcement in April 2022 of its intention to build a new biomanufacturing production facility together with a research center, representing its first mRNA vaccine manufacturing outside of the U.S., was a major indicator of the industry’s potential in Canada. Having one of the world’s leading biotech companies investing within Canada illustrates the attractiveness of the country and demonstrates an acceleration in the sector, with companies generating more projects driven by such investment. During the press conference, Moderna CEO Stéphane Bancel mentioned the importance of having trained workers and a skilled workforce. By investing in cities such as Montreal, foreign businesses can take advantage of a welcoming, interconnected ecosystem that is built on a commitment to cooperation among industry, academia, and research institutions.

By the end of 2021, LSHT was back to its 2018 level, both in terms of the number of projects (around 950) and the level of investment (US$30 billion). Canada has one of the world’s best-educated talent pools and is also home to a large pool of highly skilled life sciences professionals with a broad range of expertise. InvestCanada states that with 59.4 percent of Canadians aged 25–64 having graduated from tertiary educational institutions, Canada ranks as the most highly educated country in the world. Of those graduates, over 4.8 million hold a degree from a STEM or healthcare program, making Canada a prime destination for life sciences companies. The country is also in a positive trend — in 2018, Canada counted close to 125,000 STEM graduates, a 51 percent increase compared to 2010. Overall, Canada’s labor force contains more than 2.8 million STEM graduates.

Canada offers an innovative environment for life sciences companies, especially through the provinces of Québec and Ontario, and the Québec City - Windsor corridor represents a hotspot of innovation, talent, collaboration, and industry clusters — all a signature of what Canada has to offer global investors in life sciences. In fact, this corridor is the second-largest life sciences cluster in North America, representing some 1,100 organizations and 490 graduate and undergraduate programs in biological and biomedicine sciences. The diversity of those activities is significant: from Montreal’s AI expertise leading healthcare innovation to Toronto’s large concentration of hospitals, research institutes, business incubators, and venture capital organizations, every stop along the corridor has unique characteristics and a speciality to round out Canadian expertise in life sciences, and their agglomeration creates a collaborative ecosystem that is varied and dynamic.

Canada has one of the world’s best-educated talent pools and is also home to a large pool of highly skilled life sciences professionals with a broad range of expertise. The Challenge of Domestic Drug Production

Canada is still facing important challenges in the pharmaceutical industry as 70 percent of all finished prescription drugs in Canada and 90 percent of all components used in drugs manufactured domestically originate from abroad. Over the last 20 years, most of Canada’s pharmaceutical industry has shut down in favor of offshore manufacturers in India and China.6 Unfortunately, a gap in homegrown drug manufacturing means that Canadians are at the mercy of the global supply chain when it comes to ensuring they have access to the drugs they need. Promoting the “Made in Canada” label is not as easy as it sounds, as Canada’s share of global pharmaceutical consumption is just 2 percent, compared to 44 percent in the United States, meaning that filling all of Canada’s drug needs from within wouldn’t make much sense from an economic perspective.

Canada needs to work at filing holes in its drug supply system by bringing together world-leading laboratories and existing drug manufacturers, and such initiatives are starting to rise across the country. For example, the Canadian Critical Drug Initiative aims to provide some solutions to Canada’s international drug dependency by transforming Alberta into a powerhouse in the development of life-saving therapies.

Canada is still facing important challenges in the pharmaceutical industry as 70 percent of all finished prescription drugs in Canada and 90 percent of all components used in drugs manufactured domestically originate from abroad. API, an industry-led Edmonton nonprofit, is partnering with the University of Alberta’s Li Ka Shing Applied Virology Institute to help Canada gain a critical lifeline in the production of small-molecule drugs (e.g., ibuprofen and propofol), which represent the majority of drugs administered in the country. This type of project would be a critical component of the government strategy presented above, as its proposed 40,000-square-foot facility in Edmonton will be able to produce 70 million vials annually of a wide range of small-molecule drugs.

In Sum

The COVID-19 pandemic reinforced not only the importance of domestic capacity to develop and produce vaccines and therapeutics, but also significant breakthroughs in health science and technology. As a response, the strategy put in place by the Canadian government aims to ensure the growth of a strong, competitive domestic life sciences sector with cutting-edge biomanufacturing capabilities and, at the same time, prepare for future pandemics or other health emergencies. Added to this federal strategy are world-class universities and renowned researchers, high-quality talent, low operational costs, and a great quality of life making Canada the place to invest in LSHT.