The industrial sector has undergone a seismic shift over the past five years, transforming from a stable yet unremarkable sector into a high-growth, frenetic superstar sector. Nonetheless, exponential growth is not forever, nor should it be, and as the industrial sector stabilizes, new opportunities and challenges emerge for the property type.

Nearshoring and reshoring have been top-of-mind for manufacturing and industrial commercial real estate investors alike. While globalization led to manufacturing in concentrated locations where there was a competitive advantage – think production in the lowest cost location – the global shut down of trade brought on by the pandemic revealed the need for more domestic manufacturing of critical intermediate and final goods.

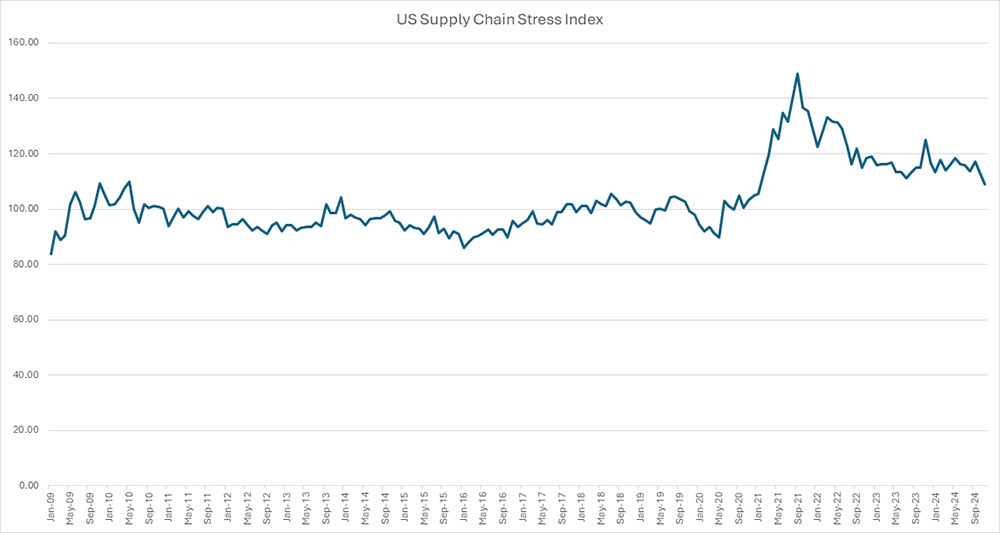

A key example of this is semiconductors. Supply chain stress skyrocketed as countries shut down production and shipping during the pandemic. Although conditions have vastly improved in the five years since the start of the pandemic, the supply chain stress index remains elevated, 12.4 percent higher than its long-term prior average.

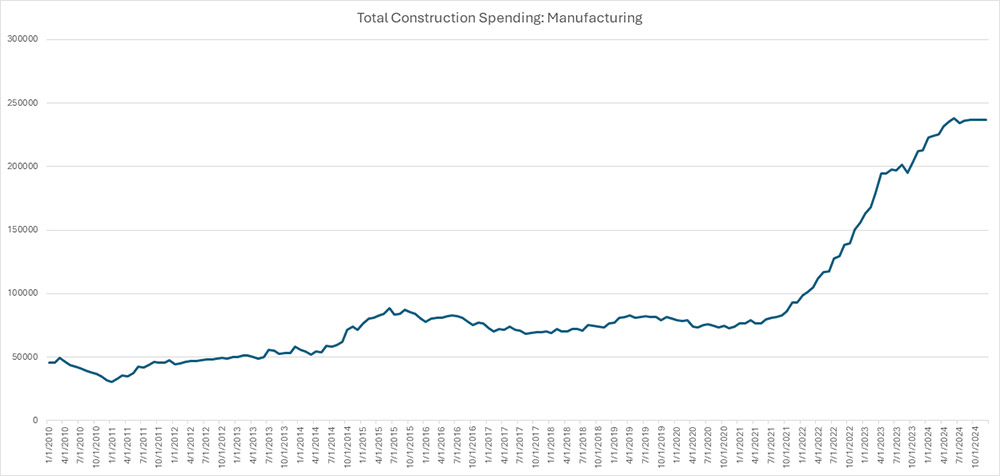

In response to these challenges, the CHIPS Act was passed in 2022 with the primary goal of reshoring semiconductor supply chains, along with other science-focused manufacturing sectors. The implications for industrial properties were clear: a buoying effect across various industrial property subtypes, including manufacturing, warehousing, and cold storage to name a few. This policy support encouraged the private sector to invest in reshoring and nearshoring initiatives. Manufacturing investment in the United States has since soared due a desire to avoid the supply chain constraints and manufacturing limitations that contributed to decades-high inflation. While the growth rate of total construction spending on manufacturing has leveled off and remained flat for the last five months of available data (ending December 2024), monthly spending more than tripled from its most recent trough-to-peak cycle between November 2020 and June 2024, growing by 227 percent.

Focusing on reshoring, there has been tremendous activity in the industrial sector in the U.S., leading to outsized growth in property types and propelling the sector to a new higher-growth path. Nonetheless, there has been a pullback in recent industrial demand drivers, particularly from e-commerce growth, which is back on its original growth path. Many retailers have switched to just-in-time inventory management systems, reducing the need for warehousing goods for extended periods and instead focusing on storing and shipping items to customers directly from retail points of sale.

The pandemic revealed the urgent need for more domestic manufacturing of critical intermediate and final goods.

Nearshoring has also become a significant focus in recent years. Free trade agreements like the current United States-Mexico-Canada Agreement (USMCA) and the North American Free Trade Agreement (NAFTA) before it, combined with the competitive advantage of less expensive and well- established manufacturing processes, have incentivized manufacturers to relocate to Canada and Mexico over the past three decades as globalization has expanded to be in close proximity to final consumers in the U.S. The ability to engage in free trade across North America without tariffs for 30 years has resulted in numerous industrial hubs flourishing in border cities, performing remarkably well compared to the national figure in recent years in the effective rent growth category as overall growth in the asset type across the country has slowed. Border cities in the south with land crossings, like El Paso and San Diego, and in the north, with quasi-land crossings in the form of a bridge, like Buffalo and Detroit, have had consistently lower vacancy rates than the national figure, regardless of the timing of the industrial market cycle. Additionally, other markets, including McAllen and Laredo, both in Texas, have burgeoned as the flow of goods from Mexico has expanded.

| Effective Rent Growth | Buffalo | Detroit | El Paso | San Diego | U.S. |

| 2020 | -0.70% | 1.00% | 0.50% | 2.00% | 1.50% |

| 2021 | 7.20% | 8.40% | 9.10% | 9.50% | 10.60% |

| 2022 | 6.70% | 13.60% | 16.20% | 16.40% | 21.90% |

| 2023 | 5.40% | 5.00% | 7.20% | 4.90% | 4.80% |

| 2024 | 1.70% | 1.70% | 3.90% | 1.70% | 1.60% |

| Source: Moody’s | |||||

| Vacancy Rate | Buffalo | Detroit | El Paso | San Diego | U.S. |

| 2020 | 5.50% | 10.40% | 10.30% | 9.30% | 10.80% |

| 2021 | 2.10% | 5.30% | 5.60% | 4.80% | 6.70% |

| 2022 | 2.80% | 3.10% | 2.20% | 2.60% | 4.60% |

| 2023 | 2.40% | 3.50% | 2.90% | 3.70% | 6.40% |

| 2024 | 2.60% | 3.40% | 4.20% | 4.80% | 6.90% |

| Source: Moody’s | |||||

However, proposed and implemented policy actions in the form of tariffs present a headwind for nearshoring. Manufacturers, concerned about the duration and severity of tariffs might weigh the cost of domestic manufacturing against the cost of manufacturing abroad with a tariff fee structure in place. This comparison could influence their decisions, potentially favoring free trade scenarios over those with tariffs.

Border cities like El Paso, San Diego, Buffalo, and Detroit have consistently lower vacancy rates than the national average, regardless of market cycles.

Employment metrics serve as a useful indicator in determining investor interest in reshoring and consequently, demand for industrial properties. In a May 2023 report, the Reshoring Initiative estimated that approximately 400,000 new jobs would be added that year for domestic manufacturing, a peak forecast for annual job growth. Such an optimistic forecast was based on the fact that in 2022, the number of observed reshoring and foreign direct investment job announcements peaked at 343,304. However, for that same metric, the observed number of jobs announced in 2023 only reached 287,299. While still the second highest figure on record dating back to 2010, the figure was nonetheless 16 percent lower than the prior year, highlighting that the strength and perseverance of reshoring waned slightly due to the time- intensive nature of the process. This slowdown in job growth coincided with a slowdown in the industrial sector, as both absorption and rent growth began to normalize.

Another example of changing policy targets related to manufacturing that have a strong impact on industrial demand relates to electric vehicle battery production. Growth in demand for this product was tied not only to changing consumer tastes for vehicles but also to an executive order passed in 2021 that required all new vehicles sold in the U.S. to be electric. However, this has since been reversed. Renewable energy in the form of solar was also supported by policy but once again, the changing tides of policy priorities have pivoted away from renewables and toward natural gas extraction.

Although the positive impacts of reshoring and nearshoring initiatives have lessened over the course of the past two years, as policy focuses shift in 2025 and geopolitical risk endures, renewed investment interest in this industrial tailwind can be expected on one hand, while on the other, the site selection decisions may move away from border cities to manufacturing heartlands.